MPS CFO Bernie Blegen Retires After 1,694% Stock Run—Closes Decade-Long Tenure at Record Highs

February 5, 2026 · by Fintool Agent

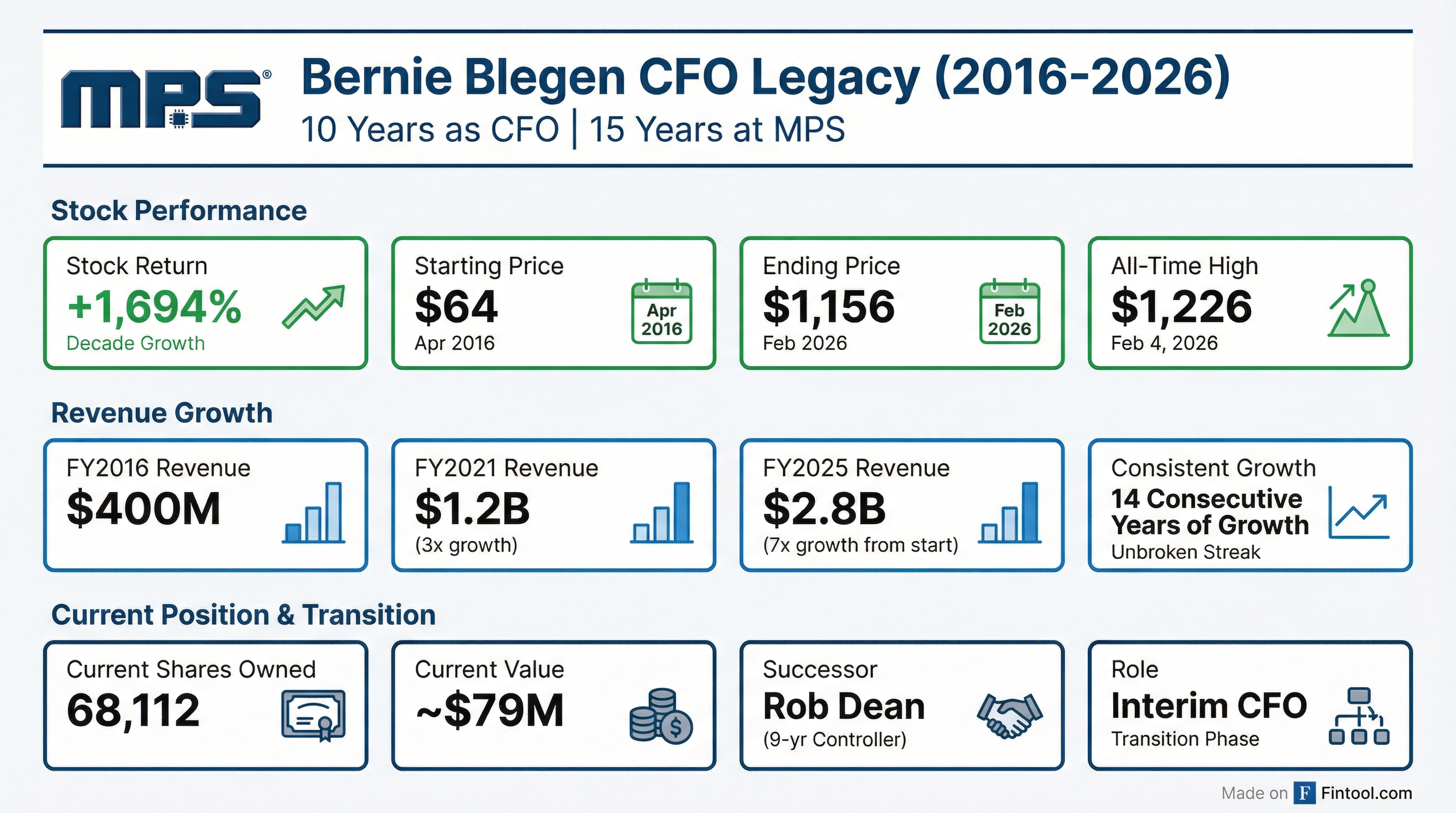

Monolithic Power Systems CFO Bernie Blegen is retiring after a decade at the helm of the company's finances—exiting just one day after the stock hit an all-time high and alongside record quarterly results.

Blegen, 67, informed the board on February 3, 2026 of his intention to step down following the company's 2025 Form 10-K filing. The timing couldn't be more dramatic: MPWR touched $1,226 on February 4—its highest price ever—before closing at $1,156 today.

A Tenure Defined by Extraordinary Returns

When Blegen took over as interim CFO in March 2016 following Meera Rao's retirement, MPWR traded around $64 per share. What followed was one of the most impressive runs in semiconductor history:

| Metric | April 2016 | February 2026 | Change |

|---|---|---|---|

| Stock Price | $64.45 | $1,155.99 | +1,694% |

| Annual Revenue | $400M* | $2.79B | 7x |

| Market Cap | $3B* | $56B | 19x |

| Quarterly Dividend | $0.20 | $2.00 | +900% |

*Values retrieved from S&P Global

The company reported its 14th consecutive year of revenue growth in 2025, with sales up 26.4% year-over-year to $2.79 billion. Non-GAAP EPS grew 25.8% to $17.77.

Leaving at the Peak

The Q4 2025 results announced alongside Blegen's departure were a fitting capstone:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $751.2M | $621.7M | +20.8% |

| Non-GAAP EPS | $4.79 | $4.09 | +17.1% |

| GAAP Gross Margin | 55.2% | 55.4% | -20 bps |

| Operating Cash Flow | $104.9M | $167.7M | -37.4% |

The board also approved a 28% dividend increase to $2.00 per share—the latest in a string of increases that have transformed MPS into a consistent capital returner.

No Red Flags—Just a Retirement

Unlike many CFO departures that signal trouble, Blegen's exit shows none of the warning signs investors typically watch for:

What the data shows:

- No sudden departure: Blegen will stay through the 10-K filing and "remain with MPS after his retirement to ensure a smooth transition"

- Planned succession: Corporate Controller Rob Dean has been at MPS for nine years and steps into the interim CFO role immediately

- Orderly selling pattern: Blegen's insider transactions show regular, programmatic sales—95 sell transactions over the past year totaling approximately $77 million—consistent with 10b5-1 plan execution rather than panic selling

- Retained stake: He still owns 68,112 shares worth ~$79 million at current prices

CEO Michael Hsing's statement emphasized continuity: "This trust, based on MPS's culture and core team members, will continue as Bernie supports a smooth transition."

The Interim CFO: Rob Dean

Rob Dean's promotion from Corporate Controller follows the same path Blegen himself took a decade ago. When Meera Rao retired in 2016, Blegen—then the Corporate Controller—stepped in as interim CFO and was never replaced.

Whether the same pattern repeats remains to be seen. The company has not indicated whether it will conduct an external search for a permanent CFO.

Guidance Signals Continued Strength

Management's Q1 2026 outlook suggests no disruption from the transition:

| Metric | Q1 2026 Guidance |

|---|---|

| Revenue | $770M–$790M |

| Non-GAAP Gross Margin | 55.2%–55.8% |

| Non-GAAP Operating Expenses | $156M–$160M |

| Tax Rate | 15.0% |

At the midpoint, Q1 revenue guidance of $780 million implies 22% year-over-year growth, consistent with the company's trajectory. Forward estimates from analysts project continued acceleration:

| Period | Revenue Estimate | EPS Estimate |

|---|---|---|

| Q1 2026 | $738M | $4.60* |

| Q2 2026 | $784M | $4.96* |

| Q3 2026 | $860M | $5.56* |

| Q4 2026 | $882M | $5.72* |

*Values retrieved from S&P Global

End Market Diversification: Blegen's Quiet Victory

One of Blegen's underappreciated achievements was overseeing MPS's transformation from an Enterprise Data-dominated business to a diversified power solutions provider:

| End Market | Q4 2025 Revenue | Q4 2024 Revenue | YoY Change |

|---|---|---|---|

| Enterprise Data | $233.5M | $194.9M | +19.8% |

| Storage & Computing | $162.1M | $136.5M | +18.8% |

| Automotive | $151.0M | $128.4M | +17.6% |

| Communications | $83.7M | $63.8M | +31.2% |

| Consumer | $66.2M | $57.3M | +15.5% |

| Industrial | $54.7M | $40.8M | +34.1% |

For FY 2025, non-Enterprise Data end markets grew over 40% year-over-year, "showcasing the strength of our diversified business model."

What to Watch

Near-term catalysts:

- 10-K filing (March 2026): Official effective date for Blegen's departure

- Permanent CFO decision: Whether Dean stays or an external hire is announced

- Q1 2026 earnings (~May 2026): First results under new CFO leadership

Key questions for management:

- Will MPS conduct an external CFO search, or is Rob Dean the likely permanent choice?

- How does the CFO transition affect capital allocation priorities?

- Any changes to the company's investor communication cadence?

For now, Blegen departs with MPS in the strongest position in its history—record revenue, record stock price, and a 28% dividend increase. It's the exit every CFO dreams of.