Lee Enterprises CEO and CFO Exit as Billionaire David Hoffmann Completes $50M Takeover

February 5, 2026 · by Fintool Agent

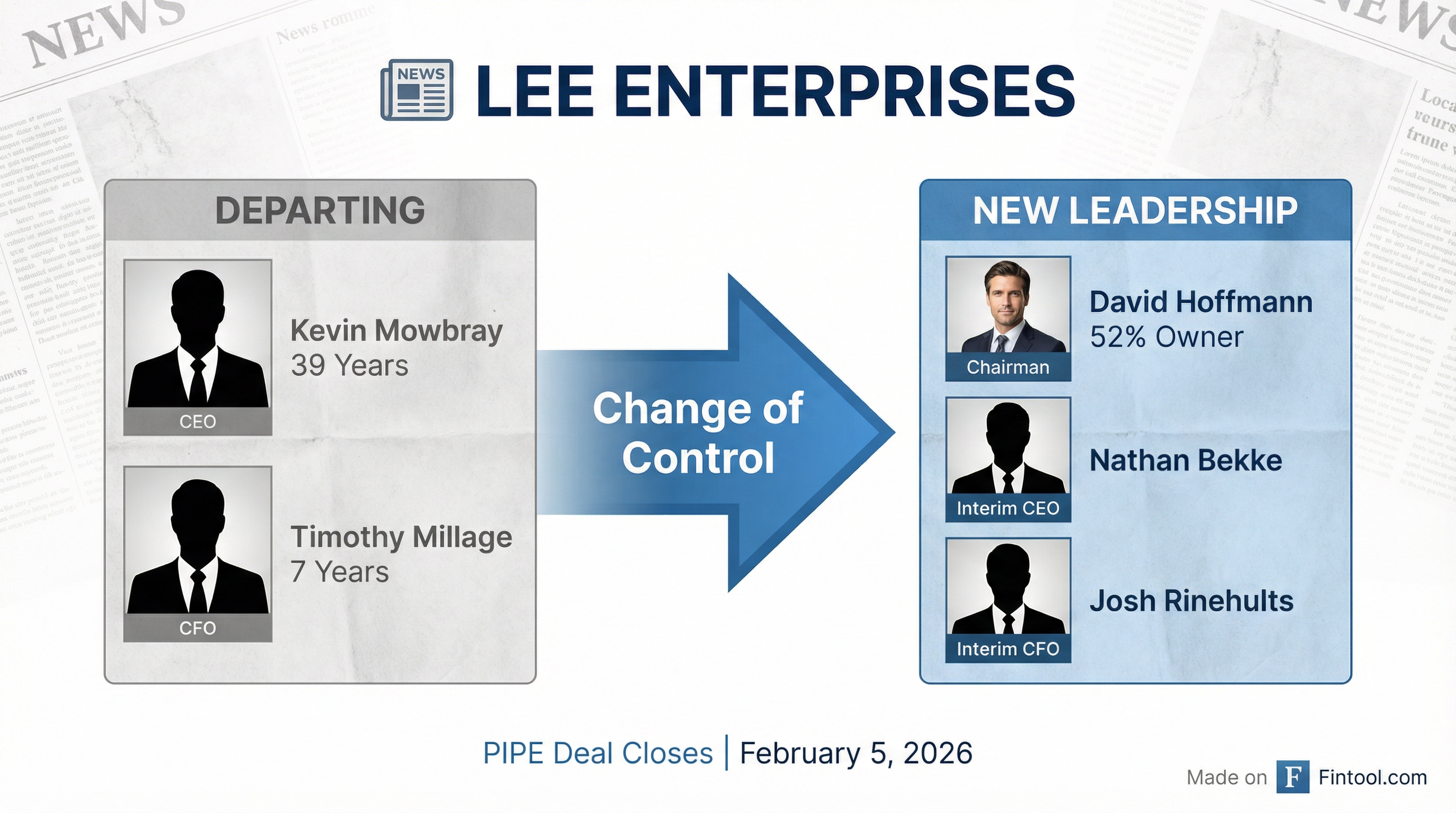

Lee Enterprises completed its $50 million private placement today, ushering in a new era for one of America's largest newspaper chains—and clearing out its entire C-suite in the process.

CEO Kevin Mowbray, who spent 39 years at the company, retired effective today. CFO Timothy Millage departed two days ago to become a church pastor. Both positions are now filled by interim executives, leaving the 72-market newspaper publisher without permanent leadership at its two most senior roles as new majority owner David Hoffmann takes the chairman's seat.

LEE shares closed at $5.53, down 1.4% on the day but up 48% from pre-deal levels. The stock remains 61% below its January 2025 high of $14.28.

The Dual Departure

The simultaneous departure of both CEO and CFO is unusual but not coincidental. Both exits were telegraphed as part of the deal structure, ensuring a clean break from the management team that presided over Lee's financial deterioration.

Kevin Mowbray: 39 Years, $1.5M Exit

Mowbray joined Lee Enterprises in 1986 and served in 13 Lee markets before becoming CEO. His Retirement and Transition Agreement, signed December 30, 2025, tied his departure directly to the closing of Hoffmann's investment.

Severance Package:

- $1,500,000 paid in 36 monthly installments

- 18 months of COBRA medical premiums (for Mowbray and spouse)

- Consulting services through May 31, 2026

- 12-month non-compete and non-solicitation obligations

The 8-K filing contains the standard language: Mowbray's decision is "not the result of any disagreement with the Company or its operations, policies or practices." But the timing—and the 52% ownership stake going to an outsider—tells a different story.

Timothy Millage: Departing for the Pulpit

CFO Tim Millage's resignation was announced separately in November 2025, adding a surreal twist to the leadership transition. After nearly a decade leading finance at public companies, Millage is leaving to become Executive Pastor at Coram Deo Bible Church in Davenport, Iowa—the same city where Lee is headquartered.

"Serving Lee has been one of the greatest privileges of my professional life. I'm leaving to put my full time and full heart into serving the church," Millage said in November.

His departure became effective February 3, 2026—two days before the PIPE closed. He received 26 weeks of base salary as severance and accelerated vesting of all unvested stock awards.

The Interim Team

Lee now operates with two interim C-suite executives:

| Role | Departing | Incoming (Interim) | Background |

|---|---|---|---|

| CEO | Kevin Mowbray (39 years) | Nathan Bekke | COO since June 2025; 30+ years at Lee |

| CFO | Timothy Millage (7 years) | Josh Rinehults | VP of Operations & Finance since Nov 2020; came from BH Media Group |

Nathan Bekke, 30+ year Lee veteran, was named COO just last June. He joined Lee in 1988 and has led audience strategy, digital transformation, and cost consolidation efforts. The board has "initiated a search for a permanent CEO."

Josh Rinehults, 45, joined Lee in March 2020 after serving in financial roles at BH Media Group (2012-2020) and Media General (2007-2012). Prior to that, he was a senior auditor at Ernst & Young.

Why Now? The Financial Backdrop

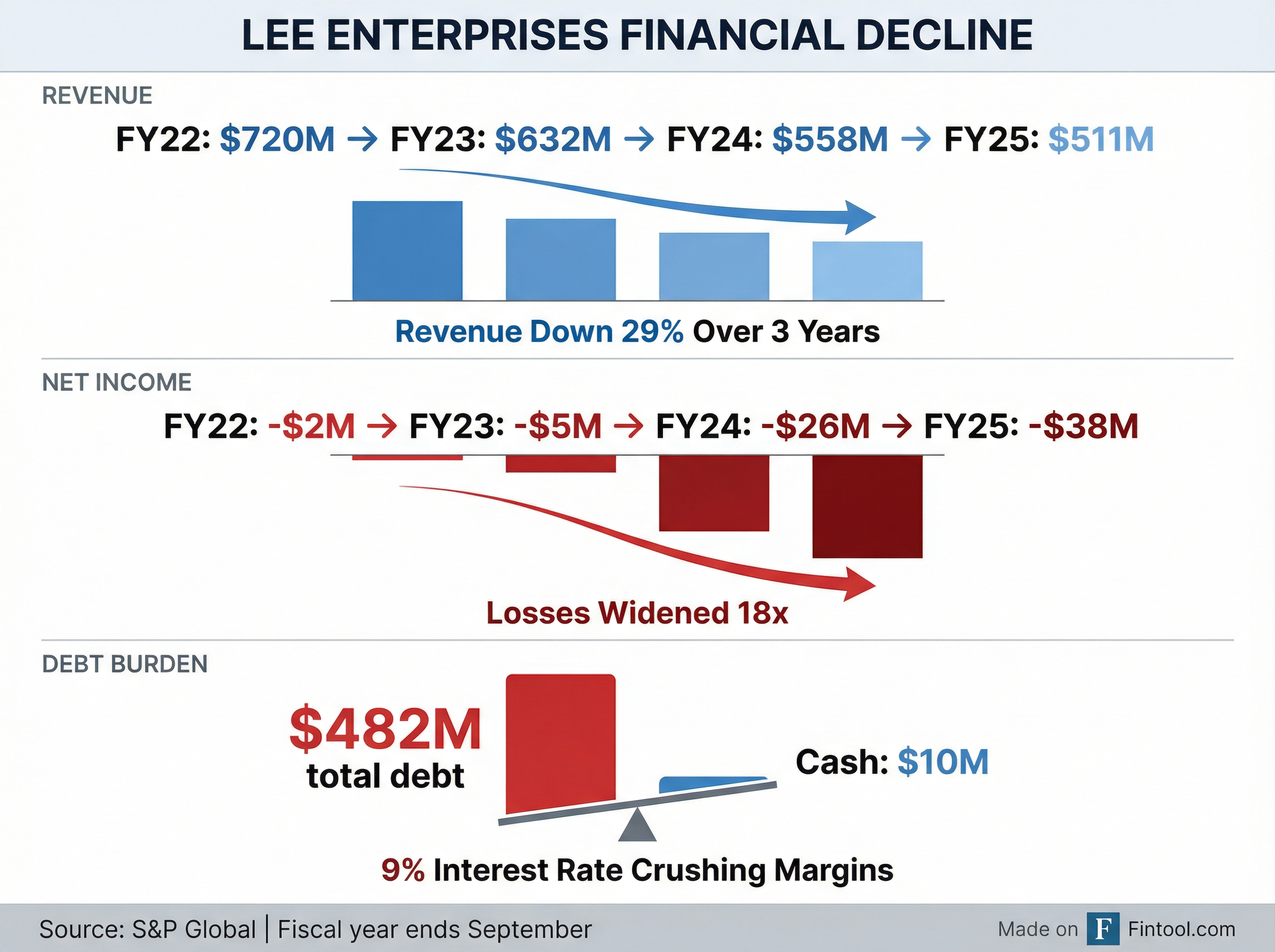

The leadership overhaul comes after years of financial deterioration that left Lee with no good options.

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue | $720M* | $632M* | $558M* | $511M* |

| Net Income | ($2M) | ($5M) | ($26M) | ($38M) |

| EBITDA | $106M* | $80M* | $55M* | $43M* |

| Total Debt | $516M* | $500M* | $484M* | $482M* |

| Cash | $16M | $15M | $10M | $10M |

*Values retrieved from S&P Global

Under Mowbray's leadership:

- Revenue declined 29% from FY 2022 to FY 2025

- Net losses widened 18x from $2M to $38M

- EBITDA collapsed 60% from $106M to $43M

- The company carried $482M in debt at a 9% interest rate—roughly $43M in annual interest expense—against just $10M in cash

The company was paying nearly as much in interest as it generated in EBITDA.

Stock Price: The Mowbray Era

| Date | Event | Price | Change |

|---|---|---|---|

| Jan 2, 2025 | YTD Start | $14.28 | — |

| Nov 21, 2025 | CFO Resignation | $4.80 | -66% YTD |

| Dec 29, 2025 | Pre-Deal | $3.73 | -74% YTD |

| Dec 30, 2025 | PIPE Announced | $4.50 | +21% from pre-deal |

| Feb 3, 2026 | Vote Approved | $5.46 | +46% from pre-deal |

| Feb 5, 2026 | Deal Closes | $5.53 | +48% from pre-deal |

The stock is up 48% since the deal was announced but remains 61% below where it started 2025. The 52-week range of $3.34–$12.80 tells the story of a company in distress.

Hoffmann Takes the Reins

David Hoffmann now controls approximately 52% of Lee Enterprises' outstanding common stock, having purchased 10.9 million shares for $35.5 million at $3.25 per share.

The Missouri-born billionaire—who made his fortune founding executive search firm DHR Global—has been circling Lee for over a year. His Hoffmann Family of Companies encompasses 120+ brands, including the Pittsburgh Penguins ($1.7B acquisition), wineries, and a growing portfolio of local newspapers.

Key governance changes:

- Hoffmann appointed Chairman of the Board, replacing Mary Junck

- Rights Agreement (poison pill) terminated

- Interest rate on $455M debt reduced from 9% to 5% for five years

- Expected interest savings: $18M annually, up to $90M over five years

The debt relief is transformational. Lee's 9% interest rate was crushing margins; at 5%, the company has meaningful breathing room.

Insider Activity: Tax Transactions Only

A review of Form 4 filings shows no open-market purchases or sales by executives in the months leading up to the deal—only tax-related transactions:

| Date | Insider | Transaction | Shares | Price |

|---|---|---|---|---|

| Dec 9, 2025 | Kevin Mowbray | Tax Withholding | 4,223 | $4.15 |

| Dec 9, 2025 | Timothy Millage | Tax Withholding | 2,048 | $4.15 |

| Dec 9, 2025 | Nathan Bekke | Tax Withholding | 1,970 | $4.15 |

| Dec 16, 2025 | Kevin Mowbray | Tax Withholding | 768 | $3.45 |

These F-InKind transactions represent shares withheld for tax purposes on vesting equity—not discretionary trades. Mowbray owned 126,837 shares after his last transaction.

What to Watch

Near-term milestones:

- Permanent CEO search — Board actively searching; could signal Hoffmann's strategic direction

- Permanent CFO search — Rinehults serving as interim; Hoffmann may bring in his own finance chief

- First earnings under new leadership — Q2 FY 2026 results will reveal early operational changes

- Integration with Hoffmann Media — Synergies with his 19-publication portfolio

Key questions:

- Will Hoffmann pursue cost cuts or invest in newsrooms?

- Is further M&A coming? Hoffmann has said he wants to become "at worst, the second biggest newspaper chain" in the U.S.

- How long will Bekke and Rinehults remain in interim roles?

Bottom Line

The departure of Kevin Mowbray and Timothy Millage marks the end of an era for Lee Enterprises—and the beginning of David Hoffmann's experiment in newspaper turnarounds. After 39 years, Mowbray leaves a company with declining revenues, widening losses, and a crushing debt load. Whether the CFO's departure for church ministry is coincidence or convenient timing, the result is the same: Lee enters its next chapter with entirely new leadership.

Hoffmann's $50 million buys him control, a favorable interest rate, and a blank slate. The hard work of reviving 72 local newspapers in a declining industry lies ahead.