Earnings summaries and quarterly performance for Kyndryl Holdings.

Executive leadership at Kyndryl Holdings.

Board of directors at Kyndryl Holdings.

Denis Machuel

Director

Dominic J. Caruso

Director

Howard I. Ungerleider

Director

Jana Schreuder

Director

Janina Kugel

Director

John D. Harris II

Director

Rahul N. Merchant

Director

Shirley Ann Jackson

Director

Stephen A.M. Hester

Lead Independent Director

Research analysts who have asked questions during Kyndryl Holdings earnings calls.

Tien-tsin Huang

JPMorgan Chase & Co.

6 questions for KD

Ian Zaffino

Oppenheimer & Co. Inc.

5 questions for KD

James Friedman

Susquehanna Financial Group, LLLP

5 questions for KD

Divya Goyal

Scotiabank

4 questions for KD

James Faucette

Morgan Stanley

2 questions for KD

Jonathan Lee

Arias Resource Capital

2 questions for KD

Tyler DuPont

Bank of America

2 questions for KD

Isaac Opper

Oppenheimer & Co. Inc.

1 question for KD

Jamie Friedman

Susquehanna International Group

1 question for KD

Recent press releases and 8-K filings for KD.

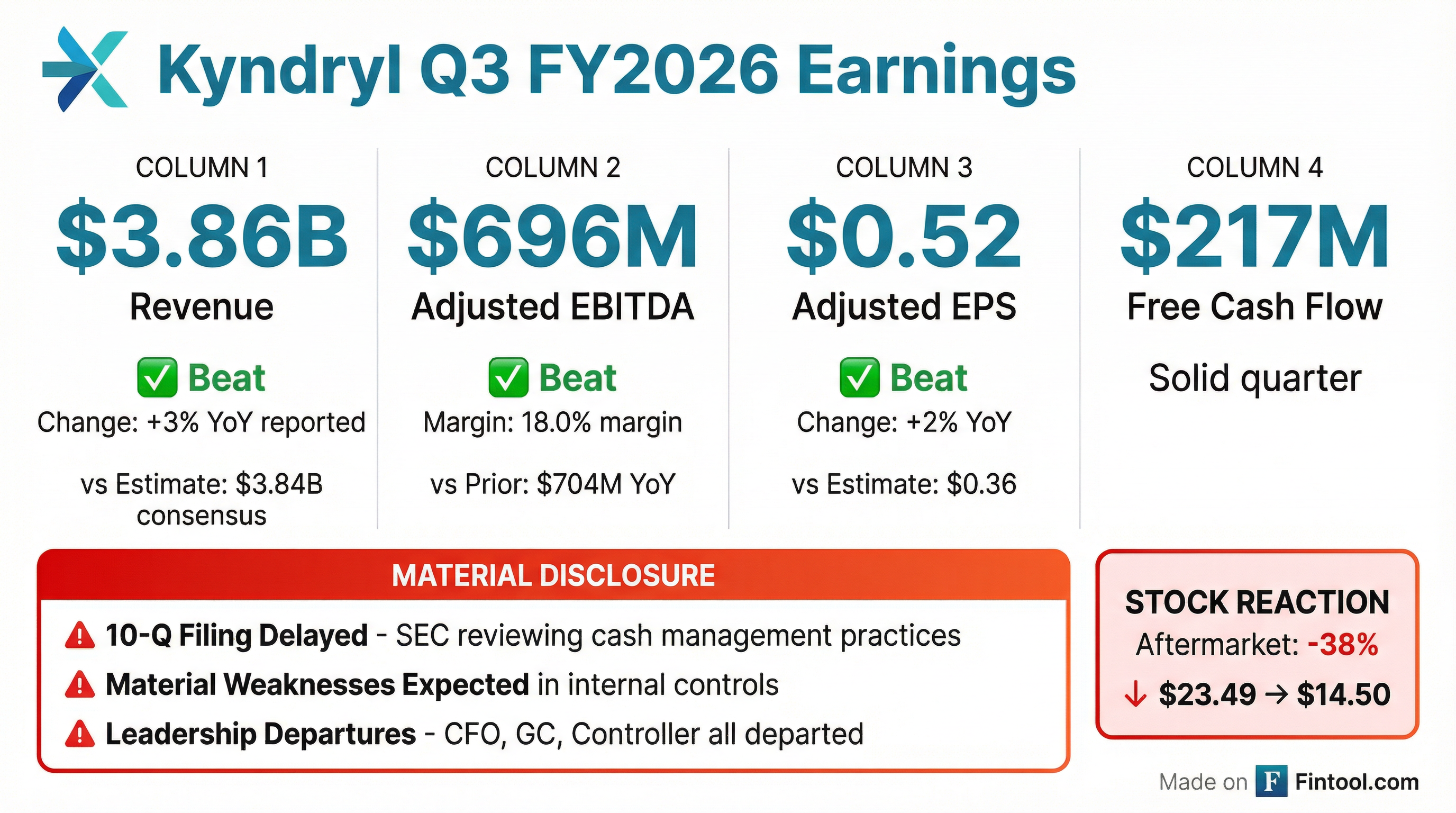

- Kyndryl Holdings (KD) filed amended quarterly and annual reports on February 17, 2026, disclosing that its disclosure controls and procedures and internal control over financial reporting were ineffective as of March 31, June 30, and September 30, 2025.

- These filings follow a 55% decline in Kyndryl's stock price on February 9, 2026, after the company announced it would not timely file its quarterly report for Q4 2025, anticipated material internal control weaknesses, and C-Suite departures.

- The company also revealed that CFO David Wyshner, General Counsel Edward Sebold, and Comptroller Vineet Khurana departed effective February 5, 2026, and it received document requests from the Division of Enforcement of the SEC.

- A securities class action lawsuit is pending, seeking to represent investors who purchased Kyndryl securities between August 7, 2024, and February 9, 2026.

- Kyndryl Holdings filed amended quarterly and annual reports on February 17, 2026, detailing that its disclosure controls and procedures and internal control over financial reporting were ineffective as of March 31, June 30, and September 30, 2025.

- The company's shares cratered 55% on February 9, 2026, after it announced a delayed Q4 2025 report, anticipated material internal control weaknesses, C-Suite abrupt departures, and SEC scrutiny.

- CFO David Wyshner, General Counsel Edward Sebold, and Comptroller Vineet Khurana departed effective February 5, 2026.

- Kyndryl has received document requests from the Division of Enforcement of the SEC related to matters being reviewed by the Audit Committee.

- A securities class action lawsuit is pending, seeking to represent investors who purchased Kyndryl securities between August 7, 2024, and February 9, 2026.

- Kyndryl Holdings (KD) has filed amended quarterly and annual reports, revealing that its disclosure controls and procedures and internal control over financial reporting were ineffective as of March 31, June 30, and September 30, 2025.

- The ineffectiveness was attributed to senior finance executives failing to set an appropriate tone and a lack of transparency with the CEO, Audit Committee, and Board regarding cash management practices, specifically deferring vendor payments.

- These developments followed a 55% stock price drop on February 9, 2026, after the company announced it would not timely file its Q4 2025 report, anticipated material internal control weaknesses, C-Suite departures (including the CFO and General Counsel), and SEC scrutiny.

- A securities class action lawsuit is pending for investors who acquired Kyndryl securities between August 7, 2024, and February 9, 2026, with a lead plaintiff deadline of April 13, 2026.

- Kyndryl Holdings (KD) filed amended quarterly and annual reports on February 17, 2026, revealing ineffective disclosure controls and internal control over financial reporting for periods ending March 31, June 30, and September 30, 2025, citing issues with senior finance executives and a lack of transparency regarding cash management practices.

- These disclosures follow a 55% decline in Kyndryl's share price on February 9, 2026, when the company announced it would not timely file its Q4 2025 report, anticipated material internal control weaknesses, faced SEC scrutiny, and experienced C-Suite departures.

- On February 5, 2026, CFO David Wyshner and General Counsel Edward Sebold departed immediately, and Comptroller Vineet Khurana stepped down.

- A securities class action lawsuit is pending against Kyndryl for investors who purchased securities between August 7, 2024, and February 9, 2026, with a lead plaintiff deadline of April 13, 2026.

- A securities class action lawsuit has been filed against Kyndryl Holdings, Inc. (NYSE: KD) for investors who purchased securities between August 7, 2024, and February 9, 2026.

- The lawsuit follows a 55% stock drop on February 9, 2026, after Kyndryl announced it would not timely file its quarterly report for the quarter ended December 31, 2025.

- Kyndryl disclosed material internal control weaknesses, including "tone at the top," senior executive departures, and an SEC document request.

- The complaint alleges materially misstated financial statements and inadequate internal controls during the Class Period.

- A securities class action lawsuit has been filed against Kyndryl Holdings (KD) for investors who purchased securities between August 7, 2024, and February 9, 2026.

- The lawsuit follows a 55% stock drop on February 9, 2026, after Kyndryl announced it would not timely file its quarterly report for the quarter ended December 31, 2025.

- Key disclosures contributing to the lawsuit include anticipated material internal control weaknesses, including "tone at the top," the departure of senior executives Wyshner and Sebold on February 5, 2026, and an SEC document request.

- The complaint alleges that Kyndryl made false and misleading statements and that its financial statements during the class period were materially misstated, alongside inadequate internal controls.

- Kyndryl Holdings, Inc. (NYSE: KD) is currently undergoing an internal accounting investigation into its cash management procedures and related disclosures, which was announced on February 9, 2026.

- The investigation specifically concerns Kyndryl's cash-flow disclosures, including its transition from reporting "adjusted free cash flow" to "free cash flow," a change announced by CFO David Wyshner during the Q1 FY2026 earnings call on August 5, 2025.

- Kyndryl anticipates reporting "material weaknesses" in its internal controls and is developing a remediation plan to address these issues.

- The company's previously reported financial figures, such as the $22 million free cash flow generated in Q2 FY2026 and the $1.3 billion cash balance at September 30, are now subject to review under this investigation.

- If prior cash-flow figures are determined to be misstated, it could affect the evaluation of Kyndryl's capital-allocation strategy, including a $400 million increase to its share-repurchase program.

- Kyndryl Holdings is under review by its Audit Committee regarding cash management practices, disclosures related to adjusted free cash flow, and internal control efficacy, following voluntary document requests from the SEC's Division of Enforcement.

- The company expects to report material weaknesses in internal control over financial reporting for multiple periods, and its previously issued assessment for the fiscal year ended March 31, 2025, should no longer be relied upon.

- Kyndryl announced the immediate departures of its Chief Financial Officer and General Counsel and will delay its Quarterly Report filing by filing a Form NT 10-Q.

- Following these disclosures on February 9, 2026, Kyndryl's stock price declined approximately 50%.

- The DJS Law Group is investigating Kyndryl Holdings, Inc. for potential violations of securities laws, focusing on whether the company issued misleading statements or failed to disclose pertinent information to investors.

- On February 9, 2026, Kyndryl's shares fell by more than 55% in morning trading.

- This significant decline followed reports that the company's Chief Financial Officer was leaving amid an accounting review and that Kyndryl reported weaker earnings than expected.

- Kyndryl reported revenue of $3,859 million with 0% constant currency growth for Q3 2026 (quarter ended December 31, 2025), alongside an adjusted EBITDA of $696 million and an adjusted pretax income of $168 million.

- The company provided a Fiscal 2026 outlook, projecting adjusted pretax income of $575 to $600 million, an adjusted EBITDA margin of approximately 17.5%, and free cash flow of $325 to $375 million, with revenue expected to decline by 2% to 3% in constant currency.

- Strategic growth areas showed strong performance, with Kyndryl Consult revenue reaching $3.6 billion for the last twelve months ended December 2025, representing a +29% growth year-over-year. Additionally, the company repurchased $100 million in shares during Q3 2026.

Fintool News

In-depth analysis and coverage of Kyndryl Holdings.

Quarterly earnings call transcripts for Kyndryl Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more