Earnings summaries and quarterly performance for COMCAST.

Executive leadership at COMCAST.

Board of directors at COMCAST.

Asuka Nakahara

Director

David C. Novak

Director

Edward D. Breen

Lead Independent Director

Jeffrey A. Honickman

Director

Kenneth J. Bacon

Director

Louise F. Brady

Director

Madeline S. Bell

Director

Thomas J. Baltimore, Jr.

Director

Wonya Y. Lucas

Director

Research analysts who have asked questions during COMCAST earnings calls.

Craig Moffett

MoffettNathanson

9 questions for CMCSA

John Hodulik

UBS Group AG

9 questions for CMCSA

Michael Ng

Goldman Sachs

9 questions for CMCSA

Benjamin Swinburne

Morgan Stanley

7 questions for CMCSA

Jessica Reif Ehrlich

Bank of America Securities

5 questions for CMCSA

Michael Rollins

Citigroup

5 questions for CMCSA

Kutgun Maral

Evercore ISI

4 questions for CMCSA

Jonathan Chaplin

New Street Research

3 questions for CMCSA

Jessica Reif

Bank of America

2 questions for CMCSA

Jessica Reif Cohen

Bank of America Merrill Lynch

2 questions for CMCSA

Mike Rollins

Citigroup

2 questions for CMCSA

Steven Cahall

Wells Fargo & Company

2 questions for CMCSA

Recent press releases and 8-K filings for CMCSA.

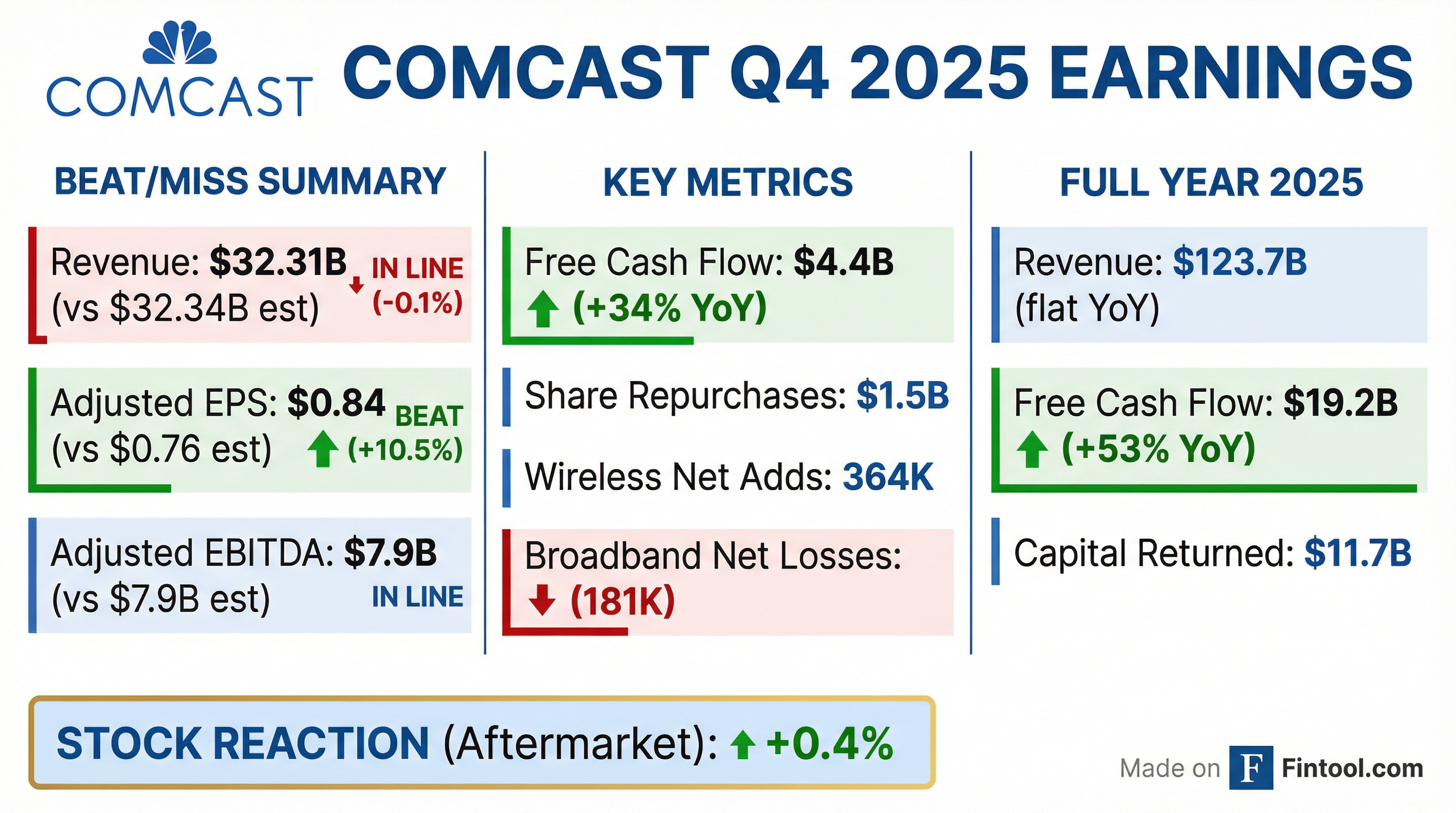

- Comcast lost 181,000 broadband subscribers in Q4 2025, froze broadband prices and rolled out simplified pricing with five-year locks and bundles to counter fiber and fixed-wireless competition.

- Broadband ARPU was $73.08 (up ~1.1% YoY) but is being diluted by promotions, with further downward pressure expected.

- Added 364,000 mobile lines in the quarter, bringing total to 9.3 million, and mobile revenue increased from $1.19 billion to $1.40 billion.

- Q4 revenue reached $32.31 billion, adjusted EPS was $0.84 (vs. $0.75 consensus), and free cash flow was $4.37 billion (above the $2.23 billion forecast).

- Peacock’s quarterly revenue grew 23% YoY to $1.6 billion, with its subscriber base rising to about 44 million.

- Total revenue grew 1%, Adjusted EBITDA declined 10%, Adjusted EPS declined 12%, and Free Cash Flow was $4.4 billion including a $2 billion tax benefit.

- In Connectivity & Platforms, broadband net losses were 181 k with ARPU up 1.1%, EBITDA down 4.5%; wireless added 364 k lines to total over 9 million (15% broadband penetration), and convergence revenue rose 2%.

- Theme Parks revenue increased 22% and EBITDA rose 24%, surpassing $1 billion EBITDA in a quarter for the first time, driven by Epic Universe attendance and per-cap spending.

- CapEx for 2025 was $14.4 billion (–5%), with $10.5 billion in connectivity & platforms and $3.6 billion in content & experiences; 2026 CapEx is expected to remain similar.

- Ended 2025 with net leverage at 2.3×, maintained the dividend at $1.32 per share (18th consecutive annual increase), and returned $2.7 billion to shareholders in the quarter, including $1.5 billion in share repurchases.

- Total company revenue grew 1% in Q4, while adjusted EBITDA declined 10% and adjusted EPS fell 12%; Q4 free cash flow was $4.4 B including a $2 B tax benefit

- Connectivity & Platforms saw broadband net losses of 181 k customers with ARPU up 1.1%; segment EBITDA fell 4.5%; wireless added 364 k lines, totaling 9 M lines (≈15% broadband penetration)

- Business Services revenue rose 6% and EBITDA 3%; Theme Parks revenue +22%, EBITDA +24% (Q4 parks EBITDA exceeded $1 B); Media revenue increased 6%, driven by Peacock growth

- Capital returned: $12 B to shareholders in 2025 including $7 B of share repurchases; dividend maintained at $1.32/share; completed Versant Media spin-off on Jan 2, 2026

- Revenue +1% in Q4, with theme parks, Peacock, and domestic wireless each delivering ~20% growth.

- Adjusted EBITDA –10% and EPS –12%; generated $4.4 B free cash flow (including $2 B tax benefit); returned $2.7 B to shareholders (incl. $1.5 B in buybacks).

- Connectivity segment saw 181k broadband net losses and ARPU +1.1%; convergence revenue +2% driven by 364k wireless adds, ~50% on free lines.

- Peacock revenue +>20% to $1.6 B, paid subs reached 44 M; Q4 losses of $552 M; full-year Peacock losses improved by >$700 M YoY.

- Full-year FCF of $19.2 B (record); 2025 capex $14.4 B; net leverage 2.3x; 2026 capex expected similar; dividend maintained at $1.32/sh.

- Comcast reported Q4 2025 revenue of $32.3 billion (vs. $31.9 billion in Q4 2024), Adjusted EBITDA of $7.9 billion (vs. $8.8 billion), and Adj. EPS of $0.84 (vs. $0.96); FY 2025 revenue was $123.7 billion (flat y/y), Adjusted EBITDA $37.4 billion, and Adj. EPS $4.31.

- Free Cash Flow was $4.4 billion in Q4 and $19.2 billion for FY 2025; returned $11.7 billion to shareholders via $6.8 billion in share repurchases and $4.9 billion in dividends.

- Connectivity & Platforms: Q4 residential revenue down 3.1% to $17.646 billion, domestic wireless revenue up 18%, 364 K wireless lines added in Q4; Business Services revenue up 5.8% to $2.59 billion.

- Content & Experiences: Theme Parks revenue up 21.9% to $2.893 billion, Studios revenue down 7.4% to $3.027 billion, Media revenue up 5.5% to $7.62 billion; Peacock revenue grew 23% to $1.6 billion with 44 million subscribers (+22%).

- Revenue of $32.31 B in Q4 (+1.2% YoY) and $123.707 B for FY (flat), with net income of $2.168 B in Q4 (–54.6%) and $19.998 B for FY (+23.5%).

- Adjusted EBITDA of $7.9 B in Q4 (–10.3%) and $37.384 B for FY (–1.8%).

- Free cash flow of $4.369 B in Q4 (+34%) and $19.235 B for FY (+53.4%); returned $2.7 B to shareholders in Q4 and $11.7 B for the full year.

- Achieved record 1.5 M wireless net line additions in 2025, totaling over 9 M lines and surpassing 15% broadband penetration.

- Completed tax-free separation of Versant Media on January 2, 2026 (1 share Versant per 25 Comcast).

- Reported 4Q revenue of $32.31 B (+1.2% y/y) and net income of $2.17 B (−54.6% y/y), with EPS of $0.60 and adjusted EPS of $0.84.

- Achieved $7.9 B adjusted EBITDA and $4.37 B free cash flow in the quarter; returned $2.7 B to shareholders via $1.2 B in dividends and $1.5 B in share repurchases.

- Domestic wireless delivered its best year ever with 1.5 M net line additions, reaching 9.3 M total lines, and initiated a simplified broadband go-to-market strategy.

- Peacock paid subscribers rose 22% to 44 M, driving 23% Q4 revenue growth; Theme Parks adjusted EBITDA grew 24% to over $1.0 B, fueled by the May opening of Epic Universe.

- Completed the tax-free separation of Versant Media on January 2, 2026, creating a more focused NBCUniversal.

- Versant Media Group began trading on Nasdaq under the ticker VSNT after Comcast distributed one Versant share for every 25 Comcast shares; listing completed Jan. 2.

- Versant shares plunged roughly 13–15% to about $40.8, valuing the new company near $6 billion on its first trading day.

- The spun-off assets, which generate approximately $7 billion in annual revenue, include cable networks such as CNBC, USA Network and SYFY, while Comcast retains NBC, Peacock, Telemundo and Sky.

- Comcast shares dipped as markets repriced around the separated assets, in line with Comcast’s prior warning of a likely share-price decline post-spin-off.

- VERSANT begins trading on Nasdaq under ticker VSNT following completion of Comcast spin-off.

- Spin-off delivered 100% of VERSANT Class A and Class B common stock via one share for every 25 Comcast shares to holders as of Dec 16, 2025, with distribution after market close Jan 2, 2026.

- The newly independent company operates in four core markets—political news, business news, golf and athletics, and sports and genre entertainment—through brands such as CNBC, USA Network, Golf Channel and others.

- VERSANT starts as a standalone public company with a strong balance sheet and substantial cash flow to fund growth.

- On December 15, 2025, Comcast filed amended and restated articles and an Articles of Amendment to designate a new series of Class A Equivalent Preferred Stock to facilitate its planned spin-off of Versant Media Group, Inc. (“SpinCo”).

- The Board fixed the series at 872,792 shares, and Comcast issued 872,791.0278 Preferred Shares to its wholly-owned subsidiaries in exchange for Class A common stock at a ratio of 0.001 Preferred Shares per common share, preventing the subsidiaries from receiving SpinCo common stock in the distribution.

- Each Preferred Share is convertible into Class A common stock at an initial 1,000:1 conversion rate (prorated for fractions and adjustable for stock dividends or splits) and is redeemable—optionally prior to the spin-off record date and mandatorily after the spin-off—at the prevailing conversion rate plus an adjustment tied to SpinCo distribution metrics.

- Holders of Class A Equivalent Preferred Stock vote alongside Class A and Class B common stock as a single class on all matters, with votes determined by the then-applicable conversion rate, and have no separate special voting rights.

Quarterly earnings call transcripts for COMCAST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more