Korro Bio Unveils KRRO-121 at Analyst Day, Eyes $3.5 Billion Ammonia Market with First-in-Class RNA Editing Approach

January 27, 2026 · by Fintool Agent

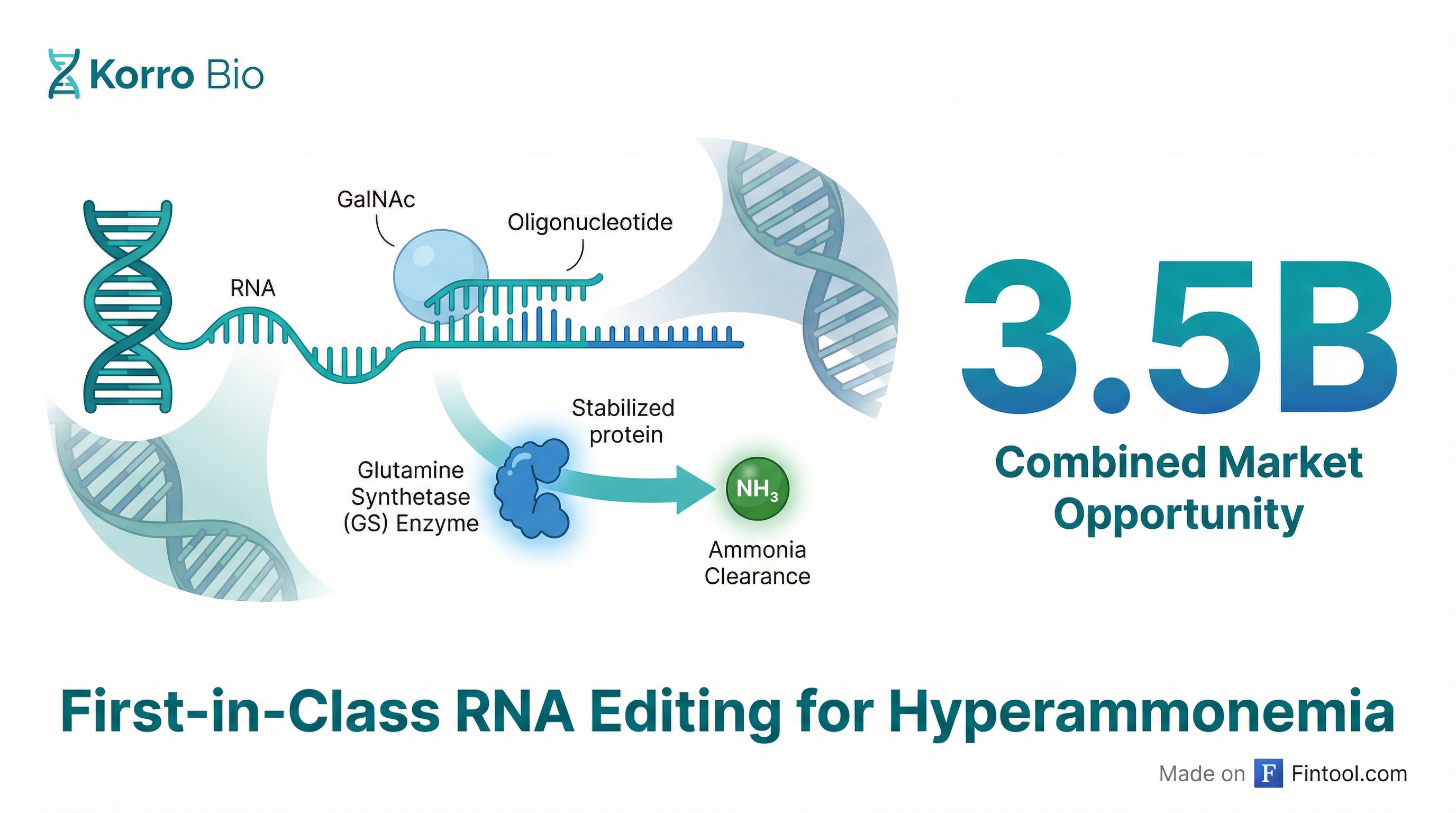

Korro Bio laid out an ambitious roadmap at its January 27, 2026 Virtual Analyst Day, positioning KRRO-121 as a first-in-class RNA editing therapy targeting a combined $3.5 billion market in ammonia-driven diseases. The Cambridge biotech detailed preclinical data showing dramatic ammonia reductions in multiple disease models—with only 20-25% RNA editing required for therapeutic effect—as it prepares for regulatory filings in the second half of 2026.

Shares of Krro traded around $10.45, down 2.6% on the session, as investors digested the pivot toward this new lead program following the company's November 2025 setback with KRRO-110 in alpha-1 antitrypsin deficiency (AATD). The stock remains down more than 80% from its 52-week high of $55.89.

The Science: A Novel Pathway to Ammonia Control

KRRO-121 takes a fundamentally different approach than existing ammonia therapies. Rather than providing an alternate excretion pathway like current drugs, Korro's GalNAc-conjugated oligonucleotide activates the body's glutamine synthetase (GS) enzyme—a complementary system to the urea cycle that clears ammonia by converting it to glutamine.

"Glutamine synthetase is a critical ammonia-clearing mechanism in the liver," explained Chief Scientific Officer Loïc Vincent during the presentation. "It complements the urea cycle and provides an alternative pathway for ammonia detoxification."

The mechanism is elegantly simple: GS naturally degrades when glutamine levels rise—precisely when ammonia-clearing capacity is needed most. KRRO-121 edits the GS messenger RNA to create a "de novo variant" that resists this degradation, extending the enzyme's half-life from 1-2 days to approximately 14 days.

The company presented compelling genetic validation for this approach. Nine patients have been identified with natural "start loss variants" that stabilize GS—these individuals show increased GS stability and, critically, lower ammonia levels.

Preclinical Data: Robust Ammonia Control Across Disease Models

Korro presented an extensive preclinical data package showing KRRO-121's efficacy across multiple models:

OTC-Deficient Mice: Treatment with KRRO-121 produced "dramatic reduction in ammonia levels," bringing OTC-deficient mice much closer to normal ranges (below the 450 micromolar upper limit of normal) even during metabolic stress from ammonia challenge. Importantly, glutamine levels remained steady—critical for avoiding accumulation concerns.

CPS1-Deficient Mice: Independent validation from Dr. Brunetti-Pierri's academic research group in Italy confirmed significant ammonia reduction in a different UCD genotype, supporting the pan-UCD applicability of the approach.

Humanized Liver Mice (PXB-mice): In what Vincent called "our most important preclinical dataset," mice with humanized livers showed:

- 20-30% reduction in basal ammonia levels

- Ammonia levels staying at or near normal limits during challenge (vs. vehicle-treated animals spiking to ~1,600 micromolar)

- Only 10-15% of total GS being the edited variant required for efficacy

Safety data showed greater than 90% of KRRO-121 delivered to the liver with minimal distribution elsewhere and no CNS exposure—critical given glutamine synthetase's role in brain function.

A $3.5 Billion Market Opportunity

Chief Operating Officer Todd Chappell outlined the commercial opportunity across two distinct patient populations:

Urea Cycle Disorders (UCD):

- ~9,000 addressable patients in US and Europe combined

- ~4,200 severe post-neonatal onset patients in US alone expected to benefit from pharmacological therapy

- $1.5 billion market opportunity

Hepatic Encephalopathy (HE):

- ~230,000 addressable patients in US and Europe with severe recurring HE, high ammonia, and sufficient liver function

- Greater than 2x increase in HE-related hospitalizations for high-ammonia patients

- HE hospitalizations can exceed $75,000 per visit, totaling over $10 billion in annual US patient charges

- Over $2 billion market opportunity

The current standard of care for UCD—Ravicti (glycerol phenylbutyrate), now owned by Amgen following its $27.8 billion acquisition of Horizon Therapeutics—requires three-times-daily oral dosing alongside severe protein restriction. Many patients still experience hyperammonemic crises despite compliance.

"The constant not knowing where her ammonia level was... that was always the piece that was the most unsettling," shared Michelle Dinneen, mother of a UCD patient who underwent liver transplant at age five. Her daughter's experience—ICU stays, ER visits, meticulous food weighing, hypervigilance—painted a vivid picture of the unmet need.

Ravicti Developer Joins the Case for KRRO-121

The Analyst Day featured an unusual endorsement: Dr. Bruce Scharschmidt, the former Chief Medical and Development Officer at Hyperion Therapeutics who led Ravicti's development and launch, presented the clinical perspective on ammonia-driven diseases.

"UCDs are cruel. They can affect children starting early in life, and they never let up, and they're unforgiving," Scharschmidt said. He noted that achieving tight ammonia control—which his team demonstrated correlates directly with crisis-free survival—remains extraordinarily difficult with current therapy.

Scharschmidt highlighted several theoretical advantages for KRRO-121:

-

Durable coverage: Unlike short-acting PAA prodrugs, KRRO-121 would provide around-the-clock protection—beneficial even for compliant patients during sleep or illness when they can't take oral medication.

-

Responsive to need: Current therapy removes ammonia as a byproduct of drug metabolism, regardless of ammonia levels. KRRO-121's enhanced GS should operate based on enzyme kinetics, specifically responsive to high ammonia—"treatment which is there when patients need it."

-

Dosing convenience: Potential for once-every-two-week subcutaneous administration versus three-times-daily oral dosing—particularly valuable for adolescents and compliance-challenged patients.

The Pivot: From AATD Setback to New Lead Program

Korro Bio's focus on KRRO-121 follows disappointing results from KRRO-110, its RNA editing therapy for alpha-1 antitrypsin deficiency. In November 2025, the company announced that while KRRO-110 produced functional protein in AATD patients, it "did not reach projected levels of functional protein following a single administration." The company terminated the REWRITE clinical trial and pivoted to GalNAc delivery for the AATD indication.

The stock collapsed from the mid-$40s to below $10 on the news—a stark reminder of clinical-stage biotech risk.

CEO Ram Aiyar addressed this implicitly during the Analyst Day: "Today, I hope it gives you a window of how we at Korro are approaching product-market fit with RNA editing therapies." He noted the company achieved close to 100% SERPINA1 editing in vivo and that KRRO-121 is "couple of logs fold more potent" than earlier GalNAc conjugates.

The company expects to nominate a development candidate for a next-generation GalNAc AATD program in H1 2026, having reported greater than 90% in vivo RNA editing—the highest reported to date—at the J.P. Morgan Healthcare Conference earlier this month.

Clinical Development Path

Korro outlined a clear near-term roadmap:

| Milestone | Timeline |

|---|---|

| KRRO-121 development candidate nomination | H2 2025 (completed) |

| Regulatory filing for first-in-human trial | H2 2026 |

| Initial proof-of-concept data (ammonia lowering) | Following IND clearance |

| Next-gen AATD candidate nomination | H1 2026 |

The first clinical studies will focus on demonstrating ammonia reduction—the same endpoint that supported Ravicti's approval. "The goal first is to show that mechanistically we can reduce ammonia," Aiyar explained. Dose, dosing schedule, and hard outcomes like crisis reduction or diet liberalization would follow in subsequent studies.

Competitive Landscape

KRRO-121 enters a field with established competition and emerging RNA editing rivals:

Current Standard of Care:

- Ravicti (Amgen/Horizon): ~$50,000+ monthly, requires severe protein restriction

- Buphenyl (sodium phenylbutyrate): Older formulation with compliance challenges

- Rifaximin (Salix/Bausch): For HE, but observational data suggests 27% of patients still experience events while on therapy

RNA Editing Competitors:

- Wave Life Sciences: Single-dose AATD data disclosed; different platform approach

- AIRNA: Preclinical AATD program with RESTORE+ platform

- ProQR: Axiomer platform partnered with Eli Lilly

- Shape Therapeutics: $3 billion Roche collaboration for CNS diseases

Korro believes its OPERA platform differentiates through potency improvements and the transient nature of RNA editing—changes last while dosing continues but don't permanently alter DNA.

What to Watch

Near-term catalysts:

- H1 2026: Next-generation AATD development candidate nomination

- H2 2026: KRRO-121 regulatory filing for first-in-human trial

- 2026-2027: Initial clinical proof-of-concept data

Key questions:

-

Translation: Will the robust preclinical ammonia lowering translate to humans? GalNAc delivery is well-validated, but GS stabilization is novel.

-

Competitive timing: Can Korro advance quickly enough to establish first-mover advantage in RNA editing for hyperammonemia before well-funded competitors pivot?

-

Cash runway: The company merged with Frequency Therapeutics expecting runway into 2026. Investors will want clarity on financing needs as KRRO-121 advances toward the clinic.

-

Regulatory pathway: Will FDA accept ammonia lowering as an approvable endpoint (as it did for Ravicti), or will hard outcomes be required?

The Bottom Line

Korro Bio's Analyst Day presented a compelling scientific narrative: genetic evidence validating the target, robust preclinical efficacy across multiple disease models, and a massive underserved market. The participation of Ravicti's original developer lent credibility to the unmet need argument.

But the stock's subdued reaction reflects appropriate caution. Korro must prove that its OPERA platform—which stumbled in AATD—can deliver in this new indication. The company is essentially asking investors to trust that lessons learned from KRRO-110's failure have been incorporated into KRRO-121's improved potency.

For patients like Michelle Dinneen's daughter Sophia—now a healthy 17-year-old thanks to liver transplant—the promise of a therapy that could have avoided surgery and normalized her childhood is tantalizing. Whether Korro Bio can deliver on that promise remains the $3.5 billion question.