Immunocore's R&D Chief Exits After 7 Years to Lead Moderna's Development Push

January 30, 2026 · by Fintool Agent

Immunocore is losing the architect of its flagship drug to a rival with deeper pockets and broader ambitions.

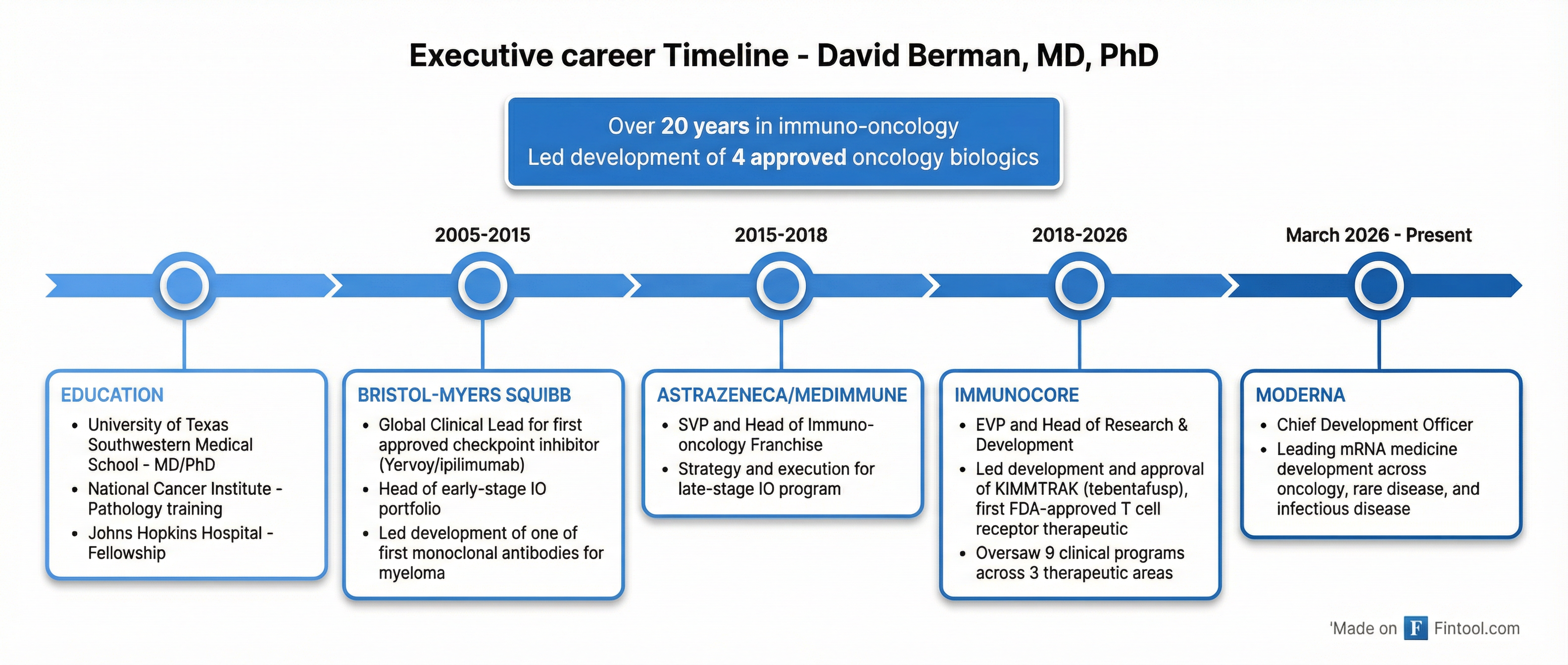

Dr. David Berman, the 54-year-old Executive Vice President and Head of Research & Development who led the development and approval of KIMMTRAK—the world's first T cell receptor therapeutic—is departing to become Moderna's Chief Development Officer. The move comes after Berman liquidated over $14 million in Immunocore stock in the two months before announcing his departure.

Immunocore's response raises its own questions: the Oxford-based biotech will not replace Berman, opting instead to "streamline and leverage its existing R&D structure."

Imcr shares fell 6% on the news to around $33, while Mrna rose 3.4% to $46.86.

A Career Built on Firsts

Berman leaves behind a seven-year tenure at Immunocore that transformed the company from clinical-stage to commercial reality. He joined in September 2018 and officially became Head of R&D in January 2019. Under his leadership:

- KIMMTRAK (tebentafusp) won FDA approval in January 2022 for metastatic uveal melanoma—a first-in-class achievement

- The pipeline expanded to 9 clinical programs across 3 therapeutic areas (oncology, infectious disease, autoimmune)

- Three Phase 3 trials launched, including first-line cutaneous melanoma (PRISM-MEL) and adjuvant uveal melanoma (ATOM)

Before Immunocore, Berman built his reputation at the epicenter of the immuno-oncology revolution. At Bristol-Myers Squibb (2005-2015), he served as Global Clinical Lead for ipilimumab (Yervoy)—the first approved checkpoint inhibitor—and led development of one of the first monoclonal antibodies for multiple myeloma. He then spent three years at AstraZeneca as SVP and Head of the Immuno-oncology Franchise.

His track record includes leadership roles in developing four FDA-approved oncology biologics—a rare pedigree that made him a prime recruiting target.

The Insider Selling Pattern

What investors may find notable is Berman's trading activity in the months before his departure became public.

Between November 24 and December 5, 2025, Berman executed a series of stock option exercises and immediate sales totaling approximately $14.4 million:

| Date | Transaction | Shares | Price | Value |

|---|---|---|---|---|

| Nov 25-26, 2025 | Option exercise + sale | 87,424 | $40.00-40.12 | $3.5M |

| Nov 28, 2025 | Option exercise + sale | 5,521 | $40.09 | $221K |

| Dec 4, 2025 | Option exercise + sale | 31,341 | $40.26 | $1.26M |

| Dec 5, 2025 | Option exercise + sale | 572 | $40.14 | $23K |

| Earlier 2025 | Additional exercises/sales | 61,000 | $40 | $2.4M+ |

These sales occurred at prices around $40 per share—approximately 21% above current trading levels. The timing, while legally permissible under pre-arranged 10b5-1 trading plans, raises the question of when Berman began entertaining Moderna's offer.

Why Moderna?

For Berman, the move makes strategic sense. Moderna is pivoting aggressively into oncology and rare disease as its pandemic-era vaccine revenues normalize. The company outlined at the J.P. Morgan Healthcare Conference that it expects nine oncology readouts over the next several years and aims to become a "multi-indication oncology franchise."

"David's leadership experience in oncology and infectious disease will be critical as we continue to invest and drive innovation across Moderna's pipeline," said Stéphane Bancel, Moderna's CEO.

For his part, Berman cited the breadth of Moderna's platform: "The strength of Moderna's mRNA platform and its diverse pipeline position the Company to address some of the most challenging diseases of our time."

The hire displaces Dr. Jacqueline Miller, who was promoted to Chief Medical Officer just two months ago in November 2024. Miller will step down from the Executive Committee but remain as a consultant to assist with the transition.

Immunocore's Response: Streamlining, Not Replacing

Perhaps more telling than Berman's departure is Immunocore's decision not to replace him directly.

The company stated it will "streamline and leverage its existing R&D structure" by promoting two internal executives, though it has not disclosed who will assume expanded responsibilities.

For a commercial-stage biotech running three Phase 3 trials and nine clinical programs, the decision not to hire externally signals either extraordinary confidence in the existing team—or a shift toward cost discipline over R&D expansion.

Immunocore reported ~$864 million in cash at year-end 2025 and expects to report Q4 results in late February. Revenue has been growing steadily on KIMMTRAK's commercial success:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $70.5 | $75.4 | $80.2 | $84.1 | $93.9 | $98.0 | $103.7 |

| Net Income ($M) | -$24.4 | -$11.6 | $8.7 | -$23.8 | $5.0 | -$10.3 | -$0.2 |

Wall Street consensus expects Q4 2025 EPS of -$0.28 (improving 40% year-over-year) on revenues of $107.8 million (+28% YoY).

The Pipeline Berman Leaves Behind

At the J.P. Morgan Healthcare Conference in January, just weeks before announcing his departure, Berman laid out an ambitious 2026 roadmap:

Phase 3 Programs:

- TEBE-AM (second-line cutaneous melanoma): Enrollment completion expected H1 2026; topline data potentially H2 2026

- PRISM-MEL (first-line cutaneous melanoma): Actively randomizing patients

- ATOM (adjuvant uveal melanoma): First patient dosed in Q4 2024, recruiting globally

Earlier-Stage Programs:

- PRAME franchise data expected H2 2026 (brenetafusp in ovarian/lung cancer, half-life extended candidate)

- Phase 1 type 1 diabetes trial to dose first patient H1 2026

- Additional HIV data expected H2 2026

Berman's own commentary at the Q2 2025 earnings call underscored the complexity ahead: "2026 will be an important year to inform the next steps for PRAME and T wall, as well as for our HIV and HBV programs. Finally, the next twelve months will bring our first clinical experience in autoimmunity."

The question now is whether internal leadership can execute this roadmap without the executive who designed it.

What to Watch

For Immunocore investors:

- Q4 2025 earnings in late February—watch for any commentary on R&D restructuring

- TEBE-AM enrollment completion and potential topline data timing

- Whether the company announces a new R&D head or formalizes internal promotions

For Moderna investors:

- Berman starts March 2, 2026—integration and early priorities

- Execution on the "nine oncology readouts" promised over coming years

- How the Miller-to-Berman transition affects development timelines

For both:

- Whether Berman's departure triggers any competitive recruiting at Immunocore

- Broader biotech M&A implications—Immunocore, with proven T cell receptor technology and a commercial product, could attract acquisition interest