Earnings summaries and quarterly performance for LEE ENTERPRISES.

Executive leadership at LEE ENTERPRISES.

Kevin Mowbray

President and Chief Executive Officer

Astrid Garcia

Vice President - Human Resources and Legal; Chief Legal Officer

Jolene Sherman

Vice President - Business Development and Market Strategy

Joseph Battistoni

Vice President - Sales and Marketing

Les Ottolenghi

Chief Transformation and Commercial Officer

Nathan Bekke

Senior Vice President - Operations and Audience Strategy

Timothy Millage

Vice President, Chief Financial Officer and Treasurer

Board of directors at LEE ENTERPRISES.

Research analysts who have asked questions during LEE ENTERPRISES earnings calls.

Recent press releases and 8-K filings for LEE.

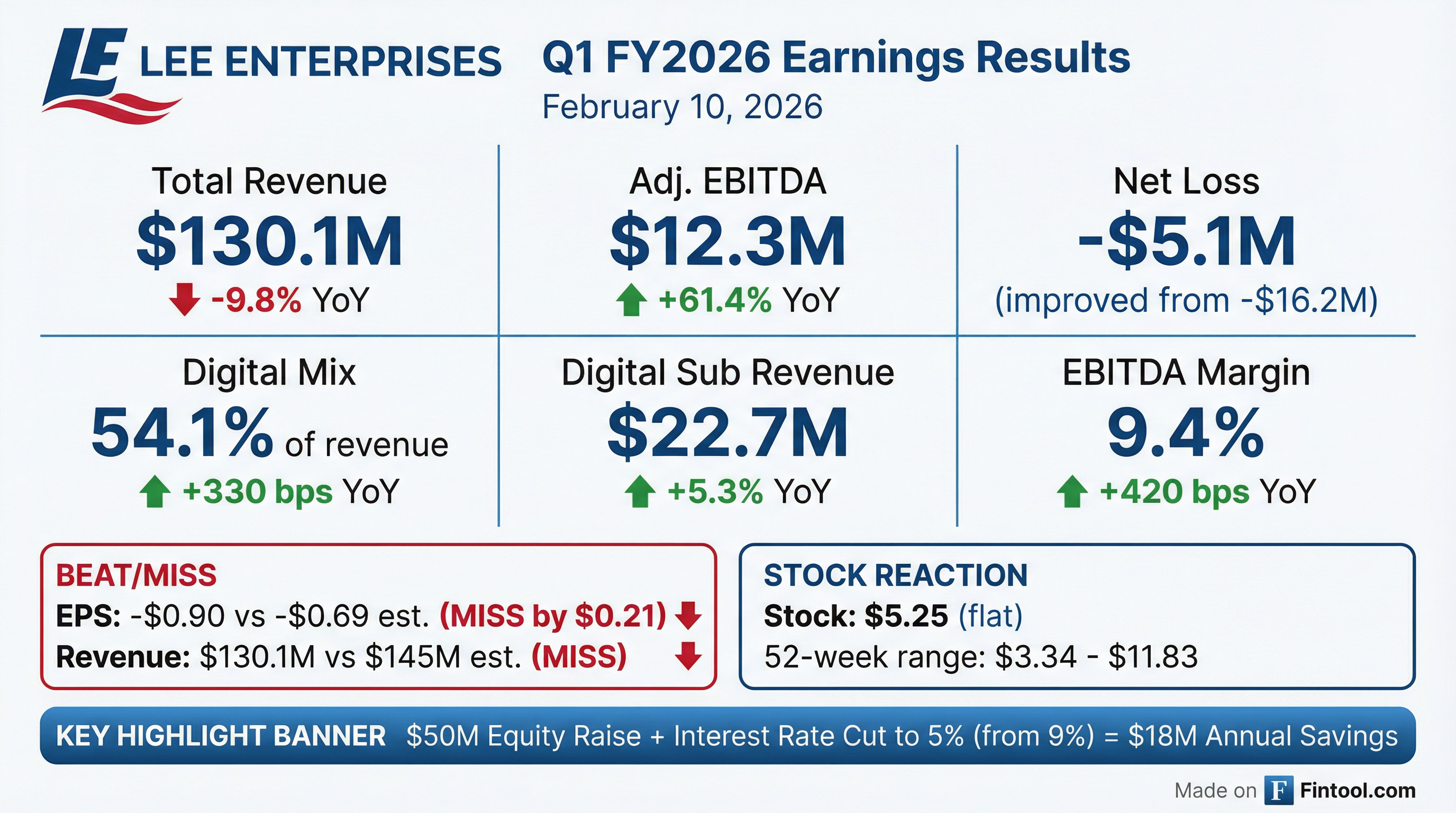

- Lee Enterprises reported preliminary first quarter fiscal 2026 Adjusted EBITDA growth of $5 million or 61% year-over-year, reaching $12 million for the period ended December 28, 2025.

- The company completed a $50 million private placement of common stock, which strengthens its balance sheet and supports digital transformation.

- An amendment to the credit agreement, a key component of the transaction, reduced the annual interest rate on outstanding debt from 9% to 5% for five years, projected to save approximately $18 million annually.

- For Q1 2026, total operating revenue was $130 million, with Total Digital Revenue at $70 million, comprising 54% of total operating revenue.

- Lee Enterprises anticipates mid-single digit year-over-year growth in Adjusted EBITDA for fiscal year 2026.

- Lee Enterprises delivered a strong Q1 2026, with Adjusted EBITDA growing 61% year-over-year to $12 million, driven by digital transformation and disciplined cost management.

- The company completed a $50 million equity investment through a private placement of common stock and amended its credit agreement, reducing the interest rate on its $455 million debt from 9% to 5% for the next five years. This is expected to generate approximately $18 million in annual interest savings.

- Digital revenue now represents 54% of total revenue as of Q1 2026, with total digital revenue exceeding $70 million and digital-only subscription revenue growing 5%.

- Lee Enterprises reaffirmed its fiscal 2026 outlook for mid-single-digit Adjusted EBITDA growth.

- Lee Enterprises reported a strong start to fiscal 2026, with Q1 Adjusted EBITDA growing 61% year-over-year to $12 million. Excluding business interruption insurance proceeds, Adjusted EBITDA grew 35%.

- The company completed a $50 million equity investment through a private placement of common stock at $3.25 per share, anchored by David Hoffmann, who was also appointed Chairman of the Board of Directors.

- A significant improvement to the capital structure includes an amended credit agreement, reducing the interest rate on $455 million of outstanding debt from 9% to 5% for the next five years, expected to generate $18 million in annual interest savings.

- Digital revenue in Q1 2026 exceeded $70 million, representing over 54% of total revenue, with digital-only subscription revenue growing 5% to $23 million from 609,000 subscribers.

- Lee Enterprises reaffirmed its outlook for fiscal 2026, expecting mid-single digit Adjusted EBITDA growth.

- Lee Enterprises reported Q1 FY2026 total revenue of $130.1 million, with digital revenue comprising 54.1% of the total, and an Adjusted EBITDA of $12.3 million.

- The company completed a $50 million equity raise through a private placement of common stock at $3.25 per share and amended its credit agreement, reducing the interest rate on outstanding debt to 5% from 9% for five years, which is expected to generate approximately $18 million in annual interest savings.

- Debt has been reduced by $121 million since March 2020, with the current outstanding debt at $455 million as of Q1 2026.

- Lee's Three Pillar Digital Growth Strategy aims for over $450 million in digital revenue by 2030, with digital revenue growing at a 12% CAGR from FY21 to FY25, and digital gross margin expected to exceed SG&A costs in FY27.

- The company reaffirmed its FY2026 outlook, projecting mid-single digit year-over-year growth in Adjusted EBITDA.

- Lee Enterprises reported a 61% year-over-year increase in Adjusted EBITDA to $12 million for Q1 2026, driven by consistent execution and disciplined cost management.

- The company completed a $50 million equity investment through a private placement of common stock and amended its credit agreement, reducing the interest rate on $455 million in debt from 9% to 5% for the next five years. This reduction is expected to generate approximately $18 million in annual interest savings.

- Digital revenue accounted for 54% of total revenue in Q1 2026, with digital-only subscription revenue growing 5% year-over-year.

- The company reaffirmed its fiscal 2026 outlook for mid-single-digit Adjusted EBITDA growth.

- David Hoffmann was welcomed as Chairman of the Board of Directors following his anchoring of the private placement.

- Lee Enterprises reported strong Q1 fiscal 2026 Adjusted EBITDA growth of $5 million or 61% year-over-year, totaling $12 million for the period ended December 28, 2025. Excluding a $2 million cyber insurance reimbursement, Adjusted EBITDA still grew $3 million or 35% year-over-year.

- For Q1 fiscal 2026, total operating revenue was $130 million, with Digital Revenue accounting for 54% of this total, and the company reported a net loss of $5 million.

- The company secured a $50 million equity investment through a private placement of common stock in February 2026, which enhances financial stability.

- This investment facilitated an amendment to the credit agreement, reducing the annual interest rate on outstanding debt from 9% to 5% for five years, projected to save approximately $18 million annually in interest expenses.

- Lee Enterprises closed a $50 million strategic equity private placement, led by David Hoffmann, resulting in the issuance of 15,384,615 common shares at $3.25 per share and an additional 615,385 fee reimbursement shares. This transaction led to a change of control, with David Hoffmann and his affiliates holding approximately 52% of the outstanding Common Stock.

- Concurrently, the company's annual interest rate on approximately $455.5 million of long-term debt was reduced to 5% from 9% for a five-year period, expected to generate $18 million in annual interest savings.

- David Hoffmann joined the Board of Directors as its chairman.

- Kevin Mowbray retired as President and CEO, with Nathan Bekke appointed Interim CEO. Timothy R. Millage resigned as CFO and Treasurer, and Josh Rinehults was appointed Vice President, Interim CFO, and Treasurer.

- Shareholders approved a Charter Amendment to increase authorized shares, the issuance of shares related to the private placement, and the Nasdaq Change of Control Proposal. The Series C Participating Convertible Preferred Stock was eliminated, and the Rights Agreement was terminated.

- Lee Enterprises has closed a $50 million strategic equity private placement, with the investment led by David Hoffmann and participation from other existing investors.

- Concurrently, an amendment to the company's existing credit facility became operative, reducing the annual interest rate on approximately $455.5 million of outstanding long-term debt to 5% from 9% for a five-year period.

- As part of the transaction, David Hoffmann joined the Company’s board of directors as its chairman.

- Interim Chief Executive Officer Nathan Bekke stated that this transaction strengthens the balance sheet, provides additional financial flexibility, and supports continued digital transformation.

- Lee Enterprises held a Special Meeting of Stockholders on February 3, 2026, to vote on four proposals related to its capital structure and share issuance.

- Stockholders approved the Additional Common Stock Proposal, which increases the authorized common stock from 12 million to 40 million shares.

- The Nasdaq Change of Control Proposal, concerning the issuance of 16,000,000 PIPE common shares at $3.25 per share that may result in a change of control, was also approved. The preliminary results did not explicitly state the outcome for the Nasdaq 19.99% Share Issuance Proposal.

- A quorum was present, with 3,970,409 shares represented out of 6,243,660 shares outstanding as of the January 2, 2026 record date.

- Lee Enterprises held a Special Meeting of Stockholders on February 3, 2026, where all four proposed items were approved.

- Stockholders approved an amendment to increase the authorized common stock from 12 million to 40 million shares.

- Approval was granted for the issuance of 16,000,000 shares of common stock at $3.25 per share pursuant to a stock purchase agreement dated December 30, 2025, which may represent more than 19.99% of outstanding shares.

- The issuance of these PIPE common shares, which could result in a change of control for Nasdaq rules purposes, was also approved.

Fintool News

In-depth analysis and coverage of LEE ENTERPRISES.

Quarterly earnings call transcripts for LEE ENTERPRISES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more