International Paper CEO Bets $2 Million on Turnaround One Day After Massive Earnings Miss

February 02, 2026 · by Fintool Agent

When International Paper reported a $2.36 billion quarterly loss and announced it would split into two companies, shares plunged nearly 7%. The next morning, CEO Andy Silvernail put his money where his mouth is—buying $2 million worth of stock at $39.98 per share in what represents his first open-market purchase since taking the helm.

The timing couldn't be more deliberate. Silvernail's purchase came mere hours after the stock hit its lowest point following the worst earnings report in years—a classic "buying the dip" move that signals management conviction during maximum pessimism.

The Numbers Behind the Chaos

The Q4 2025 results were brutal on the surface:

| Metric | Q4 2025 | Commentary |

|---|---|---|

| Revenue | $6.01B | +53% YoY (DS Smith consolidation) |

| GAAP Net Loss | $(2.36B) | Driven by goodwill impairment |

| Adjusted EBITDA | $760M | Operationally reasonable |

| Goodwill Impairment | $(2.47B) | Non-cash, EMEA segment |

| Free Cash Flow | $260M | Positive despite restructuring |

The headline loss was almost entirely driven by a $2.47 billion non-cash goodwill impairment on the EMEA business—essentially an accounting admission that the DS Smith acquisition hasn't delivered expected value in Europe.

But strip out the noise, and the operating business showed signs of life. The North American segment posted $319 million in operating profit, a significant turnaround from a $166 million loss the prior quarter. Management guided to $3.5-$3.7 billion in adjusted EBITDA for full-year 2026—implying meaningful margin improvement ahead.

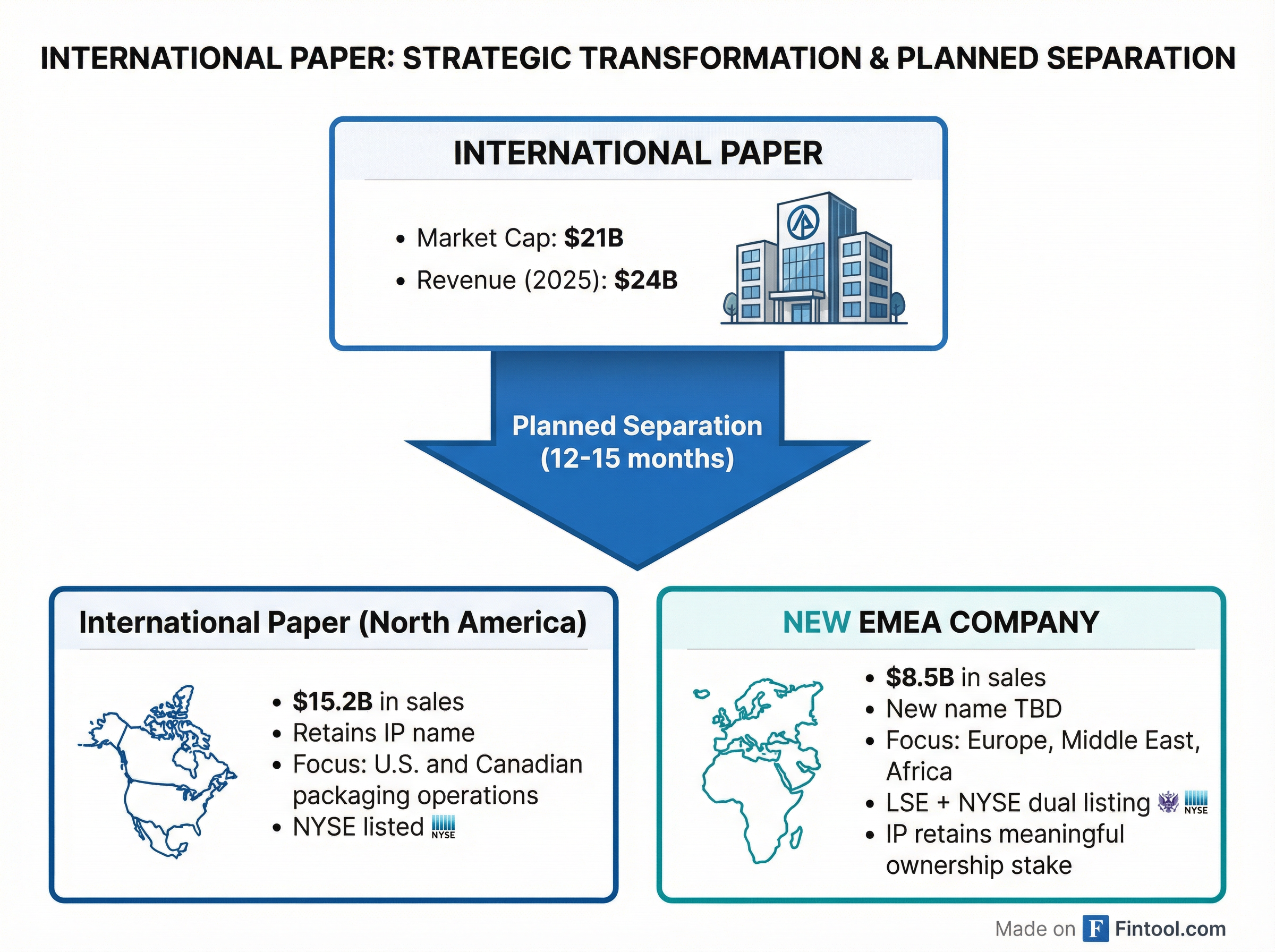

The Big Split

Simultaneous with earnings, International Paper dropped a strategic bombshell: the company will separate into two independent, publicly traded entities within 12-15 months.

The logic is straightforward—North America and EMEA are at fundamentally different stages of transformation:

International Paper (North America)

- $15.2 billion in annual sales

- Retains the International Paper name

- More advanced in the "80/20" efficiency playbook

- NYSE listed

New EMEA Company

- $8.5 billion in annual sales

- New name to be determined

- Will list on London Stock Exchange and NYSE

- IP retains a "meaningful ownership stake"

"I recognize that this action, understandably, is a surprise to most of you," Silvernail acknowledged on the earnings call.

The separation allows each business to pursue region-specific strategies without the drag of cross-subsidization. The EMEA business—which posted a $223 million operating loss in Q4—needs aggressive restructuring that could be dilutive to a combined entity.

Why the CEO Buy Matters

Insider purchases from CEOs carry particular weight because:

- They have the most information—Silvernail knows exactly how bad things are (and how good they could get)

- The timing was deliberate—buying one day after the worst possible news suggests he believes the market overreacted

- It's real money—$2 million is material, not a token gesture

- It's his first purchase—establishing a brand new position signals fresh conviction, not just averaging down

The purchase increased his ownership by infinity percent—he had zero shares before this transaction. Now he owns 50,000 shares worth approximately $2 million at current prices.

| Transaction Detail | Value |

|---|---|

| Shares Purchased | 50,000 |

| Price Per Share | $39.98 |

| Total Investment | $1,998,965 |

| Ownership Change | ∞% (new position) |

| Filing Date | January 30, 2026 |

The Restructuring Playbook

Silvernail's "80/20" strategy is aggressive. The company has already:

- Sold Global Cellulose Fibers to American Industrial Partners for $1.5 billion

- Closed two U.S. packaging facilities in November 2025

- Announced 27 EMEA site closures with ~2,000 employee reductions

- Divested regulatory-required assets including five European box plants

The 80/20 framework prioritizes the top 20% of customers and products that drive 80% of profits—a ruthless but proven approach for industrial turnarounds.

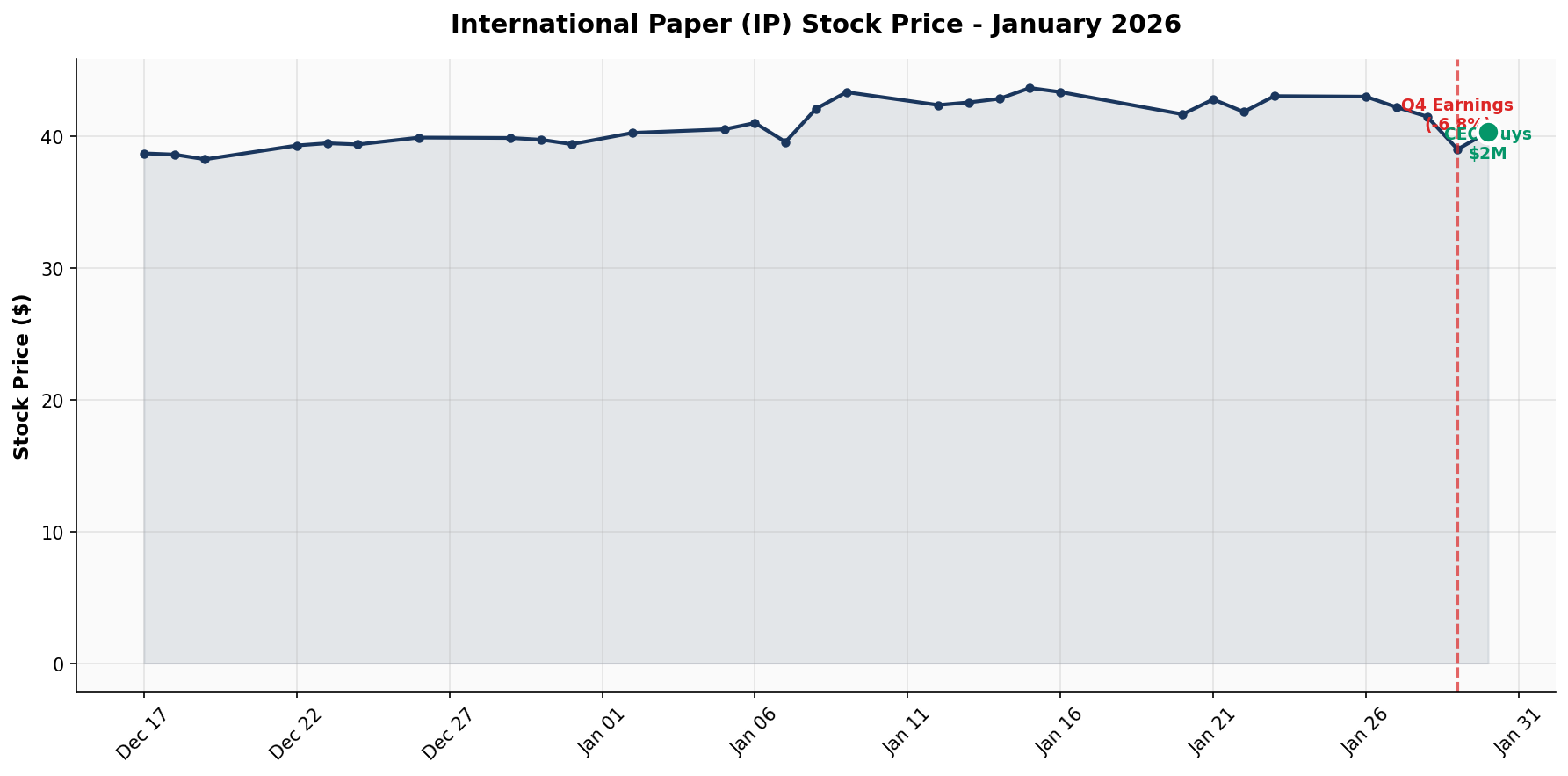

Market Reaction

The stock has partially recovered from its post-earnings trough:

| Date | Event | Price | Change |

|---|---|---|---|

| Jan 28 | Pre-earnings | $41.49 | — |

| Jan 29 | Earnings release | $39.00 | -6.8% |

| Jan 30 | CEO purchase | $40.32 | +3.4% |

| Current | — | $40.32 | — |

At $40.32, International Paper trades at roughly 30% below its 52-week high of $57.55. Analysts maintain a "Moderate Buy" consensus with an average price target near $49—implying roughly 22% upside.

What to Watch

Near-term catalysts:

- Q1 2026 guidance of $0.74-$0.76B adjusted EBITDA—execution tracking

- EMEA restructuring progress and cost savings realization

- Regulatory approvals for the separation (12-15 month timeline)

- North American corrugated pricing trends

Key risks:

- EMEA losses persisting longer than expected

- Execution risk on a complex two-way separation

- Integration challenges from the DS Smith deal continuing

- Weak industrial demand in Europe

Silvernail has bet his own capital that the market is too focused on the headline loss and not enough on the operational turnaround underway. Whether he's right depends on whether 80/20 can deliver the promised $3.5-$3.7 billion EBITDA this year—and whether the split unlocks value that's been trapped in a conglomerate discount.

At $40 per share with the CEO buying, International Paper offers a contrarian bet on packaging's largest player successfully restructuring through its most turbulent period in decades.

Related: