Kadant Pays €157M to Bring 30-Year Supplier In-House, Eliminating Critical Supply Chain Risk

February 3, 2026 · by Fintool Agent

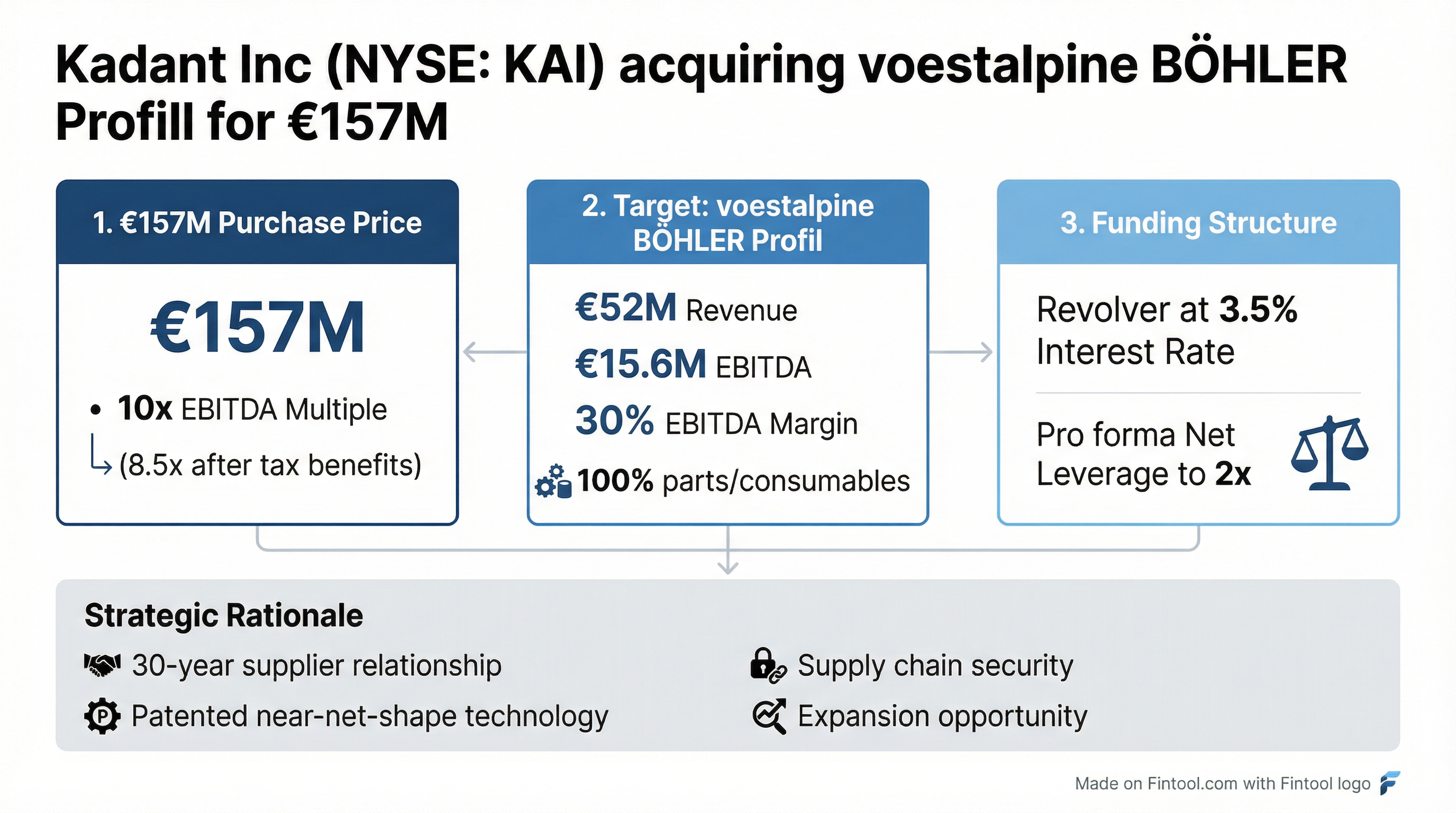

Kadant Inc. is paying €157 million ($170 million) to acquire a supplier so critical that the dependency "kept a few of our guys up at night," CEO Jeff Powell revealed on a conference call today discussing the proposed acquisition of voestalpine BÖHLER Profil .

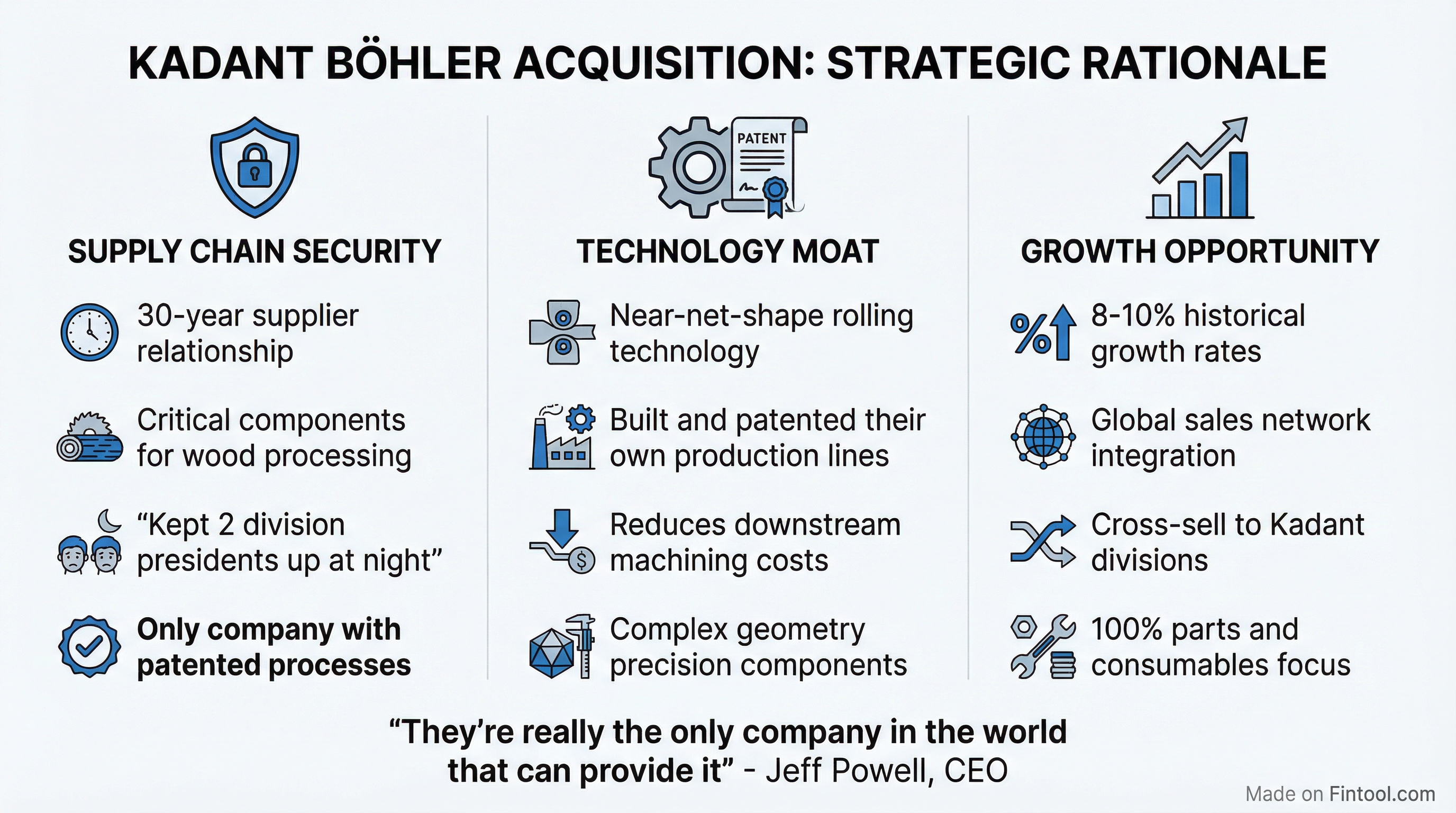

The Austrian components manufacturer has been supplying Kadant for 30 years and sat atop the company's acquisition target list for more than a decade . With 45% of BÖHLER's €52 million in annual revenue coming from Kadant, the industrial machinery company was exposed to a single-source supplier with patented technology no one else in the world can replicate .

"They're really the only company in the world that can provide it," Powell said. "And so it was something that kept a few of our guys up at night. And so having them in the family now, I think, is a great relief and a great acquisition for us."

Kadant shares traded at $327.05 at market close, down 0.2% on the day but up nearly 10% from their 50-day moving average of $297.51.

Deal Terms

The transaction values BÖHLER Profil at approximately 10x EBITDA based on €15.6 million of adjusted EBITDA in fiscal year 2025 (ended March 31) . However, CFO Michael McKenney noted that beneficial tax attributes associated with the deal are worth approximately 1.5 turns, bringing the effective multiple to 8.5x .

| Metric | Value |

|---|---|

| Purchase Price | €157M ($170M) |

| Target Revenue (FY25) | €52M |

| Target EBITDA (FY25) | €15.6M |

| EBITDA Margin | 30% |

| EBITDA Multiple | 10x (8.5x after tax benefits) |

| Funding Source | European revolver |

| Borrowing Rate | 3.5% |

| Pro Forma Leverage | Just above 2x |

Kadant will fund the acquisition primarily through borrowings under its European revolving credit facility . The deal is expected to close in Q1 2026, subject to Austrian regulatory approvals .

The Technology Moat

BÖHLER Profil, headquartered in Bruckbach, Austria, manufactures high-quality precision components using a proprietary near-net-shape rolling technology . The company developed, built, and patented its own processing lines that produce components much closer to final specifications than traditional manufacturing, dramatically reducing downstream machining time and costs .

"In some cases, they can make things with their patented process lines where there's almost nothing, no post-processing required," Powell explained .

The 150-year-old company supplies components for:

- Wood processing equipment (including industrial knives for Kadant)

- Aviation/turbine engines (stators, not blades)

- Automotive applications

- Industrial machinery

Importantly for Kadant's strategic focus, 100% of BÖHLER's business is parts and consumables—a key priority for the company .

Why 2026 Will Be Dilutive

Despite the strategic merits, management was unusually candid about near-term earnings pressure. The acquisition will be dilutive in 2026 for several reasons :

1. Intercompany Revenue Elimination

Approximately 45% of BÖHLER's €52 million in revenue (roughly €23 million) comes from sales to Kadant . Post-acquisition, this becomes intercompany revenue and will not appear in Kadant's reported results—though the company will capture the full margin benefit .

2. FIFO Inventory Dynamics

Kadant already has several quarters' worth of BÖHLER components in inventory purchased prior to the acquisition . Under FIFO accounting, the company must work through this pre-acquisition inventory before recognizing profits on new post-acquisition intercompany purchases .

"I think it may take us a good part of 2026 to work through it, a few quarters to work through inventory on hand," McKenney noted .

3. Acquisition Fair Value Accounting

Standard purchase accounting adjustments will further pressure near-term results .

Historical Growth and Synergy Potential

BÖHLER Profil has grown approximately 8% over the last two years and 10% over the past five years . Management was conservative in its modeling, though Powell noted it did not assume "high single-digit growth" .

Synergy opportunities include:

- Global Sales Network Integration – Kadant will plug BÖHLER into its direct sales infrastructure worldwide

- Cross-Divisional Expansion – BÖHLER will work with other Kadant divisions to identify new opportunities

- Non-Kadant Growth – Kadant will help expand BÖHLER's external customer base globally

Asked about the sales force reaction, Powell responded directly: "I can tell you they're very happy" .

Kadant Financial Snapshot

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Revenue | $958M | $1,053M |

| EBITDA | $202M* | $230M* |

| EBITDA Margin | 21.1%* | 21.8%* |

| Net Income | $116M | $112M |

| Total Debt | $136M* | $323M* |

| Cash | $104M | $95M |

*Values retrieved from S&P Global

The company noted it cannot comment on Q4 2025 results or 2026 guidance until its upcoming earnings call later this month .

Competitive Dynamics

One analyst asked whether BÖHLER selling to Kadant's competitors would create friction post-acquisition. Powell dismissed the concern, noting that many Kadant divisions already sell to competitors .

"They'll continue to serve everybody. They'll continue to supply to the entire industry just as our companies do now," he said .

What to Watch

- Q1 2026 Close – Subject to Austrian regulatory approval

- Q4 2025 Earnings – Management will incorporate acquisition guidance post-close

- Intercompany Margin Recognition – Several quarters to work through pre-acquisition inventory

- Integration Execution – Cross-selling opportunities and global sales network leverage

Related: