Korro Bio Unveils KRRO-121 at Analyst Day: RNA Editing Pivot Targets $3.5B Ammonia Control Market

January 27, 2026 · by Fintool Agent

Korro Bio emerged from its November 2025 near-death experience today with a comprehensive showcase of KRRO-121, a potential first-in-class RNA editing therapy targeting ammonia control across urea cycle disorders and hepatic encephalopathy—a combined market opportunity the company estimates at $3.5 billion .

At its virtual Analyst Day, the $100 million market cap biotech presented preclinical data demonstrating robust ammonia-lowering effects in humanized mouse models, with only 20-25% RNA editing efficiency required for therapeutic benefit . The company expects to file for regulatory approval to begin first-in-human trials in the second half of 2026 .

Shares of KRRO traded at $10.48, down 2.4% on the day, having recovered roughly 100% from their $5.20 low hit in early December following the company's 80% crash when its lead AATD program failed.

A Comeback Story: From 80% Crash to Pipeline Pivot

The Analyst Day marks a critical inflection point for Korro Bio, which was left for dead just weeks ago. In November 2025, the company disclosed that KRRO-110—its lead program for alpha-1 antitrypsin deficiency (AATD)—failed to produce anticipated protein levels in patients, despite showing promise in preclinical studies .

The fallout was swift and severe: an 80% single-day stock plunge, a 33% workforce reduction, and a paused collaboration with Novo Nordisk . Management pivoted to GalNAc-conjugated delivery for liver-targeted therapies, abandoning the lipid nanoparticle approach that had failed.

"KRRO-121 represents a first step in modulating protein function by stabilizing an intracellular protein through RNA editing," said CEO Ram Aiyar during the presentation, noting that the company's GalNAc platform is now "several logs more potent" than what was previously in the clinic .

The Science: Elegant but Unproven in Humans

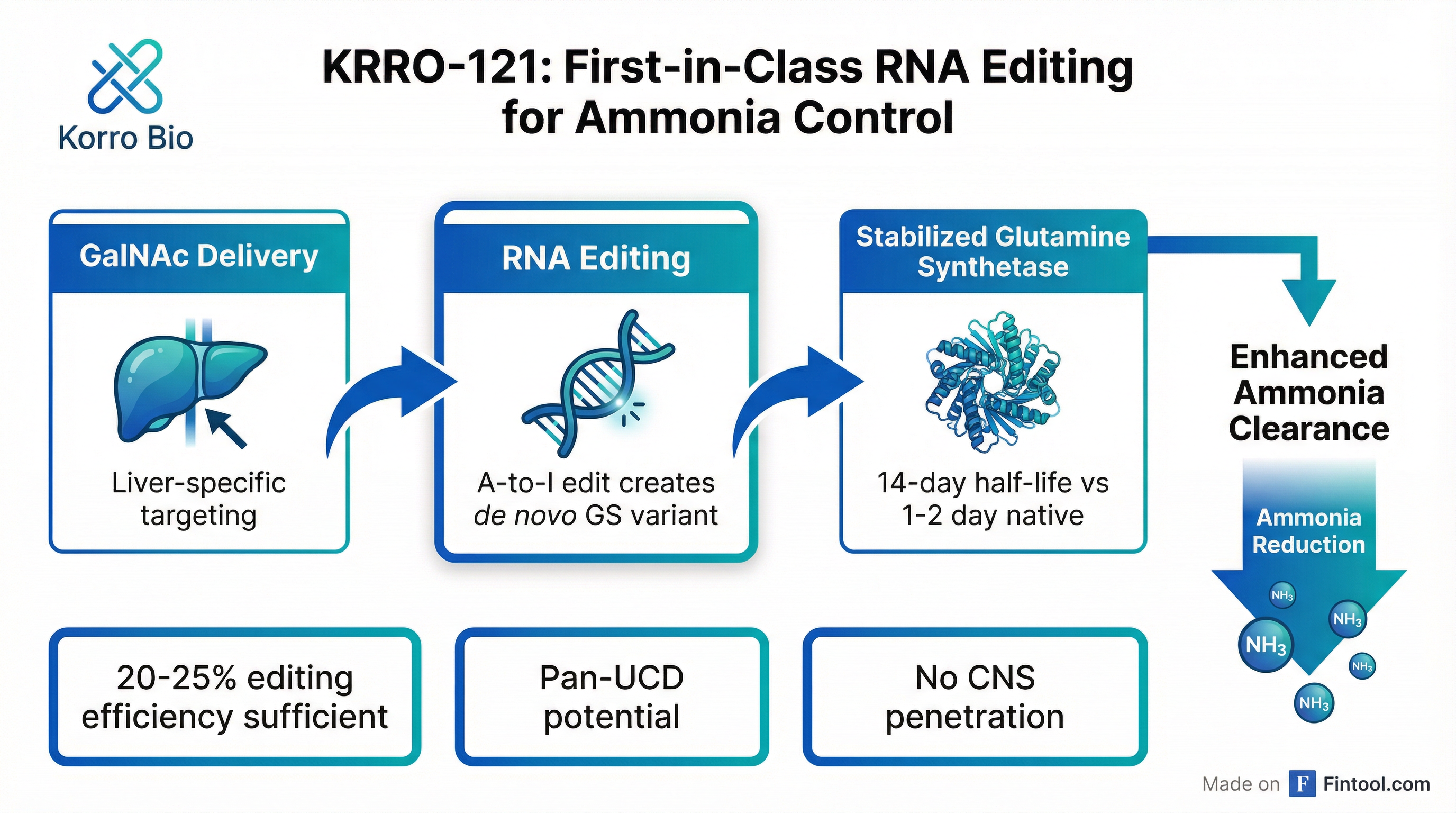

KRRO-121 takes a novel approach to ammonia control by stabilizing glutamine synthetase (GS), an enzyme that provides an alternative pathway for clearing ammonia independently of the urea cycle .

The therapy works by:

- GalNAc delivery targeting the liver exclusively (>90% biodistribution)

- A-to-I RNA editing that converts a lysine codon to arginine at a critical N-terminal position

- Preventing GS degradation, extending the protein's half-life from 1-2 days to approximately 14 days

Chief Scientific Officer Loïc Vincent presented data from PXB humanized liver mice showing that KRRO-121 produced a 20-30% reduction in basal ammonia levels and maintained ammonia near the upper limit of normal even under metabolic stress—with only 10-15% of total liver GS being the edited variant .

| Preclinical Findings | Result |

|---|---|

| Editing efficiency required | 20-25% |

| GS variant half-life | 14 days (vs 1-2 days native) |

| Liver delivery | >90% |

| CNS penetration | None detected |

| Target engagement | Confirmed via 15N-glutamate tracer |

The company validated its approach across multiple UCD genotypes—OTC, CPS1, and ASS1 deficiencies—supporting its claim of "pan-UCD potential" .

The Clinical Perspective: A Familiar Voice

Adding credibility to the presentation was Dr. Bruce Scharschmidt, a hepatologist who served as CMO at Hyperion Therapeutics—the company that developed Ravicti, the current standard of care for UCD .

Scharschmidt's presence was notable. He led the clinical development of glycerol phenylbutyrate and has deep experience with the challenges of treating ammonia-driven diseases. His endorsement carries weight: "I'd like to think there's still a lot we can do for these patients to help achieve better ammonia control and outcomes" .

He outlined the limitations of current therapy:

- Compliance burden: Ravicti requires dosing "up to several times per day" with potential body odor side effects

- Narrow therapeutic window: High phenylacetic acid levels can be toxic

- Incomplete protection: Even compliant patients experience crises due to intercurrent illness, with 40% of triggers linked to infections

- Undertreatment: Over 60% of diagnosed patients aren't prescribed drugs at all

"The most obvious advantage [of KRRO-121] compared with very short half-life PAA prodrugs is durable around-the-clock coverage," Scharschmidt noted, emphasizing the potential for protection during sleep or when patients are too sick to take oral medication .

Market Opportunity: Two Paths, One Platform

COO Todd Chappell outlined a dual-market strategy targeting both rare and prevalent diseases:

Urea Cycle Disorders ($1.5B Opportunity)

- Addressable patients: ~9,000 in US and Europe combined

- Current treatment cost: ~$794,000/year for Ravicti

- Market share: Glycerol phenylbutyrate holds 62.8% of the US UCD treatment market

- Unmet need: Strict dietary restrictions, frequent hospitalizations, life-threatening crises

Hepatic Encephalopathy ($2B+ Opportunity)

- Addressable patients: ~230,000 in US and Europe (severe recurring HE with high ammonia and sufficient liver function)

- Current market size: ~$1.7B globally, dominated by Xifaxan (rifaximin)

- Persistent unmet need: In observational studies, 27% of patients experienced additional HE events within 2 months despite treatment

- Economic burden: HE-related hospitalizations can exceed $75,000 per visit, with $10B+ in annual US patient charges

The company emphasized that both markets share a common unifying factor: ammonia is the driver, and current treatments don't adequately control it.

"We believe KRRO-121 has a compelling product profile to address HE patients with substantial unmet need," Chappell stated, noting the potential for "a differentiated ammonia-lowering approach... with improved dosing frequency compared to standard of care" .

What the Street Is Watching

Analyst questions during the Q&A session revealed key concerns:

Enrollment feasibility: Given the ultra-orphan nature of UCDs, investors questioned whether Korro can recruit efficiently. Scharschmidt noted that at Hyperion, the team completed five UCD trials in four years by partnering closely with the National Urea Cycle Disorders Foundation and NIH-sponsored UCD Consortium .

Clinical trial design: Management indicated the initial goal is to demonstrate ammonia reduction, with dose-finding studies to follow. Approval is expected to be based on "favorable ammonia control," similar to Ravicti's path .

Dosing frequency: The company anticipates "every other week or less frequent" subcutaneous administration, compared to the 3x daily oral regimen for Ravicti .

Competitive positioning: While RNA editing rivals like Wave Life Sciences and privately held Airna are advancing their own programs, Korro's pivot to GalNAc delivery "goes against the company's own thesis" according to William Blair's Myles Minter, raising "concerns about differentiation" .

The Human Element

Perhaps the most compelling aspect of the presentation was the interview with Michelle Dinneen, mother of a 17-year-old daughter with OTC deficiency who received a liver transplant at age five .

Dinneen described the "atmosphere of hypervigilance" that characterized her family's life: weighing every gram of food consumed, tracking protein intake in spiral-bound notebooks, and rushing to the emergency room whenever symptoms of elevated ammonia appeared—glassy eyes, unexplained vomiting, loss of eye contact .

"I think that the improved ammonia control would have been the ultimate factor in giving us some peace of mind," Dinneen reflected. "The constant not knowing where her ammonia level was... that was always the piece that was the most unsettling" .

Her daughter Sophia, now a junior in high school who snowboards and lives an active life, serves as testament to what's possible—but only after enduring a liver transplant, a procedure that carries its own lifelong burden of immunosuppression .

The Bottom Line

Korro Bio's Analyst Day accomplished its primary objective: demonstrating that the company has a credible path forward after its November collapse. The preclinical data package is compelling, the market opportunity is substantial, and the unmet medical need is undeniable.

But significant execution risk remains. The company must:

- Translate preclinical success to human efficacy

- Compete against well-funded RNA editing rivals

- Enroll sufficient patients in an ultra-orphan indication

- Secure regulatory approval based on ammonia biomarkers

With an anticipated regulatory filing in H2 2026, investors won't have to wait long for the next critical read-out. For a $100 million market cap biotech targeting a $3.5 billion opportunity, the risk/reward may prove compelling—assuming management can deliver on the promise articulated today.

"This is just the beginning," Aiyar concluded. "The ability to have an impact on ammonia in both these patient populations is tremendous" .