IN8bio's Glioblastoma Therapy Nearly Doubles Survival: CEO Details Path to FDA at Noble Capital Conference

February 5, 2026 · by Fintool Agent

In8bio-3.06% CEO William Ho laid out an ambitious roadmap to potential FDA registration for the company's glioblastoma therapy at Noble Capital Markets' Emerging Growth Virtual Equity Conference today, presenting data that hasn't changed in twenty years of failed attempts by the pharmaceutical industry to crack one of oncology's most intractable cancers.

The numbers are striking: patients receiving repeat doses of IN8bio's DeltEx DRI gamma-delta T cells achieved median progression-free survival of 13.0 months—nearly double the 6.6 months seen in contemporaneous controls treated with the standard Stupp protocol. Perhaps more remarkable, 57% of treated patients remained progression-free longer than their expected overall survival, compared to just 10% in the control arm.

"It's been 20 years since the last approval in glioblastoma," Ho told the conference audience. "We're bending that curve and making a difference for these patients."

The Data That Got FDA's Attention

The Phase 1 INB-200 and Phase 2 INB-400 trials enrolled patients across four academic centers—University of Alabama at Birmingham, Cleveland Clinic, Moffitt Cancer Center, and Ohio State—eliminating concerns about single-site bias or exceptional surgical skill.

| Metric | Standard of Care | DeltEx DRI (3-6 doses) |

|---|---|---|

| Median PFS | 6.6 months | 13.0 months |

| Median OS | 13.2 months | 17.2+ months (maturing) |

| Outlived Expected Survival | 10% | 57% |

| Longest PFS Patient | N/A | 4.6 years |

The control cohort wasn't cherry-picked to underperform. These were contemporaneously enrolled patients at the same clinical sites, treated by the same physicians, who chose standard of care rather than the experimental therapy. They actually had higher rates of gross total resection—which should favor better outcomes—yet performed in line with historical expectations.

Ho referenced FDA Commissioner Marty Makary's comments at a recent Cell and Gene Therapy Forum: "Dr. Makary made a comment about when he was at Hopkins, a Grade 4 glioblastoma that was alive and progression-free at 4 years. And he made the comment, 'That doesn't happen by accident.'"

IN8bio has one such patient—a Grade 4 IDH mutant glioma who remains alive and progression-free at 4.6 years, having not received treatment since month 6.

The Science: Hijacking the DNA Damage Response

IN8bio's approach exploits a fundamental biological pathway. When cells suffer DNA damage they cannot repair, they upregulate innate immune markers—essentially broadcasting a distress signal to the immune system.

The company genetically engineers gamma-delta T cells to resist chemotherapy, allowing them to survive the alkylating agents that simultaneously force tumor cells to upregulate these immune markers. Patients receive up to six doses delivered directly into the tumor cavity through a catheter inserted during surgical resection.

"Glioma cells double every 60 days. Here, we are treating the patients every 28 days," Ho explained. "The hypothesis was that if our cells can identify and kill enough tumor cells just to keep the tumor cells the same every month, then we can prolong the time to progression. If we can reduce that number just a little bit every single month, then maybe we can outrun the growth."

Histopathology from paired biopsies provides biological confirmation. Control patients who relapsed showed little change in their tumor tissue, while treated patients demonstrated clear infiltration of gamma-delta T cells along with CD3 and CD8 T cells—evidence the therapy is reaching and modifying the tumor microenvironment.

The Financing: Runway Through 2027

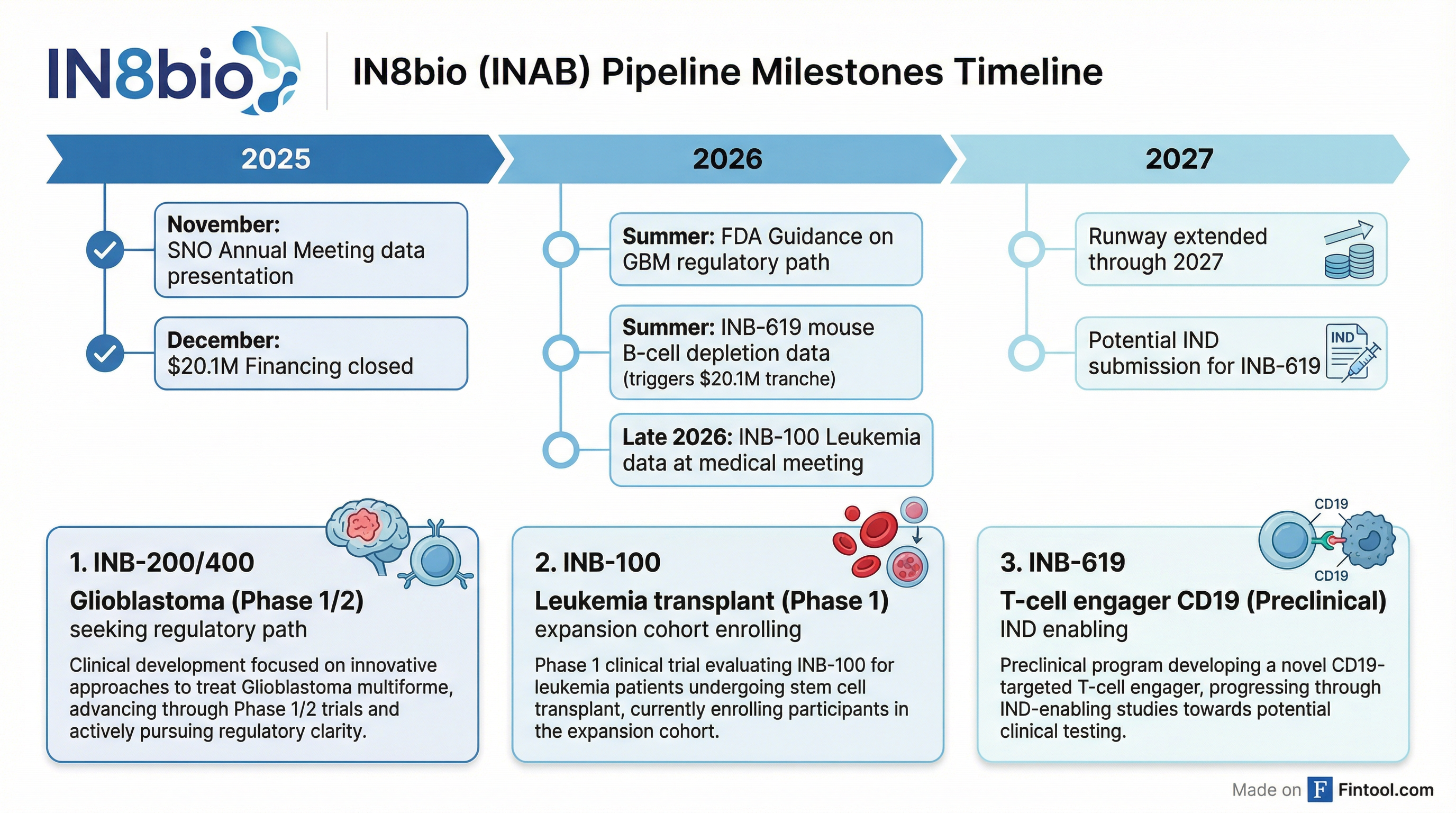

In December 2025, IN8bio closed a $20.1 million private placement led by Coastlands Capital, with participation from Franklin Templeton, Stonepine Capital, 683 Capital Partners, and existing investors.

The deal includes a milestone-triggered second tranche of an additional $20.1 million, contingent on the company presenting animal model data for its INB-619 T-cell engager program.

"The financing will allow us to take this through mice data, so we expect to show B-cell depletion data in mice by late this summer," Ho said. "That would trigger an additional second tranche of the financing, an additional $20.1 million, which will bring our cash position and available runway all the way through 2027."

This represents a material improvement from the company's Q3 2025 10-Q, which disclosed just $10.7 million in cash and a going concern warning.

INB-619: A New Angle on T-Cell Engagers

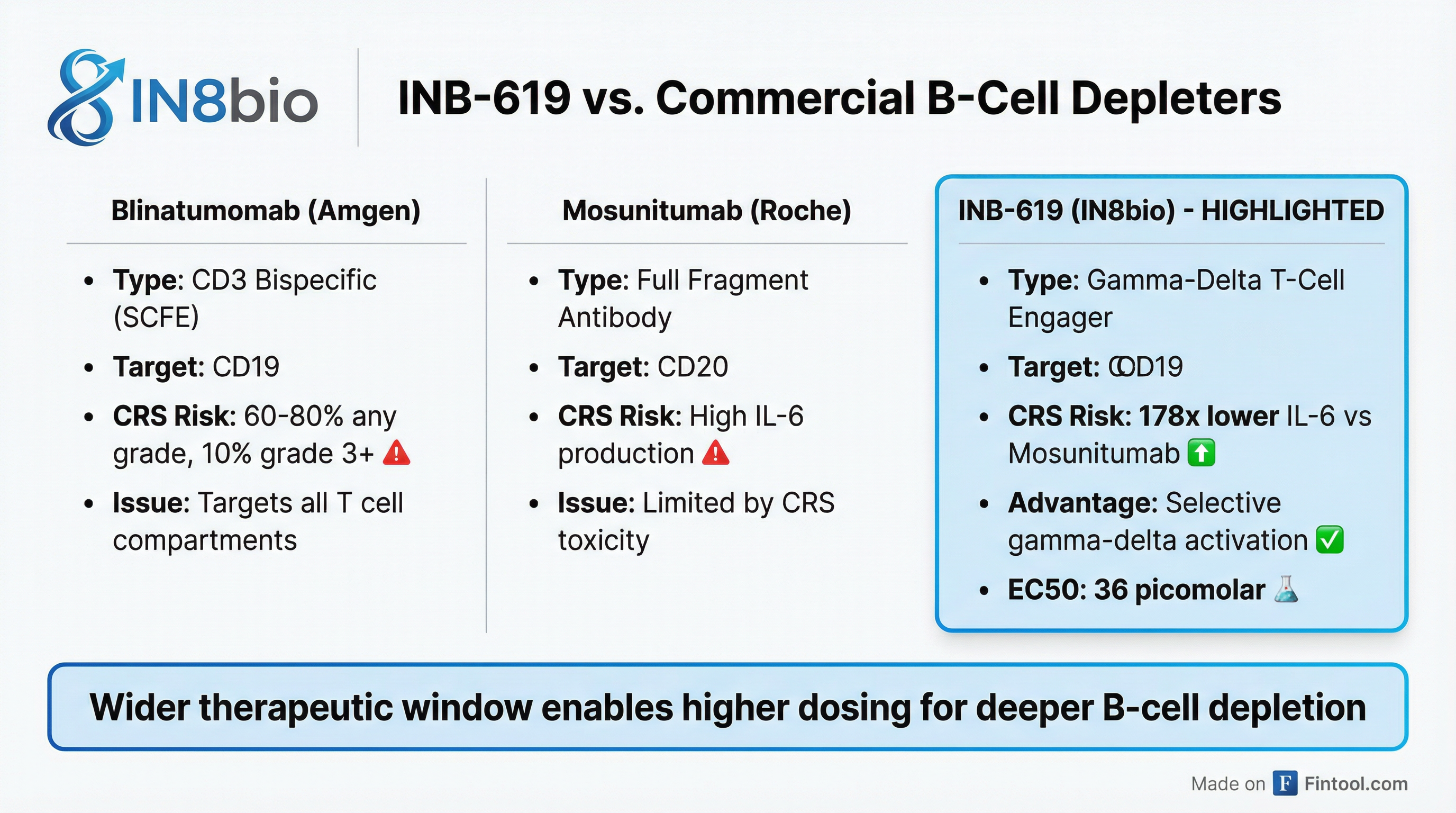

While the glioblastoma data grabbed headlines, Ho dedicated significant time to INB-619, IN8bio's internally developed T-cell engager platform that could represent a larger commercial opportunity.

The program targets CD19—the same antigen as approved CAR-T therapies—but through a gamma-delta T cell mechanism that Ho argues addresses the toxicity problems plaguing the bispecific antibody space.

Current T-cell engagers like Amgen+0.44%'s blinatumomab and Roche's mosunetuzumab target CD3, which activates multiple T cell compartments including regulatory T cells. This creates a "cytokine soup" resulting in cytokine release syndrome (CRS) in 60-80% of patients, with 10% experiencing Grade 3 or higher toxicity requiring ICU admission.

In autoimmune disease applications, this toxicity forces dose reductions to approximately 9x lower than oncology doses, preventing the deep B-cell depletion needed for durable immune reset.

IN8bio's preclinical data shows a striking differential: at 5,000 picomolar concentration, INB-619 produces IL-6 levels equivalent to just 28 picomolar of mosunetuzumab—a 178-fold difference—while achieving equivalent or superior B-cell killing.

"Showing the widening therapeutic window and our potential to be able to dose these patients at higher doses with less toxicity to drive deeper B-cell depletion and hopefully immune reset," Ho said.

Upcoming Catalysts

Ho outlined a 2026 heavily loaded with potential value-creating events:

| Timeline | Milestone | Program |

|---|---|---|

| Near-term | Complete INB-100 enrollment and dosing | Leukemia |

| Summer 2026 | FDA guidance on GBM regulatory path | INB-200/400 |

| Late Summer 2026 | Mouse B-cell depletion data (triggers $20.1M) | INB-619 |

| Late 2026 | INB-100 Phase 1 data at medical meeting | Leukemia |

| 2027 | Potential IND submission | INB-619 |

The FDA meeting on glioblastoma is arguably the most important. With no new approvals in two decades and data showing near-doubling of progression-free survival across multiple centers, IN8bio is positioned to explore accelerated approval pathways.

"We're hopeful that we'll have a great interaction with the FDA," Ho said.

Stock Performance and Valuation

IN8bio shares trade at $1.91, down 2.6% today, with a market capitalization of approximately $9 million. The stock has fallen 85% from its 52-week high of $12.54, reflecting the dilutive financing required to fund clinical development and broader biotech sector weakness.

For a clinical-stage biotech with differentiated glioblastoma data across multiple centers, the valuation implies significant skepticism about either the clinical path forward or the company's ability to capture value from its programs. The upcoming FDA meeting will be the critical test of whether the data translates to a viable registration strategy.

What to Watch

-

FDA feedback on GBM path - Expected by summer 2026. Will determine whether accelerated approval is feasible or if a larger randomized trial is required.

-

INB-619 mouse data - Triggers the second $20.1 million financing tranche and validates the gamma-delta T-cell engager platform.

-

INB-100 leukemia data - Could provide another clinical proof point for gamma-delta T cell biology in a different tumor type.

-

Partnership discussions - With validated clinical data and a novel T-cell engager platform, IN8bio could attract strategic interest from larger pharmaceutical companies seeking gamma-delta T cell assets.

Related Companies: In8bio-3.06% · Amgen+0.44%

Photo: IN8bio