Earnings summaries and quarterly performance for Inuvo.

Executive leadership at Inuvo.

Board of directors at Inuvo.

Research analysts who have asked questions during Inuvo earnings calls.

Jon Hickman

Ladenburg Thalmann

7 questions for INUV

Also covers: BLDE, BYRN, CLSK +10 more

Brian Kinstlinger

Alliance Global Partners

6 questions for INUV

Also covers: AI, ALAR, ATER +25 more

Jack Vander Aarde

Maxim Group

5 questions for INUV

Also covers: ALRM, AMPG, BKYI +10 more

SB

Scott Buck

H.C. Wainwright

4 questions for INUV

Also covers: AEYE, ARQQ, BKSY +27 more

Jack Codera

Maxim Group

1 question for INUV

Also covers: BNAI, BRAG, HEAR +1 more

Recent press releases and 8-K filings for INUV.

Inuvo announces receipt of class action settlement proceeds

INUV

Legal Proceedings

New Projects/Investments

- Inuvo, Inc. received $6.2 million from a class action lawsuit settlement on January 29, 2026.

- This settlement was previously disclosed during the company's Q3 2025 investor call.

- The proceeds are a one-time, non-recurring cash inflow that will strengthen liquidity and support ongoing investments in product innovation, market expansion, and operational initiatives.

Feb 2, 2026, 1:42 PM

Inuvo Announces Receipt of Class Action Settlement

INUV

Legal Proceedings

New Projects/Investments

- Inuvo, Inc. received $6.2 million as a claimant of a class action lawsuit settlement on February 2, 2026.

- The settlement was first referenced during the company's Q3 2025 investor call and a recent shareholder update, with a significant payout expected in the first quarter of 2026.

- Rob Buchner, Inuvo Chairman & CEO, stated that this development strengthens the company's liquidity position and supports its strategic priorities.

- The funds provide additional financial flexibility to support ongoing investments in product innovation, market expansion, and operational initiatives.

Feb 2, 2026, 1:15 PM

Inuvo Announces New CEO and Provides 2025 Revenue Update

INUV

CEO Change

Guidance Update

Demand Weakening

- Robert C. Buchner will assume the roles of Chief Executive Officer and Chairman, effective February 1, 2026, succeeding Rich Howe.

- Inuvo expects full year 2025 revenue to be approximately $86 million, a pullback attributed to issues with lower-quality traffic and bad actors within its Platforms product line.

- The company is shifting its strategic focus and investment towards its IntentKey product, aiming for higher-margin, brand-direct engagements and reporting its strongest sales pipeline to date entering 2026.

- Inuvo has secured a new $3.3 million convertible note and anticipates recoveries from a class action lawsuit, providing adequate cash to sustain operations.

Jan 29, 2026, 9:07 PM

Inuvo Announces Leadership Change and Revised 2025 Revenue Outlook

INUV

CEO Change

Guidance Update

Management Change

- Inuvo announced a leadership transition, with Rob Buchner appointed Chairman and CEO, succeeding Rich Howe.

- The company revised its full-year 2025 revenue expectation to approximately $86 million, attributing the change to a significant impact from "bad actors" affecting traffic quality in Q4 2025 and January.

- The new CEO outlined a strategic shift to focus investment on IntentKey, highlighting its proprietary AI compliance system, Ranger, and its competitive advantage in a privacy-focused market by modeling content consumption rather than user identification.

- Strategic pillars under the new leadership include focusing on higher-margin engagements, raising IntentKey's industry profile, and driving product innovation, supported by the hiring of an executive in residence to accelerate growth and build an enterprise-grade sales force.

Jan 28, 2026, 10:15 PM

Inuvo Announces Leadership Transition and Revised 2025 Revenue Outlook

INUV

CEO Change

Guidance Update

Demand Weakening

- Rob Buckner has assumed the roles of Chairman and CEO, succeeding Rich Howe.

- Inuvo anticipates full year 2025 revenues of approximately $86 million, a significant pullback from Q4 2025 and January 2026 due to issues with lower-quality traffic and bad actors within their largest platform client's network.

