Keurig Dr Pepper Launches $18 Billion Tender Offer for JDE Peet's, Creating World's Largest Pure-Play Coffee Company

January 15, 2026 · by Fintool Agent

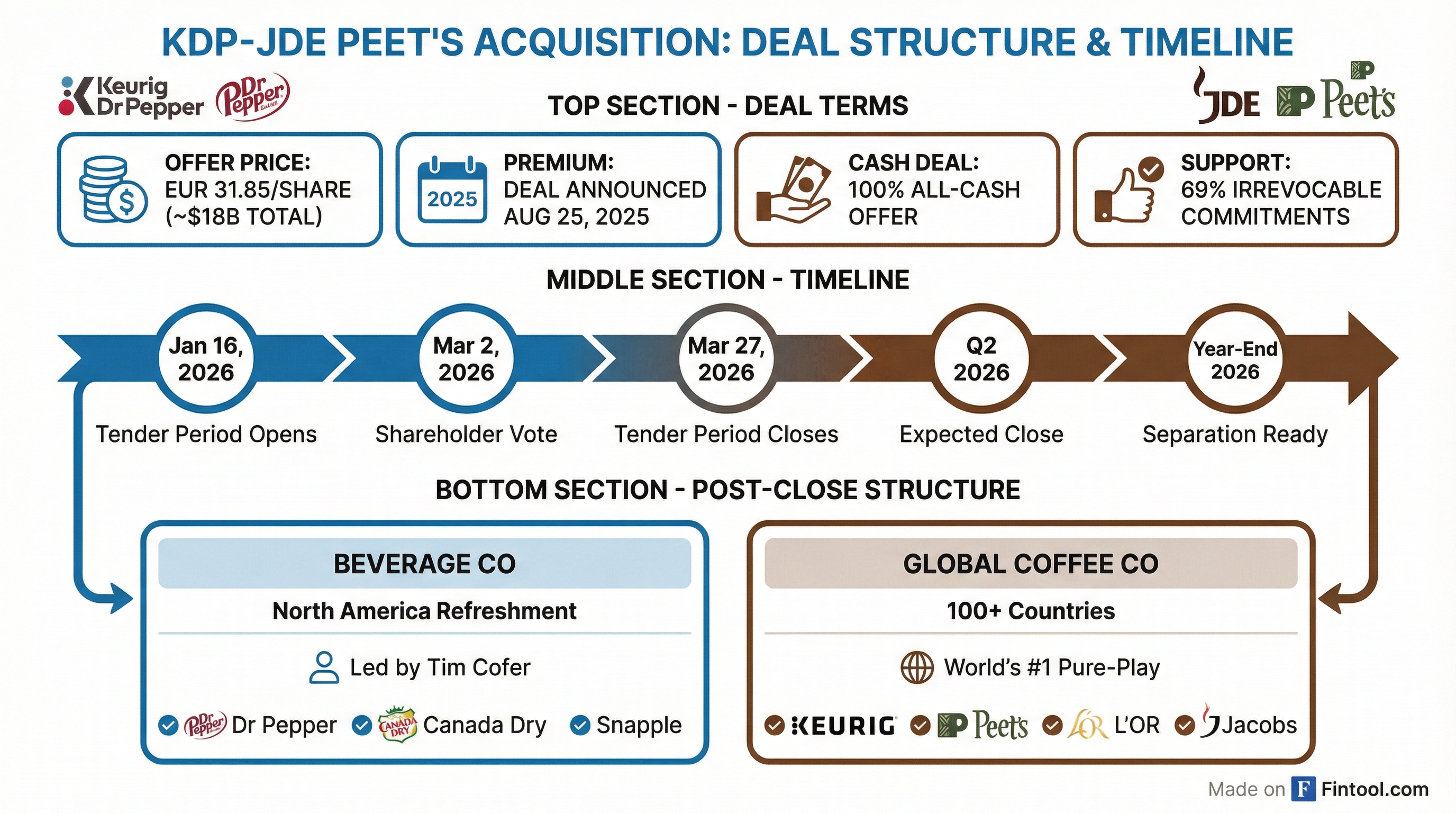

Keurig DR Pepper officially launched its €31.85-per-share all-cash tender offer for JDE Peet's on Wednesday, formally commencing what will become one of Europe's largest consumer goods acquisitions in recent years. The $18 billion deal—first announced in August 2025—clears all remaining regulatory hurdles and positions KDP to create a global coffee powerhouse that will rival market leader Nestlé.

The tender period opens January 16 and runs through March 27, 2026. JDE Peet's shareholders representing approximately 69% of outstanding shares—including majority owner Acorn Holdings B.V. and all board members—have irrevocably committed to tender their shares. Closing is expected early in Q2 2026.

Deal Terms and Timeline

The Dutch Authority for the Financial Markets has approved the Offer Memorandum, and all required competition clearances have been obtained. The deal structure includes several key provisions:

| Term | Details |

|---|---|

| Offer Price | €31.85 per share (all cash) |

| Total Deal Value | $18 billion |

| Minimum Acceptance | 95% (lowered to 80% with shareholder approval) |

| Dividend | €0.36 per share on Jan 23, 2026 (does not reduce offer price) |

| Shareholder Vote | March 2, 2026 Extraordinary General Meeting |

| Expected Close | Early Q2 2026 |

JDE Peet's board unanimously supports and recommends the offer to shareholders. Positive advice has also been obtained from the Dutch Works Council and the European Works Council.

Creating a Global Coffee Powerhouse

The strategic rationale centers on scale. As KDP Chairman Bob Gamgort explained at the company's October 2025 investor day: "If you want to form a global coffee powerhouse, the best partner is JDE Peet's. This is a scarce and valuable asset. It's of high quality and honestly there is no alternative other than matching these two businesses together."

The combined Global Coffee Co will boast formidable metrics:

| Metric | Combined Entity |

|---|---|

| Coffee Net Sales | $16+ billion |

| Adjusted EBITDA | $3+ billion |

| Global Rank | #2 worldwide (#1 pure-play) |

| Geographic Reach | 100+ countries |

| Cups Served | 4,400 per second |

The combination brings together complementary portfolios: Keurig's North American single-serve dominance (47 million active households) with JDE Peet's global brand strength across formats. JDE Peet's brings billion-dollar brands like Peet's, L'OR, and Jacobs, along with local icons such as Pilão in Brazil, Kenco in the UK, and Douwe Egberts in the Netherlands.

Post-Acquisition Separation

KDP plans to separate into two independent U.S.-listed companies following the acquisition:

Beverage Co: The North American refreshment beverages business, led by current CEO Tim Cofer, will include Dr Pepper, Canada Dry, Mott's, Snapple, and other soft drink brands. The company targets mid-single-digit net sales growth and high-single-digit EPS growth.

Global Coffee Co: The combined Keurig and JDE Peet's coffee operations will target low-single-digit net sales growth and high-single-digit EPS growth, with more than $5 billion in cumulative free cash flow projected from 2026-2028. KDP is conducting an internal and external search for the Global Coffee Co CEO; former CFO Sudhanshu Priyadarshi will no longer assume this role as originally announced.

The company plans to be operationally ready to separate by year-end 2026, subject to key milestones including establishing best-in-class leadership teams and independent boards for both entities.

Coffee Market Backdrop: Record Prices and Supply Concerns

The deal closes against a backdrop of unprecedented coffee price volatility. Arabica futures surged to all-time highs above $4.40/lb in early 2025, with prices remaining elevated due to persistent drought conditions in Brazil and Vietnam—the world's two largest coffee producers accounting for more than 50% of global supply.

Key supply dynamics:

- Brazil: The worst drought in 70 years reduced arabica yields by approximately 12% in early 2025. Brazil's 2025/26 arabica crop is forecast 13% lower than 2024/25.

- Vietnam: Robusta production remains strong, with 2025/26 output projected at a 4-year high of 30-31 million bags.

- U.S. Tariffs: Previous Trump administration tariffs on Brazilian coffee reduced U.S. purchases from Brazil by 52% during August-October 2025 compared to the prior year.

KDP management sees current coffee prices as well above long-term trends and potentially not supported by fundamentals—positioning any normalization as a cyclical profit tailwind.

Synergy Targets and Financial Impact

The company has identified $400 million in cost synergies to be captured within three years of closing, spanning:

- Procurement: Enhanced scale across green coffee sourcing (becoming the #1 coffee buyer globally) and indirect spend

- Manufacturing & Logistics: Network optimization and route-to-market consolidation

- SG&A & IT: Corporate scale efficiencies and system savings

These synergies are incremental to JDE Peet's existing €500 million productivity program (through 2032), half of which will be reinvested in the business.

On the revenue side, management sees upside from:

- Scaling Keurig's brewer innovation and economics to JDE Peet's systems (SENSEO, TASSIMO, L'OR machines)

- Expanding Peet's brand distribution beyond its West Coast concentration using Keurig's commercial relationships

- Bringing the next-generation Keurig Alta system (plastic-free K-Round pods) to international markets

- Taking legacy Keurig brands like Green Mountain and Donut Shop across all coffee formats globally

KDP expects approximately 10% adjusted EPS accretion in the first full year following the acquisition close.

Financing Structure

The acquisition is backed by a comprehensive $7 billion strategic investment package co-led by Apollo and KKR:

| Instrument | Amount | Key Terms |

|---|---|---|

| Pod Manufacturing JV | $4 billion | KDP retains controlling interest and operational control; 7.3-7.4% all-in cost over 10 years |

| Convertible Preferred | $3 billion | $37.25 conversion price (41% premium to 20-day VWAP); 4.75% preferred dividend |

As a result, KDP now projects net leverage of approximately 4.6x at acquisition close—roughly one turn lower than originally planned. Target leverage ratios at separation are 3.5-4.0x for Beverage Co and 3.75-4.25x for Global Coffee Co.

"We're proud to support Keurig Dr Pepper's leadership team as it continues to execute on a clear strategy for long-term growth and value creation across both its refreshment beverage and coffee businesses," KKR partners noted in the financing announcement.

What to Watch

Near-term catalysts:

- March 2, 2026: JDE Peet's extraordinary general meeting for post-closing restructuring approval

- March 27, 2026: Tender period expiration (80-95% acceptance threshold)

- Q2 2026: Expected transaction close

- Year-end 2026: Operational readiness for separation

Key risks:

- Coffee price volatility and tariff exposure

- Integration execution and synergy realization

- Leadership transition for Global Coffee Co

- Market conditions for the eventual separation

The 40-year coffee category growth story that convinced KDP's board to pursue this deal will now be tested on a global scale. As CEO Tim Cofer put it: "We are truly just getting started."

Related