Molson Coors Doubles Buyback to $4B But Forecasts 15% Profit Drop as Beer Industry Reckoning Deepens

February 18, 2026 · by Fintool Agent

Molson Coors shares tumbled 6% in after-hours trading Wednesday after the beer maker delivered a stark reality check: the company expects 2026 earnings per share to decline 11-15%, a dramatic miss against Wall Street's expectation for a 1.9% increase. The brewer of Miller Lite, Coors Light, and Blue Moon simultaneously announced a doubling of its buyback program to $4 billion—a defensive move that underscores both the depth of industry challenges and management's conviction that shares are undervalued.

"We made the necessary difficult decisions in our business to course correct and set ourselves up for the future," said CEO Rahul Goyal, who inherited a company still reeling from a $3.65 billion goodwill impairment charge taken in Q3 2025.

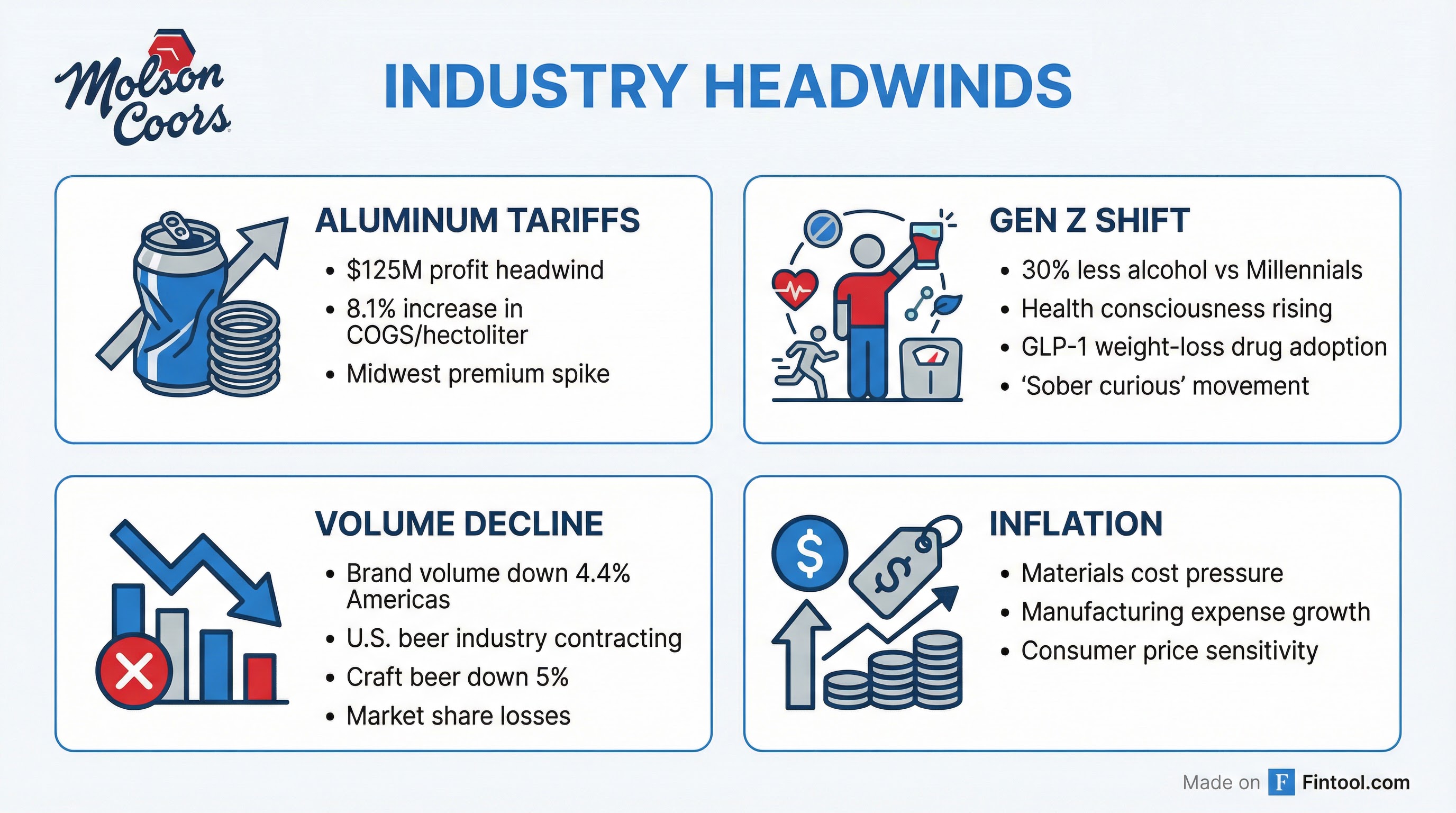

The guidance cut comes as the beer industry faces a perfect storm: aluminum tariffs adding $125 million in costs, Gen Z's documented pullback from alcohol consumption, and the emerging impact of GLP-1 weight-loss drugs on discretionary food and beverage spending.

The Numbers: Beat on EPS, Miss on Revenue

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $2.66B | $2.74B | -2.7% |

| Adjusted EPS | $1.21 | $1.39 | -12.9% |

| GAAP EPS | $1.22 | $1.39 | -12.2% |

| EBITDA Margin | 7.3%* | 22.4%* | -1,510 bps |

| Brand Volume | Down 4.4% (Americas) | -- | -- |

*Q4 2025 EBITDA reflects one-time items; underlying trends show continued pressure. Values retrieved from S&P Global.

The quarter's results tell a story of execution meeting structural headwinds. Molson Coors beat consensus EPS of $1.16 by $0.05 but missed revenue estimates of $2.71 billion by $50 million. Net sales decreased 4% in constant currency, driven by lower financial volume across both the Americas and EMEA&APAC segments.

The $4 Billion Question: Capital Returns as Defense

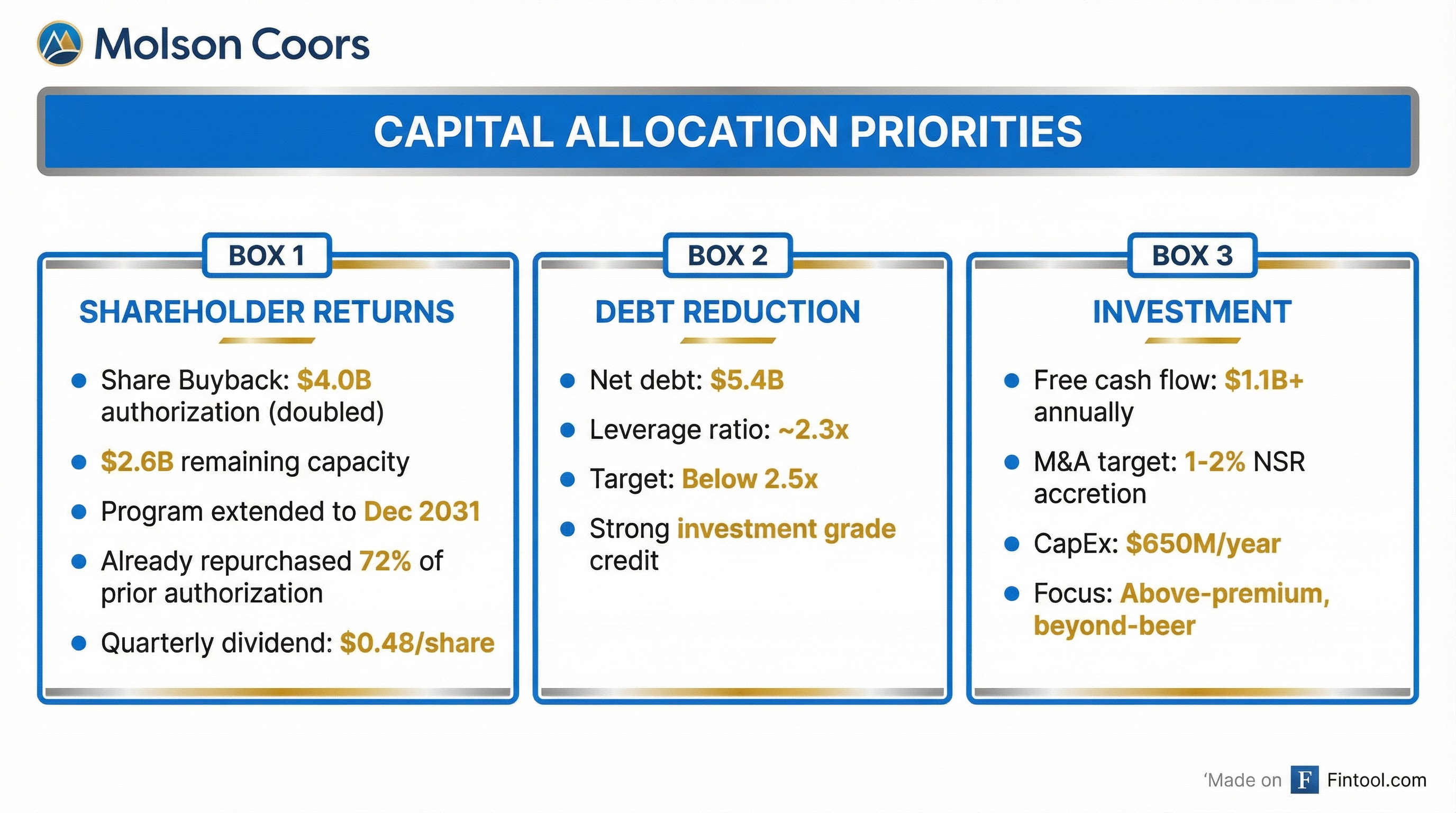

On February 9, 2026, Molson Coors' board approved a dramatic expansion of shareholder returns—doubling the Class B stock repurchase authorization from $2 billion to $4 billion and extending the program through December 2031.

The timing is notable. With approximately $2.6 billion remaining under the expanded program and shares trading at just 9.5x trailing earnings—compared to Anheuser-busch Inbev's 19x and Constellation Brands's 22x—management is making an explicit statement about perceived undervaluation.

"The share repurchase expansion, combined with the dividend, signals confidence in free cash flow durability even as profits compress," noted one analyst. The company generated over $1.1 billion in free cash flow in 2025 and expects similar levels in 2026.

The capital allocation framework prioritizes:

- Maintaining investment-grade credit with a target leverage ratio below 2.5x (currently ~2.3x)

- Returning capital to shareholders through buybacks and the maintained $0.48 quarterly dividend

- Pursuing tuck-in M&A targeting 1-2% net sales revenue accretion annually

The Headwinds: Tariffs, Gen Z, and GLP-1

Aluminum Tariffs: $125 Million Bite

The spike in U.S. Midwest aluminum premiums has become a significant earnings drag. CFO Tracey Joubert warned at the CAGNY conference that aluminum costs alone are expected to weigh on profit by approximately $125 million in 2026.

The impact was already visible in Q4: cost of goods sold per hectoliter jumped 8.1% on a reported basis, driven by materials inflation and manufacturing expenses.

The Generational Shift

The beer industry is confronting an uncomfortable truth: younger consumers are drinking less. According to Morgan Stanley research, Gen Z consumes approximately 30% less alcohol than Millennials did at the same age. The U.S. average drinks per week among 18-34-year-olds has dropped from 5.2 to 3.6 over the past two decades.

This isn't just about moderation—it's a structural shift driven by:

- Health consciousness: 22% of Gen Z want to switch to non-alcoholic versions more often

- GLP-1 adoption: Weight-loss drugs like Ozempic and Wegovy suppress appetite for both food and alcohol

- Sober-curious movement: The rise of non-alcoholic alternatives and "Dry January" culture

The Brewers Association reported craft beer volume down 5% in 2025, with brewery closings (434) outpacing openings (268) for the second consecutive year.

The Response: $450 Million Cost Program and "Horizon 2030"

To offset these headwinds, Molson Coors announced a three-year $450 million cost savings program alongside a strategic framework called "Horizon 2030."

The savings program, inclusive of the Americas Restructuring Plan announced in Q4 2025, will impact both major segments and is intended to "mitigate inflation impacts and enable continued investment at levels necessary to fuel our business."

2026 Guidance Summary:

| Metric | 2026 Guidance | vs. 2025 |

|---|---|---|

| Net Sales (constant currency) | Flat ± 1% | -4.2% in 2025 |

| Underlying Pre-Tax Income | Down 15-18% | Reset year |

| Underlying EPS | Down 11-15% | Reset year |

| Free Cash Flow | $1.1B ± 10% | Stable |

| CapEx | $650M ± 5% | Rebased lower |

CEO Goyal has framed 2026 as a "reset year"—an acknowledgment that the path to growth requires navigating significant industry headwinds first. The strategy focuses on:

- Strengthening core brands: Miller Lite, Coors Light, and Coors Banquet

- Expanding above-premium: Blue Moon, Peroni, and premium imports

- Growing beyond-beer: Integration of Fever-Tree, Topo Chico Hard Seltzer

- Pursuing selective M&A: With $2.3x leverage, the company has capacity for deals

Historical Context: The Goodwill Impairment Hangover

The current reset follows one of the most significant write-downs in the company's history. In Q3 2025, Molson Coors recorded a $3.65 billion partial goodwill impairment charge on its Americas reporting unit—nearly two-thirds of the segment's goodwill value.

The triggering event was stark: "lower 2025 and future forecasted results which were driven by declines in the beer industry, market share losses and higher than expected costs in the U.S. combined with a higher discount rate and lower market multiples."

The write-down wiped out FY 2025 profitability on a GAAP basis:

| Year | Revenue | Net Income | Diluted EPS |

|---|---|---|---|

| FY 2025 | $11.14B* | -$2.14B* | -$10.75* |

| FY 2024 | $11.63B | $1.12B* | $5.35 |

| FY 2023 | $11.70B | $949M | $4.37 |

*Values retrieved from S&P Global.

The Americas reporting unit remains "at a heightened risk of future impairment" given its fair value exceeds carrying value by less than 15%.

What to Watch

Near-term catalysts:

- Q1 2026 earnings (early May) to establish trajectory on cost savings

- Spring beer season sell-through as weather improves

- Tariff developments and potential relief measures

Structural questions:

- Can Miller Lite and Coors Light stabilize share in the value segment?

- Will the above-premium portfolio (Blue Moon, Peroni) accelerate?

- How quickly can beyond-beer (hard seltzers, RTDs) scale?

Capital allocation:

- Pace of buyback execution at depressed valuations

- M&A pipeline given available capacity

- Dividend sustainability if earnings decline persists

The Bottom Line

Molson Coors is navigating one of the most challenging periods in its history. The combination of tariff headwinds, generational consumption shifts, and competitive pressures has forced a reset that management acknowledges will take time to work through.

The doubling of the buyback authorization is a bold capital allocation decision that signals confidence in the franchise's durability even as near-term profits compress. With shares trading at a meaningful discount to peers and generating $1.1 billion in annual free cash flow, the math on buybacks is compelling—provided management can stabilize the underlying business.

For investors, the question is whether 2026's "reset year" is the trough or the beginning of a longer decline. The beer industry's structural challenges—from Gen Z's sobriety to GLP-1's appetite suppression—aren't going away. But Molson Coors' brand portfolio, cash generation, and balance sheet flexibility give it tools to adapt that smaller competitors lack.

CEO Goyal's turnaround playbook is clear: cut costs, return capital, and invest selectively in growth segments. Execution will determine whether the stock's 6% post-earnings drop represents a buying opportunity or fair warning.