Earnings summaries and quarterly performance for KADANT.

Executive leadership at KADANT.

Jeffrey Powell

President and Chief Executive Officer

Fredrik Westerhout

Vice President

Michael Colwell

Senior Vice President

Michael McKenney

Executive Vice President and Chief Financial Officer

Stacy Krause

Senior Vice President, General Counsel and Secretary

Board of directors at KADANT.

Research analysts who have asked questions during KADANT earnings calls.

Gary Prestopino

Barrington Research

6 questions for KAI

Ross Sparenblek

William Blair & Company

6 questions for KAI

Kurt Yinger

D.A. Davidson & Co.

5 questions for KAI

Walter Liptak

Seaport Research Partners

5 questions for KAI

Aditya Madan

D.A. Davidson Companies

1 question for KAI

Recent press releases and 8-K filings for KAI.

- Kadant Inc. (KAI) announced on February 19, 2026, a new methodology for calculating adjusted operating income, adjusted net income, and adjusted EPS.

- The updated methodology will now exclude the full impact of amortization expense related to acquired intangible assets from these non-GAAP financial measures, a change from previously only excluding amortization expense related to acquired backlog.

- This adjustment is intended to provide a more meaningful and consistent comparison of operating results over time and with peer companies.

- The company also provided guidance for its fiscal year and first quarter 2026 for adjusted net income and adjusted EPS, calculated using this new methodology.

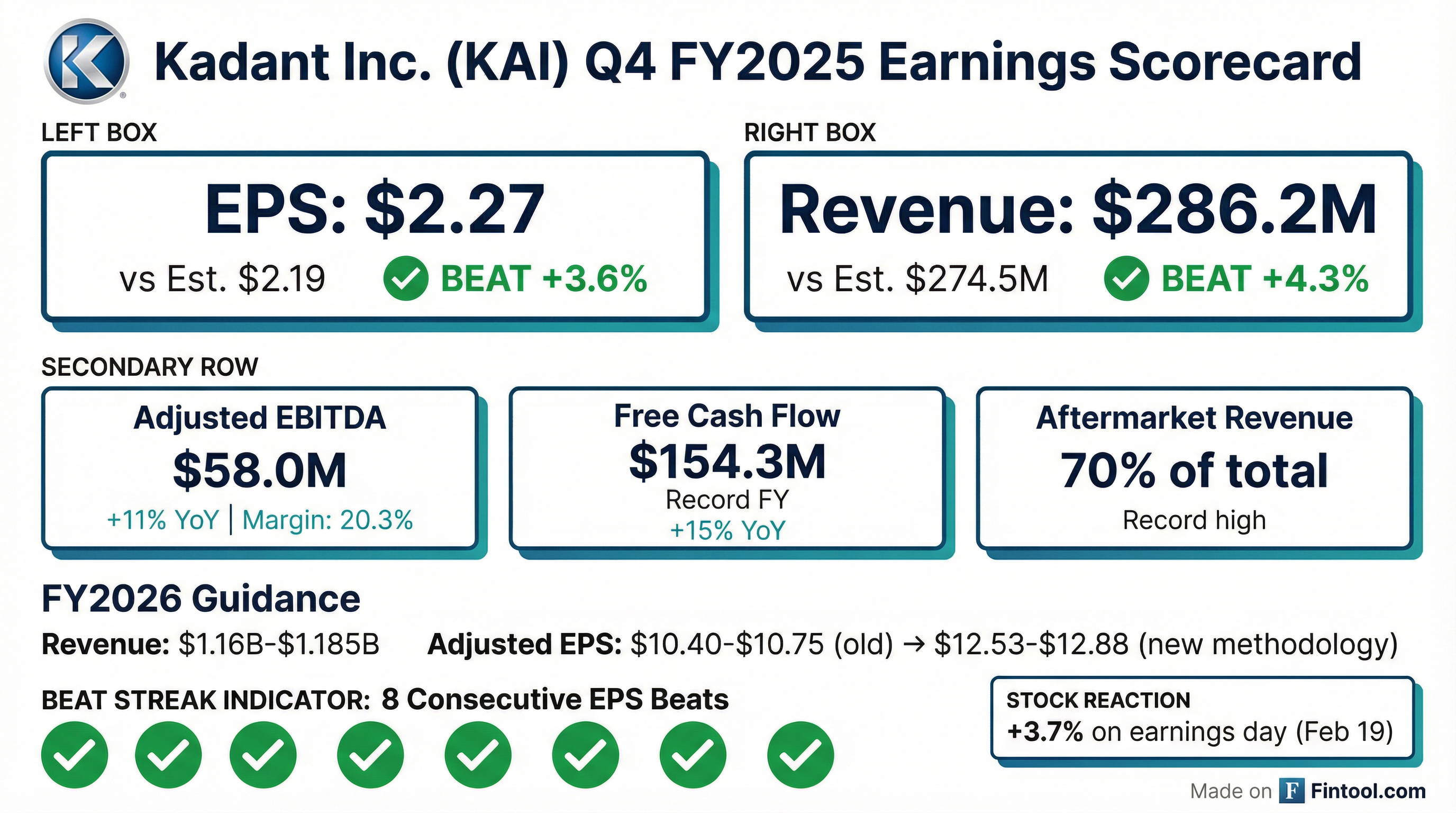

- Kadant reported record Q4 2025 revenue of $286 million, an 11% increase compared to the prior year, and adjusted EPS of $2.27, which was above the high end of its guidance range. For the full year 2025, revenue was $1.05 billion, and adjusted EPS was $9.26, compared to $10.28 in 2024.

- The company's performance in Q4 2025 was boosted by acquisitions completed in 2025 and solid demand in its flow control and material handling segments. Aftermarket parts revenue reached a record, making up 71% of total revenue for the full year 2025.

- Kadant generated record free cash flow of $154 million in 2025, marking a 15% increase over 2024, and repaid $122.2 million of debt during the year.

- For fiscal year 2026, Kadant provided revenue guidance of $1.16 billion-$1.185 billion and adjusted EPS guidance of $10.40-$10.75, excluding certain amortization. The first quarter of 2026 is anticipated to be the weakest quarter of the year.

- Starting in Q1 2026, Kadant will add back recurring intangible amortization expense in its adjusted EPS calculation to provide more consistent comparisons with adjusted EBITDA and cash flow metrics.

- Kadant reported strong Q4 2025 revenue of $286 million, an 11% increase, and full-year 2025 revenue of $1.05 billion, with aftermarket parts making up a record 71% of total revenue.

- Adjusted EPS for Q4 2025 was $2.27, and full-year 2025 adjusted EPS was $9.26. The company also achieved record free cash flow of $154.3 million in 2025, a 15% increase.

- For 2026, Kadant provided revenue guidance of $1.16 billion-$1.185 billion and adjusted EPS guidance of $12.53-$12.88, reflecting a change in calculation to include recurring intangible amortization expense.

- The company's performance in 2025 benefited from recent acquisitions, and it announced a pending acquisition of voestalpine Böhler Profil GmbH for approximately EUR 157 million, which is expected to increase the leverage ratio to just above 2.

- Kadant reported record revenue of $286.2 million in Q4 2025, an increase of 10.9% from Q4 2024, primarily driven by strong contributions from recent acquisitions and record demand for aftermarket parts.

- For the full fiscal year 2025, the company achieved record free cash flow of $154.3 million* and stable demand from aftermarket parts, which represented a record 71% of total revenue.

- Adjusted EPS* for Q4 2025 was $2.27, and for the full fiscal year 2025, it was $9.26.

- The company provided guidance for FY 2026, projecting revenue between $1.160 and $1.185 billion and adjusted EPS* (as previously reported) ranging from $10.40 to $10.75.

- Kadant reported record revenue of $286 million in Q4 2025, an 11% increase, and $1.05 billion for fiscal year 2025.

- For Q4 2025, GAAP EPS was $2.04 and Adjusted EPS increased 1% to $2.27. For fiscal year 2025, GAAP EPS decreased 9% to $8.65 and Adjusted EPS decreased 10% to $9.26.

- The company's operating cash flow increased 17% to $61 million in Q4 2025 and 10% to a record $171 million for fiscal year 2025.

- Kadant expects FY 2026 revenue of $1.160 to $1.185 billion and adjusted EPS of $10.40 to $10.75.

- For Q1 2026, the company anticipates revenue of $270 to $280 million and adjusted EPS of $1.78 to $1.88.

- Kadant Inc. reported record revenue of $286 million for the fourth quarter of 2025, an 11% increase compared to the prior year, and $1.05 billion for fiscal year 2025.

- Fourth quarter 2025 financial highlights include a 1% increase in Adjusted EPS to $2.27 and an 11% increase in Adjusted EBITDA to $58 million.

- For fiscal year 2025, net income decreased 9% to $102 million and Adjusted EPS decreased 10% to $9.26, despite achieving a record operating cash flow of $171 million.

- The company provided a positive outlook for 2026, projecting full-year revenue between $1.160 and $1.185 billion and adjusted EPS between $10.40 and $10.75.

- Kadant has entered into an agreement to acquire voestalpine BÖHLER Profil for approximately EUR 157 million, subject to customary adjustments.

- For its fiscal year ended March 31, 2025, voestalpine BÖHLER Profil reported EUR 51.5 million (or EUR 52 million) in revenue and EUR 15.6 million in adjusted EBITDA.

- The acquired company specializes in manufacturing high-quality precision components, with 100% of its business in parts and consumables, and utilizes unique patented processes to produce near-net-shaped products.

- The acquisition is expected to be dilutive in 2026 due to the elimination of intercompany revenue (Kadant businesses accounted for approximately 45% of BÖHLER Profil's 2025 revenue) and the need to work through existing inventory.

- Kadant plans to fund the acquisition primarily through borrowings under its revolving credit facility in Europe, which is estimated to increase its leverage ratio to just above 2.

- Kadant (KAI) has entered into an agreement to acquire voestalpine BÖHLER Profil for approximately EUR 157 million.

- voestalpine BÖHLER Profil, an Austrian manufacturer of high-quality precision components, reported approximately EUR 52 million in revenue and EUR 15.6 million in adjusted EBITDA for fiscal year 2025.

- The acquisition is valued at an EBITDA multiple of approximately 10x, or 8.5x after accounting for beneficial tax attributes.

- The transaction is expected to be dilutive in 2026 due to intercompany revenue adjustments and the need to work through existing inventory.

- Kadant (KAI) announced the acquisition of voestalpine BÖHLER Profil on February 3, 2026.

- voestalpine BÖHLER Profil, a manufacturer of precision-rolled profiles and industrial blades, reported 51.5 million Euros in revenue for the fiscal year ended March 31, 2025.

- The acquisition will be funded through borrowings and will integrate the acquired company into Kadant's Industrial Processing reporting segment, to be renamed Kadant Profil GmbH & Co KG.

- Approximately 45% of voestalpine BÖHLER Profil's revenue for the fiscal year ended March 31, 2025, was from Kadant businesses.

- Kadant Inc. has entered into a definitive agreement to acquire voestalpine BÖHLER Profil GmbH & Co KG for approximately 157.0 million Euros in cash.

- voestalpine BÖHLER Profil, a leader in tailor-made special profiles and high-performance industrial knives, reported revenue of 51.5 million Euros for the fiscal year ended March 31, 2025.

- The acquisition is expected to close in the first quarter of 2026, subject to regulatory approvals, and will be financed primarily through borrowings under Kadant’s revolving credit facility.

- Upon closing, the acquired company will be integrated into Kadant’s Industrial Processing reporting segment and renamed Kadant Profil GmbH & Co KG.

Fintool News

In-depth analysis and coverage of KADANT.

Quarterly earnings call transcripts for KADANT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more