International Paper to Split Into Two Companies Just 12 Months After DS Smith Acquisition

January 29, 2026 · by Fintool Agent

International Paper announced plans to split into two independent publicly traded companies Wednesday, separating its North American and European operations just 12 months after completing its $7.2 billion acquisition of DS Smith. The announcement comes alongside a $2.47 billion goodwill impairment charge for the EMEA business and a wider quarterly net loss of $2.4 billion.

The decision marks a dramatic pivot for the Memphis-based packaging giant, which had pitched the DS Smith combination as creating a global corrugated packaging powerhouse. Instead, CEO Andy Silvernail framed the separation as the next phase of the company's "80/20" transformation strategy—simplify, segment, resource, and grow.

"The acquisition of DS Smith strengthened our regional footprint and positions both businesses in North America and EMEA to advance our virtuous cycle," Silvernail said on the earnings call. "By acting now, we can more fully enable the full potential of each business."

Two Regional Powerhouses

The split will create two scaled regional players:

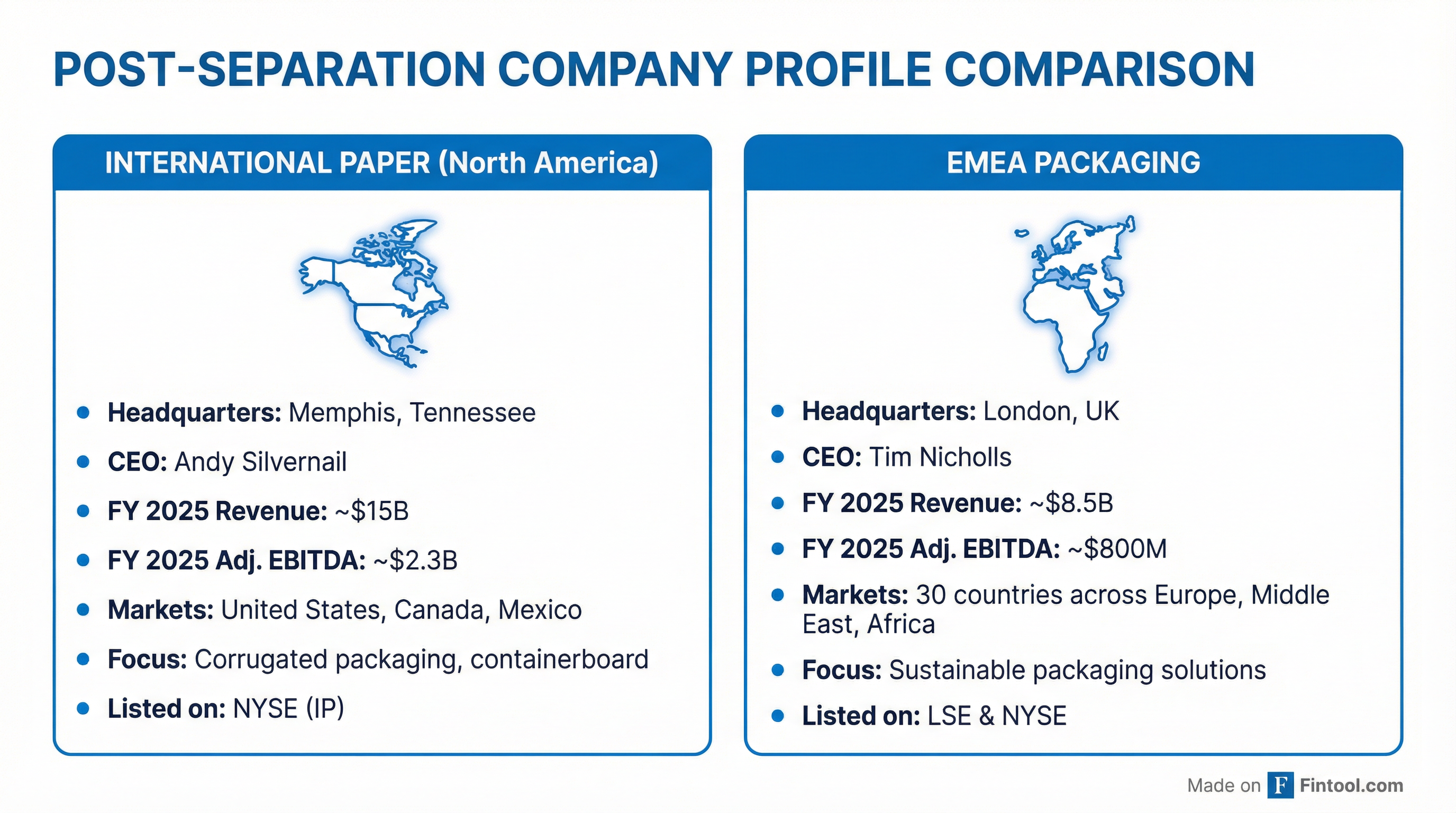

International Paper (North America) will remain the leading sustainable packaging solutions provider in the region with over $15 billion in revenue and approximately $2.3 billion of adjusted EBITDA for FY 2025. Andy Silvernail will continue as Chairman and CEO. The business commands roughly one-third of the North American corrugated packaging market and reported 37% year-over-year adjusted EBITDA growth in 2025.

EMEA Packaging will operate across 30 countries with approximately $8.5 billion in revenue and $800 million of adjusted EBITDA. Tim Nicholls—former IP CFO who has been leading the DS Smith integration—will serve as CEO. The company will list on both the London Stock Exchange and NYSE.

The $2.47 Billion Write-Down

The most striking element of the announcement is the $2.47 billion non-cash goodwill impairment charge for the EMEA business—recorded after management evaluated fair values in conjunction with the separation decision.

This charge, combined with $958 million of accelerated depreciation from mill closures and $626 million of restructuring charges, drove a staggering net loss of $3.5 billion for full-year 2025.

The impairment effectively acknowledges that the EMEA business is worth significantly less than the carrying value on IP's books—a sobering reality check just one year after the acquisition closed.

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Net Sales | $6.0B | $3.9B | +53% |

| Net Income (Loss) | $(2.38)B | $(0.15)B | NM |

| Adjusted EBITDA | $758M | $443M | +71% |

| Diluted EPS | $(4.48) | $0.25 | NM |

Why Now? The 80/20 Logic

Silvernail argued the separation reflects the natural evolution of IP's 80/20 strategy, not a retreat from the DS Smith deal thesis.

"There are key structural differences in the competitive and commercial landscapes that will require tailored commercial and capital allocation strategies going forward," he explained. "North America is more integrated and resilient in terms of supply positions and buyers... EMEA has more localized dynamics at the country level and relatively higher demand growth."

The CEO emphasized that while the businesses have benefited from integration—including $710 million of cost-out actions on a run-rate basis—they have "very, very, very little overlap" in how they serve customers and go to market.

"Using 80/20 as the lens and as the mindset, you wanna simplify, right? You wanna take the complexity out, you wanna focus on where the value is in the discrete markets, and then you want to get capital and people aligned and focused to those best opportunities," Silvernail said.

Restructuring Pain in EMEA

The EMEA business has been under intense transformation. Management disclosed that it has "actioned closures across 20 sites, reducing headcount by more than 1,400 positions" with another 7 sites and 700 roles in consultation. These actions are expected to deliver run-rate cost savings exceeding $160 million.

"While we are engaged in ongoing consultation on an additional 7 sites and more than 700 roles, we expect this to deliver run rate cost savings of more than $160 million," Silvernail noted. "At the same time, it's important to recognize these actions affect people and their families. We do not make these decisions lightly."

IP plans to invest approximately $400 million in EMEA throughout 2026 to fund the ongoing transformation before the spin-off is complete.

2026 Guidance and Path to $5 Billion

Despite the challenging Q4 results, management reiterated confidence in its transformation trajectory:

| Metric | 2026 Guidance | 2025 Actual |

|---|---|---|

| Net Sales | $24.1B - $24.9B | $23.6B |

| Adjusted EBITDA | $3.5B - $3.7B | $3.0B |

| Free Cash Flow | $300M - $500M | $(159)M |

| Q1 Adj. EBITDA | $740M - $760M | — |

The company reiterated its 2027 target of $5 billion in EBITDA—roughly $3.5 billion from North America and $1.5 billion from EMEA—which it believes the separation will help achieve.

Importantly, guidance excludes any price realization benefits. IP has issued a $70/ton price increase letter to North American customers, and EMEA has announced approximately €100/ton in paper price increases. Management noted that every $10/ton price realization in North America translates to roughly $90 million of annualized adjusted EBITDA.

Dividend Concerns

One analyst pressed Silvernail on the dividend, noting that free cash flow guidance of $300-500 million doesn't cover the roughly $1 billion annual payout.

"We are maintaining our dividend policy as it is through 2026," Silvernail responded. "Through any process like this, you're gonna review that, work in conjunction with shareholders to make sure we get to the right place on a dividend post-spin."

The company previously indicated that break-even for covering the dividend requires approximately $3.6-3.7 billion of EBITDA—above 2025's $3.0 billion but within the 2026 guidance range.

Transaction Details

The separation is expected to complete within 12-15 months, subject to:

- Final approval by IP's Board of Directors

- Filing and effectiveness of SEC registration statement

- UK Financial Conduct Authority prospectus approval

- Customary regulatory approvals

The EMEA company will list on both the London Stock Exchange and NYSE. IP intends to retain a "meaningful ownership stake" in the new company post-spin-off. Whether the transaction will be tax-free to U.S. shareholders depends on final terms and the percentage of ownership retained.

Jefferies served as lead financial advisor, with Evercore also advising. Wachtell, Lipton, Rosen & Katz provided legal counsel.

What to Watch

The split raises several questions investors will monitor:

-

Valuation arbitrage: Will the EMEA business trade at a discount given the impairment and restructuring headwinds, or will focus premium eventually materialize?

-

Execution risk: Management is promising a major second-half 2026 EBITDA acceleration—approximately $555 million sequentially in North America alone—driven by cost actions and normalizing maintenance schedules. Any slippage will raise credibility questions.

-

Price realization: The earnings guidance excludes pricing benefits. If the industry sustains even partial price increases, there's meaningful upside. If pricing fails, the dividend coverage math gets harder.

-

EMEA turnaround: Tim Nicholls inherits a business that required a $2.5 billion write-down before even being spun off. His ability to drive operational improvement while preparing for public company independence will be closely scrutinized.

IP shares were trading down modestly in pre-market following the announcement, with investors digesting the large impairment alongside the strategic rationale for the split.

Related: