Inuvo Replaces 15-Year CEO as Q4 Revenue Collapses 47%

January 28, 2026 · by Fintool Agent

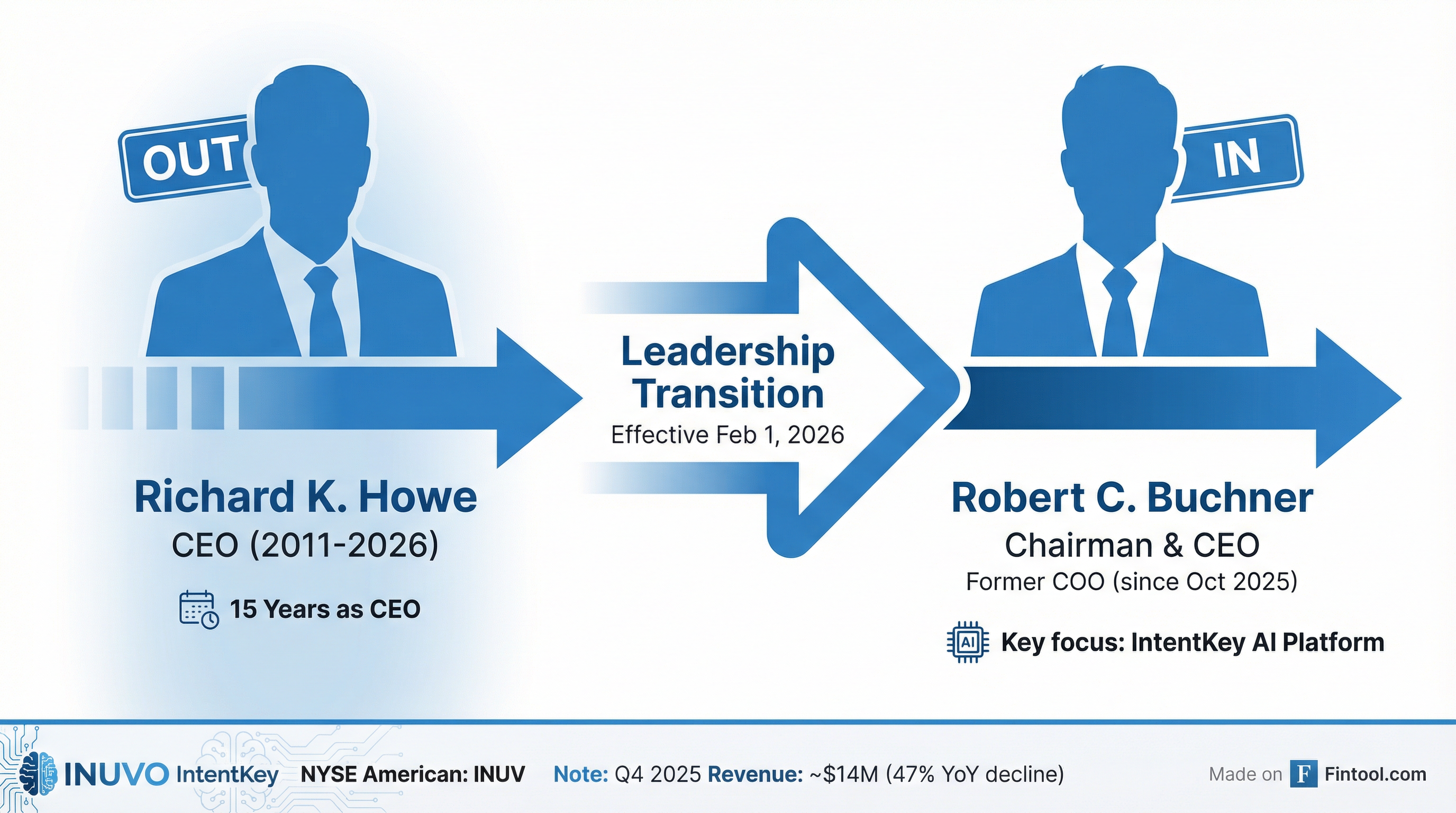

Inuvo is replacing its longtime CEO as the AI-powered AdTech company grapples with a sharp revenue decline and a stock that has lost more than half its value in the past year.

Richard K. Howe, who led Inuvo for 15 years, will step down as CEO effective January 31, 2026. The board has appointed Chief Operating Officer Robert C. Buchner to succeed him as both CEO and Chairman, effective February 1, 2026.

The leadership change coincides with a stark revenue warning: Q4 2025 preliminary revenue of approximately $14 million represents a 47% decline from the same quarter last year. The company expects full-year 2025 revenue of approximately $86 million, up just 3% year-over-year—a dramatic deceleration from the 25% growth achieved through the first nine months.

From Record Highs to Revenue Collapse

The trajectory of 2025 tells the story of a company that went from breakout success to crisis in a matter of months.

Q1 2025 was a triumph: Inuvo reported a record $26.7 million in revenue, up 57% year-over-year, with Howe declaring the company was "on track to beat and break through the $100 million barrier." Platform revenue grew 61% as campaign volume doubled. The stock peaked near $7.90 in early 2025.

But warning signs emerged by Q3. Revenue came in flat at $22.6 million, with gross margins compressing from 88% to 73%. Howe acknowledged the company had "deliberately scaled back advertising in mid-August" to comply with new requirements from its largest Platform client.

The impact proved far worse than anticipated. In today's filing, Howe stated: "While we had flagged challenges on our Q3 conference call, the impact ended up greater and more prolonged than expected, extending through Q4 and into January."

Stock in Freefall

Inuvo shares have collapsed 52% year-to-date, falling from $6.96 at the start of 2025 to $3.34 as of January 28, 2026. The stock hit a 52-week low of $2.34 in November 2025 following the Q3 results and has only partially recovered.

| Metric | Value |

|---|---|

| Current Price | $3.34 |

| 52-Week High | $6.27 (Jul 18, 2025) |

| 52-Week Low | $2.34 (Nov 21, 2025) |

| YTD Change | -52% |

| Market Cap | $47M |

Despite the stock's decline, Howe made an open-market purchase of 15,000 shares at $3.65 in June 2025—a vote of confidence that has since proven costly.

New Leadership: Buchner's Background

Rob Buchner, 62, was brought in as COO just four months ago in October 2025 after serving as a board member since February 2025. His rapid ascent to CEO reflects the urgency of Inuvo's turnaround needs.

Buchner brings traditional advertising credentials to the AI-native company. He previously served as CEO of Campbell Mithun (part of Interpublic Group), where he restructured the 80-year-old agency around what he called "Creative Sciences"—a model combining brand content, technology, and media analytics. Earlier, as CMO of Fallon Worldwide (Publicis), he architected the agency's digital and entertainment practices.

On the Q3 call, Buchner outlined an aggressive go-to-market shift: targeting "$1 million+ services deals with CXOs inside brand organizations" rather than smaller agency engagements. He described the AdTech landscape as experiencing "seismic shifts and structural failure" with "the legacy programmatic spine breaking."

His immediate priorities as CEO: "accelerate adoption of our proprietary AI platform, IntentKey, strengthen growth-focused strategic partnerships, and deliver actionable consumer intent insights."

Separation Terms

Howe's departure triggers a substantial severance package:

- $682,813 in separation pay over 22 months

- 18 months of COBRA health coverage

- 120,001 RSUs fully vest on termination date (worth ~$400,000 at current prices)

- Continues as board member

The separation agreement characterizes his departure as a "termination without Cause."

Buchner's employment agreement provides:

- $400,000 annual base salary

- 60% target bonus ($240,000), based on Compensation Committee metrics

- 75,000 RSU grant vesting 1/3 per year

- 1-year term with automatic renewal

The Platform Problem

At the heart of Inuvo's troubles is its Platform business, which generates the majority of revenue from a handful of large clients. The company has three major Platform clients, with one accounting for the bulk of recent growth—and decline.

The filing reveals Inuvo's subsidiary Vertro just received a one-month extension of its Google Services Agreement, now expiring February 28, 2026. This short-term extension suggests ongoing uncertainty in a key business relationship.

Management's explanation for the Q4 collapse centers on "prioritizing advertising quality, scalability, and compliance over short-term volume." The company launched a new AI-powered compliance tool called "Ranger" to ensure ad creatives align with landing page content.

But the revenue hit raises questions about whether the Platform business model—dependent on a few large clients with stringent compliance requirements—can sustain the growth trajectory investors were expecting.

Financial Snapshot

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025E |

|---|---|---|---|---|

| Revenue | $26.7M | $22.7M | $22.6M | $14M |

| Gross Margin | 79.0% | 75.4% | 73.4% | TBD |

| Net Income | -$1.3M | -$1.5M | -$1.7M | TBD |

| YoY Growth | +57% | +25% | +1% | -47% |

What to Watch

Near-term catalysts:

- Full Q4 2025 results and 2026 guidance (expected March 5, 2026)

- Platform revenue recovery—management said October showed year-over-year improvement

- Google Services Agreement renewal beyond February 2026

- Class action lawsuit payout expected in Q1 2026

Key risks:

- Client concentration in Platform business

- Further compliance-related revenue disruption

- Cash burn acceleration—company had $3.4M cash and $3.4M drawn on credit facility as of Q3

- Integration of new leadership amid crisis

Buchner will host a shareholder update call today at 5:15 PM ET to outline his strategic vision. Investors will be listening for specifics on the revenue recovery timeline and whether the Platform business can regain its footing.

Related: