Inuvo's New CEO Bets on 'Agentic Era' to Revive $47M AdTech Firm

January 28, 2026 · by Fintool Agent

In his first address as Inuvo's incoming CEO, Rob Buchner laid out an ambitious vision: transform a struggling $47 million AdTech firm into "the intent intelligence engine" powering the next generation of AI-driven advertising.

Speaking at the company's 2026 Shareholder Update Conference Call this afternoon, Buchner delivered a strategic pivot that goes beyond fixing the Q4 revenue crisis. He's betting that Inuvo's privacy-first AI platform will become indispensable as the advertising industry enters what he calls the "agentic era"—where AI agents make purchasing and media decisions autonomously.

"The most significant opportunity for Inuvo is the exponential scale that could come from integrations," Buchner declared. "As business moves towards agentic systems, where AI agents make decisions on behalf of users and brands, they will increasingly require generative intelligence that informs their actions. IntentKey does just that."

The Bad Actor Problem

Buchner finally explained what really happened in Q4—and it's more alarming than compliance issues alone.

The company discovered that "nefarious technologies" had infiltrated its Platform network, with bad actors using sophisticated methods to disguise low-quality traffic as legitimate high-intent consumer demand. This wasn't isolated to Inuvo; it was "a much broader market shift" affecting its largest platform client's entire ecosystem.

Inuvo's response was its new AI tool called Ranger, designed not just to enforce standards but to "reveal quality differences that had been previously difficult to detect at scale."

"The scale of these bad actors and the technological sophistication being used demanded that we intentionally slow growth so we could have clear visibility and insight into traffic quality," Buchner explained. "We had not anticipated the impact to be so significant, nor did we expect the impact to extend through fourth quarter and into January."

The result: Q4 revenue of approximately $14 million—down 47% year-over-year—and full-year 2025 revenues of roughly $86 million, far below earlier expectations of breaking $100 million.

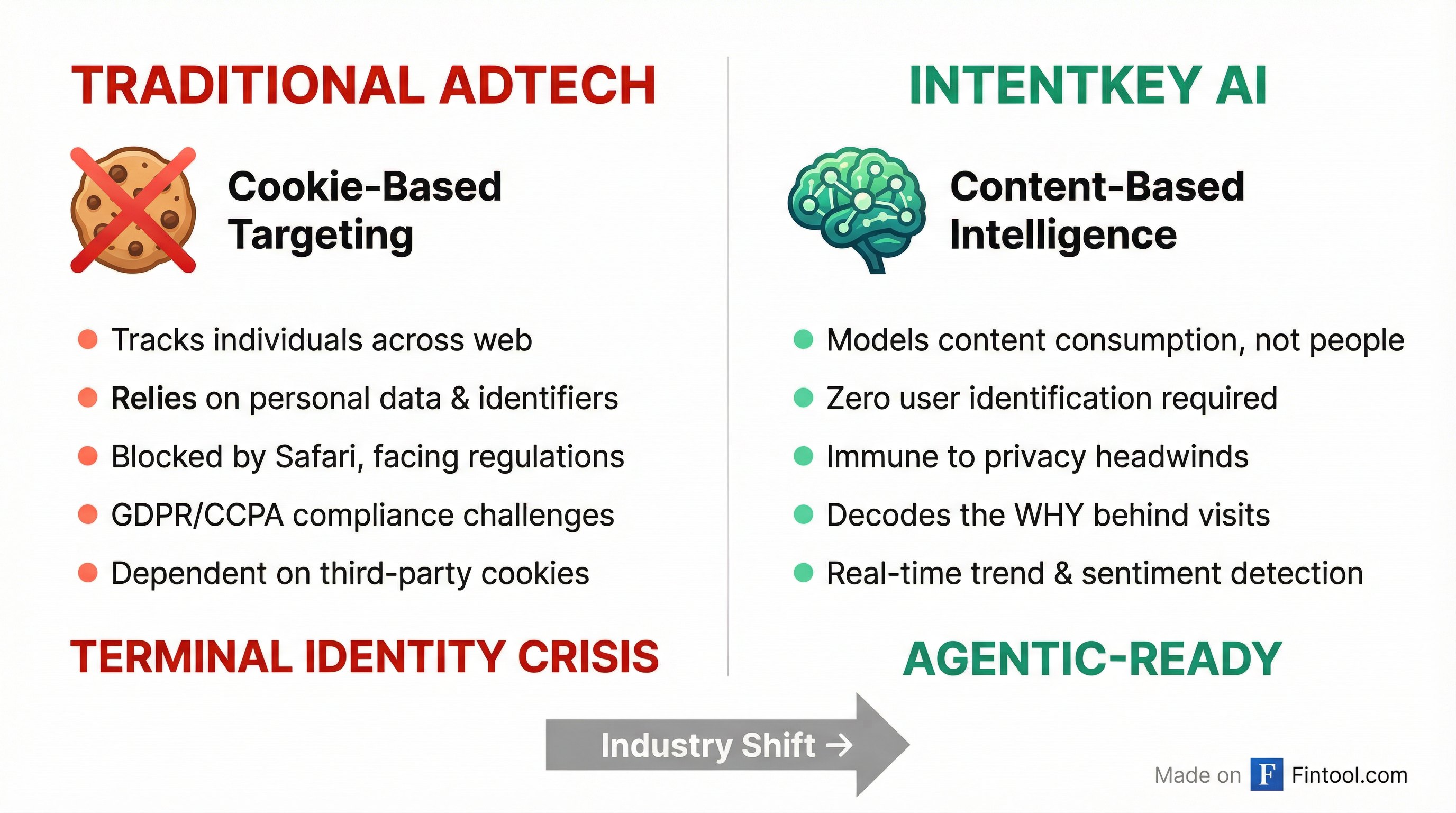

The Privacy Thesis: Why Cookies Don't Matter

Buchner's turnaround thesis hinges on a structural shift in digital advertising that he believes favors Inuvo.

"The traditional ad tech landscape is facing a terminal identity crisis," he said. "Between tightening regulations, browser-level blocking of identifiers such as Safari, and the rise of generative search, the open web as we know it is undergoing rapid and sweeping change. Traditional ad techs who have almost universally relied on tracking individuals and using their personal data as targeting signals are now being locked out."

Inuvo's IntentKey AI takes a fundamentally different approach. Rather than tracking users, it models content consumption patterns to understand consumer intent without requiring personal identification.

"We don't just categorize a web page; we decode the why behind the visit," Buchner explained. "IntentKey understands which geographies are pivoting towards specific concepts in real time. It identifies trending behaviors before they become mainstream."

This positioning, he argues, makes IntentKey uniquely suited for the agentic future: "Because we can integrate into legacy and emerging buying systems more efficiently than other targeting processes, we have the opportunity to harness exponential growth through integration in ways traditional competitors cannot."

Four Pillars of the Turnaround

Buchner outlined a four-pillar strategy to stabilize and scale the business:

1. Go-to-Market Focus: Shift from volume-driven agency relationships to "higher margin, upstream, strategic, and brand direct engagements."

2. Raise Industry Profile: Better translate IntentKey's value proposition into sustainable, high-retention revenue. "We're seeing traction in terms of increased client retention and expansion, as well as high-velocity deal flow," Buchner noted, adding that Inuvo enters 2026 "with our strongest sales pipeline to date."

3. Product Innovation: Expand IntentKey applications beyond core media—a priority for the new executive being brought in.

4. High-Margin Growth: Transform from a "service-reliant" model to a "high-margin, technology-first platform" focused on profitability.

Bringing In Reinforcements

To execute this vision, Buchner is bringing in an "executive in residence"—a seasoned operator with expertise in data architecture and enterprise technology partnerships.

The unnamed hire will focus on three priorities:

- Strategic growth acceleration: Developing and executing a roadmap for alliances, deals, and partnerships to expand market reach

- Building an enterprise-grade sales force: Recruiting directors capable of navigating complex brand-direct commercial deals

- Expanding the product roadmap: Identifying new monetization opportunities for IntentKey beyond core advertising

Financial Lifelines

The cash question looms large for a company burning money while revenue collapsed.

Buchner said Inuvo has "adequate cash to sustain us" through the recovery period, citing two sources: proceeds from a $3.3 million convertible note and expected recoveries from a class action lawsuit referenced on the Q3 call.

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025E |

|---|---|---|---|---|---|---|---|---|

| Revenue ($M) | $17.0 | $18.2 | $22.4 | $26.2 | $26.7 | $22.7 | $22.6 | $14.0 |

| Gross Margin | 87.7% | 84.0% | 88.4% | 83.1% | 79.0% | 75.4% | 73.4% | TBD |

| Cash Position ($M) | $2.4 | $2.0 | $2.6 | $2.5 | $2.6 | $2.1 | $3.4 | TBD |

Importantly, he signaled confidence in a turnaround: "We believe that we're past the worst of it. More importantly, we have ample reason to believe that revenue will recover as we progress through the months ahead."

After-Hours Reaction

Inuvo shares closed flat at $3.34 on Tuesday—down 52% over the past year. However, after-hours trading showed the stock falling to $2.47, suggesting investors remain skeptical of the turnaround narrative.

| Metric | Value |

|---|---|

| Market Close | $3.34 |

| After-Hours Trade | $2.47 (-26%) |

| 52-Week High | $6.27 |

| 52-Week Low | $2.34 |

| Market Cap | $47M |

What to Watch

Near-term catalysts:

- Full Q4 2025 results and 2026 guidance (March 5, 2026)

- Google Services Agreement renewal (current extension expires February 28, 2026)

- Class action lawsuit payout expected Q1 2026

- Platform revenue recovery metrics

Key questions:

- Can IntentKey scale brand-direct deals fast enough to offset Platform volatility?

- Will the "agentic AI" positioning translate into real integrations and revenue?

- Is the $3.3 million convertible note enough runway if recovery takes longer than expected?

Buchner acknowledged the volatility: "This incident has reinforced the importance of channeling our focus and investment towards IntentKey, where our proprietary technology gives us a significantly more decisive and sustainable competitive advantage."

The bet is clear: Inuvo's future lies not in chasing Platform revenue but in becoming essential infrastructure for the AI-powered advertising ecosystem. Whether that vision can rescue a stock trading near 52-week lows remains the central question.

Related: