McKesson Beats Q3 Estimates, Raises Guidance as Oncology Platform Delivers 57% Profit Growth

February 4, 2026 · by Fintool Agent

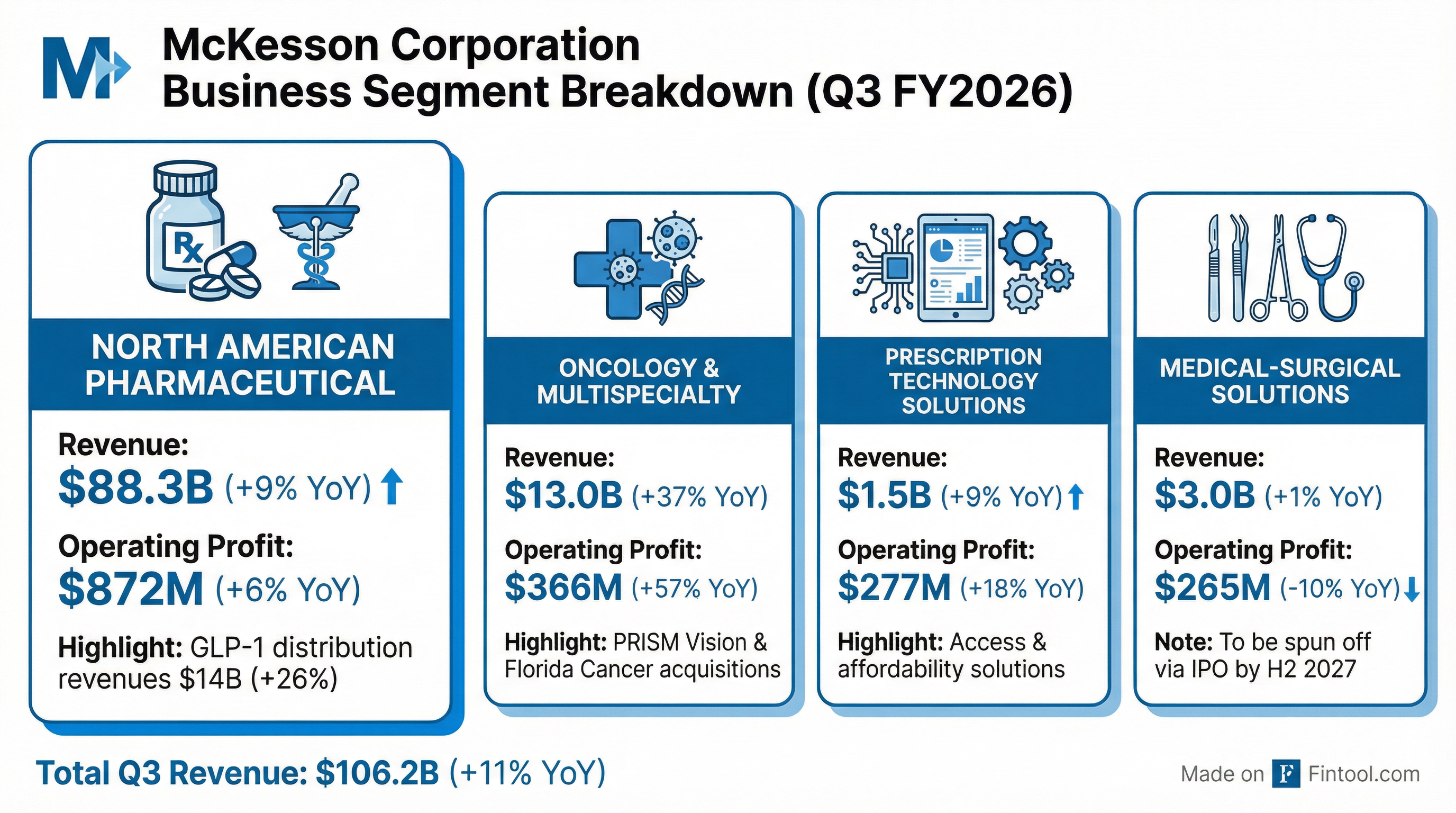

Mckesson Corporation delivered another beat-and-raise quarter, reporting fiscal Q3 2026 adjusted EPS of $9.34 that topped the $9.19 consensus estimate by 2%, while raising full-year guidance for the third consecutive quarter. The healthcare distribution giant's oncology platform continues to be the standout performer, with operating profit surging 57% as recently acquired assets outperform expectations.

Despite the earnings beat and guidance raise, shares closed down 2.7% at $822 on the day—though aftermarket trading showed recovery to $837—as investors digested a broad tech selloff that overshadowed solid healthcare results.

The Numbers: Record Revenue, Double-Digit Growth Across Metrics

McKesson reported consolidated revenue of $106.2 billion, up 11% year-over-year, marking another quarterly record. GAAP EPS of $9.59 surged 38% from $6.95 a year ago, benefiting from a $160 million pre-tax credit related to the Rite Aid bankruptcy.

| Metric | Q3 FY26 | Q3 FY25 | Change |

|---|---|---|---|

| Revenue | $106.2B | $95.3B | +11% |

| Adjusted EPS | $9.34 | $8.03 | +16% |

| GAAP EPS | $9.59 | $6.95 | +38% |

| Cash from Operations | $1.2B | — | — |

| Free Cash Flow | $1.1B | — | — |

Data: McKesson Q3 FY2026 Earnings Release

The company raised and narrowed its fiscal 2026 adjusted EPS guidance to $38.80-$39.20, up from the prior range of $38.35-$38.85, implying 17-19% full-year growth.

Oncology & Multispecialty: The Growth Engine

The real story is in McKesson's strategic growth platforms. The Oncology & Multispecialty segment posted revenue of $13.0 billion (+37%) and adjusted operating profit of $366 million (+57%), making it the fastest-growing business in the portfolio.

CEO Brian Tyler emphasized the strength of recent acquisitions: "We're pleased with the integration of Florida Cancer Specialists and PRISM Vision, contributing meaningfully to the strong performance of the segment."

CFO Britt Vitalone noted that excluding acquisitions, organic operating profit in the segment still grew 15%, highlighting strong underlying momentum. The acquisitions of PRISM Vision (retina and ophthalmology) and Core Ventures are tracking to contribute 30-34% of the segment's full-year operating profit growth.

The US Oncology Network now spans approximately 3,400 providers, while PRISM Vision brings together over 200 providers in retina and ophthalmology.

GLP-1 Tailwind: $14 Billion and Climbing

McKesson's North American Pharmaceutical segment—the core distribution business—generated revenue of $88.3 billion (+9%) and adjusted operating profit of $872 million (+6%).

A key driver: GLP-1 weight-loss and diabetes medications. Distribution revenues from GLP-1s reached $14 billion in the quarter, up 26% year-over-year and 7% sequentially. With Novo Nordisk's oral Wegovy recently launched, McKesson is well-positioned to capture continued growth in this category.

"We continue to see very strong specialty distribution growth and specialty product growth," Vitalone said. "And that's playing out very well, not only in our North American Pharmaceutical segment but also in the Oncology and Multispecialty segment."

AI and Automation: Efficiency Gains Taking Hold

Management highlighted the impact of AI and technology investments on operating efficiency. The company achieved a 138 basis point improvement in operating expenses as a percentage of gross profit compared to the prior year.

Specific examples cited:

- Annual verification season: Each full-time employee is now supporting 120 more patients than last year through workflow automation.

- DSCSA compliance: A new AI chat tool handles customer inquiries about Drug Supply Chain Security Act requirements, preventing 75% of inquiries from being escalated and improving first-contact resolution.

- Canada contact center: AI-powered agent assist and enhanced live chat are delivering close to 100% service accuracy while reducing turnaround time.

"We think these are strong proof points that the investments we've been making in technology are yielding results for the company," Tyler said.

Medical-Surgical Spinoff: On Track for 2027 IPO

McKesson continues to advance the planned separation of its Medical-Surgical Solutions segment. On January 1, 2026, transition service agreements were implemented across the enterprise—a key milestone in preparing the business for independence.

The segment itself had a softer quarter, with revenue of $3.0 billion (+1%) and adjusted operating profit of $265 million (-10%), pressured by lower volumes across physician office settings and a mild illness season.

The company remains on track for an IPO by the second half of calendar 2027, subject to market conditions and regulatory approvals.

"We continue to focus on the next steps, which include establishing an independent organization and capital structure," Tyler noted.

The divestiture of Norwegian retail and distribution businesses closed on January 30, 2026, marking McKesson's complete exit from Europe.

Stock Performance and Outlook

McKesson shares have gained approximately 45% over the past year but traded lower on earnings day amid a broader tech selloff. The stock closed at $822, down 2.7%, but recovered to $837 in aftermarket trading as the earnings beat sank in.

The company has returned $2.4 billion to shareholders through the first nine months of fiscal 2026, including $2.1 billion in share repurchases and $280 million in dividends.

Free cash flow was $1.1 billion in the quarter and $9.6 billion on a trailing 12-month basis, demonstrating the cash-generative nature of the business. Return on invested capital now exceeds 30%, up more than 1,900 basis points since fiscal 2020.

What's Next

Key events to watch:

- Medical-Surgical separation: Progress toward IPO structure and capital requirements

- GLP-1 trajectory: Oral Wegovy launch and category expansion

- Oncology acquisitions: Integration of PRISM Vision and Florida Cancer Specialists

- FY2027 guidance: Expected in May 2026 with Q4 results

McKesson management will present at the Leerink Partners Global Healthcare Conference (March 8-11) and Barclays Global Healthcare Conference (March 10-12).