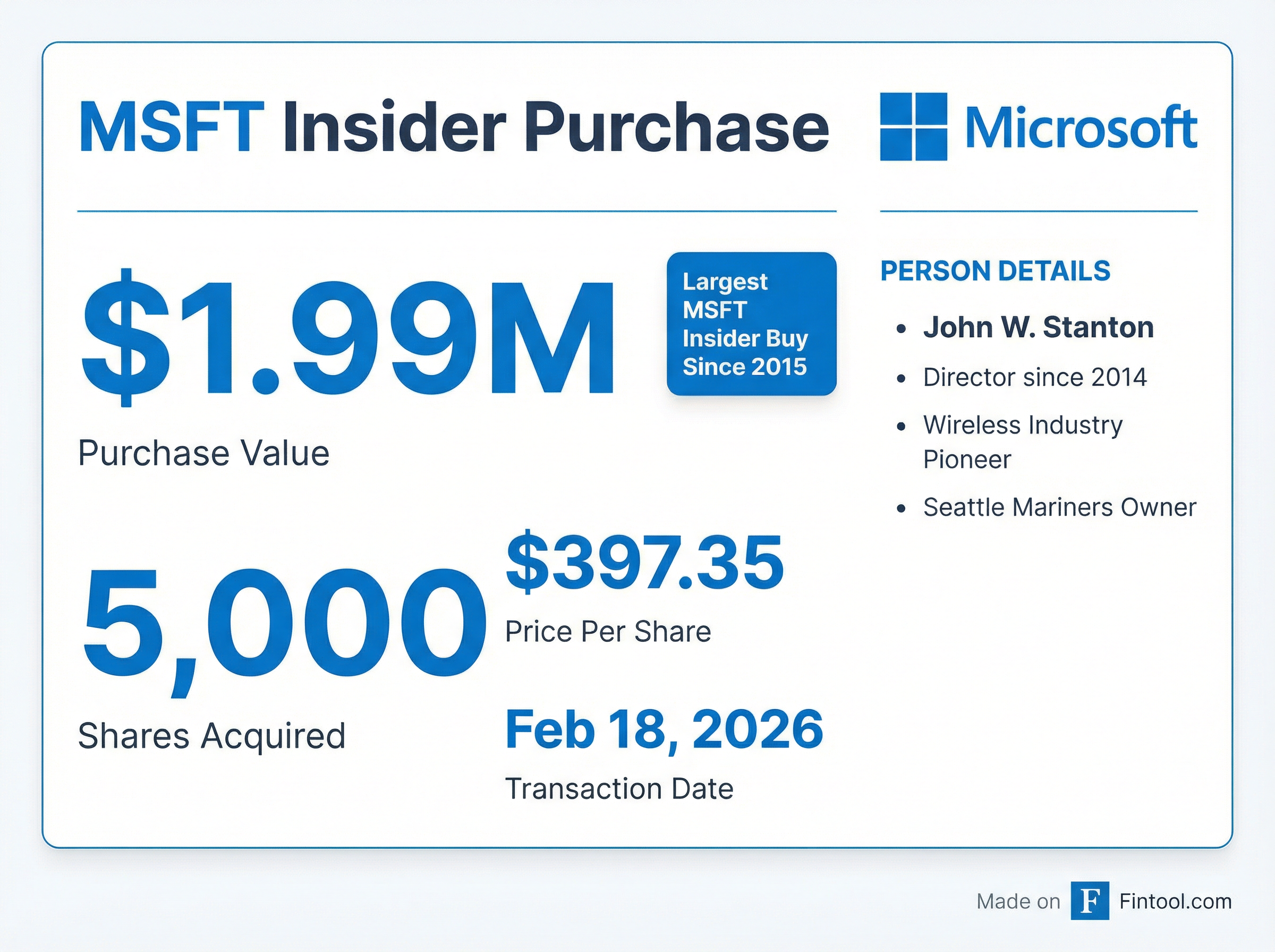

Microsoft Director John Stanton Bets $2M on MSFT—First Mega Insider Buy Since 2015

February 21, 2026 · by Fintool Agent

A billionaire wireless pioneer just placed a nearly $2 million bet that Microsoft is oversold.

John W. Stanton, who has served on Microsoft's board since 2014, purchased 5,000 shares at $397.35 on February 18—the largest open-market insider buy at the company in over a decade. The purchase comes three weeks after Microsoft stock plunged 10% in a single day despite posting its best earnings beat in company history.

The timing is deliberate. Microsoft is the worst-performing "Magnificent Seven" stock of 2026, down approximately 18% year-to-date while Google has declined just 1.2% and Nvidia trades roughly flat. Investors have fled the stock despite 47% operating margins and 24% year-over-year earnings growth, fixated instead on whether the company's massive AI infrastructure spending will generate sustainable returns.

The Signal in the Noise

Stanton isn't just any board member writing a check. The 70-year-old co-founded McCaw Cellular in the 1980s (later AT&T Wireless), built Western Wireless into a national carrier, and created VoiceStream Wireless—which became T-Mobile USA after Deutsche Telekom acquired it for billions. He owns the Seattle Mariners, sits on Costco's board, and Forbes pegs his net worth at $2.4 billion.

When someone with that track record puts nearly $2 million into a stock he's been watching from the inside for 12 years, it carries weight.

The purchase is the largest insider buy at Microsoft since activist investor G. Mason Morfit accumulated over $40 million in shares during February 2015. Since then, no Microsoft insider has deployed seven figures of personal capital into the stock. The drought made Stanton's trade stand out immediately—one X account tracking insider activity called it "the largest insider buying at Microsoft in 11 years."

Why Investors Dumped MSFT

Microsoft's January 28 earnings report beat on every metric that matters: revenue of $81.3 billion (+17%), operating income up 21%, EPS of $4.14 (+24%). The company returned $12.7 billion to shareholders through buybacks and dividends, grew Azure revenue 39%, and expanded operating margins to 47%.

None of it mattered. The stock crashed 10% the next day—its worst single-session loss since March 2020—wiping out roughly $360 billion in market value.

Three concerns dominated the selloff:

AI Spending Scale: Capital expenditures hit $37.5 billion in Q2 alone, with roughly two-thirds going to short-lived assets like GPUs and CPUs. Microsoft acknowledged that "customer demand continues to exceed our supply," but investors worry the spending pace isn't translating to Azure revenue growth fast enough.

Azure Deceleration: Azure growth came in at 39%, down from 40% the prior quarter. While still exceptional, the slight slowdown fed fears that Microsoft's core cloud engine is losing momentum. CFO Amy Hood noted on the earnings call that if Microsoft had allocated all new GPUs to Azure instead of Copilot products and R&D, "the KPI would have been over 40."

OpenAI Concentration: A staggering 45% of Microsoft's $625 billion commercial backlog (remaining performance obligation) comes from OpenAI. Investors parsing the RPO growth realized much of it reflects future obligations to a single customer—one that is simultaneously a competitor in the AI space.

The Bull Case Stanton Is Betting On

The bear case is priced in. At $397, Microsoft trades at roughly 25x trailing earnings—a level some analysts consider bear-case pricing for a company posting double-digit earnings growth with 47% operating margins.

Microsoft's CFO made the case for patience on the earnings call: "The majority of the GPUs that we're buying are already contracted for most of their useful life. Much of that risk isn't there because they're already sold for the entirety of their useful life."

CEO Satya Nadella emphasized the breadth of AI monetization beyond Azure: "As an investor, when you think about our capital, you should obviously think about Azure, but you should think about M365 Copilot, GitHub Copilot, Dragon Copilot, Security Copilot. All of those have a gross margin profile and lifetime value."

The company's first-party AI products are ramping—M365 Copilot is integrated across 450+ million commercial seats, while GitHub Copilot continues to expand. These represent high-margin, recurring revenue streams that don't show up cleanly in Azure metrics but benefit from the same GPU infrastructure.

What to Watch

Microsoft's next major catalyst is the Q3 fiscal 2026 earnings report, expected in late April. Key metrics to monitor:

- Azure growth trajectory: Can it stabilize above 35%?

- Copilot adoption metrics: Any quantified revenue contribution?

- CapEx guidance: Will management signal spending moderation?

- OpenAI RPO concentration: Is the backlog diversifying?

Stanton's purchase doesn't guarantee the stock has bottomed. But when a billionaire who made his fortune building telecom infrastructure puts $2 million into a company investing heavily in AI infrastructure, it suggests he sees something in the spending that Wall Street is missing.

Related Companies: Microsoft