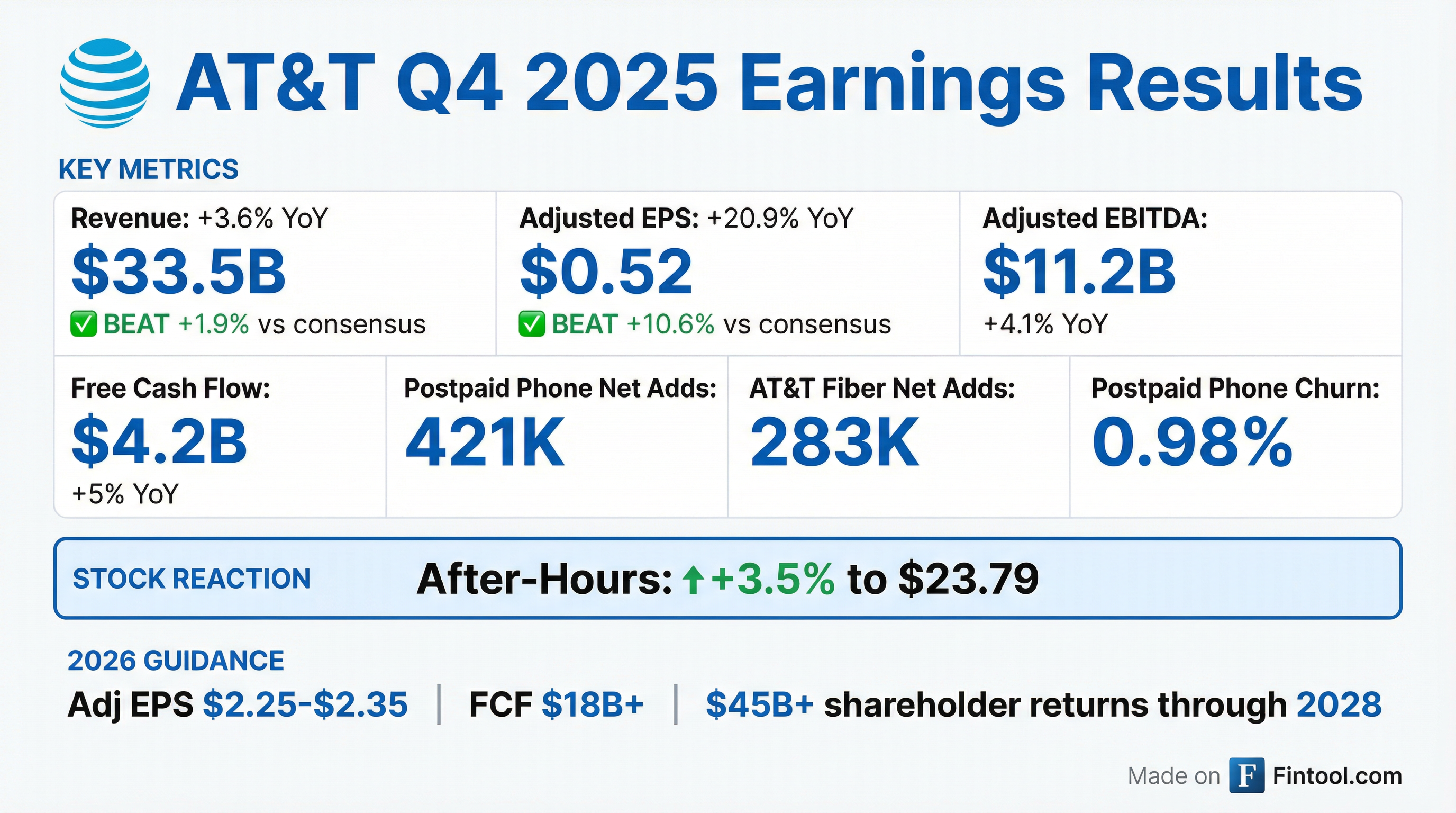

Earnings summaries and quarterly performance for AT&T.

Executive leadership at AT&T.

John Stankey

Chief Executive Officer

David McAtee

Senior Executive Vice President and General Counsel

Jeff McElfresh

Chief Operating Officer

Lori Lee

Global Marketing Officer and Senior Executive Vice President-HR and International

Pascal Desroches

Senior Executive Vice President and Chief Financial Officer

Board of directors at AT&T.

Research analysts who have asked questions during AT&T earnings calls.

Benjamin Swinburne

Morgan Stanley

7 questions for T

John Hodulik

UBS Group AG

7 questions for T

Michael Rollins

Citigroup

7 questions for T

Peter Supino

Wolfe Research

7 questions for T

Sebastiano Petti

JPMorgan Chase & Co.

7 questions for T

Michael Ng

Goldman Sachs

4 questions for T

David Barden

Bank of America

3 questions for T

Bryan Kraft

Deutsche Bank AG

2 questions for T

Drew McReynolds

RBC Capital Markets

2 questions for T

James Schneider

Goldman Sachs

2 questions for T

Jérome Dubreuil

Desjardins Group

2 questions for T

Kannan Venkateshwar

Barclays PLC

2 questions for T

Maher Yaghi

Scotiabank

2 questions for T

Michael Funk

Bank of America

2 questions for T

Samuel McHugh

BNP Paribas

2 questions for T

Stephanie Price

CIBC World Markets

2 questions for T

Vince Valentini

TD Securities

2 questions for T

John Hudlick

UBS

1 question for T

Timothy Horan

Oppenheimer & Co. Inc.

1 question for T

Recent press releases and 8-K filings for T.

- AT&T expects to end 2026 with over 40 million fiber passings (up from 36 million post-Lumen) and a 5 million passings annual build rate, targeting over 50 million by the end of its three-year guidance period.

- Integration of the Lumen Mass Markets assets (4 million passings, 1 million subscribers, ~25% penetration) will weigh on Q1 2026 results, with EBITDA growth in the low single digits and free cash flow of $2–$2.5 billion due to integration and transaction costs.

- Starting in Q1 2026, AT&T will report in two segments—advanced connectivity and legacy communications—to better showcase returns on fiber/5G investments and progress on sunsetting copper.

- Capital allocation includes an annual $8 billion dividend, $8 billion in share buybacks over the next three years, and a target of 2.5× net debt/EBITDA within three years, preserving flexibility for strategic investments.

- AT&T will focus on integrating the Lumen Mass Markets assets (4 million passings, 1 million subs), closing the EchoStar deal, and ramping its fiber network to 40 million passings by year-end—building at a 5 million passings annual pace toward 50 million over the next three years.

- Beginning in Q1 2026, AT&T will report under two segments—Advanced Connectivity (fiber/5G investments) and Legacy Communications—to better highlight returns on its growth assets and progress in sunsetting copper.

- Q1 2026 is expected to deliver low-single-digit EBITDA growth and $2 billion–$2.5 billion free cash flow due to integration and transaction costs; full-year targets include >30% advanced home internet revenue growth and 2–3% wireless service revenue growth.

- Capital allocation for 2026 assumes >$18 billion in free cash flow directed to an $8 billion dividend and $8 billion share buyback, with a path to reduce net leverage to 2.5× within three years while preserving capacity for strategic investments.

- AT&T will focus in 2026 on integrating the Lumen Mass Markets assets, closing the EchoStar spectrum deal, and executing its fiber build to reach 4 million organic passings and a 5 million passings annual run rate by year-end, targeting 40 million total passings by exit 2026.

- In Q1 2026, consolidation of Lumen’s 4 million passings (at 25% penetration vs. 40% in AT&T’s core) will lower reported penetration and convergence rates, with EBITDA growth of low single digits and free cash flow of $2 billion–$2.5 billion after integration and transaction costs.

- Beginning in Q1, AT&T will report in two segments—Advanced Connectivity and Legacy Communications—to spotlight returns on fiber/5G investments and track the wind-down of its legacy network.

- Over the next three years, AT&T plans to expand to over 50 million fiber passings (with 5 million annual builds), funded by strong free cash flow after an $8 billion dividend, $8 billion buybacks, and aiming to reduce leverage to 2.5× EBITDA while retaining flexibility for strategic opportunities.

- Pascal Desroches, AT&T’s CFO, will speak on March 9 at 8:00 a.m. ET at the Deutsche Bank Media, Internet & Telecom Conference to review the company’s progress on its multi-year growth strategy.

- Beginning with Q1 2026, AT&T will report three new segments—Advanced Connectivity (≈ 90% of 2025 revenues), Legacy and Latin America—to improve visibility into its 5G and fiber investments.

- The company closed its acquisition of Lumen’s Mass Markets fiber business on February 2, adding over 1 million fiber customers across 4 million locations, which will be reflected in Q1 2026 results.

- AT&T reiterates its 2026 targets: Q1 free cash flow of $2.0–2.5 billion, full-year adjusted EBITDA growth of 3–4%, and $45 billion+ in shareholder returns through 2028.

- Following its EchoStar transaction, AT&T expects net debt/adjusted EBITDA of ≈ 3.2x, declining to ≈ 3.0x by year-end 2026.

- CEO succession on track: Victor will join as CEO designate in May and assume full responsibilities in July, with management focused on executing current strategic plans and further deleveraging.

- Wireless outlook: Subscriber growth in 2026 is expected to mirror 2025 levels amid slower immigration; ARPU will continue improving but may not reach positive growth by year-end, as TELUS emphasizes value-based bundles over aggressive loading tactics.

- Fiber and capital intensity: Capital spending is targeted at ≤10% of revenue, reflecting largely completed fiber builds in core markets; future investments will shift toward AI and digital platforms while copper networks are phased out regionally.

