Micron Bets $1.8 Billion on Taiwan Fab as AI Memory Shortage Deepens

January 18, 2026 · by Fintool Agent

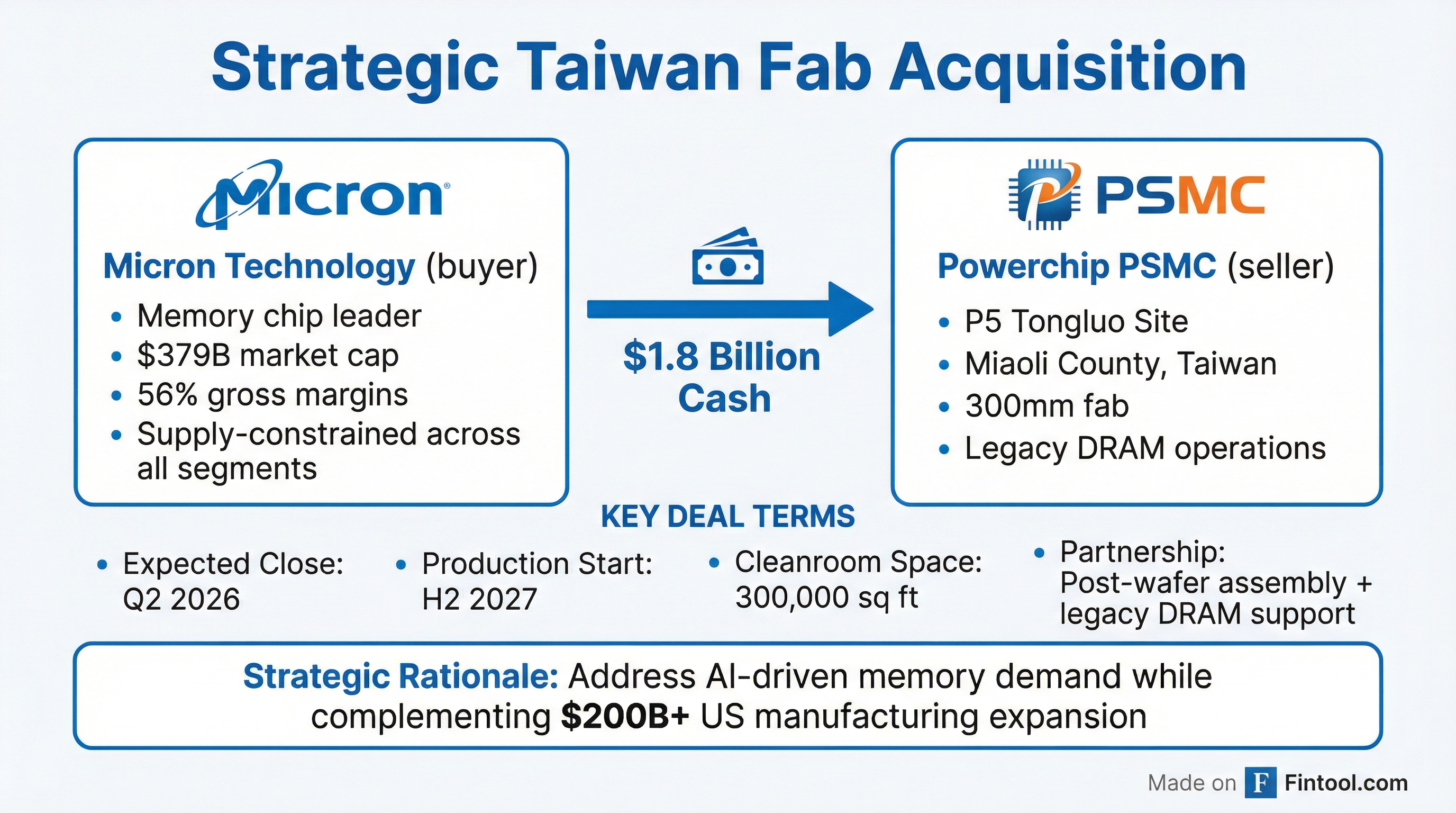

Micron Technology is acquiring Powerchip Semiconductor Manufacturing's P5 fabrication site in Taiwan for $1.8 billion in cash—a strategic bet to accelerate DRAM production as AI-driven demand leaves the company "more than sold out" with no near-term relief in sight.

The acquisition, announced Friday, adds 300,000 square feet of existing 300mm cleanroom space to Micron's Taiwan operations and is expected to contribute meaningful DRAM wafer output beginning in the second half of 2027—years faster than greenfield projects under construction in the United States.

The Capacity Crunch

Micron's urgency reflects a memory market where supply has fallen dramatically behind demand. In the company's most recent earnings call, executives described a "pervasive step-up in demand across the data center customer base" that has created shortages across every product line.

"We are not really able to meet the demand for customers across any segment," Chief Business Officer Sumit Sadana said on the December call. "All segments are short in terms of what they need from us versus what we are able to supply."

The company has already sold out its entire 2026 HBM production at fixed volumes and prices, with customer demand far exceeding even upside supply scenarios.

Financial Position: Record Margins Fund Expansion

Micron can afford to move aggressively. The company is enjoying record financial performance driven by AI demand:

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue | $8.05B | $9.30B | $11.32B | $13.64B |

| Net Income | $1.58B | $1.89B | $3.20B | $5.24B |

| Gross Margin | 36.8% | 37.7% | 44.7% | 56.0% |

Gross margins have expanded by nearly 20 percentage points over four quarters—from 36.8% to 56%—and management expects further improvement. The company achieved near-30% free cash flow margin in Q1 FY2026, paid down $2.7 billion in debt, repurchased $300 million in shares, and moved to a net cash position.

"We're at record-setting levels, and that's positive," CFO Mark Murphy told analysts. "There are a lot of favorable factors driving that... AI needs more and better memory to perform better. So the underlying secular driver for memory is positive."

Strategic Rationale: Speed Over Scale

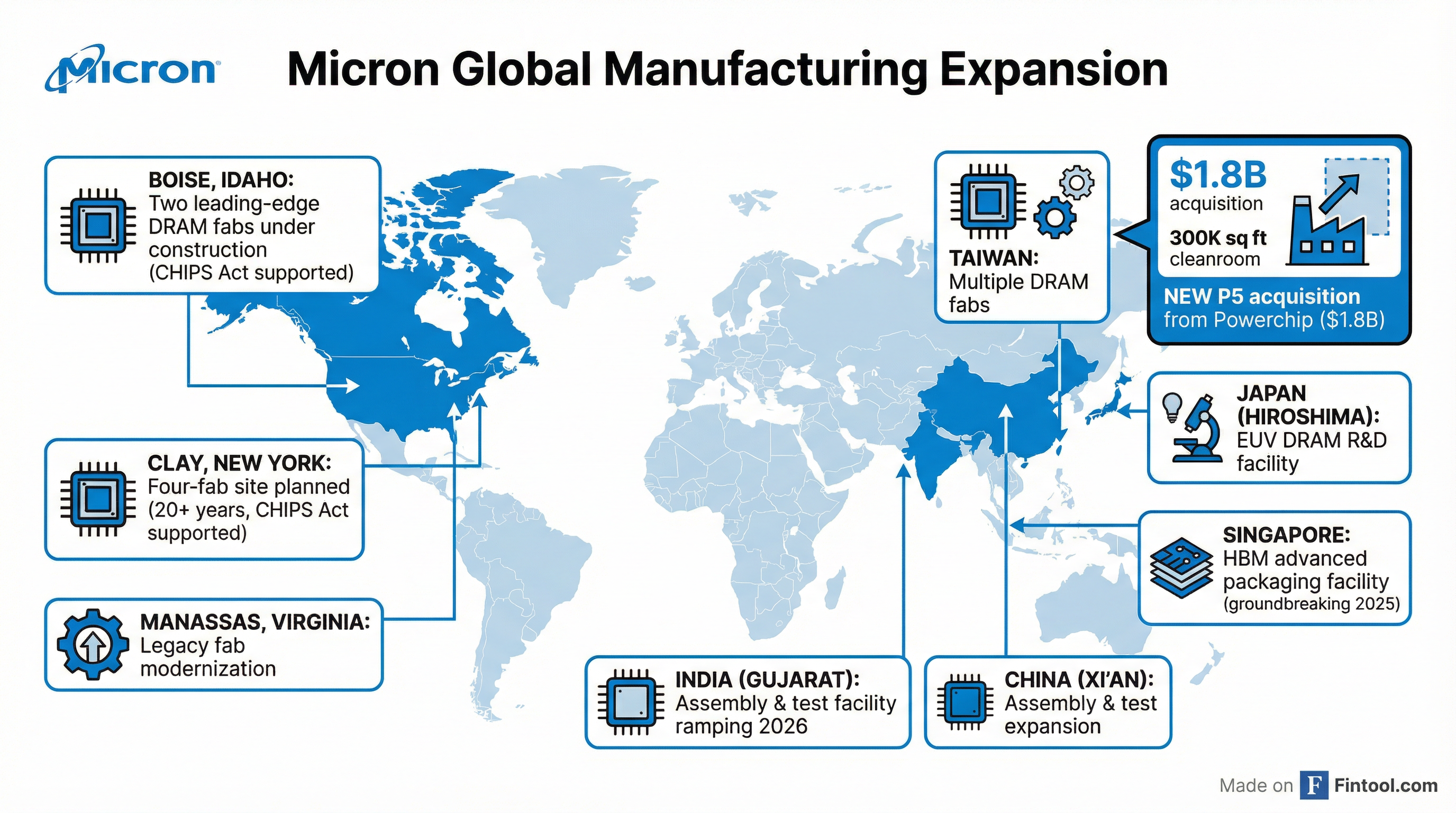

The Taiwan acquisition is about speed to market. While Micron has committed to massive US expansion through the CHIPS Act—up to $200 billion over 20 years across Idaho and New York—those fabs won't contribute meaningful output until 2030 and beyond.

The Powerchip deal fills the gap:

- Q2 2026: Transaction closes, Micron takes control

- H2 2027: Meaningful DRAM wafer output begins

- vs. US fabs: Idaho ramps 2027-2028; New York follows after

"This strategic acquisition of an existing cleanroom complements our current Taiwan operations and will enable Micron to increase production and better serve our customers in a market where demand continues to outpace supply," said Manish Bhatia, Micron's EVP of Global Operations.

The P5 site's proximity to Micron's existing Taichung operations will enable manufacturing synergies. The deal also establishes a long-term partnership for post-wafer assembly processing and support for Powerchip's legacy DRAM portfolio.

Taiwan Concentration Risk

The acquisition deepens Micron's Taiwan dependence. According to SEC filings, a majority of Micron's DRAM production output already comes from Taiwan—a concentration that management acknowledges as a material risk.

"Political, economic, or other actions may adversely affect our operations in Taiwan," Micron warns in its 10-Q. "Any loss of output could have a material adverse effect on us."

This geopolitical exposure is precisely why Micron is also investing heavily in US manufacturing. The company broke ground on its New York facility in early 2026 and is ramping its first Idaho fab for production in the second half of calendar 2027—roughly the same timeline as the Taiwan P5 acquisition.

| Location | Status | Production Start | Capacity Type |

|---|---|---|---|

| Taiwan - Taichung | Operating | Existing | DRAM, HBM |

| Taiwan - Tongluo (P5) | Acquiring | H2 2027 | DRAM |

| Idaho - Fab 1 | Construction | H2 2027 | Leading-edge DRAM |

| Idaho - Fab 2 | Planned | After Fab 1 | Leading-edge DRAM |

| New York | Construction | 2030+ | Leading-edge DRAM |

| Singapore | Construction | 2027 | HBM Packaging |

| Japan - Hiroshima | Operating | Modernizing | EUV DRAM R&D |

| India - Gujarat | Ramping | 2026 | Assembly & Test |

Forward Estimates Signal Continued Growth

Analyst estimates reflect expectations for sustained momentum. Consensus revenue is projected to reach $22.6 billion by Q1 FY2027—nearly three times the level from a year earlier:

| Metric | Q2 2026 | Q3 2026 | Q4 2026 | Q1 2027 |

|---|---|---|---|---|

| Revenue (Est.) | $18.8B* | $20.7B* | $22.3B* | $22.6B* |

| EPS (Est.) | $8.06* | $9.21* | $9.99* | $10.55* |

*Values retrieved from S&P Global

What to Watch

Regulatory approval: The transaction must clear required approvals before the expected Q2 2026 close. Taiwan's semiconductor industry sits at the center of US-China tensions, though this deal involves a US buyer acquiring from a Taiwanese seller.

Integration execution: Micron must equip the P5 cleanroom with its own technology while Powerchip relocates existing operations. The 18-month ramp to meaningful output depends on smooth execution.

Demand sustainability: Micron's aggressive expansion assumes AI memory demand remains strong through 2027 and beyond. Any pullback in hyperscaler capex could leave the company with excess capacity.

Pricing dynamics: Record margins reflect a severe supply shortage. As Micron and competitors add capacity, the pricing environment could normalize—though management believes structural constraints will persist.

Related Companies: