Earnings summaries and quarterly performance for JANUS HENDERSON GROUP.

Executive leadership at JANUS HENDERSON GROUP.

Board of directors at JANUS HENDERSON GROUP.

Alison Quirk

Director

Angela Seymour-Jackson

Director

Anne Sheehan

Director

Brian Baldwin

Director

Eugene Flood Jr.

Director

John Cassaday

Chair of the Board

Josh Frank

Director

Kalpana Desai

Director

Kevin Dolan

Director

Leslie F. Seidman

Director

Research analysts who have asked questions during JANUS HENDERSON GROUP earnings calls.

Kenneth Worthington

JPMorgan Chase & Co.

4 questions for JHG

Craig Siegenthaler

Bank of America

3 questions for JHG

John Dunn

Evercore ISI

3 questions for JHG

Michael Cyprys

Morgan Stanley

3 questions for JHG

William Katz

TD Cowen

3 questions for JHG

Alexander Blostein

Goldman Sachs

2 questions for JHG

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for JHG

Michael Brown

Wells Fargo Securities

2 questions for JHG

Bill Katz

TD Securities

1 question for JHG

Brennan Hawken

UBS Group AG

1 question for JHG

Dan Fannon

Jefferies & Company Inc.

1 question for JHG

Patrick Davitt

Autonomous Research

1 question for JHG

Recent press releases and 8-K filings for JHG.

- Janus Henderson Group (JHG) has confirmed the receipt of an unsolicited, non-binding proposal.

- The Special Committee of the Board of Directors will evaluate this new proposal.

- On December 22, 2025, Janus Henderson announced a definitive merger agreement to be acquired by Trian Fund Management, L.P. and General Catalyst Group Management, LLC for $49.00 per share in cash.

- The existing merger agreement remains in full force and effect, and the Board of Directors continues to recommend that shareholders vote in favor of it.

- Shareholders are advised that no action is required at this time.

- Janus Henderson has launched the Janus Henderson AA-A CLO ETF (JA), expanding its active fixed income ETF lineup in the securitized space.

- The new fund, which secured $100 million in seed capital from The Guardian Life Insurance Company of America, is designed to provide access to high-quality AA to A rated CLOs.

- Managed by John Kerschner, CFA, Nick Childs, CFA, and Jessica Shill, JA offers diversification benefits with historically low daily volatility and low correlation to traditional fixed income markets. It complements the firm's JAAA and JBBB ETFs, with A-rated CLOs having a yield to worst of 5.1% as of January 30, 2026.

- The Prospect Enhanced Yield Fund delivered an annualized total gross return of 10.6% (net return of 10.6%) for the three-month period ended January 31, 2026, outperforming two comparable ETFs and two benchmark indices.

- The Fund announced an annualized cash dividend yield of 9.0% based on its $25.25 net asset value per share as of January 31, 2026.

- As of October 31, 2025, the Fund's anchor capital was fully deployed across 30 BB-rated tranches of Collateralized Loan Obligations (CLOs), with $29 million in total assets as of September 30, 2025.

- The estimated Total Annual Expense Ratio for Class I shares is 6.28% Gross / 0.00% Net.

- Halper Sadeh LLC is investigating Janus Henderson Group plc (NYSE: JHG) for potential violations of federal securities laws and/or breaches of fiduciary duties.

- The investigation concerns JHG's sale to Trian Fund Management and General Catalyst for $49.00 per share in cash.

- The firm is encouraging Janus shareholders to contact them to discuss their legal rights and options, potentially seeking increased consideration or additional disclosures.

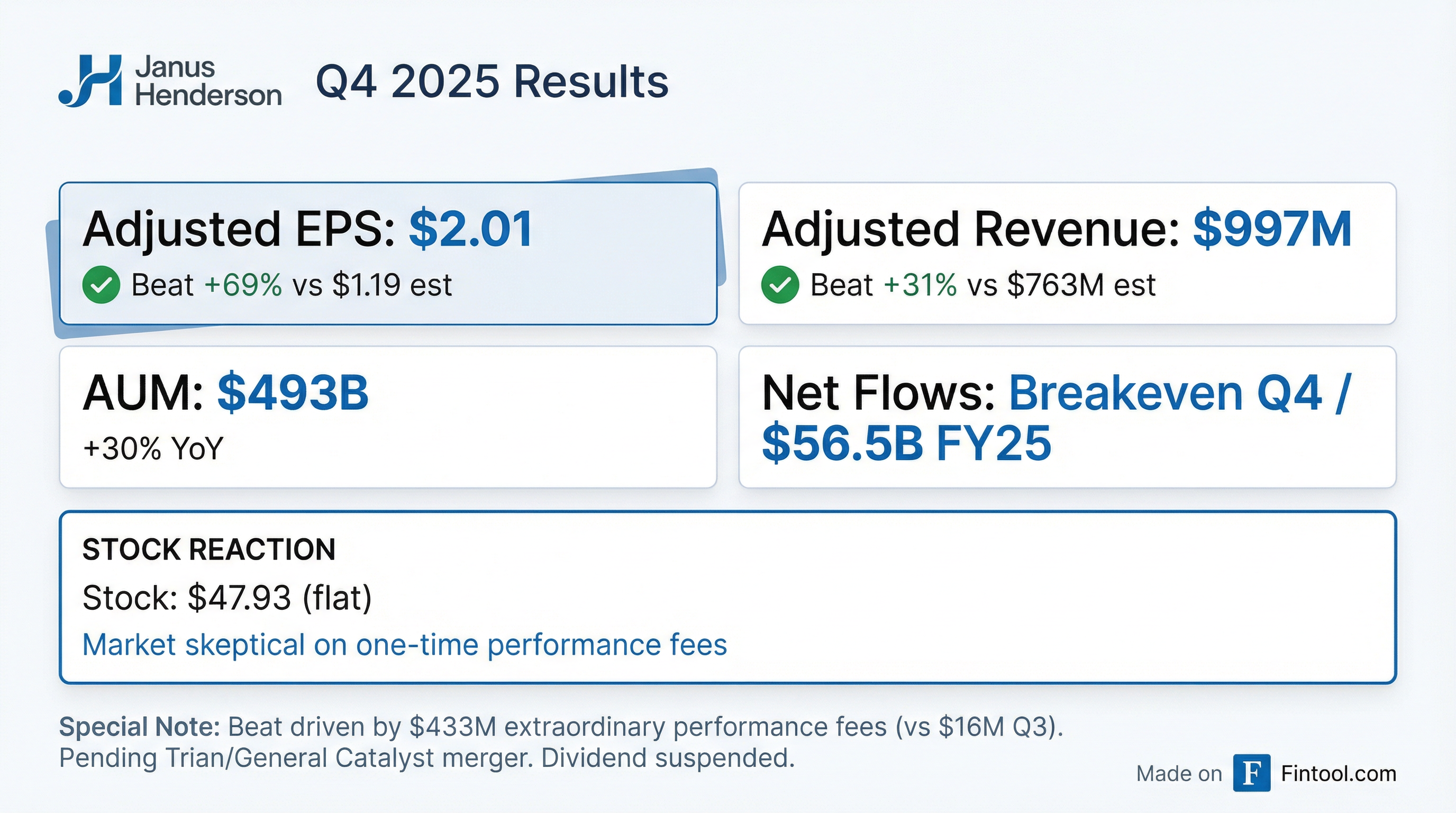

- Janus Henderson Group plc reported Q4 2025 diluted EPS of US$2.62 and adjusted diluted EPS of US$2.01, with Assets Under Management (AUM) growing 30% year over year to US$493 billion as of December 31, 2025.

- The company achieved breakeven net flows in Q4 2025 and US$56.5 billion of net inflows for the full year 2025.

- Janus Henderson has entered into a definitive merger agreement to be acquired by an investor group led by Trian Fund Management, L.P. and General Catalyst Group Management, LLC.

- As a result of the proposed merger, the company is suspending the payment of its regular quarterly dividend.

- Additionally, Janus Henderson announced a definitive agreement to acquire Richard Bernstein Advisors (RBA) to enhance its model portfolio and separately managed account offerings.

- ProMIS Neurosciences Inc. has entered into a securities purchase agreement for a private investment in public equity (PIPE) financing of up to approximately $175 million.

- The financing comprises common shares, common share warrants, and pre-funded warrants.

- The PIPE financing is co-led by Janus Henderson and Ally Bridge Group, with participation from other institutional and accredited investors, as well as ProMIS's CEO, management team, and Board of Directors.

- The upfront gross proceeds are anticipated to be approximately $75 million, with an additional approximately $100 million if the common share warrants and pre-funded warrants are fully exercised for cash.

- The proceeds are expected to extend ProMIS's cash runway into 2028 and enable the completion of its landmark Phase 1b Alzheimer's disease clinical study. The financing is expected to close on February 3, 2026.

- Janus Henderson Group PLC reported Total Assets Under Management (AUM) of $493.2 billion at the end of Q4 2025.

- The company recorded net flows of $0.0 billion in Q4 2025, contributing to $56.5 billion in net flows for the full year 2025.

- U.S. GAAP diluted EPS was $2.62 for Q4 2025 and $5.23 for the full year 2025.

- Total revenue reached $1,142.3 million in Q4 2025 and $3,097.3 million for the full year 2025.

- Investment performance remained solid, with 65% of AUM outperforming its benchmark over 3, 5, and 10 years as of December 31, 2025.

- Janus Henderson has agreed to acquire Richard Bernstein Advisors (RBA), a research-driven macro investment manager that oversees approximately $20 billion in client assets.

- The acquisition is expected to significantly strengthen Janus Henderson’s model portfolio and separately managed account (SMA) offerings, positioning the firm among the top 10 model-portfolio providers in North America.

- Richard Bernstein will join Janus Henderson as Global Head of Macro & Customized Investing and has signed a multi-year agreement to lead RBA’s next phase of growth.

- The transaction is expected to close in the second quarter of 2026, although financial terms were not disclosed.

- This acquisition comes as Janus Henderson itself is set to be taken private following a $7.4 billion buyout by Trian and General Catalyst.

- Janus Henderson Group (JHG) has entered into a definitive agreement to acquire Richard Bernstein Advisors (RBA), a research-driven, macro multi-asset investment manager.

- RBA oversees approximately $20 billion in client assets as of January 16, 2026, and the acquisition is expected to position Janus Henderson as a leading model portfolio and separately managed account (SMA) provider.

- The transaction is anticipated to close in Q2 2026.

- Caldera Therapeutics launched with $112.5 million in total capital raised, including a $37.5 million Series A-1 funding round in which Janus Henderson Investors participated.

- The company announced that the first subjects have been dosed in a Phase 1 trial for its lead program, CLD-423.

- CLD-423 is a first-in-class bispecific antibody designed to treat inflammatory bowel disease (IBD) and other immunologic and inflammatory diseases.

Fintool News

In-depth analysis and coverage of JANUS HENDERSON GROUP.

Quarterly earnings call transcripts for JANUS HENDERSON GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more