Jacobs Shareholders Approve All Proposals at 2026 Annual Meeting as $1.6B PA Consulting Acquisition Approaches Close

January 28, 2026 · by Fintool Agent

Jacobs Solutions (NYSE: J) held its 2026 Annual Meeting of Shareholders on Tuesday, with CEO Bob Pragada using the occasion to outline the company's transformation strategy and provide updates on its pending $1.6 billion acquisition of the remaining stake in PA Consulting—a deal that will give Jacobs full ownership of the UK-based innovation and transformation consultancy.

All three proposals passed with overwhelming shareholder approval, setting the stage for what Pragada called an "inflection point" in Jacobs' evolution into a global advisory powerhouse.

The Numbers: Shareholders Back Management Across the Board

| Proposal | Description | Approval Rate |

|---|---|---|

| Proposal 1 | Election of 10 Directors | 97.03% |

| Proposal 2 | Advisory Vote on Executive Compensation | 96.56% |

| Proposal 3 | Ratification of Ernst & Young LLP | 93.83% |

With 118.1 million shares entitled to vote and over 104 million shares represented by proxy—a quorum of at least 51%—the meeting proceeded without incident.

Board Refresh: Tech Expertise Joins, 16-Year Veteran Retires

Pragada opened the meeting by acknowledging the departure of Peter J. Robertson after 16 years of distinguished service. Robertson served on the Sustainability and Risk Committee and chaired the Human Resource and Compensation Committee.

Taking his place: Diane Bryant, who brings extensive global leadership experience spanning technology, digital transformation, and enterprise-scale innovation. Pragada specifically noted her expertise will "further strengthen our board and accelerate Jacobs' strategy for long-term value creation."

The full slate of 10 directors elected to one-year terms includes:

- Bob Pragada (Chair & CEO)

- Louis Pinkham

- Priya Abani

- Diane Bryant (new)

- Michael Collins

- Manny Fernandez

- Vice Admiral Mary Jackson

- Georgette Kiser

- Robert McNamara

- Julie Sloat

PA Consulting Acquisition: The Path to Full Ownership

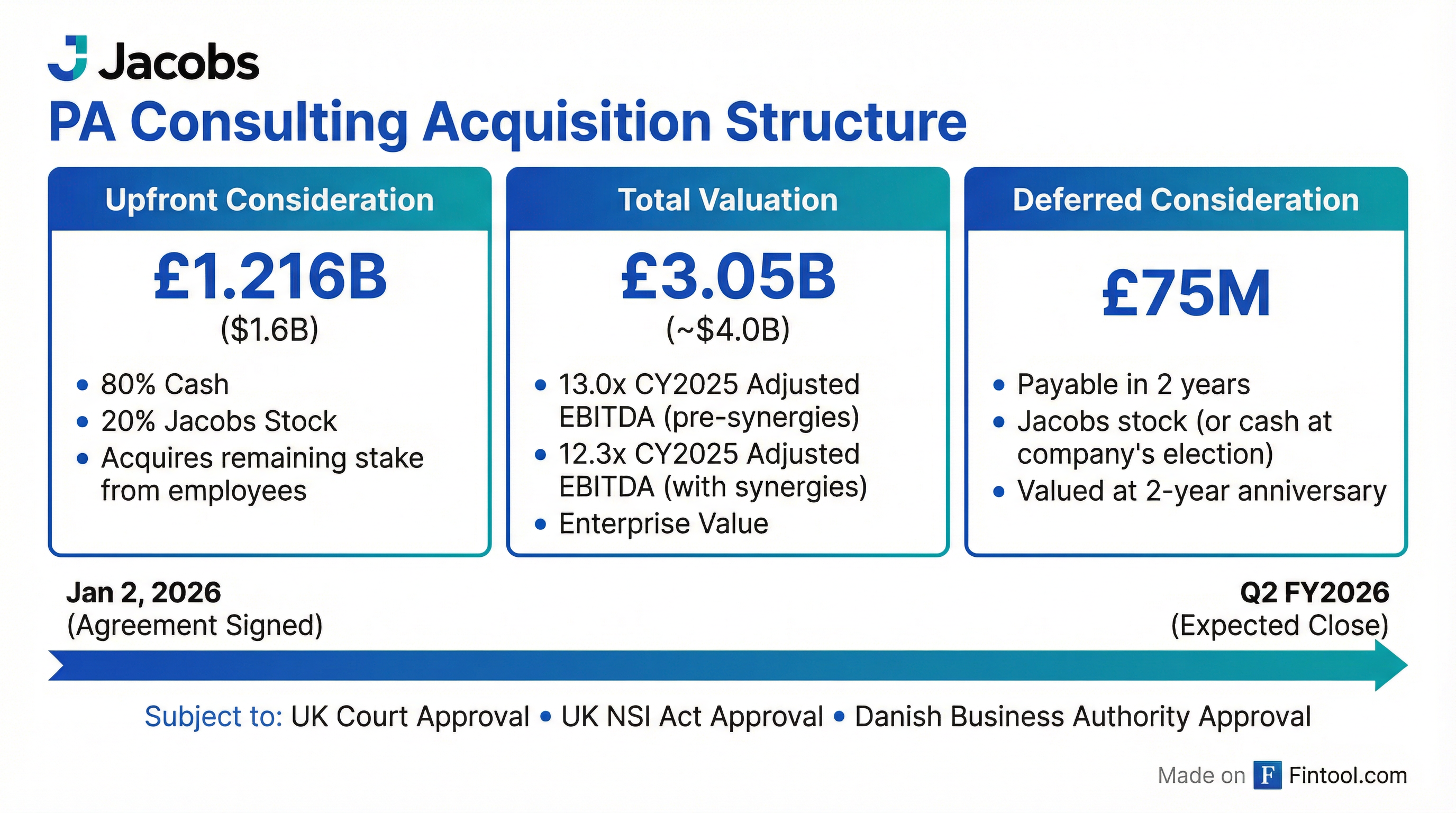

The elephant in the room—and the strategic capstone of Pragada's remarks—is the pending acquisition of the remaining stake in PA Consulting, announced January 5, 2026.

Jacobs first acquired a 65% stake in PA Consulting in 2021 for approximately $1.9 billion. The remaining shares are primarily held by PA's existing and former employees.

Transaction Economics

| Metric | Value |

|---|---|

| Upfront Consideration | £1.216B ($1.6B) |

| Deferred Consideration | £75M (payable in 2 years) |

| Total Enterprise Value (100%) | £3.05B ($4.0B) |

| Valuation Multiple | 13.0x CY2025 Adj. EBITDA |

| Multiple w/ Synergies | 12.3x CY2025 Adj. EBITDA |

| Payment Structure | 80% cash / 20% Jacobs stock |

| Expected Close | Q2 FY2026 |

The deal requires approval from the UK Court (via a scheme of arrangement under Part 26 of the UK Companies Act 2006), the UK NSI Authority, and the Danish Business Authority. The long stop date is May 29, 2026.

"Our collaboration with PA Consulting has accelerated profitable growth and reinforced Jacobs' leadership as we redefine the asset lifecycle," Pragada said at the meeting. The acquisition is expected to close by the end of Q2 FY2026, subject to closing regulatory conditions.

Strategic Rationale: Why Full Ownership Matters Now

The acquisition thesis centers on five pillars:

1. Full Asset Lifecycle Capability PA Consulting's strategic advisory and innovation capabilities complement Jacobs' project management and technical engineering expertise. Together, they can capture clients "earlier in the journey" and deliver from strategy through execution.

2. High-Growth Sector Exposure The combined capabilities are "particularly well-suited for the wave of investment in AI data centers, power generation, regionalized supply chains, advanced pharmaceutical facilities and critical infrastructure resilience."

3. Margin Expansion Had Jacobs fully owned PA Consulting for all of FY25, adjusted EBITDA margin would have been 14.5% compared to the actual 13.9%—a 60 basis point uplift.

4. Cost Synergies Expected cost synergies of £12-15 million are targeted within 24 months post-close.

5. EPS Accretion The transaction is expected to be accretive to adjusted EPS within 12 months after closing.

Financial Performance: FY2025 in Context

Pragada's remarks provided context for Jacobs' fiscal 2025 results, which the company reported in November:

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue | $10.9B | $11.5B | $12.0B |

| EBITDA | $913M | $1.1B | $1.3B |

| EBITDA Margin | 8.4% | 9.6% | 10.5% |

| Total Debt | $3.5B | $2.8B | $2.7B |

| Cash | $771M | $1.1B | $1.2B |

Values retrieved from S&P Global

"In fiscal 2025, we delivered strong results against a dynamic economic background, anchored by our commitment to disciplined fiscal management," Pragada told shareholders.

The company now operates as a more focused organization following the September 2024 spin-off of its Critical Mission Solutions business, centered on water and environmental, life sciences and advanced manufacturing, and critical infrastructure sectors.

Forward Estimates

| Metric | FY 2026E | FY 2027E |

|---|---|---|

| Revenue | $12.9B | $13.7B |

| EPS | $7.08 | $7.97 |

| EBITDA | $1.4B | $1.5B |

| Target Price (Consensus) | $155.93 | $155.93 |

Values retrieved from S&P Global

AI Strategy: "Central to How We Scale Delivery"

Pragada devoted significant time to discussing Jacobs' artificial intelligence roadmap—a key differentiator in the professional services sector:

"While Jacobs has been deploying AI tools across client solutions for years, in 2025, we formalized our enterprise-wide approach with a company-wide AI roadmap, governance model, and go-to-market strategy. AI is central to how we scale delivery, enhance client value, and improve internal efficiency."

The company is integrating AI to optimize project workflows, automate repetitive tasks, and strengthen predictive analytics across its core markets, including advisory services, infrastructure, environmental services, and defense.

In FY2025, Jacobs launched several enterprise-wide AI and digital initiatives:

- Jacobs University — a global learning hub for skill building and leadership development, with access to nearly 30,000 training programs

- Internal Talent Marketplace — a digital platform connecting employees with opportunities across the organization

- Jacobs AI Assist — a proprietary AI tool making authoritative knowledge more discoverable for employees

With PA Consulting's data analytics and digital expertise, the combined company is positioned to accelerate "AI business transformation across the enterprise, both internally and externally for clients."

Market Reaction: Stock Trading Near Flat

Jacobs shares traded at $136.48 as of late Tuesday, down 0.1% on the day. The stock has traded in a relatively tight range since the PA Consulting acquisition announcement on January 5, suggesting the market had largely priced in the deal.

| Metric | Value |

|---|---|

| Current Price | $136.61 |

| 52-Week High | $168.44 |

| 52-Week Low | $105.18 |

| Market Cap | $16.2B |

| 50-Day Average | $137.75 |

| 200-Day Average | $138.86 |

The stock is trading approximately 19% below its 52-week high, reflecting broader market volatility and the post-spin-off transition period.

What to Watch

Near-Term Catalysts:

- Q1 FY2026 Earnings — Expected February 2026

- PA Consulting Close — Expected by end of Q2 FY2026 (late March/April 2026)

- Regulatory Approvals — UK NSI Act and Danish Business Authority decisions

Risks:

- Integration execution and employee retention at PA Consulting

- Debt increase to fund the $1.3B cash portion of the deal

- Macro slowdown in infrastructure and federal spending

- Heightened cybersecurity and AI regulatory compliance costs

Key Questions for the Next Earnings Call:

- Progress on regulatory approvals for the PA Consulting deal

- Updated synergy targets and integration timeline

- Organic growth trends by segment (Water & Environmental, Life Sciences, Critical Infrastructure)

- AI/digital revenue contribution and pipeline

The Bottom Line

Jacobs' 2026 annual meeting was procedurally routine but strategically significant. With overwhelming shareholder support across all proposals, a refreshed board with enhanced tech expertise, and a transformative acquisition on the verge of closing, the company is positioning itself as an end-to-end advisory and engineering solutions provider for the AI and infrastructure era.

The ~$16 billion engineering and consulting firm is betting that full ownership of PA Consulting—and the combined AI, digital, and advisory capabilities it brings—will unlock the next leg of profitable growth. Investors will get their first look at the combined entity's financial profile when the deal closes, expected in the next 2-3 months.