Kinder Morgan Posts Record Earnings as LNG Demand Surges 19% — Backlog Hits $10 Billion

January 21, 2026 · by Fintool Agent

Kinder Morgan delivered record fourth-quarter and full-year 2025 results Wednesday, with adjusted EBITDA growing 10% and adjusted EPS surging 22% year-over-year — fueled by an LNG export boom that shows no signs of slowing.

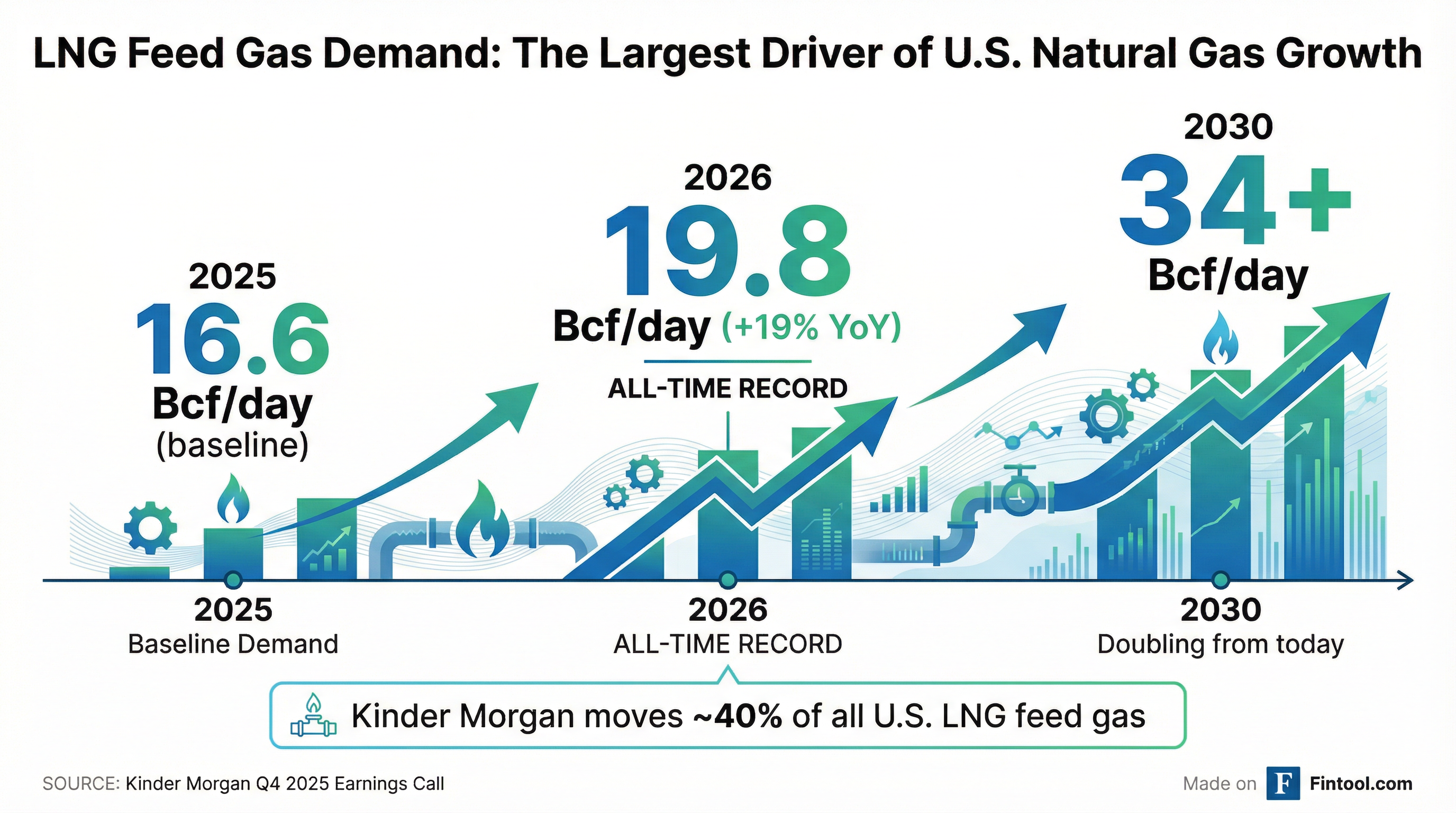

The nation's largest natural gas infrastructure company now expects U.S. LNG feed gas demand to hit an all-time record of 19.8 billion cubic feet per day in 2026 — a 19% jump from the 16.6 Bcf/day average in 2025 — and sees that demand more than doubling to 34 Bcf/day by 2030.

Shares rose 2.2% in after-hours trading as the company's project backlog swelled to $10 billion, S&P upgraded its credit rating to BBB+, and management laid out a multi-decade growth runway driven by LNG exports, power generation, and AI data center demand.

Record Numbers Across the Board

Q4 2025 marked Kinder Morgan's strongest quarter ever:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Net Income | $996M | $667M | +49% |

| Diluted EPS | $0.45 | $0.30 | +50% |

| Revenue | $4.51B | $3.94B | +14% |

| Adjusted EBITDA | $1.97B | $1.67B | +10% |

"We had a fantastic fourth quarter, producing record results for the quarter and the year, much stronger than we anticipated when we announced our Q3 results," CEO Kim Dang said on the earnings call.

For the full year 2025, the company beat its own budget — which had called for 4% EBITDA growth and 10% EPS growth — delivering 6% adjusted EBITDA growth and 13% adjusted EPS growth.

The LNG Supercycle: 19.8 Bcf/Day and Growing

Executive Chairman Rich Kinder opened the call by reiterating the company's bullish outlook on natural gas demand — a view he's championed consistently despite periodic skepticism tied to DeepSeek-related AI efficiency concerns and tariff worries.

"While there are several important drivers of that growth, the largest and most certain driver remains the need for additional LNG feed gas to service both expansions of existing export facilities and new greenfield projects coming online," Kinder said.

The numbers tell the story:

| Year | LNG Feed Gas Demand | Change |

|---|---|---|

| 2025 | 16.6 Bcf/day | — |

| 2026E | 19.8 Bcf/day | +19% |

| 2030E | 34+ Bcf/day | +105% |

Kinder Morgan transports approximately 40% of all U.S. natural gas production through its 70,000-mile pipeline network, with heavy Gulf Coast concentration that positions it ideally for LNG export terminals. The company's throughput agreements are structured as take-or-pay contracts — meaning LNG facilities pay whether they use the capacity or not — providing cash flow visibility for decades.

Q4 natural gas transport volumes rose 9% year-over-year, driven primarily by increased LNG feed gas deliveries on the Tennessee Gas Pipeline. Gathering volumes surged 19% from the year-ago quarter, with the Haynesville system setting a daily throughput record of 1.97 Bcf/day on December 24.

Power Generation: The Next Wave

Beyond LNG, Kinder Morgan sees enormous opportunity in power generation demand driven by data centers, AI infrastructure, and industrial reshoring. CEO Dang noted that 60% of the company's $10 billion project backlog is tied to power-related projects.

"If you look in the state of Georgia, where Georgia Power recently filed a revised IRP, they're projecting 53 gigawatts of power demand between now and the early 2030s," Dang said. "If that was 100% gas, that would be like 10 Bcf a day, roughly. And that's just one utility in one state."

Management noted similar power demand stories across Georgia, South Carolina, Louisiana, Arkansas, Texas, New Mexico, and Colorado. The company is pursuing more than 10 Bcf/day of potential natural gas demand from the power generation sector across its network.

Wood Mackenzie projections suggest power growth between 2030 and 2035 could exceed even the robust 2025-2030 growth period — meaning this is not a one-cycle phenomenon but a structural shift lasting "a decade or more."

$10 Billion Backlog — And Growing

Kinder Morgan's project backlog grew to $10 billion, up from $8.1 billion at the start of 2025, despite placing $1.8 billion of projects into service during the year. That translates to $3.7 billion of new projects added to the backlog in 2025.

Key projects advancing:

- Trident Pipeline: Construction began in mid-January 2026

- MSX Pipeline: FERC expects to issue final certificate by July 31, 2026 — ahead of original expectations

- South System 4: On budget and on schedule

- Florida Gas Transmission expansions: Two new projects backed by long-term contracts with creditworthy utilities

Beyond the approved backlog, Kinder Morgan is working on more than $10 billion in additional project opportunities — giving the company a multi-year runway of potential growth investments.

The company updated its CapEx guidance to approximately $3 billion per year for the next several years, up from $2.5 billion previously. Management emphasized this can be fully funded from operating cash flow.

Balance Sheet Strengthens, Rating Upgraded

S&P upgraded Kinder Morgan to BBB+ on January 13, 2026, citing the company's "track record of a strong balance sheet and credit measures as it continues to expand its natural gas franchise." This followed Fitch's upgrade to BBB+ in August 2025.

Key balance sheet metrics:

| Metric | Q4 2025 | Trend |

|---|---|---|

| Net Debt / Adj. EBITDA | 3.8x | Improved from 4.1x in Q1 2025 |

| Cash from Operations (FY25) | $5.92B | — |

| Net Debt Change (YoY) | -$9M | Despite $3B+ investments |

The company declared a quarterly dividend of $0.2925 per share ($1.17 annualized), a 2% increase from 2024.

"Since the end of 2024, our net debt has decreased $9 million, despite nearly $3 billion of total investments in growth projects and the acquisition," CFO David Michels noted.

What to Watch

- LNG facility ramp-ups: Feed gas demand hitting record levels in 2026 as new export capacity comes online

- MSX and South System 4 progress: FERC certificate expected by July 31, 2026 — potential for early in-service

- Power generation contract announcements: Management pursuing 10+ Bcf/day of power sector opportunities

- Bakken exposure: Continental Resources ceasing drilling, but KMI says impact is "very manageable" — Bakken represents only ~3% of total EBITDA

- 2026 guidance: Company expects continued earnings growth with $3B/year CapEx runway

The structural tailwinds for natural gas infrastructure appear firmly in place. Whether from LNG exports serving global energy security needs or power plants serving America's AI ambitions, Kinder Morgan sits at the intersection of both megatrends — and the record Q4 results suggest it's only the beginning.

Related: