Micron Pays $1.8 Billion for Taiwan Fab as AI Memory Shortage Intensifies

January 19, 2026 · by Fintool Agent

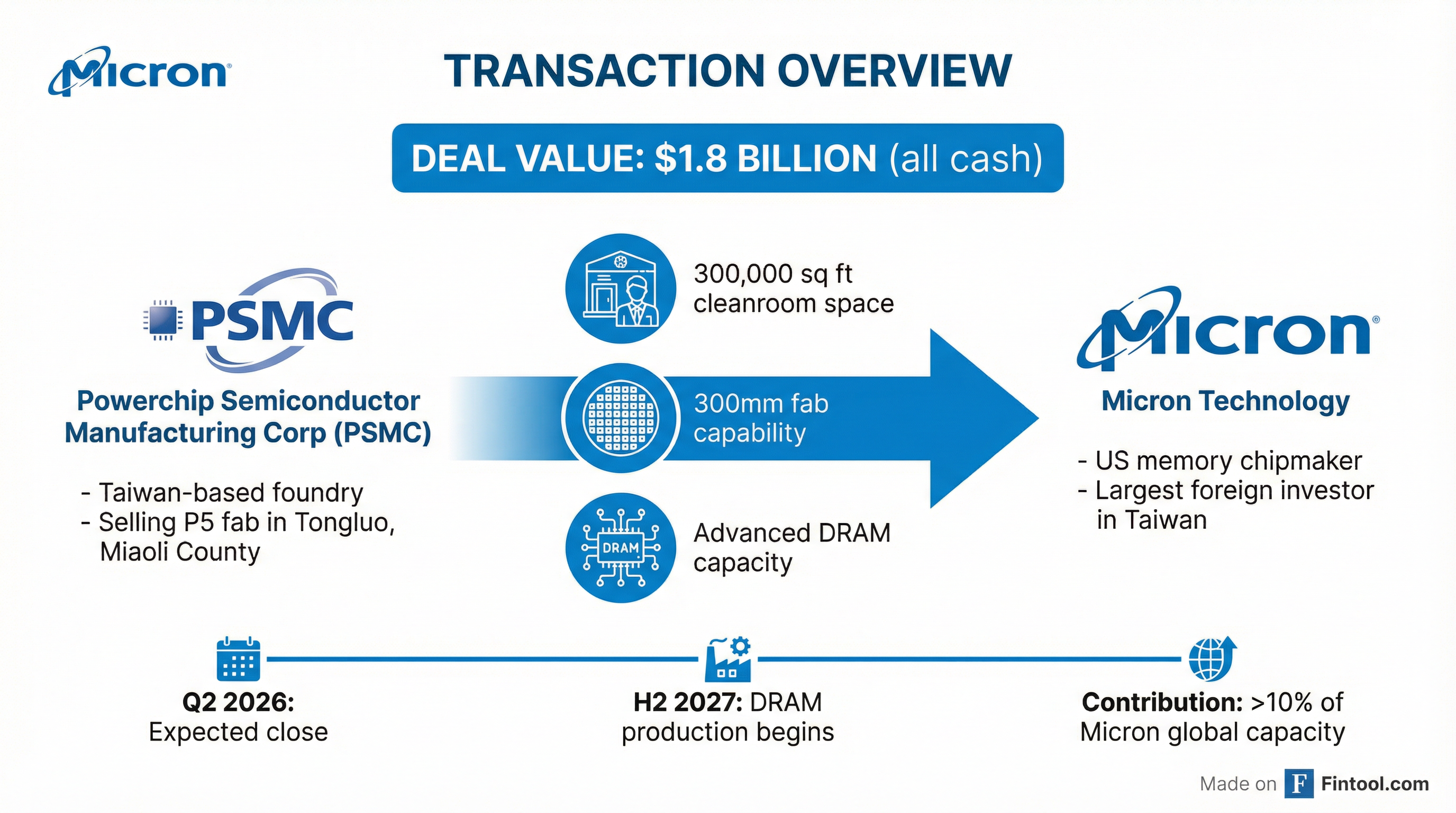

Micron Technology+3.08% is acquiring Powerchip Semiconductor Manufacturing Corporation's P5 fabrication facility in Taiwan for $1.8 billion in cash, its latest move to expand DRAM production capacity as artificial intelligence devours the world's memory supply.

Powerchip shares surged nearly 10% on Monday following the announcement, while U.S. markets were closed for Martin Luther King Jr. Day.

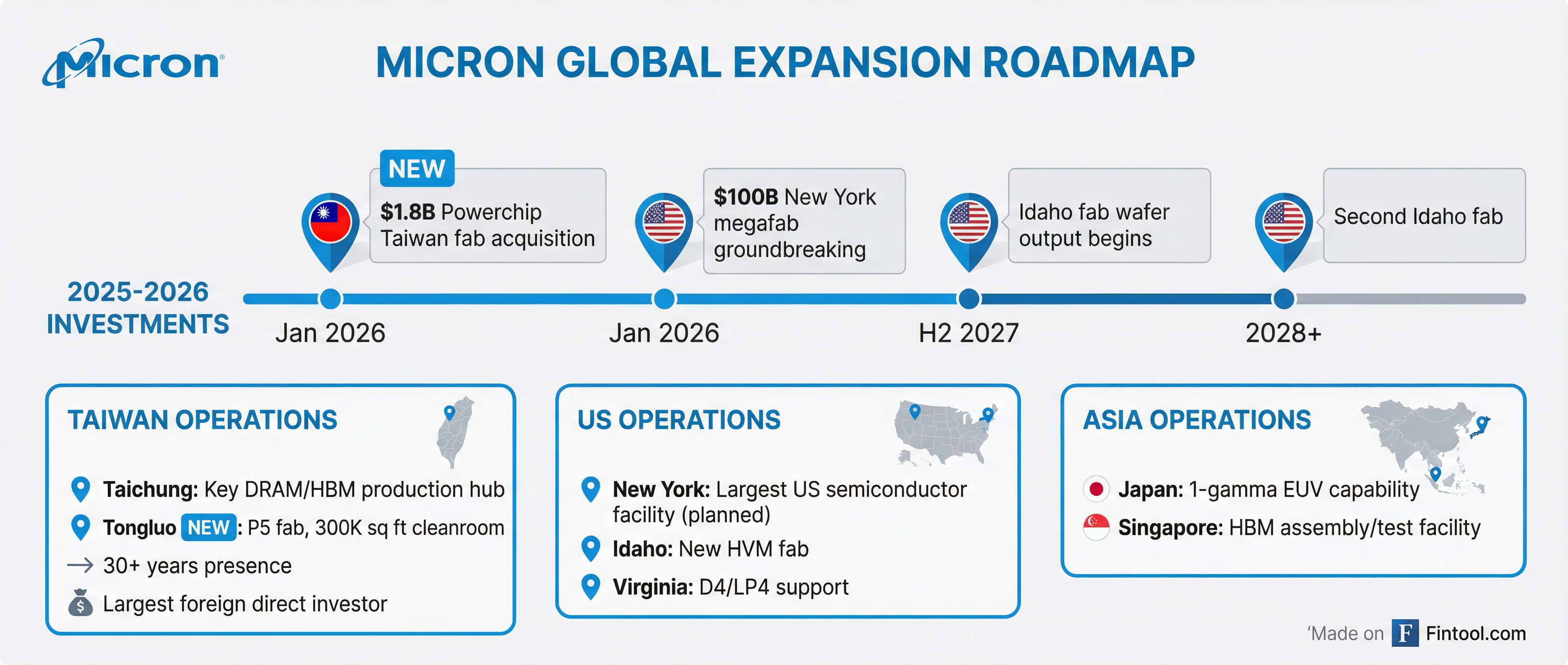

The deal lands just three days after Micron broke ground on a $100 billion megafab campus in New York—what will become the largest semiconductor facility in the United States when complete. Together, these investments position America's lone major memory maker to capture a disproportionate share of the AI infrastructure buildout.

The Deal

The P5 site in Tongluo, Miaoli County, gives Micron an existing 300mm fab with 300,000 square feet of cleanroom space—the highly controlled environment essential for chip production. The facility sits close to Micron's existing Taichung operations, enabling cost synergies across its Taiwan footprint.

"This strategic acquisition of an existing cleanroom complements our current Taiwan operations and will enable Micron to increase production and better serve our customers in a market where demand continues to outpace supply," said Manish Bhatia, executive vice president of global operations at Micron Technology.

Beyond the physical assets, the letter of intent establishes a long-term foundry relationship where Micron will work with Powerchip on DRAM advanced-packaging wafer manufacturing and help enhance Powerchip's specialty DRAM process technologies.

Research firm TrendForce estimates the Tongluo fab's first-phase capacity contribution in H2 2027 will exceed 10% of Micron's global capacity as of Q4 2026—a significant addition that could lift 2027 DRAM supply estimates.

Why Now: The AI Memory Crunch

The timing reflects a memory market transformed by artificial intelligence. Data centers—the beating heart of AI infrastructure—now drive an unprecedented share of semiconductor demand, and the bottleneck increasingly sits in memory, not compute.

Micron's data center business reached a record 56% of total company revenue in fiscal 2025, with gross margins of 52%. High-bandwidth memory (HBM) revenue alone grew to nearly $2 billion in fiscal Q4, implying an annualized run rate approaching $8 billion.

CEO Sanjay Mehrotra has been explicit about the supply picture: "In calendar 2026, we anticipate further DRAM supply tightness in the industry and continued strengthening in NAND market conditions."

The constraints are structural, not cyclical:

- Low industry inventories with DRAM particularly tight

- Node migration constraints as the industry supports extended D4 and LP4 end-of-life cycles

- Higher costs globally for new wafer capacity

- Long lead times for equipment and construction

Wall Street Journal data from TrendForce shows that up to 70% of memory produced worldwide in 2026 will be consumed by data centers—a concentration that gives companies like Micron significant pricing power.

Micron's Financial Trajectory

The financial results underscore why Micron is investing aggressively. Quarterly revenue has accelerated from $8.1 billion in Q2 FY2025 to $13.6 billion in Q1 FY2026—a 69% increase in three quarters. Net income over the same period grew more than three-fold.

| Metric | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 |

|---|---|---|---|---|

| Revenue ($B) | $8.05 | $9.30 | $11.32 | $13.64 |

| Net Income ($B) | $1.58 | $1.89 | $3.20 | $5.24 |

| EBITDA Margin % | 47.4%* | 45.6%* | 51.5%* | 61.2%* |

| Operating Cash Flow ($B) | $3.94 | $4.61 | $5.73 | $8.41 |

*Values retrieved from S&P Global

The company invested $13.8 billion in capital expenditure in fiscal 2025, with management guiding for even higher spending in fiscal 2026 as it ramps 1-gamma DRAM production and HBM-related investments.

The Bigger Picture: A Global Expansion Push

The Powerchip acquisition is one piece of a multi-pronged expansion strategy:

Taiwan Operations

- Taichung remains a key production hub for DRAM and HBM products

- Tongluo fab (the new acquisition) adds 300K sq ft of cleanroom

- Micron has operated in Taiwan for more than 30 years and is the island's largest foreign direct investor

United States

- New York: Broke ground January 16 on a $100 billion megafab campus in Onondaga County—four fabs when complete, expected to be the largest semiconductor facility in the U.S.

- Idaho: New high-volume manufacturing fab, first wafer output expected H2 2027

- A second Idaho fab is in design, providing additional capacity beyond 2028

- CHIPS Act grant disbursements are supporting the Idaho construction

Japan

- Installed first EUV tool to enable 1-gamma capability

- Record installation speed demonstrates Micron's equipment expertise

Singapore

- HBM assembly and test facility under construction

- On track to contribute to HBM supply capability in calendar 2027

What This Means for Powerchip

For Powerchip, the deal provides a $1.8 billion cash injection to boost production of high-value wafer products at its P3 fab in Hsinchu. The company will also join Micron's domestic DRAM packaging supply chain, with Micron providing technical support for advanced chip production.

Powerchip Chairman Frank Huang called the deal "mutually beneficial," highlighting the cash infusion and ongoing technical collaboration.

Equipment and personnel at the Tongluo fab will be transferred to Powerchip's Hsinchu facilities over the coming months as Micron prepares to take control.

The Competitive Landscape

Micron is one of only three major suppliers of high-bandwidth memory chips essential to AI technology, alongside South Korea's Samsung and SK Hynix. The company's HBM4 product—with industry-leading bandwidth exceeding 2.8 terabytes per second and pin speeds over 11 gigabits per second—positions it at the forefront of next-generation AI accelerator support.

Management has emphasized that HBM market share is on track to match Micron's overall DRAM share, a target discussed for several quarters.

The deal closes as geopolitical tensions continue to reshape semiconductor supply chains. Micron's heavy investments in both Taiwan and the United States reflect a dual strategy: maintaining proximity to Asian customers and manufacturing ecosystems while building domestic capacity aligned with U.S. industrial policy.

What to Watch

- Q2 2026: Expected deal close, subject to regulatory approvals

- H2 2027: First meaningful DRAM wafer output from Tongluo fab

- Fiscal Q2 2026 earnings (late February): Updates on New York construction progress and HBM customer qualifications

- Industry DRAM pricing: Whether supply tightness translates to continued ASP strength

The transaction is anticipated to close by calendar Q2 2026, following the execution of definitive agreements and required regulatory approvals.