Earnings summaries and quarterly performance for Lumen Technologies.

Executive leadership at Lumen Technologies.

Board of directors at Lumen Technologies.

Christopher Capossela

Director

Diankha Linear

Director

Hal Stanley Jones

Director

James Fowler

Director

Kevin P. Chilton

Director

Martha Helena Béjar

Director

Michelle J. Goldberg

Director

Quincy Allen

Director

Stephen McMillan

Director

T. Michael Glenn

Chairman of the Board

Research analysts who have asked questions during Lumen Technologies earnings calls.

Frank Louthan

Raymond James

6 questions for LUMN

Gregory Williams

TD Cowen

6 questions for LUMN

Michael Rollins

Citigroup

6 questions for LUMN

Batya Levi

UBS

5 questions for LUMN

Sebastiano Petti

JPMorgan Chase & Co.

5 questions for LUMN

James Schneider

Goldman Sachs

3 questions for LUMN

Jonathan Chaplin

New Street Research

3 questions for LUMN

Nicholas Del Deo

MoffettNathanson

3 questions for LUMN

Nick Del Deo

MoffettNathanson LLC

3 questions for LUMN

David Barden

Bank of America

2 questions for LUMN

Eric Luebchow

Wells Fargo

2 questions for LUMN

Michael Funk

Bank of America

2 questions for LUMN

Michael Ng

Goldman Sachs

2 questions for LUMN

Samuel McHugh

BNP Paribas

2 questions for LUMN

Batya Levy

UBS Investment Bank

1 question for LUMN

Sam McHugh

BNP Paribas S.A.

1 question for LUMN

Recent press releases and 8-K filings for LUMN.

- Lumen Technologies has significantly rebooted its capital structure through $13 billion in Private Connectivity Fabric (PCF) deals and the sale of its consumer fiber business to AT&T, resulting in debt trading above 95% of par and a 400% return for equity investors over the past two years.

- The company is strategically pivoting to become the trusted network for AI, targeting the east-west market (inter-cloud/data center data movement) which is an $11 billion Total Addressable Market (TAM) growing at a 13% CAGR, projected to reach $20 billion by 2030.

- Lumen plans to invest $500 million in 2026 to build a programmable network for AI workloads, aiming for 90% coverage of existing cloud/AI on-ramps by the end of 2026. Its Network as a Service (NaaS) platform, launched in January 2024, has grown to 2,000 customers with 3,800 active ports, contributing $117 million in digital revenue in 2025 with a target of $500-$600 million by 2028.

- The company is also pursuing modernization and simplification efforts, delivering $400 million in savings in 2025 and targeting $700 million in 2026, with a goal of $1 billion by 2027.

- Lumen Technologies outlined key financial goals, targeting a return to free cash flow (FCF) growth, Adjusted EBITDA inflection exiting 2026, and a return to business revenue growth.

- The company has significantly transformed its capital structure, reducing approximately $5.5 billion of debt and achieving a gross leverage of <3.8x as of December 31, 2025, with ~$200 million in annual interest expense savings from refinancings.

- Lumen is strategically repositioning as "The Trusted Network for AI," focusing on expanding its network footprint and capacity, and innovating a new digital platform to deliver ubiquitous, universal connectivity to enterprises.

- The company has secured nearly $13 billion in Private Connectivity Fabric (PCF) deals, projecting PCF revenue to reach $116 million to $200 million in 2026F and grow to $550 million to $650 million by 2030F.

- Lumen aims to increase its Strategic Revenue mix to over 50% by 2026 and over 70% by 2030, reflecting a shift from its 2024 strategic revenue of $4,322 million.

- Lumen Technologies is undergoing a significant transformation, pivoting to become a "digital network services company" focused on Cloud 2.0 and AI, with a goal to achieve business segment revenue growth by 2028. This strategy involves simplifying its product portfolio, expanding its physical network, and building a digital platform, including its Network as a Service (NaaS) offering, which has seen its customer base double to 2,000 customers.

- The company has substantially transformed its capital structure, securing $13 billion in Private Connectivity Fabric (PCF) deals and selling its consumer fiber business to AT&T, which enabled the paydown of $4.8 billion of highly restrictive super priority debt and reduced interest expense by almost half a billion dollars. As a result, Lumen's debt is now trading at greater than 95% of par, it has received ratings upgrades, and its leverage ratio is below 4.

- Lumen projects its EBITDA margins to rise from the mid-to-high 20s to the mid-30s, and capital intensity (excluding PCF) to decrease by 25%. The company plans to invest $500 million in 2026 to build a programmable network for AI-driven workloads, alongside $1 billion annually for PCF and $1.5 billion for foundational IT improvements, all of which are fully funded and expected to generate positive free cash flow.

- Equity investors have experienced a 400% return in the past two years, with the average stock price increasing from slightly above $1 to slightly above $7.

- Lumen is repositioning as the "trusted network for AI" and a digital network services company, focusing on providing high-bandwidth, low-latency, programmable networks for enterprises in the Cloud 2.0 and AI economy.

- The company has successfully transformed its capital structure, reducing interest expense by almost half a billion dollars, with debt now trading at over 95% of par and leverage at approximately 3.8 times with a near-term target of 3-3.5 times.

- Lumen has secured $13 billion in Private Connectivity Fabric (PCF) deals, positioning itself as critical infrastructure for hyperscalers building AI, with PCF cash inflows being front-end loaded.

- Significant network expansion is underway, including growing 400 gig RapidRoutes to 49 new routes and 18 expanded routes by year-end, increasing metro gateways to 35 in 32 markets, and expanding data center connectivity to 139 data centers in 28 markets by year-end 2026.

- The company is committed to EBITDA growth this year and expects a return to revenue growth in a couple of years, supported by modernization and simplification efforts targeting $1 billion in savings by 2027.

- Lumen Technologies announced the completion of its turnaround phase and a multi-year growth plan at its 2026 Investor Day, pivoting to an enterprise-focused, technology infrastructure company.

- The company has strengthened its financial foundation by securing nearly $13 billion in Private Connectivity Fabric (PCF) deals, reducing debt to under $13 billion, and achieving approximately $500 million in annual interest savings and $1 billion in reduced capex.

- Strategic growth initiatives include expanding its network to 58 million fiber miles by 2031 and growing its Network-as-a-Service (NaaS) platform to over 2,000 customers.

- Lumen targets expanding adjusted EBITDA margins from 27.1% in 2025 to approximately the mid 30% range by 2030 and expects to deliver Business Segment Revenue growth in 2028.

- Lumen Technologies has doubled its Network-as-a-Service (NaaS) customer base to more than 2,000 businesses since Q3 2025.

- This growth is attributed to enterprises rearchitecting networks for AI-driven and multi-cloud workloads, and Lumen's expansion of its Internet On-Demand capabilities to over 10 million new locations.

- In 2025, Lumen was named NaaS Provider of the Year - North America by Mplify.

- Lumen Technologies has expanded its enterprise networking portfolio with the Lumen Multi-Cloud Gateway and enhanced metro data center connectivity across major U.S. markets.

- These new capabilities are designed to accelerate data movement across distributed AI environments, aiming to lower complexity and total cost for enterprises.

- The Multi-Cloud Gateway (MCGW) is a software-defined, self-service routing layer providing private, high-capacity connectivity among enterprises, hyperscalers, and emerging cloud platforms.

- Enhanced Metro Ethernet & IP Services offer high-capacity, dedicated connectivity up to 100Gbps between regional data centers and edge locations, and up to 400Gbps at key cloud data centers in 16 upgraded U.S. markets.

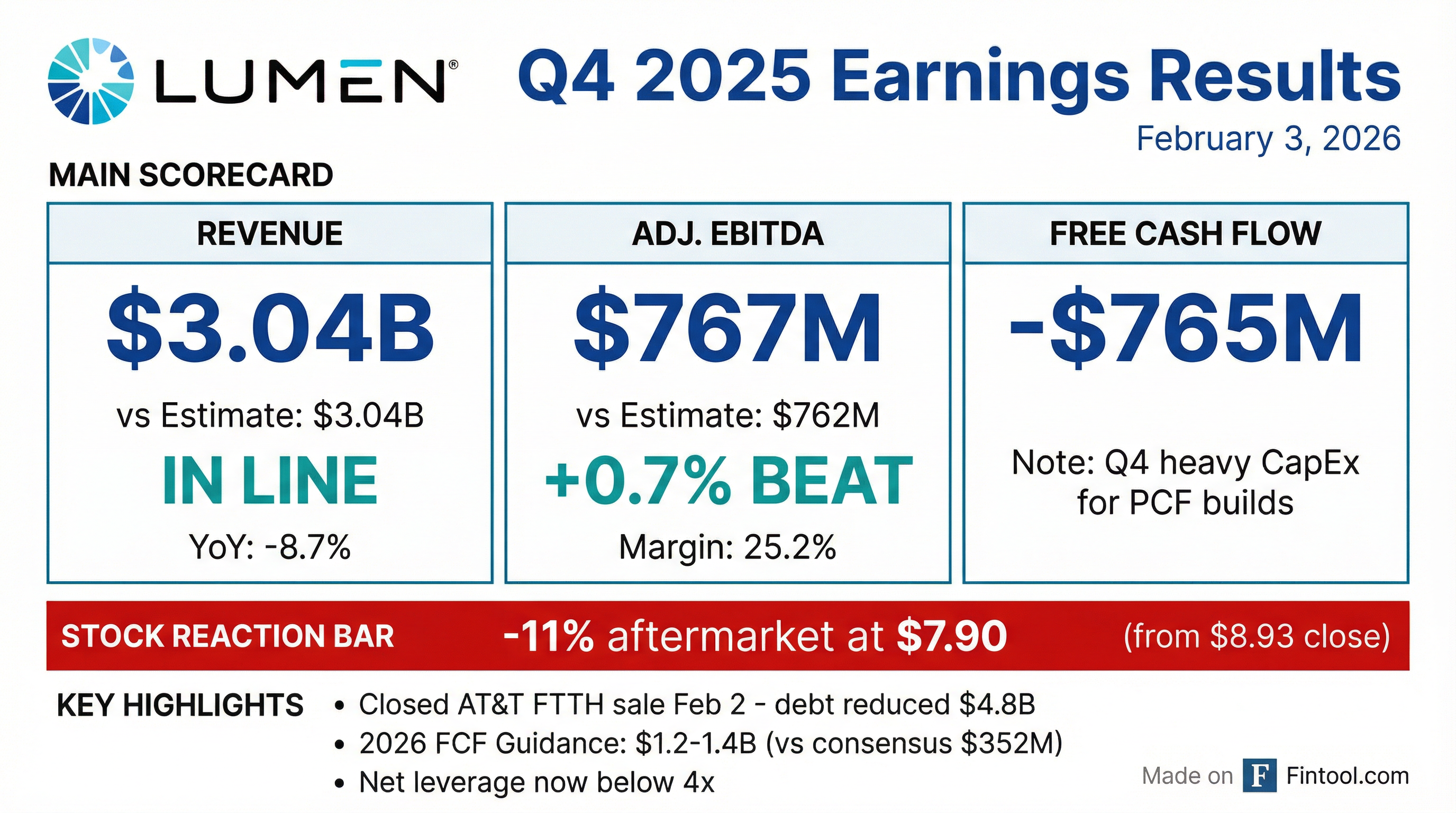

- Lumen Technologies reported Q4 2025 total revenue of $3.041 billion, an 8.7% decline, and Adjusted EBITDA of $767 million. Free cash flow was -$765 million, partly due to a $400 million delayed tax refund expected in the first half of 2026.

- For 2026, the company expects Adjusted EBITDA in the range of $3.1 billion to $3.3 billion, projecting an inflection to growth. Total capital expenditures are guided between $3.2 billion and $3.4 billion, and free cash flow between $1.2 billion and $1.4 billion.

- Lumen significantly improved its capital structure, reducing debt to under $13 billion after the $5.75 billion sale of its fiber to the home business to AT&T. This, along with other refinancing, reduced annual interest expense by nearly $500 million in the last 12 months.

- The company is on track for $1 billion in run rate cost reductions by the end of 2027, having achieved over $400 million in 2025. 52% of North American enterprise revenue now comes from growth products, supporting targets for business revenue growth by 2028 and total revenue growth by 2029.

- Lumen completed its AT&T FTTH transaction on February 2, 2026, which reduced debt by $4.8 billion, eliminated all Super Priority Bonds, and is expected to reduce Capex by over $1 billion annually and interest expense by an additional $300 million at close, bringing net leverage below 4x.

- For Q4 2025, Lumen reported Total Revenue of $3041 million and Adjusted EBITDA (excluding special items) of $767 million, with Free Cash Flow at -$765 million, which were in-line with expectations.

- The company provided a 2026 financial outlook, projecting Adjusted EBITDA between $3.1 billion and $3.3 billion and Free Cash Flow between $1.2 billion and $1.4 billion. Capital expenditures are expected to be $3.2 billion to $3.4 billion.

- Lumen achieved 29% quarter-over-quarter growth in Active NaaS Customers and reached nearly $13 billion in Private Connectivity Fabrics (PCF) Deals Signed to Date.

- Lumen Technologies completed its transaction with AT&T, utilizing $4.8 billion in net proceeds to pay off super priority bonds, reducing total debt to less than $13 billion and annual interest expense by nearly $500 million.

- For Q4 2025, the company reported total revenue of $3.041 billion, adjusted EBITDA of $767 million, and negative free cash flow of $765 million, with a $400 million tax refund anticipated in the first half of 2026.

- The 2026 financial outlook projects adjusted EBITDA between $3.1 billion and $3.3 billion, total capital expenditures between $3.2 billion and $3.4 billion, and free cash flow between $1.2 billion and $1.4 billion.

- Lumen achieved over $400 million in run rate cost reductions in 2025, targeting $700 million by year-end 2026, and expects business revenue growth by 2028, supported by nearly $13 billion in PCF deals.

Fintool News

In-depth analysis and coverage of Lumen Technologies.

Quarterly earnings call transcripts for Lumen Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more