Hollywood's $108 Billion Bidding War: Paramount Goes Hostile for Warner Bros.

December 15, 2025 · by Fintool Agent

The Fight for Media's Crown Jewel Just Escalated

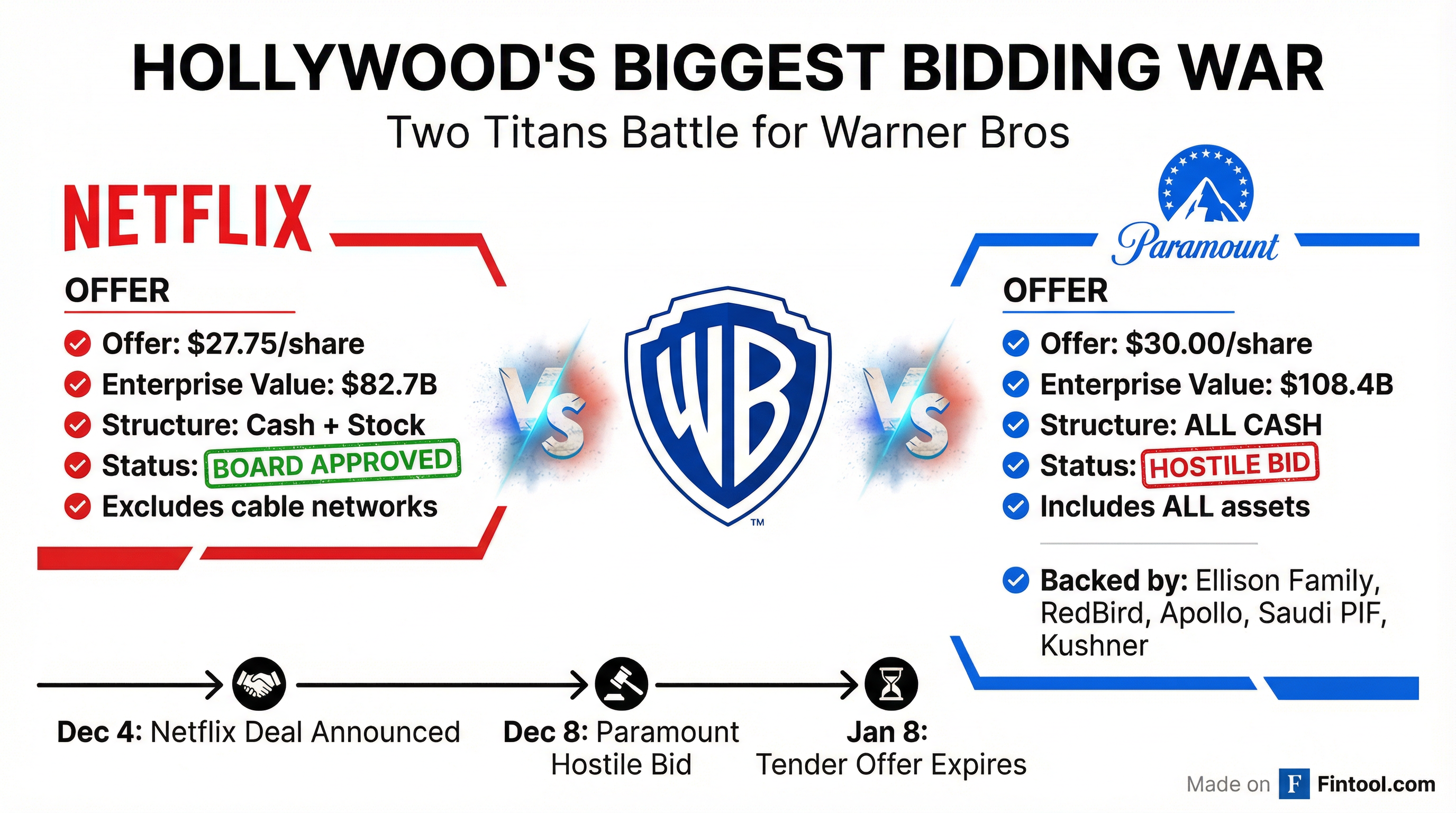

Just four days after Netflix+1.64% announced its landmark $72 billion deal for Warner Bros. Discovery+2.24%, Paramount Skydance+0.38% launched a hostile takeover bid worth $108.4 billion—going directly to shareholders with an all-cash offer that represents a 139% premium to WBD's undisturbed stock price.

This isn't just an M&A battle. It's a fight over the future of entertainment—with Trump administration politics, Middle Eastern sovereign wealth, and Hollywood's survival all in play.

The Tale of Two Offers

| Term | Netflix Offer | Paramount Offer |

|---|---|---|

| Price Per Share | $27.75 (cash + stock) | $30.00 (all cash) |

| Enterprise Value | $82.7 billion | $108.4 billion |

| Structure | $23.25 cash + $4.50 stock | 100% cash |

| Assets Included | Studios, HBO Max (excludes cable) | ALL assets including cable |

| Premium to Sept 10 Price | 121% | 139% |

| Board Status | Approved | Hostile |

Source: Company filings

What Happened

December 4, 2025: Netflix and Warner Bros. Discovery announced a definitive merger agreement valued at $82.7 billion enterprise value ($72 billion equity). The deal would give Netflix control of HBO, HBO Max, DC Studios, Harry Potter, Game of Thrones, and Lord of the Rings—while spinning off WBD's cable networks (including CNN) into a separate company.

December 8, 2025: Paramount Skydance went hostile. CEO David Ellison launched an all-cash tender offer directly to WBD shareholders at $30 per share—$18 billion more in cash value than Netflix's offer. The bid is backstopped by:

- Ellison family and RedBird Capital — equity financing

- Bank of America, Citi, and Apollo — $54 billion in debt commitments

- Saudi Arabia's Public Investment Fund (PIF) — non-voting equity

- Abu Dhabi's L'imad Holding — non-voting equity

- Qatar Investment Authority — non-voting equity

- Jared Kushner's Affinity Partners — non-voting equity

The Middle Eastern investors and Kushner's firm have agreed to forgo governance rights, structuring their investments to avoid CFIUS jurisdiction.

December 9, 2025: Warner Bros. Discovery's board said it would "carefully review" Paramount's offer but did not modify its recommendation for the Netflix deal, advising shareholders to "take no action at this time."

The tender offer expires January 8, 2026, unless extended.

Why Paramount Went Hostile

Paramount claims the WBD board never meaningfully engaged with its proposals despite submitting six offers over 12 weeks. In its hostile bid announcement, Paramount made three key arguments:

1. Superior Value

All-cash at $30/share versus Netflix's complex cash-and-stock structure at $27.75—which subjects WBD shareholders to Netflix stock volatility and collar provisions.

2. Complete Acquisition

Paramount is bidding for all of WBD, not leaving shareholders holding "a sub-scale and highly leveraged stub" in the spun-off cable networks (Global Networks).

3. Regulatory Certainty

Paramount argues its deal is "pro-consumer" and enhances competition, while Netflix's acquisition would give the streamer 43% of global SVOD subscribers—creating clear antitrust risk.

The Political Dimension

This deal has become politically charged in ways few M&A transactions have.

Trump's involvement: President Trump has publicly "raised questions" about the Netflix deal and said he would "be involved" in the review process. He stated neither bidding party "are friends of mine" and that he wanted "to do what's right."

Kushner connection: The presence of Jared Kushner's Affinity Partners in Paramount's financing consortium has raised influence-peddling concerns. Netflix has characterized the backing as "a who's who of Trump buddies... raising serious questions about influence-peddling, political favoritism, and national security risks."

Sovereign wealth: Saudi, Emirati, and Qatari state funds participating in the Paramount bid adds another geopolitical layer—though their non-voting structure is designed to minimize regulatory complications.

Netflix's Defense

At the UBS conference on December 8, Netflix co-CEOs Ted Sarandos and Greg Peters defended their deal:

-

On the hostile bid: "Entirely expected," said Sarandos, expressing confidence the Netflix deal will close.

-

On jobs: "In the offer that Paramount was talking about today, they also were talking about $6 billion of synergies. Where do you think synergies come from? Cutting jobs. So we're not cutting jobs, we're making jobs."

-

On content: The companies are "complementary"—Netflix dominates in volume while HBO represents prestige television's pinnacle.

Netflix has previously emphasized its strategic vision: capturing the 80% of TV viewing that neither Netflix nor YouTube currently wins.

The Stakes

Breakup Fees

- If WBD accepts Paramount's offer, it owes Netflix a $2.8 billion breakup fee

- If Netflix's deal falls through, Netflix owes $5.8 billion

What WBD Shareholders Get

| Scenario | Value Per Share | Cash Component | Certainty |

|---|---|---|---|

| Netflix Deal | $27.75 | $23.25 + NFLX stock | Board approved, regulatory risk |

| Paramount Deal | $30.00 | 100% cash | Hostile, financing questions |

Market Reaction (Dec 8)

- Paramount (PSKY): +9%

- Warner Bros. Discovery (WBD): +4%

- Netflix (NFLX): -3%

The Numbers in Context

Netflix Financial Performance (FY 2022-2024)

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue ($B) | $31.6 | $33.7 | $39.0 |

| Net Income ($B) | $4.5 | $5.4 | $8.7 |

| EBITDA ($B) | $6.0* | $7.3* | $10.7* |

| Market Cap | - | - | $435B |

*Values retrieved from S&P Global

Warner Bros. Discovery Financial Performance (FY 2022-2024)

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenue ($B) | $24.7* | $28.9* | $27.8* |

| Net Income ($B) | $(7.4) | $(3.1) | $(11.3) |

| EBITDA ($B) | $4.9* | $7.4 | $7.7* |

| Total Debt ($B) | $52.6* | $47.3* | $43.0 |

*Values retrieved from S&P Global

Paramount Skydance

Following the Skydance-Paramount merger completed in 2025, the combined company has a market cap of approximately $15 billion—making its $108 billion bid for WBD a transformational bet that would require massive external financing.

What Happens Next

Key dates:

- January 8, 2026: Paramount tender offer expires (unless extended)

- 10 business days from Dec 9: WBD board required to issue formal recommendation on Paramount bid

- 12-18 months: Expected timeline for Netflix deal regulatory approval

Critical questions:

-

Will WBD shareholders tender? The $2.25/share premium (plus all-cash certainty) is compelling. But financing concerns and political risk may give pause.

-

Can Paramount's financing hold? The consortium includes controversial participants. Any defections could collapse the bid.

-

How will regulators respond? Netflix at 43% global SVOD share faces serious antitrust scrutiny. But a Paramount-WBD combination also creates concentration concerns.

-

What does Trump do? The administration's involvement adds unprecedented uncertainty to what would normally be a straightforward regulatory process.

-

Does a third bidder emerge? Comcast+1.69% was in the original auction. Could they return?

Investment Implications

This battle is far from over. As eMarketer analyst Ross Benes noted: "The Warner Bros Discovery acquisition is far from over. Paramount will appeal to shareholders, regulators, and politicians to try to stymie Netflix. The battle could become prolonged."

For investors:

- WBD shareholders face a genuine choice between higher cash value (Paramount) and perceived deal certainty (Netflix)

- Netflix investors should monitor regulatory developments and any shift in WBD board recommendation

- Paramount investors are betting on a highly leveraged, politically charged transformation

- Broader media sector consolidation thesis remains intact regardless of outcome