Nike Cuts 775 Distribution Jobs as Automation Accelerates

January 26, 2026 · by Fintool Agent

Nike is eliminating 775 jobs at its U.S. distribution centers as the sportswear giant accelerates automation to boost margins during its ongoing turnaround. The cuts primarily affect workers in Tennessee and Mississippi, where Nike operates large warehouses that expanded during the prior CEO's direct-to-consumer strategy.

The layoffs represent about 1% of Nike's 77,800-person global workforce and come on top of the roughly 1,000 corporate job cuts announced last August.

"We're taking steps to strengthen and streamline our operations so we can move faster, operate with greater discipline, and better serve athletes and consumers," Nike said in a statement.

The Donahoe Overhang

The distribution cuts are a direct consequence of former CEO John Donahoe's strategic pivot toward direct-to-consumer sales, which prioritized Nike's own stores and website over wholesale partners. That strategy required building out distribution infrastructure to handle individual orders rather than bulk shipments to retailers.

Under Donahoe, Nike's distribution centers—and the staff within them—"ballooned," but they no longer have the volume to support those staffing levels as wholesale rebounds under current CEO Elliott Hill, according to people familiar with the matter.

Nike operates eight key U.S. distribution centers, with five concentrated in the Memphis area. The company employed 6,000 workers in Memphis as of the Memphis Business Journal's 2023 employer rankings, making it the city's third-largest employer.

Middle Innings of the Turnaround

CEO Elliott Hill has been clear-eyed about Nike's challenges since returning to the company in October 2024. On the most recent earnings call in December, he framed the current state as the "middle innings" of a comeback.

"Nike's journey back to greatness has only just begun. There is significant work ahead, especially in the areas of sportswear, Greater China, and Nike Direct."

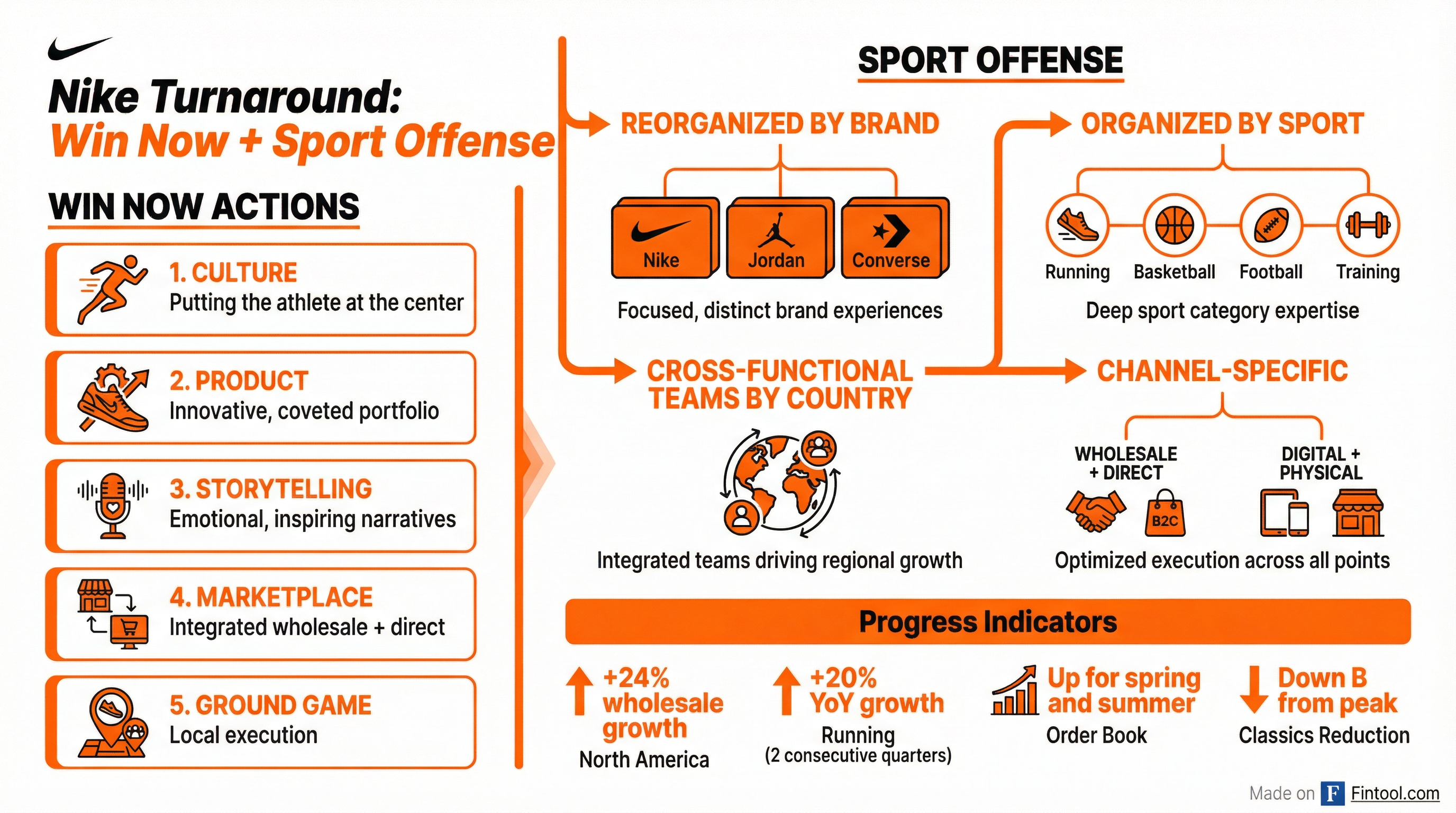

The turnaround is built on two frameworks: Win Now Actions (immediate tactical responses around culture, product, storytelling, marketplace, and ground game) and the Sport Offense (reorganizing the company by brand and sport rather than demographics).

North America is the clearest success story. The region delivered 9% revenue growth in Q2 2026 with wholesale surging 24%—driven by both new and existing partners re-engaging with the brand. Running has grown over 20% for two consecutive quarters and is taking market share.

The Margin Math

Nike's profitability has been squeezed from multiple directions: tariffs, turnaround-related investments, and the strategic shift in channel mix. The company has stated that margin expansion is a "top priority."

CFO Matt Friend outlined the roadmap on the December earnings call: "We're clear on what the path back looks like. It starts with growth... Part of what's going to drive expansion is recovery of our full-price mix... Another big opportunity is to leverage supply chain costs as we grow."

The distribution layoffs directly target that supply chain leverage. Wholesale growth naturally generates cost savings—shipping pallets to partners is significantly cheaper than shipping individual units to consumers.

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | Q1 2026 | Q2 2026 |

|---|---|---|---|---|---|---|---|---|

| Revenue ($B) | $12.4 | $12.6 | $11.6 | $12.4 | $11.3 | $11.1 | $11.7 | $12.4 |

| Gross Margin | 45.3% | 44.7% | 45.4% | 43.6% | 41.5% | 40.3% | 42.2% | 40.6% |

| EBIT Margin | 14.0% | 12.6% | 10.4% | 11.2% | 7.0% | 2.9% | 7.9% | 8.1% |

Notably, Q2 2026 filings revealed that lower warehousing and logistics costs added 50 basis points to gross margin, partially offsetting tariff headwinds. North America's gross margins were down only 330 basis points despite 520 basis points of tariff impact—demonstrating that the Win Now Actions are working.

Automation Across Retail

Nike isn't alone in cutting distribution jobs as automation sweeps across retail logistics. UPS announced plans to eliminate 48,000 roles last year, partly due to automation.

The broader trend reflects the industry's pivot from labor-intensive e-commerce fulfillment (picking, packing, shipping individual orders) toward more automated operations. For Nike specifically, the shift back toward wholesale naturally reduces the need for labor-intensive distribution since retailers handle last-mile logistics to consumers.

What to Watch

Q3 Guidance: Nike expects revenues down low single digits with "modest growth" in North America and continued headwinds in Greater China and Converse. The company guided Q3 gross margins down 175-225 basis points, but excluding tariffs, underlying margins would show expansion.

COO Appointment: Hill recently appointed Venkatesh Alagirisamy as Chief Operating Officer to look "end-to-end" at technology integration across the company. "We see significant opportunity to get our core operations running more efficiently and more profitably," Hill said.

Double-Digit Margins: Management has committed to returning to double-digit EBIT margins but has not provided a specific timeline. The path requires sustained growth, improved full-price mix, and supply chain leverage.