Nelson Peltz Completes Five-Year Campaign: Trian Takes Janus Henderson Private in $7.4B Deal

December 22, 2025 · by Fintool Agent

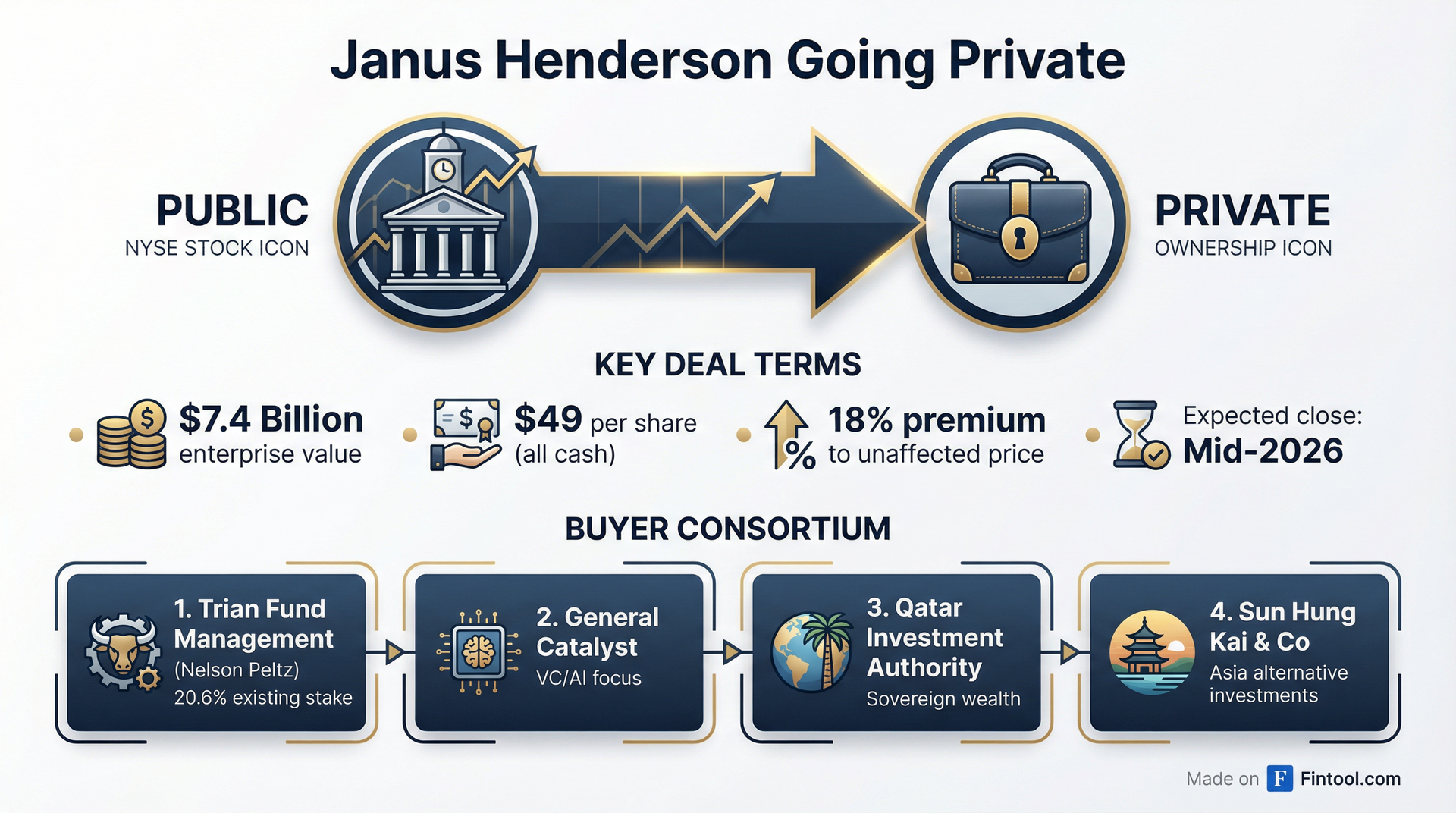

Nelson Peltz's Trian Fund Management has reached the end game of a five-year activist campaign at Janus Henderson, agreeing to take the $484 billion asset manager private in a $7.4 billion deal that represents one of the most successful—and patient—plays in activist investing history.

The deal, announced Monday, values Janus Henderson at $49 per share in cash, representing an 18% premium to the stock's closing price on October 24, the last trading day before the initial proposal was made public.

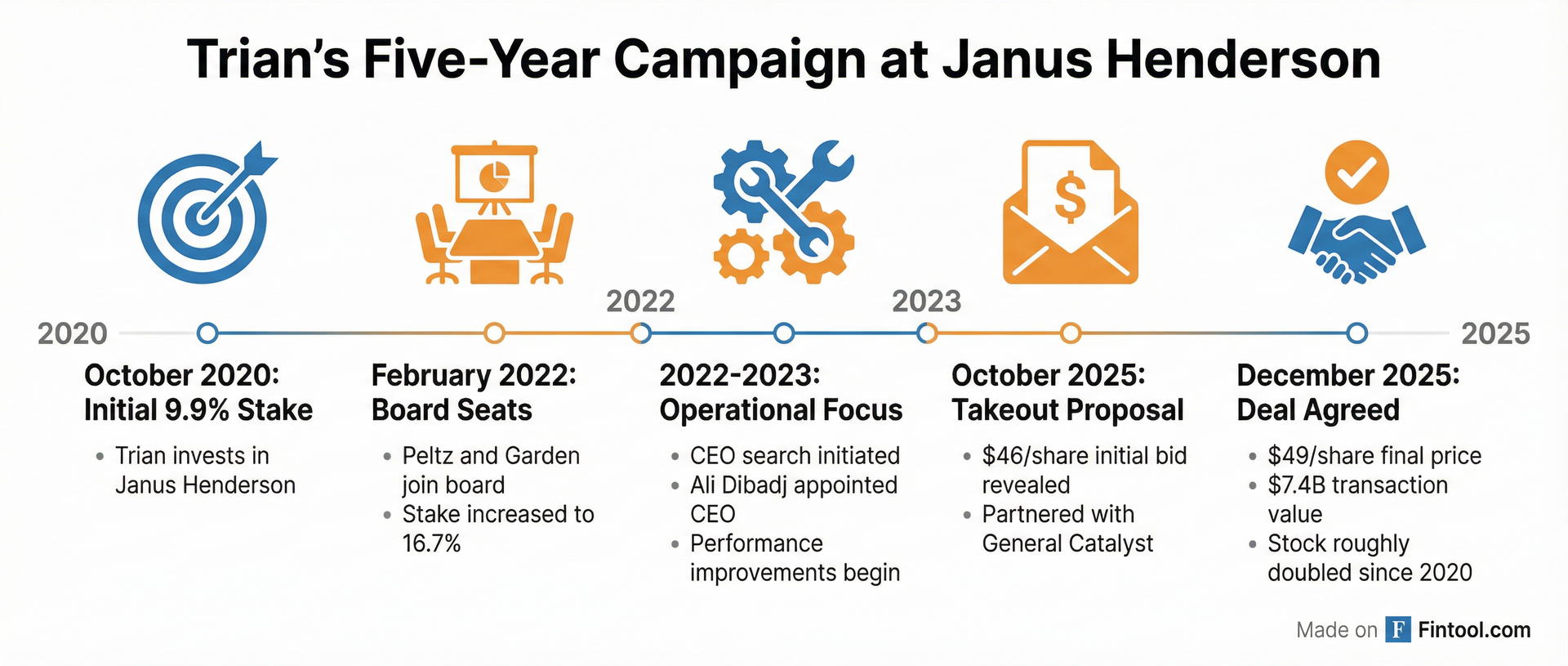

For Trian, which first took a stake in Janus Henderson in October 2020, the transaction marks the culmination of a methodical value-creation strategy. The stock has roughly doubled since Trian's initial investment, and now shareholders will exit with a healthy premium.

An Unusual Buyer Consortium

The acquisition isn't a traditional private equity takeout. Peltz has assembled a diverse coalition of investors that brings together an activist hedge fund, a technology-focused venture capital firm, and sovereign wealth capital:

Trian Fund Management already owns 20.6% of Janus Henderson's outstanding shares and has held board seats since February 2022. Nelson Peltz serves as Trian's CEO, while Ed Garden is Chief Investment Officer.

General Catalyst, the venture capital firm managing over $30 billion in assets, brings a distinctive angle: expertise in applying artificial intelligence to transform business operations. The firm has invested in companies like Stripe, Snap, and Mistral AI, and recently raised $8 billion in new funds with a focus on "applied AI."

Qatar Investment Authority, one of the world's largest sovereign wealth funds, and Sun Hung Kai & Co., a Hong Kong-based alternative investment company, round out the consortium as strategic investors.

"With this partnership with Trian and General Catalyst, we are confident that we will be able to further invest in our product offering, client services, technology, and talent to accelerate our growth," said Janus Henderson CEO Ali Dibadj.

The Trian Playbook: From Activist to Owner

Peltz's journey at Janus Henderson exemplifies the evolution of modern activism—from agitator to operator to owner.

The campaign began in October 2020 when Trian took a 9.9% stake in both Janus Henderson and Invesco, signaling its interest in the asset management sector. While Trian exited Invesco in February 2022 after that company's "financial performance had significantly improved," Janus Henderson proved a longer project.

By February 2022, Trian had increased its stake to 16.7% and placed both Peltz and Garden on the board of directors. At the time, the company was searching for a new CEO, and Trian saw "numerous operating and strategic opportunities ahead."

The appointment of Ali Dibadj as CEO initiated a turnaround phase. Performance improved, net inflows returned, and the stock recovered—though Trian evidently saw more value to be unlocked out of the public eye.

The go-private proposal, first revealed in late October 2025 at $46 per share, met with initial skepticism. The offer was bumped to $49 per share in the definitive agreement—a 6.5% increase that secured board approval.

What Janus Henderson Looks Like Today

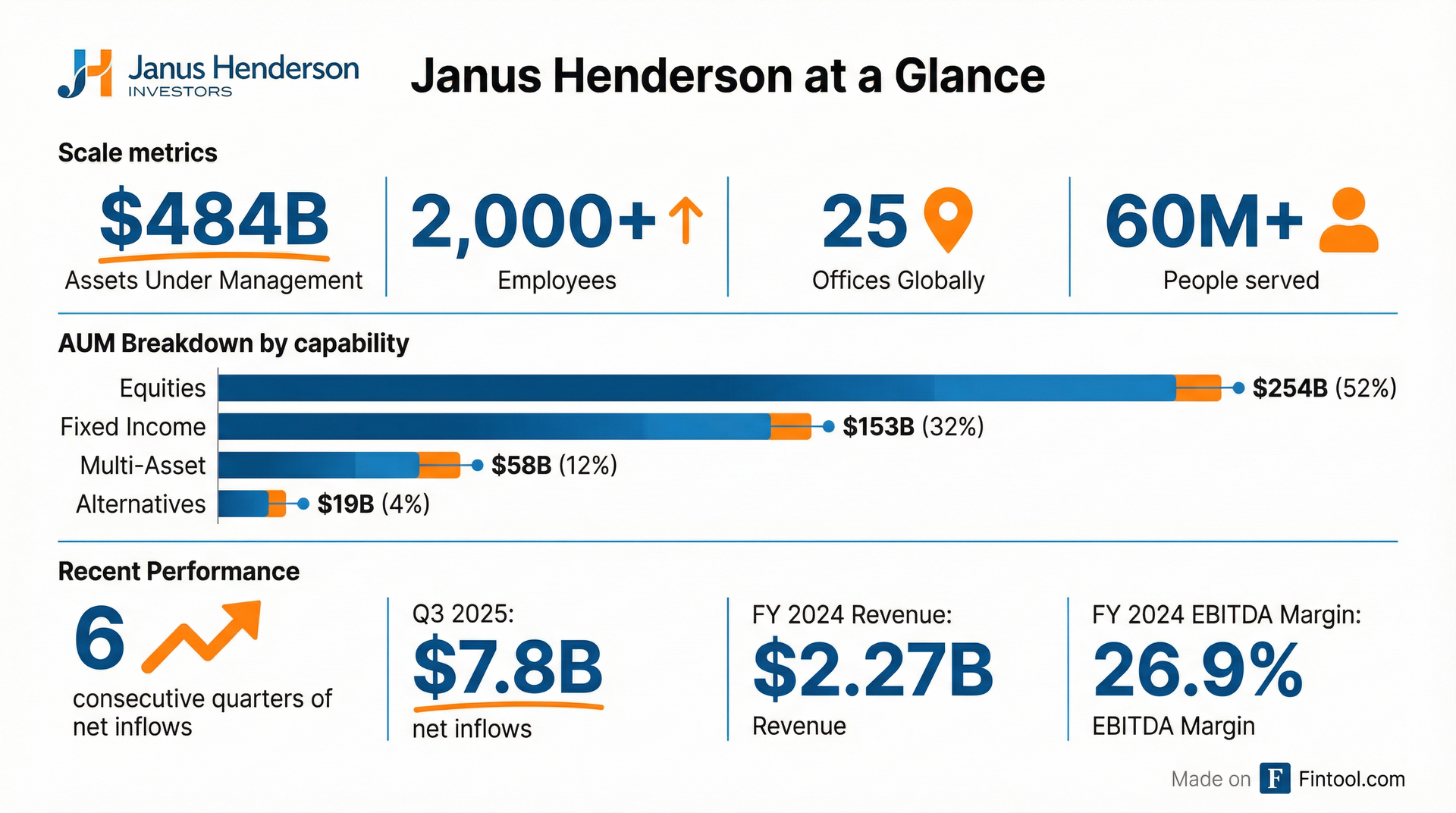

Janus Henderson is no longer the struggling firm that attracted Trian's attention five years ago. The company has delivered six consecutive quarters of positive net inflows and reported third-quarter 2025 net inflows of $7.8 billion.

Recent Financial Performance:

| Metric | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|---|

| Revenue ($B) | $2.10* | $2.55* | $2.01* | $1.92* | $2.27* |

| Net Income ($M) | $130* | $620* | $372* | $392* | $409* |

| EBITDA Margin (%) | 31.5%* | 35.5%* | 25.3%* | 24.1%* | 26.9%* |

*Values retrieved from S&P Global

The numbers tell a story of recovery from the 2022-2023 trough. Revenue climbed back above $2.2 billion in FY 2024, and EBITDA margins have expanded to nearly 27%. Assets under management reached $484 billion as of September 30, 2025—a 27% increase year-over-year.

Strong investment performance has supported the turnaround. As of September 2025, 65% of Janus Henderson's mutual fund AUM ranked in the top two Morningstar quartiles on a one-year basis, with 83% ranking favorably on three-year performance.

The AI Angle

General Catalyst's involvement raises intriguing questions about the future direction of the business. The firm has been explicit about its strategy of using AI to transform traditional industries—what it calls "applied AI."

"We see a growing opportunity to accelerate investment in people, technology, and clients," Peltz said in the announcement.

General Catalyst's "creation strategy" involves deploying $1.5 billion to build AI-native companies that target traditional service verticals—acquiring legacy providers, automating workflows, and driving margin expansion. Asset management, with its data-intensive operations and scalable fee structures, could fit that playbook.

The question for Janus Henderson clients and competitors: Will AI integration be limited to back-office efficiency, or will it extend to investment processes themselves?

Deal Mechanics and Timeline

The transaction includes fully committed debt financing from JPMorgan Chase, Citi, Bank of America, Jefferies, and MUFG Bank. Debevoise & Plimpton and Kirkland & Ellis are serving as legal advisors to the buyer group.

The deal is expected to close in mid-2026, subject to customary closing conditions including regulatory approvals, client consents, and shareholder approval.

Janus Henderson shares rose more than 3% on the news Monday, trading toward the $49 deal price.

Industry Implications

The Janus Henderson deal adds to an accelerating trend of asset management consolidation. Active managers have faced years of pressure from the rapid growth of passive giants like Blackrock and Vanguard. Scale has become essential for distributing costs across larger asset bases, funding technology investments, and maintaining competitive fee structures.

For Trian, the transaction validates a patient approach to value creation—one that contrasts with the rapid-fire campaigns that defined an earlier era of activism. Five years from initial investment to takeout may seem slow, but the returns speak for themselves.

What to Watch

- Regulatory review: Asset management deals typically attract scrutiny around client consents and continuity of service

- Technology integration: How aggressively will General Catalyst push AI adoption?

- Fee pressure: Private ownership could give Janus Henderson flexibility to compete more aggressively on pricing

- Talent retention: Key investment professionals will be watching how the new owners approach compensation and autonomy

Related: