KeyCorp Doubles Down on Embedded Banking at UBS Conference, Eyes 100% Growth in 2026

February 9, 2026 · by Fintool Agent

Keycorp delivered a bullish message at the UBS Financial Services Conference in Key Biscayne, Florida today, revealing that its embedded banking business doubled in 2025 and is on track to double again this year. In a striking proof point, Head of Commercial Banking Ken Gavrity disclosed that a single pharmacy software platform client generated as many merchant MIDs in one month as KeyCorp's entire branch network—a scale advantage that management believes is "just the beginning" of a multi-year growth story.

Shares of KEY closed at $23.01, down 0.9% on the day, though the stock remains up 32% over the past year and is trading near its 52-week high of $23.35.

The Embedded Banking Thesis

KeyCorp's embedded banking strategy centers on wrapping its existing payment and reporting capabilities in APIs, allowing software platforms to integrate banking services directly into their products. Rather than acquiring clients one at a time through traditional branches, Key can now access thousands of end clients through a single platform partnership.

"The real power of that strategy is to go after a software platform like the pharmacy software I talked about... and I could have done dental software, logistics software," Gavrity explained. "There's so many of these areas where I can go to one platform and then get access to their several hundred, sometimes several thousand clients underneath."

The strategy is gaining traction. KeyCorp doubled its embedded banking business in 2025 and expects to replicate that growth in 2026. More technology companies are seeking banking partners that combine deep industry understanding with scalable platforms that can grow alongside their businesses.

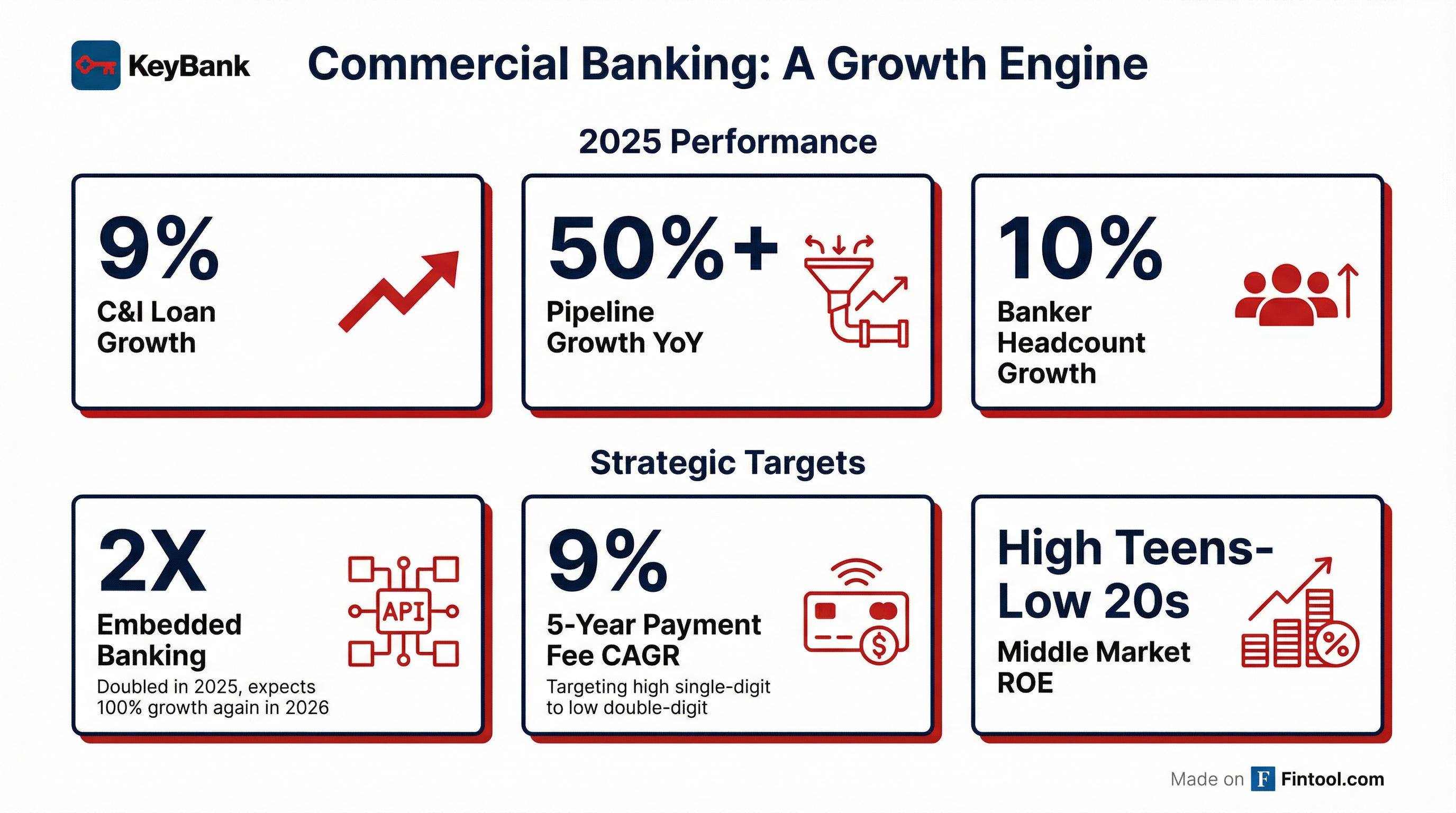

Commercial Banking: A $2.1 Billion Growth Engine

KeyCorp's commercial bank contributed $2.1 billion of revenue in 2025—nearly one-third of the company's total—and accounts for roughly 40% of deposits. The middle market franchise, which serves companies with $10 million to $1 billion in annual revenue, consistently generates returns on equity in the high teens to low twenties.

The numbers from 2025 were strong across the board:

| Metric | 2025 Result | 2026 Target |

|---|---|---|

| C&I Loan Growth | 9% | 5-6% (above market) |

| New Client Growth | 4% | Continue expansion |

| Pipeline Growth | 50%+ YoY | Strong momentum |

| Banker Headcount | +10% | +10% target |

| Payment Fee Growth | 9% | High single-digit to low double-digit |

Management guided for 5-6% commercial loan growth in 2026, which they expect will outperform the broader market's estimated 3-5% C&I loan growth. The more conservative guide relative to 2025's 9% reflects a normalization after pent-up demand was released in late 2024 and early 2025, as well as expectations for increased M&A activity among middle market clients—which could create fee income but also loan paydowns.

AI Agents Live in Production

In a notable disclosure, Gavrity revealed that KeyCorp has multiple AI agents operating in production within its commercial servicing operations. Management characterized the technology adoption as unprecedented in their careers.

"I've never seen a technology in my career get this pervasive, this fast," Gavrity said. "Our clients have proof of concept in their own businesses, regardless of whether they're a metal bender, they're a law firm, a real estate firm. Everybody is already starting to ring-fence use cases."

The AI agents are focused on reducing friction in commercial servicing, where manual touchpoints create latency across the customer request-to-fulfillment cycle. Management emphasized a careful, measured rollout given that "service and expertise is how we win in the marketplace."

Geographic Expansion: Kansas City Family Office Team

KeyCorp announced a new banker team in Kansas City focused exclusively on family offices nationwide—a high-growth segment well-suited to the bank's integrated model of capital markets, payments, wealth, and lending.

The move follows successful team additions in Chicago and Southern California, which have driven client and loan production at roughly two times the rate of the rest of the portfolio. KeyCorp operates in 11 of the top 20 MSAs for middle market companies and continues to selectively expand into high-opportunity markets.

Management's hiring philosophy centers on talent quality over geographic quotas. "Follow great bankers" has become an internal mantra, with the bank willing to enter "micro markets" like Toledo, Akron, or Northern Indiana if they can recruit top talent with deep local relationships.

Middle Market Sentiment: "Cautious Optimism"

When asked about client sentiment amid tariff uncertainty, Gavrity offered a nuanced but ultimately constructive view. Middle market companies have weathered significant shocks over the past five years—pandemic-driven supply chain disruptions, double-digit inflation, and aggressive rate hikes—yet still managed to grow revenue at double-digit rates through 2024.

"If you read the headlines and you look at all the news around tariffs... the view of this particular cohort was, 'We've seen bigger shocks than this,'" Gavrity noted. A recent KeyCorp client survey found that while only 50% were neutral on the broader macro economy, 77% expressed confidence in their own businesses.

Key themes driving CapEx investment include new production lines, geographic expansion, and M&A. Management sees growing interest in acquisitions as the bid-ask spread between buyers and sellers narrows, with clients increasingly seeking debt capacity for rollup strategies.

Competitive Positioning: Private Credit Not a Threat (Yet)

Gavrity pushed back on concerns that the $2 trillion private credit market is encroaching on traditional commercial banking relationships. "We still don't see them competing for our core commercial customer," he said, noting that private credit funds target leveraged deals at 5-7x EBITDA—exposure that KeyCorp generally avoids.

Private credit providers are single-product funds seeking high returns and aren't interested in the low-leverage revolvers and payments business that form KeyCorp's core middle market offering. When clients do need high-leverage financing for M&A, KeyCorp can facilitate introductions to private capital solutions while maintaining the primary banking relationship.

Stablecoins and Tokenized Deposits: "Early Days"

On the question of stablecoins and tokenized deposits, management acknowledged the bank is "in all the right conversations" but emphasized that practical client applications remain nascent.

"There's not a single middle market client that's asking for this, and most of them don't know what it is," Gavrity said. While KeyCorp sees potential use cases in cross-border payments and settlement efficiency, the focus remains on ensuring customer value before committing resources. "I need to see more conviction around true value delivery in this space before I start putting more chips on some of these use cases."

What to Watch

Q1 2026 earnings will provide the first test of management's 2026 guidance. Key metrics to monitor include commercial loan growth, deposit trends, and payment fee momentum. The embedded banking business—while still small relative to the overall franchise—represents an optionality that could become material if the 100% annual growth trajectory continues.

Credit quality remains healthy, with net charge-offs and NPLs at the low end of targeted ranges for middle market. Management flagged agriculture (commodity prices), healthcare (reimbursement rates), and consumer goods (tariff exposure) as sectors under closer watch.

Financial Snapshot

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($M) | $668 | $690 | $702 | $782 |

| Net Income ($M) | $405 | $425 | $489 | $510 |

| ROE (%) | 8.7%* | 8.8%* | 9.9% | 10.1% |

| Total Assets ($B) | $189 | $185 | $187 | $184 |

*Values retrieved from S&P Global

Analysts maintain a largely constructive view on KEY. According to consensus data, 11 analysts have "Strong Buy" ratings, two have "Moderate Buy," nine have "Hold," and one has "Strong Sell." The average price target of $21.77 implies limited upside from current levels, though JPMorgan raised its target to $24.50 today with a neutral rating.

Related: Keycorp Company Profile · Fifth Third Bancorp · U.s. Bancorp · Truist Financial