- The company is shifting its strategic focus and investment towards IntentKey, its proprietary AI-based large language model, which is designed to be immune to privacy headwinds by modeling content consumption.

- Inuvo has implemented Ranger, an AI compliance system, to address traffic quality, and expects revenue recovery in the coming months, supported by $3.3 million from a convertible note and anticipated recoveries from a class action lawsuit.

Jan 28, 2026, 10:15 PM

Inuvo CEO Assumes Chairman Role and Updates 2025 Revenue Guidance

INUV

CEO Change

Guidance Update

New Projects/Investments

- Rob Buckner has assumed the roles of Chairman and Chief Executive Officer for Inuvo.

- Inuvo now expects full year 2025 revenues to be approximately $86 million, a reduction attributed to a "broader market shift" in Q4 2025 involving "bad actors" that necessitated intentionally slowing growth.

- The company is strategically shifting its focus and investment towards its proprietary IntentKey technology, which utilizes a large language model for audience discovery and digital media activation, emphasizing its privacy-first approach.

- An executive in residence will be brought in to accelerate strategic growth, build an enterprise-grade sales force, and expand the product roadmap.

Jan 28, 2026, 10:15 PM

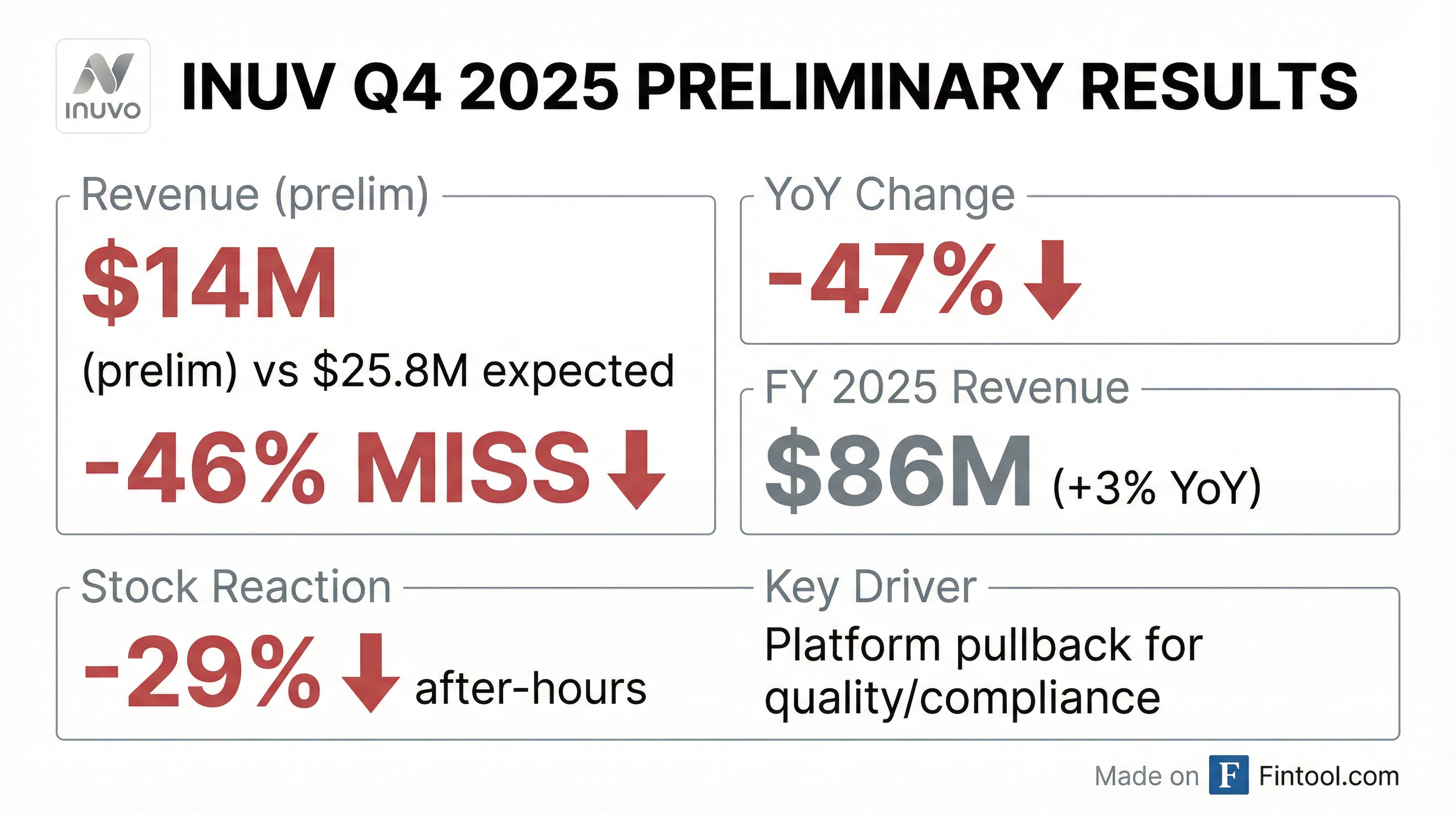

Inuvo Reports Preliminary Q4 and Full-Year 2025 Revenue Results

INUV

Earnings

Guidance Update

Demand Weakening

- Inuvo, Inc. reported preliminary unaudited net revenue of approximately $14 million for the fourth quarter ended December 31, 2025, which is an approximate 47% decrease compared to the same quarter of the prior year.

- The company expects full-year 2025 net revenue to be approximately $86 million, representing a year-over-year increase of approximately 3%.

- The Q4 revenue shortfall was primarily driven by an intentional pullback in the Platform product line, prioritizing advertising quality, scalability, and compliance over short-term volume.

Jan 28, 2026, 9:22 PM

Inuvo Reports Preliminary Fourth Quarter and Full-Year 2025 Revenue

INUV

Earnings

Guidance Update

Demand Weakening

- Inuvo, Inc. announced preliminary unaudited net revenue of approximately $14 million for the fourth quarter ended December 31, 2025.

- This Q4 2025 revenue reflects an approximate 47% decrease compared to the prior year's fourth quarter, primarily due to an intentional pullback in the Platform product line.

- For the full-year 2025, Inuvo expects net revenue to be approximately $86 million, representing an approximate 3% increase year-over-year.

- CEO Rich Howe noted that the company prioritized advertising quality and compliance, which led to the near-term revenue reduction, but anticipates revenue recovery in the coming months.

- These financial results are preliminary and unaudited, subject to finalization and audit.

Jan 28, 2026, 9:10 PM

Inuvo, Inc. Enters into Subordinated Convertible Note Financing

INUV

Debt Issuance

- Inuvo, Inc. entered into a securities purchase agreement on January 14, 2026, for the issuance of unsecured subordinated convertible notes with an aggregate principal amount of $3,333,333.33.

- The notes were issued with a 10% original issue discount, resulting in $3,000,000 in net proceeds to the company.

- The notes are convertible into common stock at a conversion price of $3.10 per share, with an issuance date of January 14, 2026, and a maturity date of January 14, 2027.

- The company is limited to issuing no more than 2,941,274 shares (19.99% of outstanding common stock) upon conversion without stockholder approval, and buyers' beneficial ownership is capped at 4.99% (potentially 9.99%).

Jan 15, 2026, 1:32 PM

Advini and Cordier by InVivo Enter Exclusive Negotiations

INUV

M&A

New Projects/Investments

- Advini Group and Cordier by InVivo have entered into exclusive negotiations to merge certain activities, aiming to strengthen their position in the French wine industry.

- This merger is expected to allow Advini to strengthen its position in the Bordeaux region, enter the sparkling wine market, and enhance its export activities. The combined entity would have consolidated revenues over €320 million, with 65% generated internationally.

- The transaction would primarily involve an asset contribution from Cordier by InVivo to Advini, making InVivo a key shareholder in Advini, while the Jeanjean family and Antoine Leccia would retain an absolute majority of Advini's capital.

- The parties aim to close the transaction by March 31st of next year (2026).

Dec 15, 2025, 5:00 PM

Fintool News

In-depth analysis and coverage of Inuvo.

Quarterly earnings call transcripts for Inuvo.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more