Impinj Crashes 25% After Q1 Guidance Comes in 20% Below Street

February 6, 2026 · by Fintool Agent

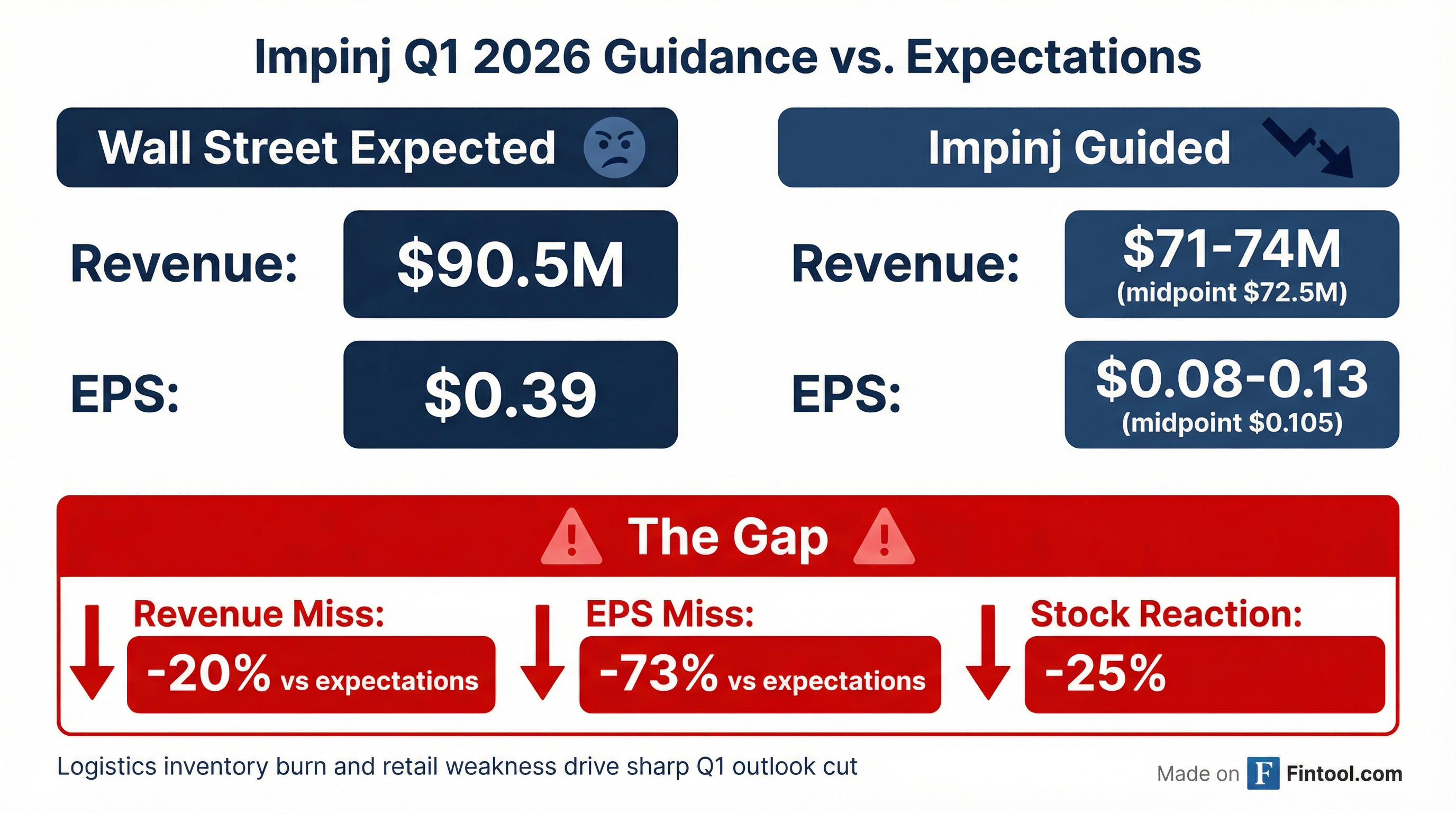

Impinj shares collapsed 25% on Friday after the RFID semiconductor leader issued Q1 2026 guidance that stunned Wall Street, forecasting revenue of just $71-74 million versus consensus expectations of $90.5 million. The company's Q4 results were solid—the market reaction was entirely driven by the shocking near-term outlook.

The stock plunged to $116.04, wiping out roughly $1.1 billion in market value and pushing shares 52% below their October 2025 highs.

The Guidance Bomb

Impinj's Q4 2025 results were unremarkable—revenue of $92.8 million met expectations, non-GAAP EPS of $0.50 matched consensus, and adjusted EBITDA of $16.4 million came in ahead of estimates.

But the Q1 outlook destroyed the bull case:

| Metric | Q1 2026 Guidance | Wall Street Estimate | Gap |

|---|---|---|---|

| Revenue | $71-74M | $90.5M | -20% |

| EPS | $0.08-0.13 | $0.39 | -73% |

| Adjusted EBITDA | $1.2-2.7M | $18M | -88% |

*Note: Values retrieved from S&P Global

CEO Chris Diorio described 2025 as "a tough year for our industry," citing tariffs, supply chain disruptions, and inventory reductions at every layer of retail markets. But the Q1 weakness stems from several simultaneous headwinds:

1. Logistics Inventory Burn-Down: Impinj's second-largest North American supply chain and logistics customer underwent its annual label supplier rebid. Inlay partners anticipating share gains built inventory ahead, but those who didn't win as much allocation must now work down excess inventory in Q1.

2. Custom Chip Transition: The company is pivoting to a custom-built endpoint IC for this same major logistics customer, causing a temporary dip as partners reduce prior M800 inventory while Impinj ramps the new chip.

3. Retail Apparel Weakness: Retailers are still burning down inventory, a trend that masked itself in Q4 behind stronger logistics orders. CFO Cary Baker acknowledged: "When we unpacked the Q4 volumes in mid-January...we realized that the logistics build had masked some weakness in retail apparel."

Evercore Slashes Target 59%

Analyst Mark Lipacis at Evercore ISI downgraded Impinj from Outperform to In-Line and cut his price target from $273 to $112—a 59% reduction—citing higher volatility and slower near-term growth.

The firm now models a 4% revenue decline for 2026, versus a previous projection of 26% growth.

Financial Snapshot

Despite the guidance shock, Impinj's underlying financials show a company that executed through a difficult 2025:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $76.8 | $102.5 | $95.2 | $91.6 | $74.3 | $97.9 | $96.1 | $92.8 |

| Gross Margin (%) | 48.9% | 56.1% | 50.0% | 50.5% | 49.4% | 57.8% | 50.3% | 51.8% |

Full-year 2025 highlights:

- Revenue: $361.1 million (down 1% YoY)

- Adjusted EBITDA: Record $69.6 million (19.3% margin)

- Cash position: Record $279.1 million

- Free cash flow: $45.9 million

The company noted M800 is now its volume runner, and it grew endpoint IC volumes 9% year-over-year in 2025 despite market headwinds.

The Bull Case: Why Management Sees Green Shoots

Despite the brutal Q1 outlook, CEO Diorio painted an optimistic picture for the remainder of 2026:

Custom Chip Opportunity: The new custom IC for the major logistics customer is already in production—not just in design. The customer plans to fully switch to it in 2026, which will give Impinj better visibility into channel inventory going forward.

Retail Apparel Normalization: Management expects demand to normalize "as early as Q2" based on input from retailers and partners. New accounts like Abercrombie & Fitch, Aritzia, Old Navy, and Academy Sports are coming online.

Gen2X as Solutions Differentiator: The company is positioning its Gen2X technology as a toolbox for enterprise solutions—not just a chip but a complete platform including reader ICs, firmware, and software.

Food Opportunity: While food volumes remain modest, bakery deployments are ramping and proteins are expected to follow. Diorio called the opportunity "staggeringly large."

Why Visibility Remains Murky

CFO Baker was candid about the forecasting challenges. The M800's fungibility—usable across retail apparel, general merchandise, and logistics—gave inlay partners confidence to build inventory ahead of winning awards, knowing they could sell through other channels if needed.

This made it difficult to see retail weakness until mid-January when the company matched Q4 shipments with channel inventory reports. Baker acknowledged: "We know from history that it's difficult to contain a correction to a single quarter, and it may spill over into the Q2."

The custom chip transition should improve visibility going forward, as shipments can be matched directly to the end customer's monthly consumption reports.

What to Watch

Near-term catalysts:

- Q2 license payment from competitor (confirmed by CFO)

- Investor conferences in February-March at Barclays, Susquehanna, and Cantor

- Progress on custom chip ramp through Q1-Q2

Key risks:

- Inventory correction extends beyond Q1

- Retail apparel doesn't normalize as expected

- Food adoption slower than projected

- Competition from NXP's new chip

Bottom Line

Impinj delivered a classically devastating guidance cut—solid Q4 results completely overshadowed by a Q1 outlook that came in 20% below consensus on revenue and 73% below on EPS. The stock's 25% single-day plunge reflects genuine surprise from a Street that had expected accelerating growth, not a sudden demand cliff.

Management's explanation—logistics inventory burn-down, custom chip transition, and retail weakness—is logical but introduces meaningful execution risk. The key question is whether Q1 represents the trough or the start of a longer correction cycle.

For believers in the RFID adoption thesis, the pullback may eventually prove a buying opportunity. But with visibility so limited that management missed the retail weakness until mid-January, investors may demand several quarters of proof before giving Impinj the benefit of the doubt again.