- Deleveraging and Health monetization: Net debt/EBITDA is projected to fall to 3.3x by end-2026 and 3.0x by 2027, supported by tower transactions and potential asset sales; TELUS Health is in a formal sale process with over 75 inbound interests and pitch books due within 30 days.

- Digital strategy: TELUS Digital will refocus on external AI and digital solutions, reintegrating customer-experience services into core operations while exploring future transaction options for the external CX business.

- AT&T reconfirmed its multi-year guidance with 2–3% wireless service revenue growth through 2028 (volume-driven) and 3–4% EBITDA growth in 2026, ramping to 5%+ by 2028, backed by a $4 billion cost reduction target.

- AT&T’s convergence strategy drives growth: it serves customers across 36 million fiber passings, expects 40 million by year-end, and emphasizes fiber + wireless bundles that deliver industry-leading brand love, NPS and low churn.

- Closed the Lumen Mass Markets acquisition, adding 4 million passings, and is scaling its Gigapower build engine to 1 million passings per year to exceed 60 million total fiber passings by 2030.

- Advancing wireless network modernization, with half of radio rip-and-replace complete and full deployment in 18 months, yielding higher throughput, better reliability, lower operating costs and opening the network to new hardware vendors.

- Accelerating copper network decommissioning, with 85% of wire centers discontinued for sale and 30% cleared for full shutdown, and introducing new reporting to separate Advanced Connectivity from legacy services to track migration progress.

- Updated multi-year guidance: targeting 2–3% wireless service revenue growth through 2028 and 3–4% EBITDA growth in 2026, ramping to 5%+ by 2028.

- Closed Lumen Mass Markets acquisition, adding 4 million fiber passings to reach 36 million today and 40 million by year-end, with a goal of 60 million by 2030; build engine scaled to 1 million passings/year.

- Network modernization: ~50% of wireless radios already replaced, full rip-and-replace expected in 18 months to boost performance, cost efficiency and enable open standards.

- Copper sunset acceleration: 85% of wire centers discontinued for sale and 30% eligible for shutdown, aiming to retire legacy copper by end-2029 and debuting separate “Advanced Connectivity” reporting.

- AT&T closed the Lumen Mass Markets acquisition, adding 4 million fiber passings to reach 36 million, targeting 40 million by year-end and 60 million by 2030 with a 1 million homes/year build run rate.

- Emphasized a disciplined convergence strategy where converged customers exhibit lowest churn and highest NPS, supporting guidance for 2%–3% wireless service revenue growth through 2028 and 3%–4% EBITDA growth in 2026, ramping to 5%+ by 2028.

- Network modernization includes a wireless rip-and-replace program halfway complete (to finish in ~18 months) for improved performance and cost efficiency , and a copper decommission plan to sunset most legacy services by 2029 with 85% of wire centers sales-discontinued and 30% ready for shutdown.

- Positioning for enterprise AI, leveraging the largest fiber and modern 5G network, and partnering with Amazon LEO and AST to integrate satellite connectivity as a complementary service.

- Closed the acquisition of substantially all of Lumen’s Mass Markets fiber business on February 2, adding over 1 million subscribers across 4 million locations and expanding AT&T Fiber into 32 states.

- With the Lumen assets, AT&T Fiber now reaches 36 million total locations, and is expected to exceed 40 million by end-2026 and 60 million by 2030.

- Expanded fiber footprint enhances AT&T’s ability to offer converged home internet and 5G services to over half of U.S. households, driving growth in high-value bundled customers.

- Reiterated full-year 2026 and multi-year guidance for adjusted EBITDA and EPS growth, higher free cash flow through 2028, and $45 billion+ in capital returns (2026–2028); net debt/EBITDA projected to peak at 3.2x post-EchoStar closing and fall to 3.0x by end-2026.

- AT&T expanded its fiber footprint from 32 million to 36 million locations passed post-Lumen and expects to exceed 40 million by end-2026, driving higher ARPU and lower churn among converged wireless + fiber customers.

- Integration of Lumen's 4 million fiber passes (25% penetration, <20% convergence) is underway, with 2026 build plans of 4 million organic and 1 million Lumen locations, ramping to 5 million annual builds from 2027.

- Following the EchoStar spectrum acquisition (part of a $30 billion total investment with Lumen), AT&T is modernizing its network to deploy new spectrum by end-2027, with fixed wireless growth set to accelerate post-refresh.

- AT&T targets $4 billion in cost savings over 2026–2028 (vs prior $3 billion plan), expects free cash flow to improve sequentially after Q1 headwinds, and full EBITDA accretion from acquisitions by 2028.

Fintool News

In-depth analysis and coverage of AT&T.

AT&T CFO Lays Out Fiber-First Playbook at Barclays: 60M Locations by 2030, Accretion in 2028

AT&T and Amazon Forge 'Fiber-to-Space' Alliance to Challenge Starlink Dominance

AT&T Abandons Downtown Dallas for Suburban Plano in $2.7 Billion Property Value Shock

Quarterly earnings call transcripts for AT&T.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more