Intuitive Surgical Returns to Its Roots: FDA Clears da Vinci 5 for Cardiac Surgery

January 26, 2026 · by Fintool Agent

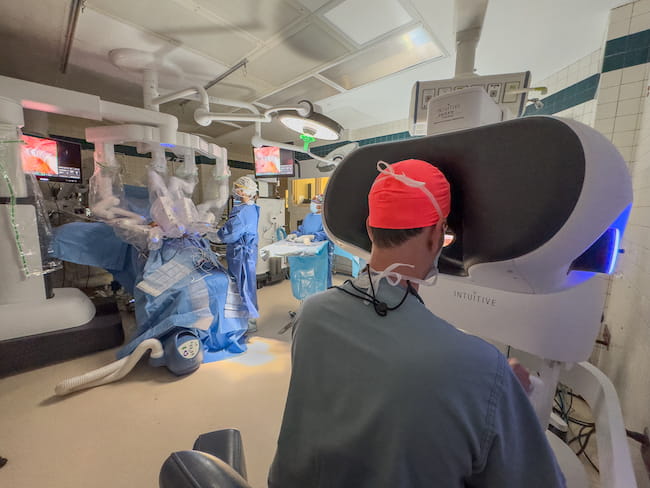

Twenty-four years after cardiac surgery became the first specialty cleared on the original da Vinci system, Intuitive Surgical is coming full circle. The FDA has granted 510(k) clearance for the da Vinci 5 surgical system in nine cardiac procedures—a strategic return to a market Intuitive largely abandoned due to technical limitations and training infrastructure gaps.

The clearance covers mitral valve repair, internal mammary artery mobilization for cardiac revascularization, atrial septal defect repair, patent foramen ovale closure, left atrial appendage closure, atrial myxoma excision, mitral valve replacement, tricuspid valve repair, and epicardial pacing lead placement.

ISRG shares rose 0.9% to $528.81 on the news. The stock remains 13% below its 52-week high of $609.08.

The Strategic Significance

This isn't a routine clearance expansion—it's a deliberate strategic pivot. CEO Dave Rosa framed the announcement in the context of patient outcomes that current approaches fail to deliver: "Opening the chest to perform surgical procedures can involve significant pain, high risk of complications, and long recovery times that can affect patients' physical and psychological wellbeing."

The numbers underscore the opportunity:

- 18 million lives lost annually to cardiovascular disease, the world's leading cause of death

- 2 million+ open heart surgeries performed globally each year, most requiring sternotomy—splitting the breastbone

- 160,000 addressable procedures annually in the US and Korea (where da Vinci 5 is cleared for cardiac use)

Why Intuitive Left—And Why It's Coming Back

Cardiac surgery was da Vinci's first cleared specialty in 2002. Since then, more than 140,000 robotic-assisted cardiac procedures have been performed using da Vinci systems across 51 countries.

But Intuitive shifted its primary focus away from cardiac surgery years ago. As the company explained, "a combination of technical limitations of first‑generation platforms and the absence of a global training and support infrastructure led Intuitive to shift its primary focus away from cardiac surgery."

What's changed? Da Vinci 5's technological capabilities and a mature ecosystem:

- 10,000x computing power compared to earlier systems

- Advanced imaging for enhanced visualization

- Smart instrumentation capturing 1,000+ data points per second

- Force feedback capabilities (pending for cardiac-specific instruments)

"Today, with those barriers addressed and a mature ecosystem in place, minimally invasive cardiac surgery is positioned for meaningful expansion with da Vinci 5," the company stated.

A Measured Rollout, Not a Blitz

Management is taking a deliberate approach. "Given the complexity of minimally invasive cardiac surgery, we are planning a measured rollout to support training, education, and adoption," Rosa said on the Q4 2025 earnings call.

The multi-year buildout includes:

| Initiative | Status |

|---|---|

| FDA clearance (US) | ✓ Completed January 2026 |

| European approval | In progress |

| Force feedback instruments | In regulatory pathway |

| Cardiac-specific instrumentation | In development |

| Training programs | Being developed |

| Surgical society partnerships | Active engagement |

CFO Jamie Samath provided context on current scale: "In 2025, globally, there were about 17,000 cardiac procedures performed. That's on SP and Xi. That business has been growing for multiples of years, but obviously from a small base."

The Clinical Case for Robotic Cardiac Surgery

Historical data supports the value proposition. A 2009 study comparing da Vinci revascularization to open sternotomy found dramatic quality-of-life improvements:

| Recovery Metric | Open Sternotomy | da Vinci Approach | Improvement |

|---|---|---|---|

| Hospitalization | Standard | 50% shorter | 2x faster |

| Time to shower | 9.8 days | 3.7 days | 62% faster |

| Driving a car | 35.5 days | 16.4 days | 54% faster |

| Walking outdoors | 15.5 days | 6.2 days | 60% faster |

| Riding a bicycle | 67.2 days | 28.2 days | 58% faster |

More recent data reinforces this. A November 2025 meta-analysis in the Annals of Surgery found that patients undergoing robotic-assisted surgery were approximately 50% less likely to experience conversion to open surgery compared to laparoscopic procedures.

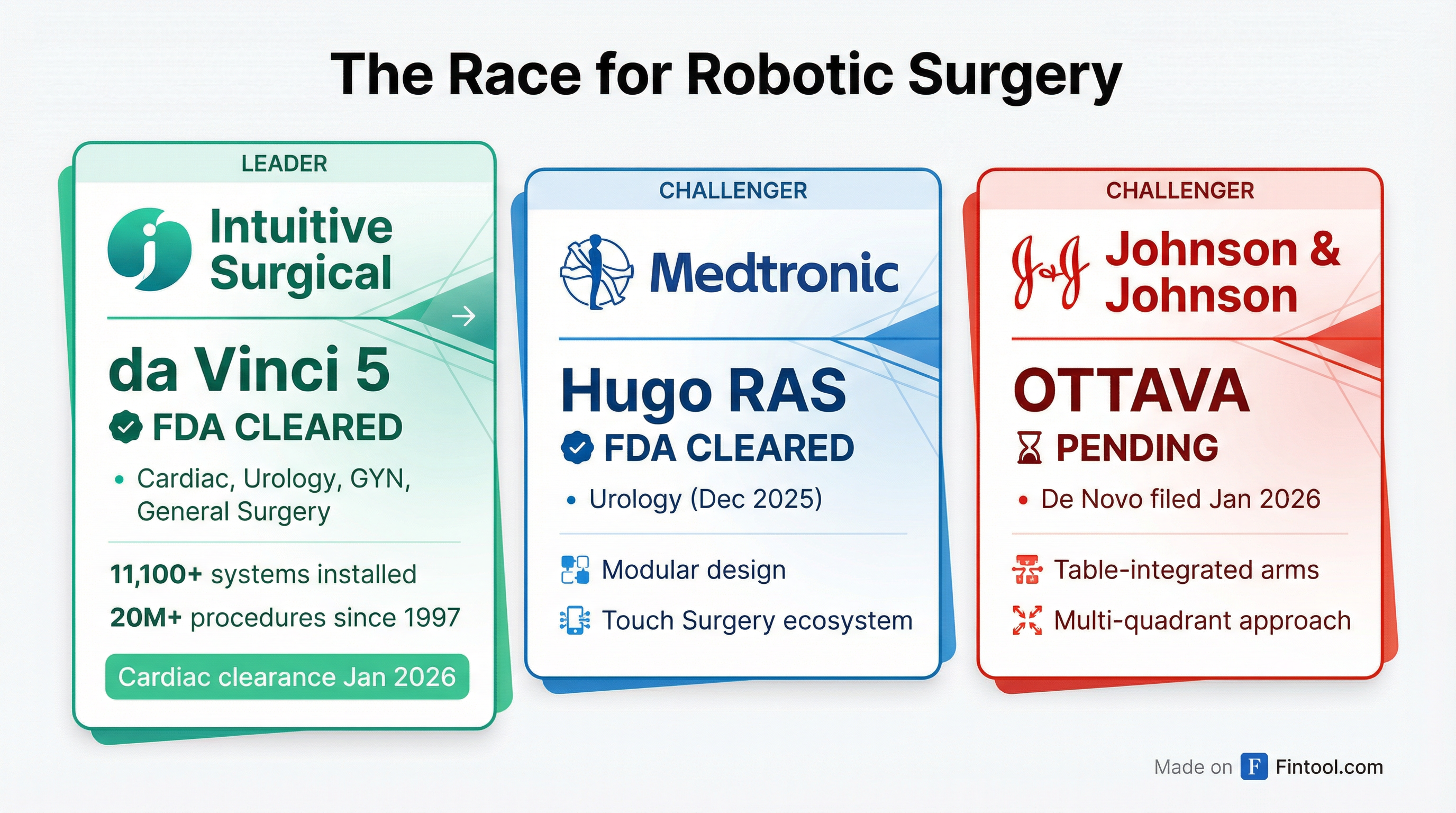

Competition Is Heating Up—But Intuitive Extends Its Lead

The cardiac clearance widens Intuitive's competitive moat just as Medtronic and Johnson & Johnson intensify their push into robotic surgery.

Medtronic Hugo RAS received FDA clearance in December 2025—but only for urologic procedures. The modular system features a Touch Surgery digital ecosystem for training and case insights.

J&J's Ottava filed a de novo FDA submission in early January 2026 for general surgery procedures in the upper abdomen. The platform features arms integrated into the operating table for a multi-quadrant approach.

Neither competitor has cardiac surgery clearances.

"Intuitive Surgical's Dv5 remains in a strong position, having seen growing adoption and rapid uptake above and beyond prior Dv systems," BTIG analysts wrote following the clearance announcement.

Financial Context

Intuitive enters this cardiac expansion from a position of strength:

| Metric | Q4 2025 | YoY Change |

|---|---|---|

| Revenue | $2.87B | +19% |

| Net Income | $794.8M | — |

| Gross Margin | 66.4% | — |

| EBITDA Margin | 35.7% | — |

Full-year 2025 results were equally robust:

- Total revenue: $10.1 billion (+21% YoY)

- Procedures performed: 3.1 million+ globally

- Da Vinci 5 placements: 870 systems

- Total installed base: 11,100+ da Vinci systems

- Cumulative procedures since 1997: 20 million+

For 2026, Intuitive projects da Vinci procedure growth of 13%-15%.

What to Watch

Near-term catalysts:

- European cardiac clearance (in progress)

- Force feedback instrument regulatory submissions

- Early adopter feedback from limited US cardiac sites through 2026

Key risks:

- Complexity of cardiac surgery may slow adoption vs other specialties

- Competition from J&J Ottava once approved

- Reimbursement dynamics for robotic cardiac procedures

- Training pipeline constraints for cardiac surgeons

The bottom line: Intuitive's cardiac clearance isn't about the next quarter—it's about the next decade. The company is returning to its roots with vastly superior technology and a mature commercial infrastructure. In a market where cardiovascular disease kills 18 million people annually, the opportunity to replace sternotomies with minimally invasive approaches represents one of the most compelling long-term growth vectors in surgical robotics.