Medtronic Exercises $585M Option to Acquire AI Cardiac Diagnostics Pioneer CathWorks

February 3, 2026 · by Fintool Agent

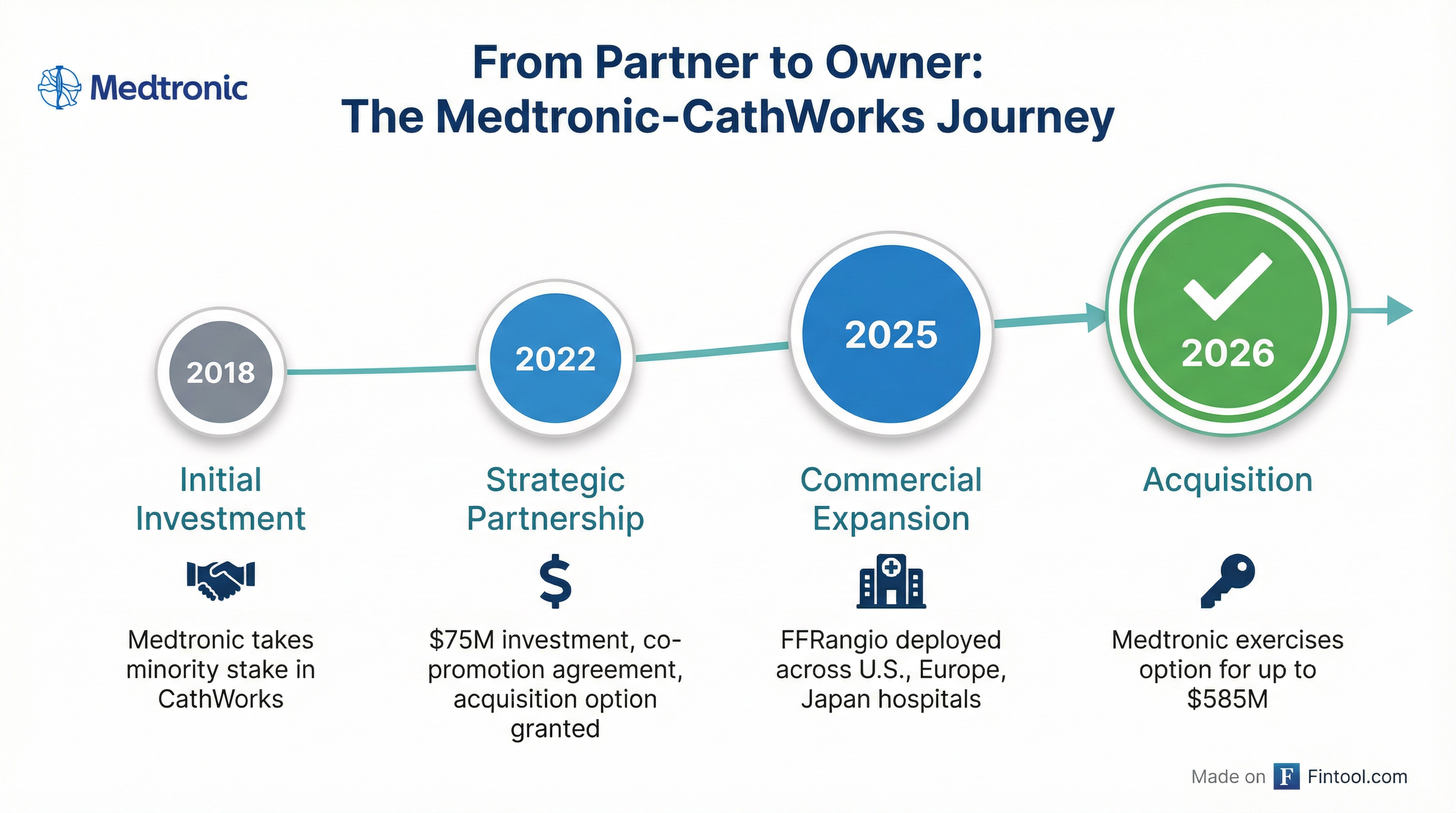

Medtronic is exercising its option to acquire CathWorks for up to $585 million, bringing in-house an AI-powered cardiac diagnostic platform that the medtech giant has been co-promoting since 2022. The deal transforms a strategic partnership into full ownership of technology that could reshape how cardiologists diagnose and treat coronary artery disease.

Shares of Medtronic rose 1% on the news, trading at $103.74—near their 52-week high of $106.33—as investors welcomed the tuck-in acquisition that aligns with CEO Geoff Martha's stated goal of accelerating M&A to support strong market positions.

The Deal

Medtronic will pay up to $585 million for CathWorks, the Israeli medical device company behind the FFRangio System. The acquisition includes potential undisclosed earn-out payments post-closing.

The transaction follows a 2022 strategic partnership in which Medtronic invested $75 million and gained co-promotion rights for FFRangio in the U.S., Europe, and Japan. That agreement also gave Medtronic an option to acquire CathWorks upon meeting certain milestones—an option that expires in July 2027.

"Medtronic is thrilled to move forward with our option to officially acquire CathWorks," said Jason Weidman, SVP and President of Medtronic's Coronary & Renal Denervation business. "Through our co-promotion agreement, we've seen how CathWorks can disrupt the traditional wire-based FFR segment and leverage the power of data and AI to deliver innovative solutions."

The deal is pending FTC clearance and is expected to close by the end of Medtronic's fiscal year 2026. Medtronic expects the acquisition to be immaterial to FY2027 earnings and neutral-to-accretive thereafter.

Why FFRangio Matters

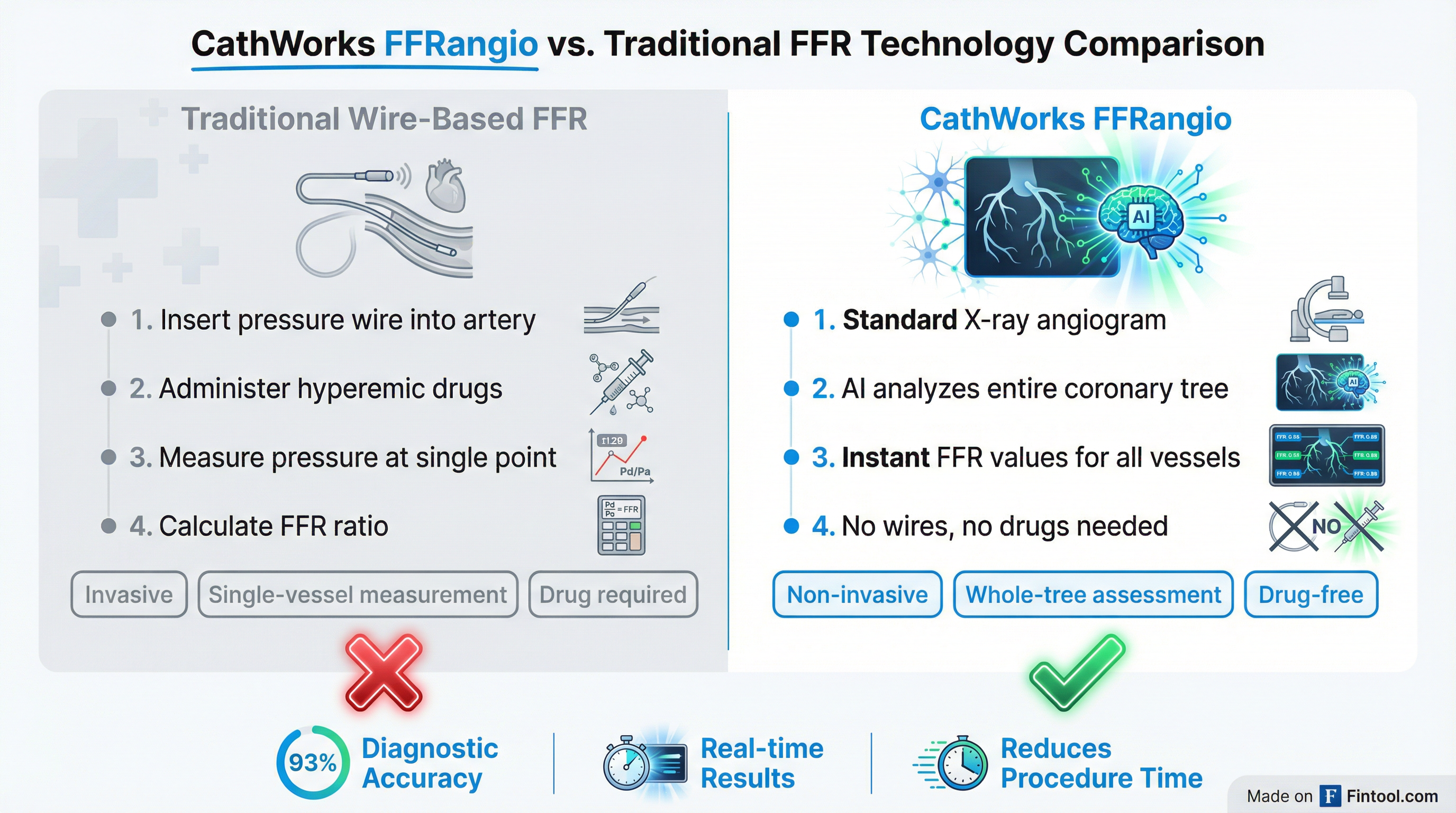

Fractional flow reserve (FFR) is the gold standard for evaluating whether coronary artery blockages are significant enough to warrant intervention. The measurement tells cardiologists which lesions actually cause reduced blood flow—and which patients truly need stents or other procedures.

The problem: traditional FFR is invasive, requiring physicians to thread a pressure-sensing wire into the coronary arteries and administer drugs to induce hyperemia (increased blood flow). This adds time, cost, and risk to procedures. Despite strong clinical evidence supporting FFR-guided treatment, utilization remains low precisely because of these barriers.

CathWorks' FFRangio system solves this by using AI and computational science to derive FFR values directly from routine X-ray angiograms—the images cardiologists already capture during standard catheterization procedures. No additional wires. No hyperemic drugs. And instead of single-point measurements, FFRangio provides a comprehensive physiological assessment of the entire coronary tree.

Clinical studies have demonstrated impressive results. A pooled analysis of five prospective studies published in JACC: Cardiovascular Interventions found FFRangio achieved 93% diagnostic accuracy, with 91% sensitivity and 94% specificity compared to invasive wire-based FFR.

"This acquisition allows Medtronic to transform the cath lab with a technology that provides real-time data, informs individualized treatment approaches, and drives new standards of care," Weidman said.

Strategic Fit with Medtronic's Portfolio

The CathWorks acquisition bolsters Medtronic's interventional cardiology portfolio, which has become a key growth driver for the $133 billion medtech giant. The company's Cardiovascular segment generated $8.96 billion in revenue last quarter—up from $8.29 billion a year earlier—with mid-single-digit organic growth driven by products like pulse field ablation (PFA) systems and renal denervation platforms.

| Metric | Q3 2025 | Q4 2025 | Q1 2026 | Q2 2026 |

|---|---|---|---|---|

| Revenue ($B) | $8.29 | $8.93 | $8.58 | $8.96 |

| Net Income ($B) | $1.29 | $1.06 | $1.04 | $1.37 |

| EBITDA ($B) | $2.50* | $2.22* | $2.31* | $2.52* |

*Values retrieved from S&P Global

CathWorks fits squarely into Medtronic's cath lab ecosystem, where it already sells stents, catheters, ablation systems, and imaging products. The FFRangio platform complements existing offerings while opening new revenue streams from AI-driven software and services.

CEO Geoff Martha has been explicit about Medtronic's M&A intentions. On the company's Q4 2025 earnings call, he said: "We're at a point now where I would like to turn up the heat on some tuck-in M&A to support these strong market positions."

CFO Gary Corona echoed the strategy: "Regarding our portfolio, we've increased our focus on finding tuck-in acquisitions that can enhance our growth and margin profile."

Competitive Landscape

Medtronic is entering an FFR market dominated by a handful of players, with the overall market expected to grow at a 12-15% CAGR through 2030 as AI-driven solutions gain traction.

Key competitors include:

- Abbott Laboratories — Dominates invasive FFR with its PressureWire X guidewire platform, the legacy technology that FFRangio aims to disrupt

- HeartFlow — Leads in non-invasive CT-derived FFR (FFR-CT), using AI to analyze coronary CT angiography images. HeartFlow has reached 250,000+ patients and recently secured expanded Medicare coverage

- Philips — Acquired SpectraWAVE in December 2025 to add AI angio-physiology and plaque imaging

- Boston Scientific — Offers the COMET pressure guidewire for invasive FFR

- Siemens Healthineers — Provides integrated imaging and physiology solutions

The competitive dynamics break down along two axes: invasive vs. non-invasive, and wire-based vs. AI-derived. CathWorks occupies a unique position—it works within the existing cath lab workflow (unlike HeartFlow's CT-based approach) but eliminates the invasive wire requirement (unlike Abbott's guidewires).

What to Watch

FTC review timeline — The deal requires Federal Trade Commission clearance. Given Medtronic's scale and the concentrated nature of the cardiac diagnostics market, regulators may scrutinize competitive implications. Medtronic expects to complete this process by fiscal year-end (late April 2026).

Commercial traction — After three years of co-promotion, Medtronic has visibility into FFRangio adoption rates. The technology is already deployed across hospitals in the U.S., Europe, and Japan. Full ownership will allow Medtronic to leverage its 95,000-person global salesforce to accelerate penetration.

Reimbursement dynamics — Procedure economics will determine adoption speed. If FFRangio can demonstrate superior outcomes at comparable or lower total cost than wire-based FFR, payer support should follow.

Integration execution — CathWorks' Israel-based R&D team will need to mesh with Medtronic's larger organization. CathWorks CEO Ramin Mousavi expressed enthusiasm: "With Medtronic's vast global footprint, FFRangio will continue to reach even more patients globally."

The acquisition represents exactly the kind of "tuck-in M&A" that Medtronic's leadership has been telegraphing—a deal that adds AI-powered differentiation to an established portfolio, targets a high-growth segment, and leverages existing customer relationships. For a company generating nearly $36 billion in annual revenue, a $585 million bet on the future of cardiac diagnostics is a measured play with asymmetric upside.