Molecular Partners' First-in-Human Alpha Therapy Data at TWC 2026 'Checks All the Boxes' for DLL3-Targeting Cancer Treatment

February 2, 2026 · by Fintool Agent

Molecular Partners unveiled first-in-human imaging and dosimetry data for its DLL3-targeting radiotherapeutic MP0712 at the 8th Theranostics World Congress (TWC) in Cape Town, South Africa, with nuclear medicine expert Prof. Ken Herrmann declaring that "all boxes are checked" to move into therapeutic trials.

Shares of the Swiss biotech rose 2.4% to $4.25 on January 30, with aftermarket trades pushing the stock up to $4.63—an 8.9% premium reflecting investor enthusiasm for the data. The company has a market cap of approximately $159 million.

The Data: Favorable Biodistribution in 5 Patients

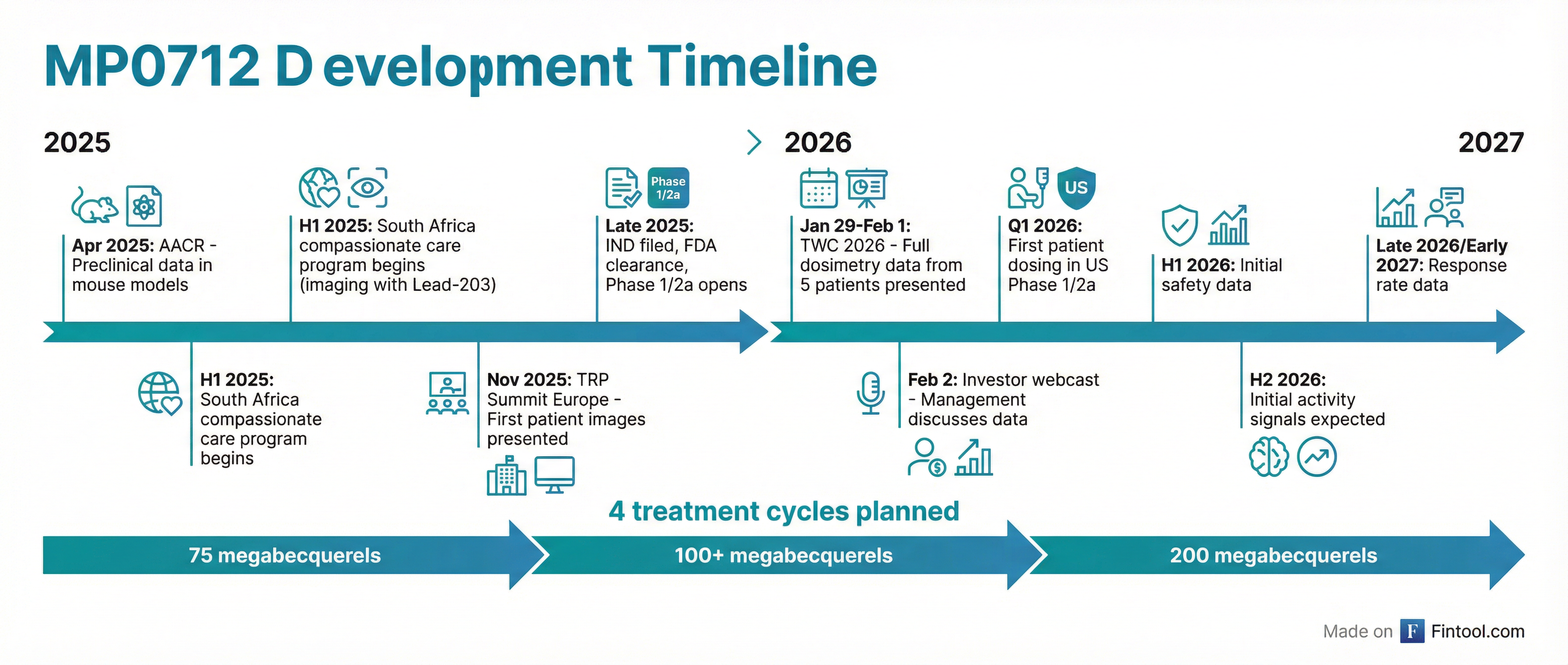

The clinical data, presented via two posters and an oral presentation at TWC 2026 (January 29-February 1), came from five evaluable patients treated under South Africa's compassionate care framework (Section 21) at the Nuclear Medicine Research Infrastructure (NuMeRI), led by Dr. Mike Sathekge.

The key findings that de-risk the Phase 1/2a program:

| Observation | Clinical Significance |

|---|---|

| Rapid tumor uptake | 80% of drug reaches tumor in first 24 hours—critical for Lead-212's 48-hour activity window |

| Sustained retention | Tumor curves continue rising beyond 24 hours while healthy organs wash out |

| Low healthy organ exposure | Kidneys and liver did not light up strongly; marrow dose within FDA-agreed EBRT limits |

| Metastasis visibility | Previously unknown liver metastases identified in one patient, enabling disease upstaging |

"The overall headline...all boxes are checked," Prof. Herrmann, Chair of Nuclear Medicine at University of Essen and Molecular Partners' Scientific Advisory Board Chairman, told investors on a morning webcast. "Human biodistribution is very favorable. We see very little background uptake...nice, crisp uptake in the tumor."

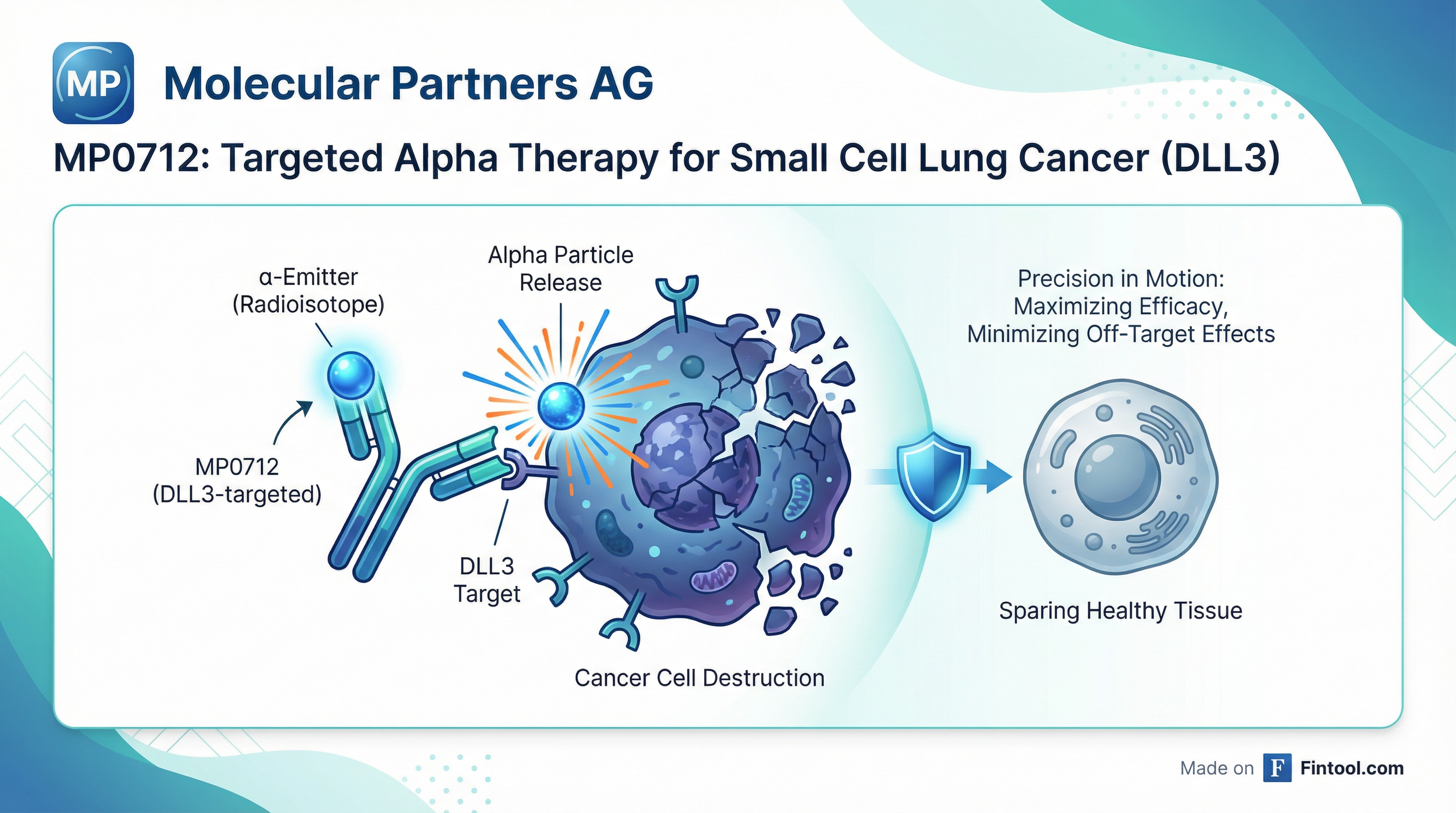

The DLL3 Challenge: Low Copy Numbers, Novel Solution

MP0712 represents a technical achievement in radiopharmaceuticals. Unlike PSMA-targeting therapies for prostate cancer where targets have high copy numbers, DLL3 presents with over 100x fewer copies per cell.

Molecular Partners solved this through half-life engineering of its DARPin vector. "One cycle only, so full internalization takes less than 30 minutes. Within 24 hours, we actually see almost the same number of copies of DLL3 as you would see on a PSMA high copy number cell line or tumor," CEO Patrick Amstutz explained.

This mechanism—internalization, falling off, and replenishment—creates an "apparent copy number" that enables therapeutic accumulation in what's typically considered a difficult target.

Competitive Landscape: A Third Modality for DLL3

The TWC 2026 presentation comes just two months after Amgen received full FDA approval for tarlatamab (Imdelltra), a bispecific T-cell engager targeting DLL3. Tarlatamab demonstrated a 40% reduction in death risk versus chemotherapy in Phase 3 trials, with median overall survival of 13.6 months versus 8.3 months.

Molecular Partners sees room for all three modalities—T-cell engagers, antibody-drug conjugates (ADCs), and radiotherapy:

"Given that neither T-cell engagers nor ADCs will cure cancer in these patients, we think there is the need for an additional [option]," Amstutz said. T-cell engagers show good response duration but have cytokine release syndrome and neurotoxicity risks. ADCs offer higher response rates but face chemo resistance that limits durability.

Critically, management sees potential for combination therapy: "With an alpha like lead, you create a lot of inflammation, a lot of damage to the tumor...a very hot tumor after that, where a PD-1 and/or a T-cell engager would profit from."

Reports suggest DLL3 loss is not the primary resistance mechanism for tarlatamab, meaning patients who progress on the T-cell engager may still respond to alpha therapy.

Phase 1/2a Design: Path to Proof-of-Concept

The Phase 1/2a trial (NCT07278479) is now open in the U.S., with first patient dosing expected in the coming weeks.

| Trial Element | Detail |

|---|---|

| Starting dose | 75 megabecquerels (FDA-agreed based on allometric scaling from mouse data) |

| Dose escalation | 75 → 100 → 150 → 200 megabecquerels |

| Treatment cycles | 4 standard (up to 6 based on benefit-risk) |

| Cycle interval | Every 4-6 weeks |

| Initial indication | Small cell lung cancer (uniform, high DLL3 expression) |

| Expansion | Neuroendocrine cancers |

Prof. Herrmann noted that based on preclinical data and South African imaging results, efficacy signals could emerge earlier than typical: "I've seen this for two competitive programs that you see efficacy actually potentially earlier than you sometimes think."

The Orano Med Partnership: Securing Isotope Supply

The 50/50 collaboration with Orano Med, a subsidiary of French nuclear giant Orano, provides Molecular Partners access to the world's only industrial-scale Lead-212 production.

Orano Med derives Lead-212 from its proprietary stockpile of Thorium-232, accumulated through decades of uranium mining operations. This gives the partnership a structural advantage in a field where isotope supply has historically constrained development.

In January 2025, the partners expanded their agreement to co-develop up to ten radiotherapy programs.

Looking Ahead: Actinium Option Preserved

While Lead-212 remains the lead isotope, management highlighted that MP0712's favorable tumor retention—continuing to accumulate over 5-7 days—could support an Actinium-225 program if needed.

"If the potential therapeutic index is not significant enough...it's always an option to switch to actinium," Herrmann acknowledged, though he added: "Right now, I wouldn't be surprised if we see pretty good responses based on lead."

The company plans to remain "radionuclide agnostic," optimizing for each target-isotope combination.

Key Milestones to Watch

| Timeline | Catalyst |

|---|---|

| Q1 2026 | First patient dosed in U.S. Phase 1/2a |

| H1 2026 | Initial safety data (blood/bone marrow monitoring) |

| Q2-Q4 2026 | Early activity signals expected |

| Mid-2026 | Nomination of 1-2 additional Radio-DARPin programs with new targets |

| Late 2026-Early 2027 | Response rate data at recommended Phase 2 dose |

"In a year from now, heading towards recommended Phase 2 dose would be an ambitious and highly valuable moment for us," Amstutz said. "We are at the brink of this new chapter for Molecular Partners...the leader in the targeted alpha radio field for DLL3 small cell lung cancer."

Investment Context

Molecular Partners remains a clinical-stage company with limited revenue. According to recent data, trailing twelve-month revenue stands at approximately $5.6 million with ongoing losses (EPS of -$1.95).

The stock trades at $4.25, well below its 52-week high of $5.15 but above the $3.36 low. Analyst coverage includes a Buy rating with a $13.00 price target from Leerink Partners.

The risk/reward hinges on MP0712's ability to demonstrate therapeutic activity in humans—data that could emerge as early as Q2 2026. If successful, the company would be positioned as the leader in alpha-targeted DLL3 therapy, a differentiated approach in a validated target space where Amgen has already proven the market opportunity.

Related

Molecular Partners (moln) · Amgen (amgn)