Kyndryl Stock Crashes 55% as SEC Investigation Confirms Short Seller's Worst Allegations

February 9, 2026 · by Fintool Agent

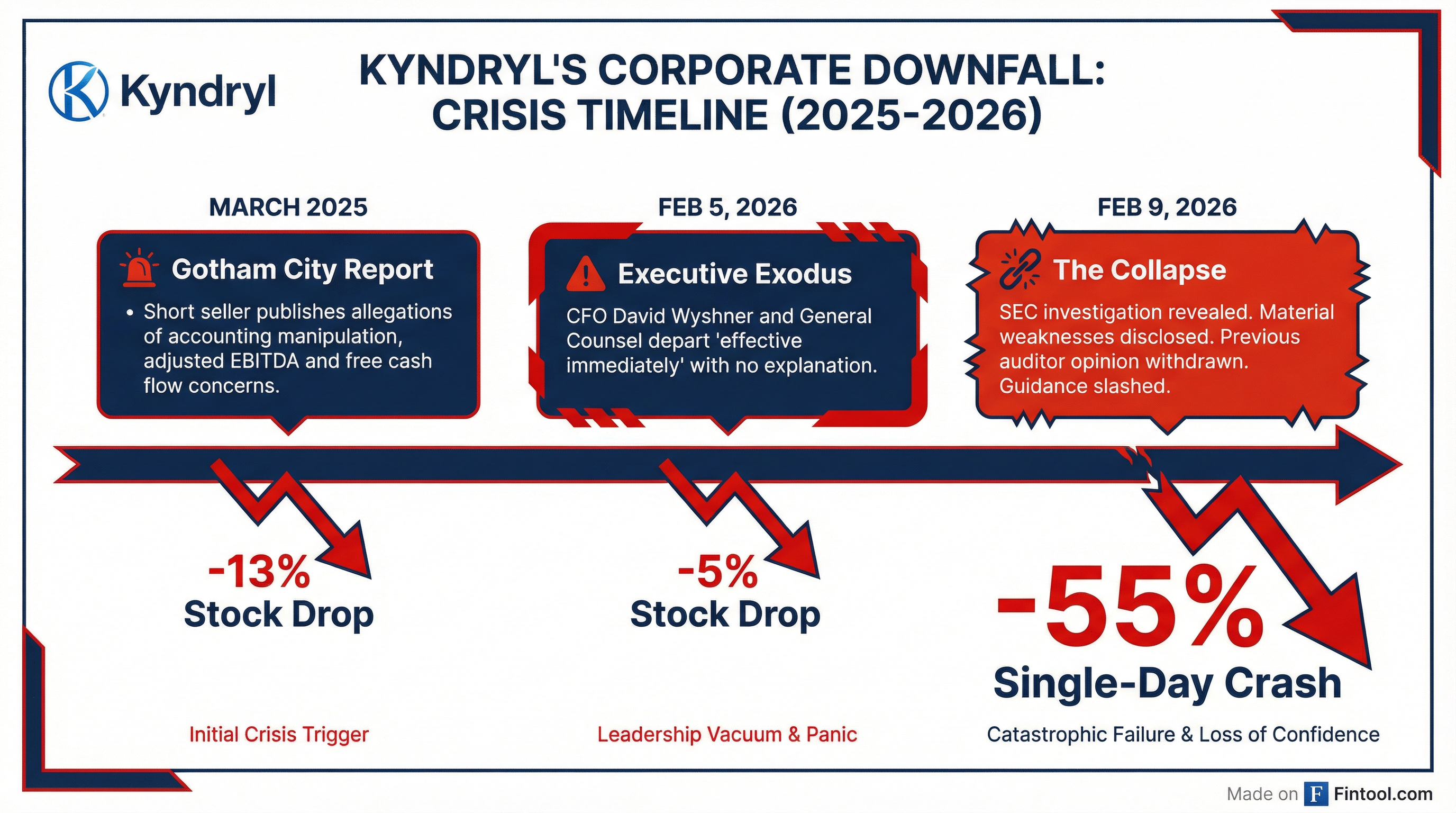

Kyndryl Holdings-54.93% (NYSE: KD) suffered one of the most dramatic single-day collapses in IT services history on Monday, plunging 55% to $10.59 after disclosing an SEC enforcement investigation, material weaknesses in financial reporting spanning multiple periods, and the abrupt departure of its CFO and General Counsel.

The disclosures vindicate short seller Gotham City Research, which nearly a year ago accused the Ibm-0.87% spinoff of manipulating key financial metrics—allegations the company dismissed at the time as "falsehoods."

"Following the receipt of voluntary document requests from the SEC, the company, through the audit committee of our board of directors, is reviewing our cash management practices, related disclosures, the effectiveness of internal control over financial reporting, and certain other matters," CEO Martin Schroeter said on the earnings call, declining to take further questions on the matter .

The Damage

The cascade of revelations erased approximately $2.8 billion in market capitalization in a single session. Here's what investors learned today:

SEC Enforcement Investigation: The SEC's Division of Enforcement issued "voluntary document requests" related to Kyndryl's cash management practices—specifically the drivers of its adjusted free cash flow metric .

Material Weaknesses Confirmed: The company expects to report material weaknesses in internal control over financial reporting for the full fiscal year ended March 31, 2025, and the first three quarters of fiscal 2026 .

Previous Auditor Opinion Withdrawn: Kyndryl stated that its "previously issued assessment of internal control over financial reporting and its independent auditor's opinion... should no longer be relied upon" .

Executive Exodus: CFO David Wyshner and General Counsel Edward Sebold departed "effective immediately" four days before earnings. Global Controller Vineet Khurana also moved to a different role .

Guidance Slashed: Revenue outlook cut from 1% constant-currency growth to a 2-3% decline for fiscal year 2026 .

Gotham City Vindicated

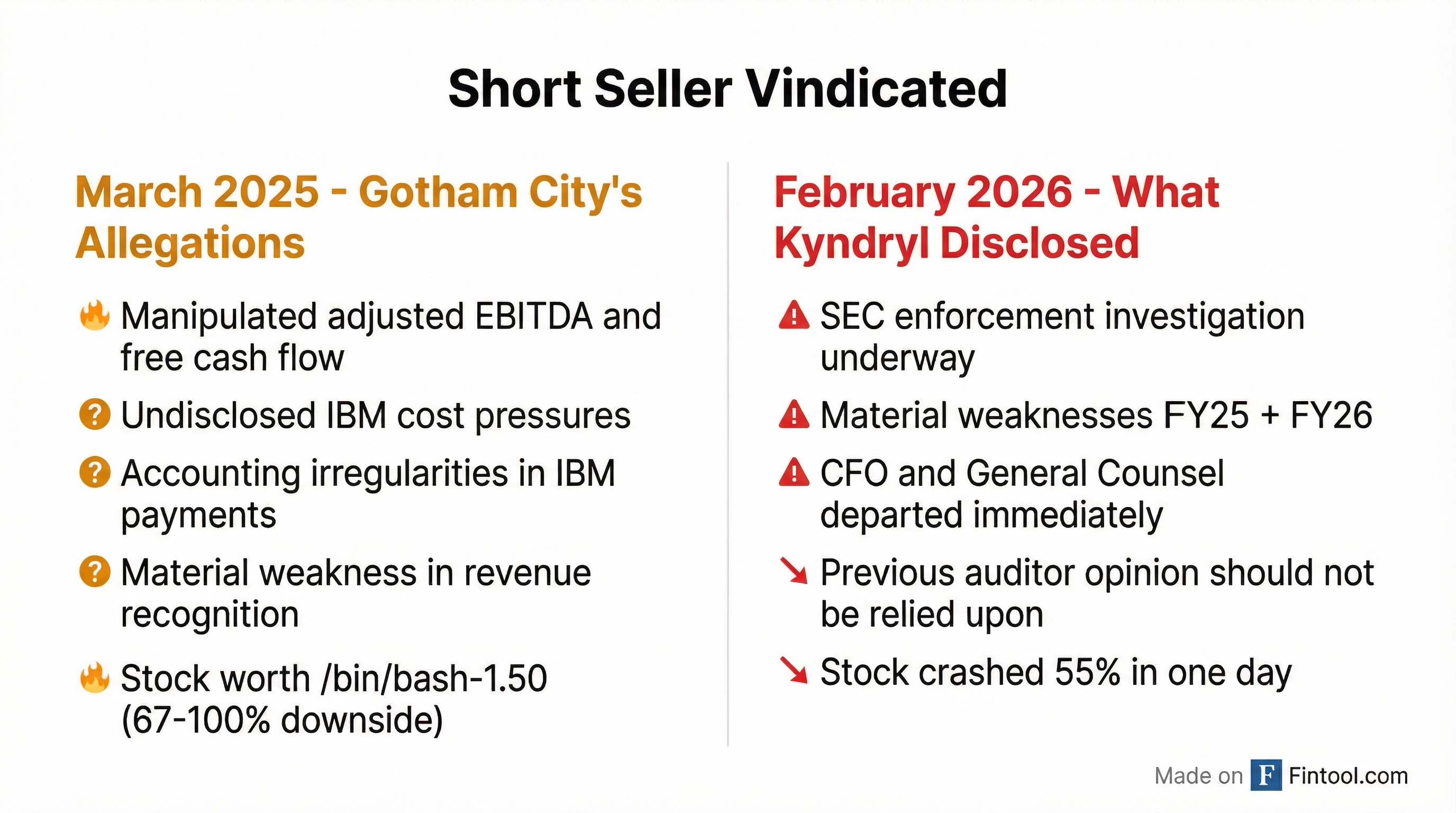

The SEC's investigation focuses on the exact issues Gotham City Research flagged in its devastating March 2025 report titled "Kyndryl – Like the old IBM, except with an Undisclosed Cost Problem."

Gotham's core allegations from March 2025 :

| Gotham's Allegation | What Kyndryl Disclosed Today |

|---|---|

| "Manipulates reported Adj EBITDA + Adj. FCF to artificially give the appearance that it generates profits and cash flow" | SEC investigating "cash management practices, related disclosures, including regarding the drivers of the Company's adjusted free cash flow metric" |

| "We have identified accounting and disclosure irregularities" | Material weaknesses confirmed in financial reporting controls |

| "Auditor identified a material weakness related to revenue recognition" | Previous auditor opinion should "no longer be relied upon" |

| Stock worth "$4.71-$11.50" (67%-100% downside) | Stock closed at $10.59—within Gotham's target range |

At the time, Kyndryl dismissed the report, stating it "rejects in the strongest possible terms the conclusions reached within the report, which was clearly designed to manipulate the company's stock for the short seller's benefit" .

The stock fell 13% on the Gotham report in March 2025. It has now fallen an additional 55% as the allegations appear substantiated.

The Accounting Issues

The disclosures reveal systemic problems with Kyndryl's financial reporting going back to its March 2021 spinoff from IBM.

What "Material Weakness" Means: A material weakness is a deficiency in internal controls that creates a reasonable possibility that a material misstatement in financial statements will not be prevented or detected on a timely basis. It's among the most severe accounting red flags a public company can disclose.

Kyndryl's weaknesses are "expected to include, but may not be limited to, the effectiveness and strength of certain functions at the Company, including with respect to controls related to information and communication and tone at the top" .

The phrase "tone at the top" refers to management's ethical climate and commitment to accurate financial reporting—suggesting the problems extend beyond technical accounting issues to corporate governance.

The Cash Flow Questions: Gotham City's original report highlighted Kyndryl's aggressive working capital management, including unusually low days sales outstanding (34 days vs. 80 days for peers) and potential receivables factoring that inflated cash flow metrics. The SEC's focus on "adjusted free cash flow" drivers suggests investigators are examining these exact practices.

The company's own disclosure acknowledges extensive cash management activities: "The Company's standard practice since the time of the Company's spin-off from International Business Machines Corporation is to actively manage the Company's working capital, including accounts receivables and accounts payables. This includes optimizing payment terms and conditions, accelerating certain cash receipts and delaying certain cash payments" .

Financial Performance

Despite the accounting turmoil, Kyndryl's Q3 results showed some operational progress before today's implosion:

| Metric | Q3 FY2026 | Q3 FY2025 | YoY Change |

|---|---|---|---|

| Revenue | $3.86B | $3.74B | +3% reported, flat CC |

| Net Income | $57M | $215M | -73%* |

| Adjusted EBITDA | $696M | $704M | -1% |

| Adjusted EPS | $0.52 | $0.51 | +2% |

| Free Cash Flow | $217M | $167M | +30% |

*Note: Prior year included $145M transaction-related gain

What's Next

Near-Term Catalysts:

- 10-Q Filing: Delayed indefinitely pending the audit committee review. The company must remediate material weaknesses before filing.

- Permanent CFO Search: Harsh Chugh serves as interim CFO but a permanent replacement search is underway.

- SEC Investigation Timeline: Unknown. The company stated it is "cooperating with the SEC" and does not expect a restatement, but the investigation scope could expand.

- Shareholder Litigation: Multiple law firms have already announced investigations into potential securities fraud claims .

Key Risks:

- Further accounting restatements despite management's current denial

- Credit rating downgrades affecting $3.1B in debt

- Customer defections as reputational damage spreads

- Executive departures continue (CHRO already announced March retirement)

The irony is bitter: just three months ago, CFO Wyshner assured analysts the company was "right on track to generate high single digit adjusted pre-tax margins in fiscal 2027 and fiscal 2028" . Today, investors are left wondering what else they don't know.

Related: