Court Clears $7.4B Korea Zinc Deal: Pentagon to Take Stake in Foreign Company in Rare Critical Minerals Play

December 24, 2025 · by Fintool Agent

A South Korean court delivered a Christmas Eve gift to the Trump administration's critical minerals strategy, dismissing an injunction that threatened to derail one of the most unusual national security deals in years: the U.S. government taking a direct equity stake in a foreign company.

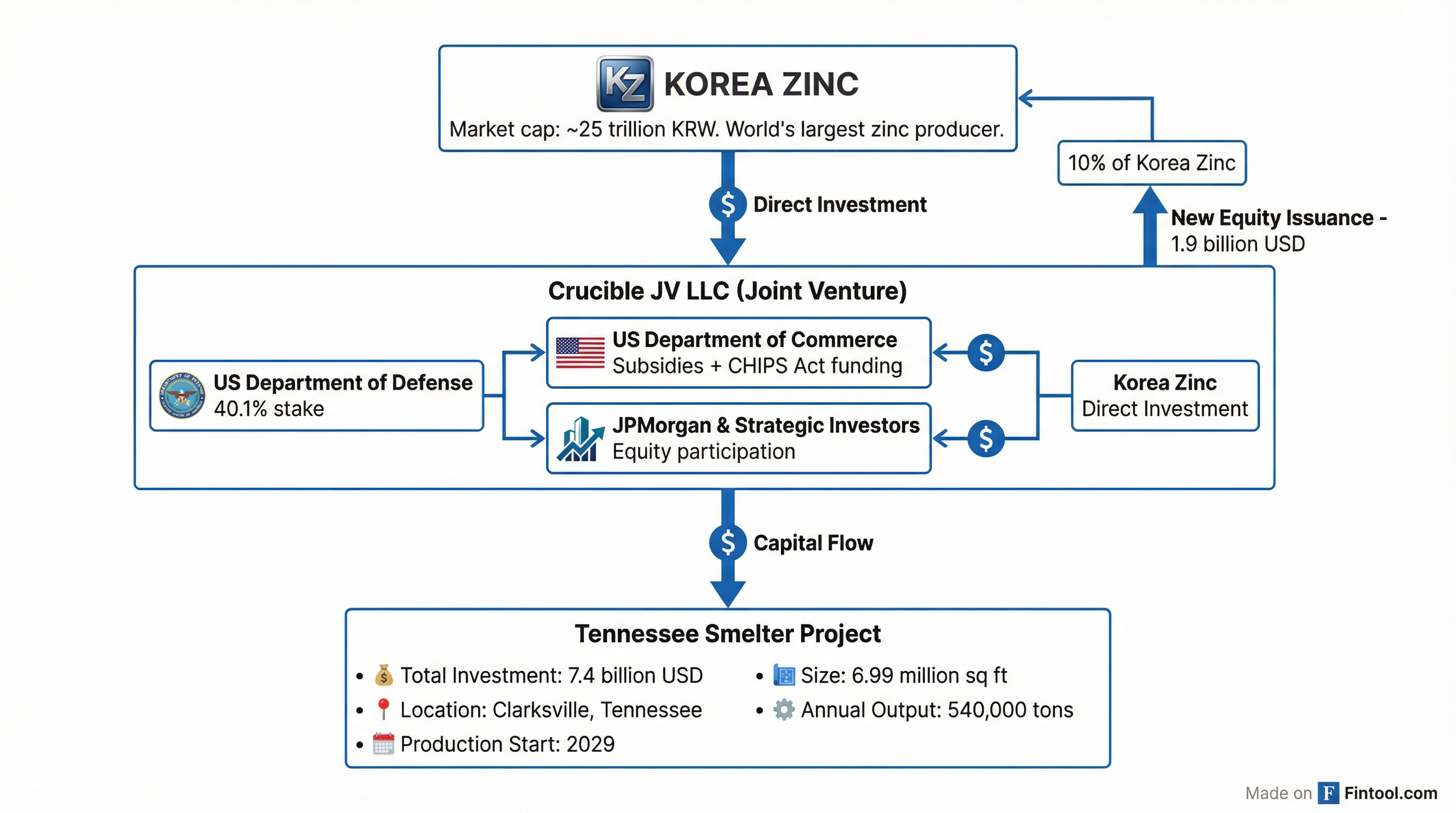

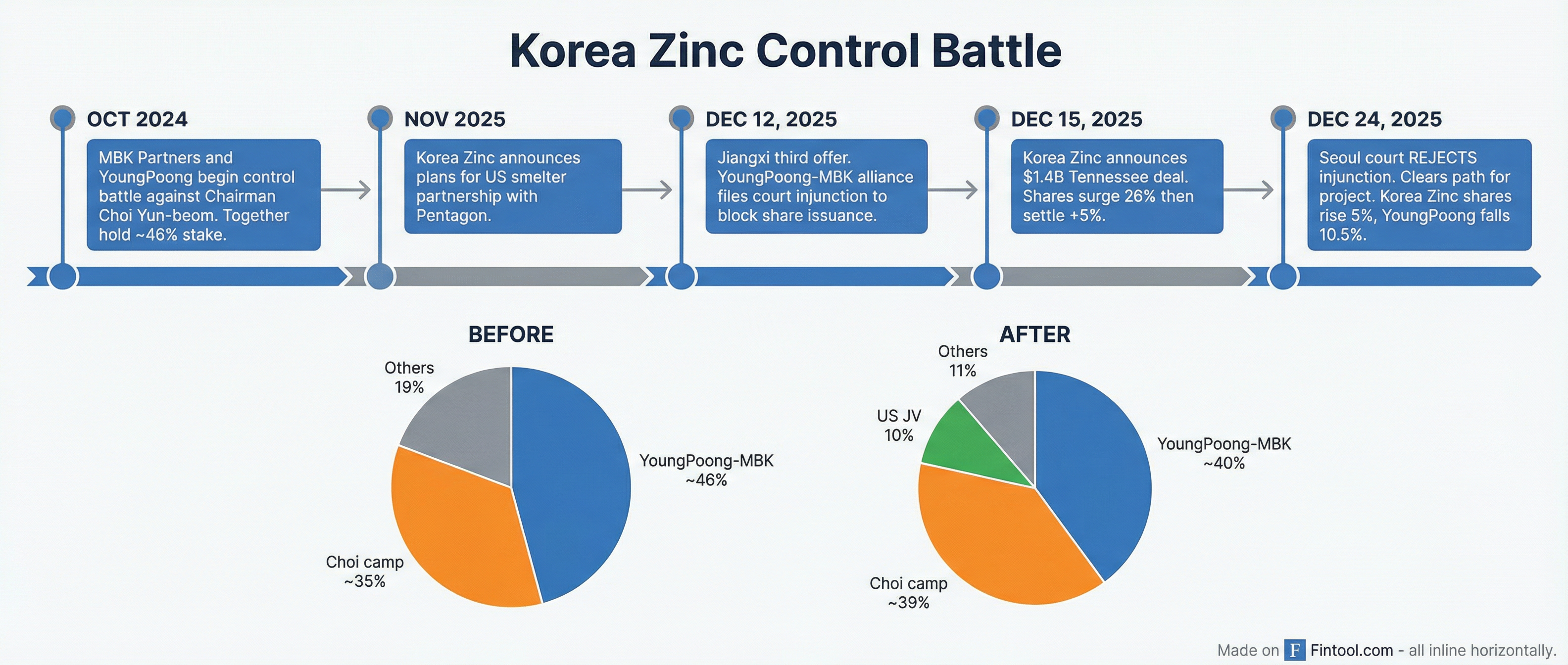

The Seoul Central District Court rejected a challenge from major shareholders MBK Partners and YoungPoong Corp., clearing the way for Korea Zinc-3.98%—the world's largest refined zinc producer—to issue $1.9 billion in new shares to a U.S.-backed joint venture. That venture, called Crucible JV, will be controlled by the Pentagon and the Commerce Department, giving Washington approximately 10% ownership in the South Korean industrial giant.

Korea Zinc shares jumped as much as 5% on the ruling before settling down 2.7%. YoungPoong cratered 10.4%.

The Deal: Pentagon as Shareholder

The $7.4 billion Tennessee smelter project represents the largest single private corporate investment in Tennessee state history—and one of the most strategically significant foreign investments in U.S. industrial capacity.

The structure is unprecedented:

| Component | Value | Details |

|---|---|---|

| Total Investment | $7.4B | Including working capital and financing costs |

| Capital Expenditure | $6.6B | Plant and equipment |

| Korea Zinc Equity Issuance | $1.9B | To Crucible JV for 10% ownership |

| Pentagon Stake in JV | 40.1% | Direct equity investment via Dept. of War |

| Commerce Dept. Role | Subsidies | $210M CHIPS Act funding confirmed |

| JPMorgan+3.95% | Advisor + Investor | Strategic investor in Crucible JV |

The Department of Defense stake is extraordinary. While Washington routinely provides loans, grants, and tax incentives to attract investment, direct equity ownership in a foreign company's domestic operations is virtually unheard of.

Commerce Secretary Howard Lutnick called it "a big win for America" on social media. "This is exactly how we win: build here, secure our supply chains, create great jobs, and keep America the world's industrial and technological leader."

What Korea Zinc Brings

Korea Zinc is not a household name, but it's a global industrial powerhouse. The company operates the world's largest single-site smelter at Onsan in Ulsan, South Korea, with annual production capacity of 650,000 tons of zinc and 420,000 tons of lead.

The Tennessee facility will be modeled on Onsan, spanning 6.99 million square feet in Clarksville. When operational in 2029, it will process 1.1 million tons of raw materials annually and produce 540,000 tons of finished products.

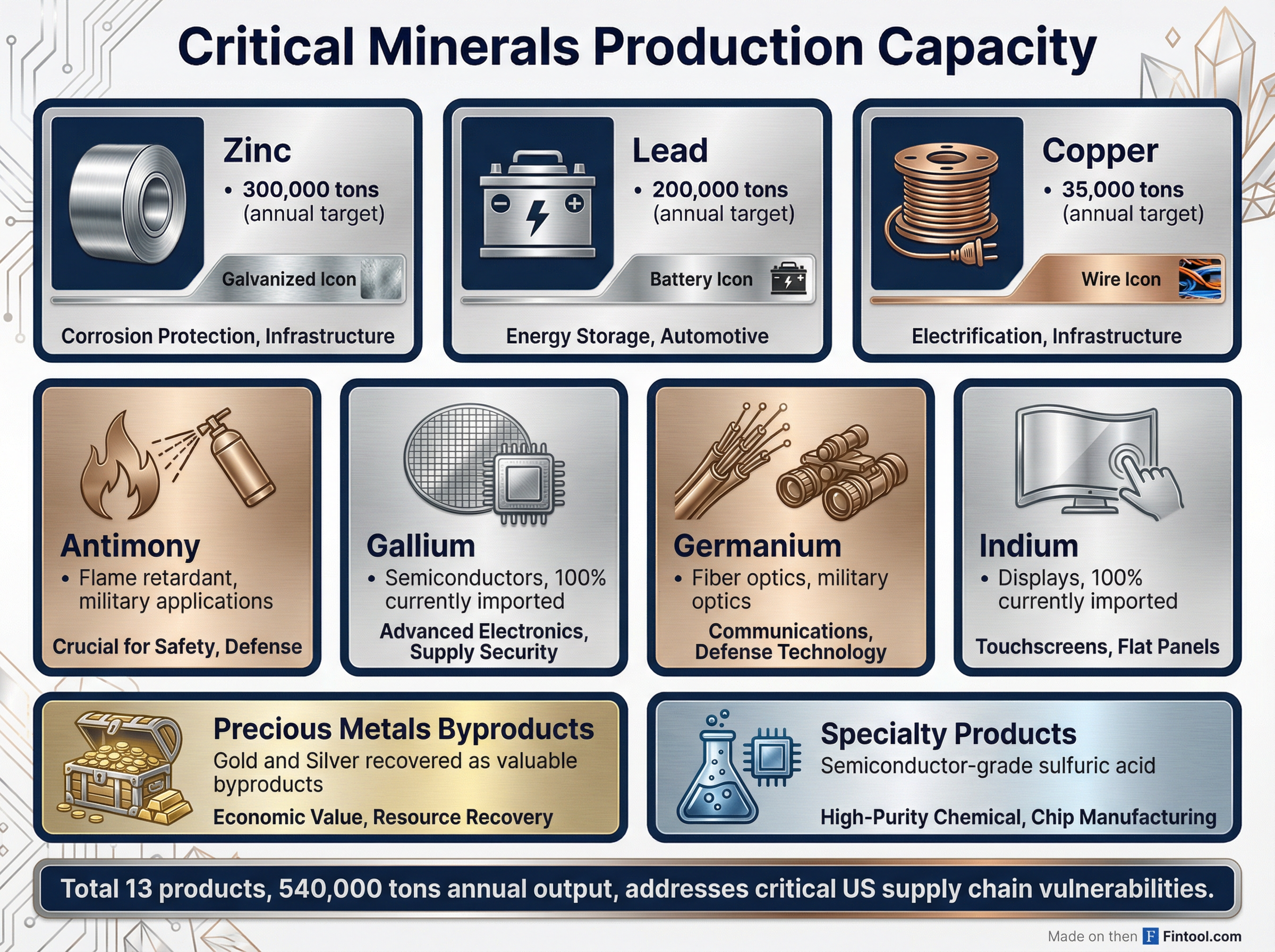

The product slate addresses critical U.S. supply chain vulnerabilities:

| Product | Annual Target | U.S. Import Dependence |

|---|---|---|

| Zinc | 300,000 tons | Only domestic smelter |

| Lead | 200,000 tons | Battery applications |

| Copper | 35,000 tons | Strategic |

| Antimony | 5,100 tons | 100% imported |

| Gallium | Included | 100% imported |

| Germanium | Included | 100% imported |

| Indium | Included | 100% imported |

According to the U.S. Geological Survey, gallium and indium are 100% import-dependent, with China dominating global supply. These minerals are essential for semiconductors, fiber optics, military optics, and advanced electronics.

Korea Zinc will acquire Nyrstar's existing Clarksville zinc smelter—currently the only primary zinc producer in the United States—from Trafigura Group, then tear it down and build the larger integrated facility.

The Governance Battle

The court ruling isn't just about Tennessee jobs and national security. It's the latest salvo in a bitter Korean corporate war.

Since October 2024, Korea Zinc Chairman Yun B. Choi has been locked in a control battle with private equity firm MBK Partners and conglomerate YoungPoong, which together hold approximately 46% of the company.

The U.S. deal fundamentally reshapes the ownership landscape. Issuing shares to Crucible JV dilutes the YoungPoong-MBK bloc from ~46% to approximately 40%, while Choi's camp plus the U.S. investors would rise to nearly 49% combined.

The opposition characterized the deal as a "tactical maneuver designed to entrench management control" and an "abnormal structure" that grants favorable equity terms during a control dispute.

The court disagreed, ruling that the transaction was intended to support "a U.S.-led restructuring of the global critical minerals supply chain" and "deepen cooperation between South Korea and the U.S." The filing noted that direct investment or subsidies alone would not be sufficient—the U.S. government specifically sought an equity stake to ensure the project's success.

Despite losing, MBK and YoungPoong struck a conciliatory tone: "We intend to support the U.S. smelter project so that it may deliver genuine 'win-win' results for the United States, Korea Zinc, and the broader Korean economy."

Why Tennessee?

The site selection is strategic. Clarksville sits beside the Cumberland River, providing water access for raw material supply. It's within 900 kilometers of the U.S. industrial heartland—Chicago, Detroit—and within one-day trucking distance of a large portion of the U.S. zinc market.

The Nyrstar smelter being acquired was specifically designed in 1978 to process the high-grade, low-impurity zinc concentrates from Tennessee mines. Korea Zinc will also reopen a former mine in Gordonsville, creating 320 additional jobs in Smith County.

Total job creation: 740 positions across both counties over five years.

Geopolitical Stakes

The deal fits a broader pattern of the Trump administration moving aggressively to reduce China dependence in critical minerals. Earlier this year, Washington and Australia signed agreements on rare earths and critical minerals potentially worth $8.5 billion.

In August, Korea Zinc signed an MOU with Lockheed Martin to supply germanium—a mineral essential for military optics and fiber optic communications—from its new U.S. operations.

Senator Bill Hagerty (R-TN) called the investment "a geostrategic victory that directly supports President Trump's efforts to restore American economic security in partnership with trusted allies."

What to Watch

Near-term catalysts:

- Final transaction close expected H1 2026

- Site preparation beginning 2026

- Nyrstar sale completion (2026 zinc production continues under Trafigura offtake agreement)

Long-term milestones:

- Commercial operations beginning 2029

- Full production ramp to 540,000 tons annually

- Potential for expanded U.S. government partnerships

Risks:

- Any appeal of court ruling (unlikely to succeed given national security framing)

- U.S.-Korea relations under future administrations

- Global zinc/copper price volatility affecting economics

- Continued governance battles at Korea Zinc

The court's reasoning—that U.S. national security interests justified the transaction structure—sets a precedent that could accelerate similar public-private partnerships in critical minerals, rare earths, and other strategically sensitive sectors.