EEOC Takes Nike to Court Over DEI Policies in Landmark 'Reverse Discrimination' Probe

February 4, 2026 · by Fintool Agent

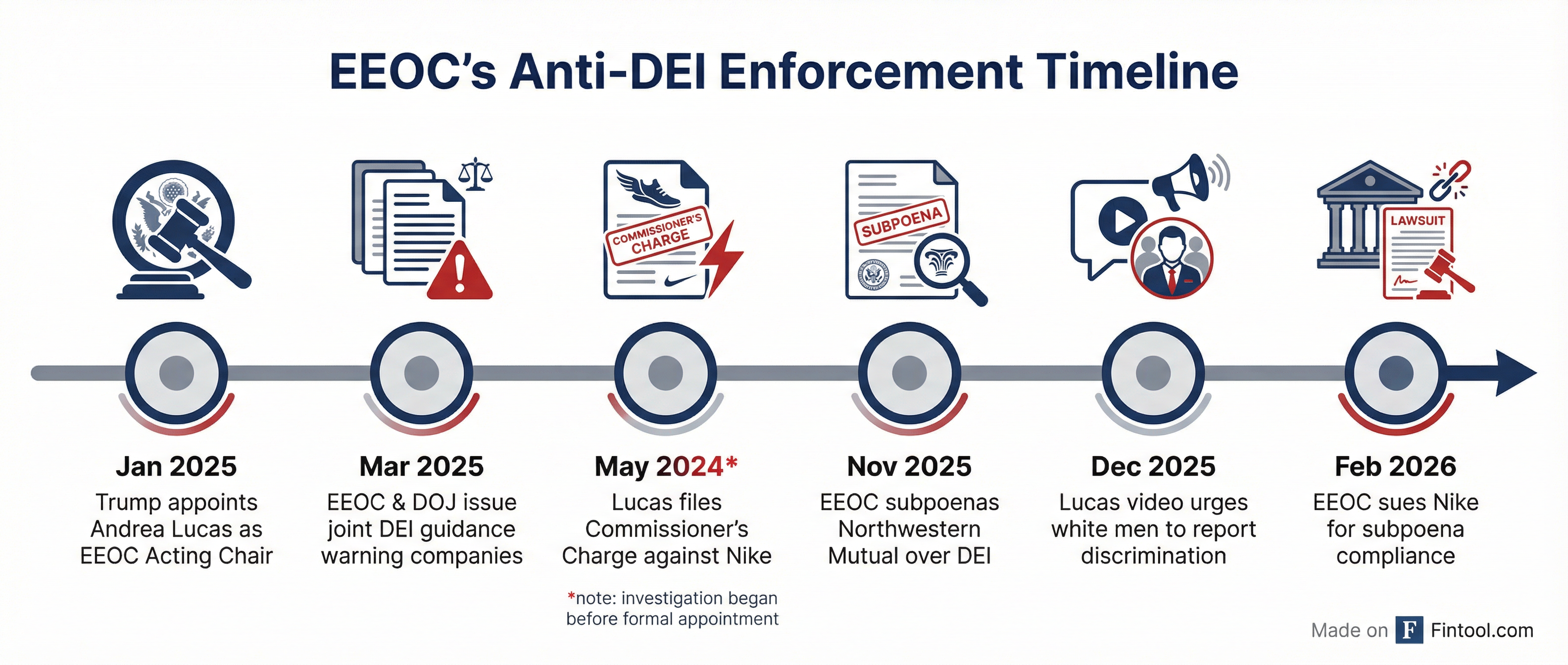

The Equal Employment Opportunity Commission filed a subpoena enforcement action against Nike in federal court Wednesday, demanding the sportswear giant turn over documents related to an investigation into alleged discrimination against white employees—the most significant legal escalation yet in the Trump administration's campaign against corporate diversity initiatives.

The filing in the U.S. District Court for the Eastern District of Missouri marks the first time the EEOC has sought court intervention against a major consumer brand over so-called "reverse discrimination" tied to diversity, equity, and inclusion programs.

What the EEOC Alleges

EEOC Chair Andrea Lucas launched a "commissioner's charge" against Nike in May 2024 to investigate whether the company's DEI objectives resulted in "a pattern or practice of disparate treatment against white employees."

The agency's subpoena seeks sweeping information from Nike, including:

- Layoff selection criteria: How the company determines which employees are terminated during workforce reductions

- Race and ethnicity tracking: Data on Nike's workforce demographics and how the company monitors diversity

- 16 allegedly race-restricted programs: Details on mentoring and career development initiatives that the EEOC claims may provide preferential treatment based on race

Nike has not fully complied with the EEOC's administrative requests, prompting the agency to seek judicial intervention.

Nike's DEI Commitments Under Scrutiny

Nike has been among the most vocal Fortune 500 companies on diversity. In its FY 2024 proxy statement, the company outlined ambitious representation targets for fiscal 2025:

| Target | Goal | Status (2023) |

|---|---|---|

| Women in global corporate workforce | 50% | 51% (surpassed) |

| Women in leadership (VP+) globally | 45% | 44% |

| U.S. racial/ethnic minorities in workforce | 35% | 41% (surpassed) |

| U.S. minorities at director level+ | 30% | 34% (surpassed) |

The company's 10-K describes DEI as a "strategic priority," noting that it aims "to foster an inclusive and accessible workplace through recruitment, development and retention of talent from diverse experiences and backgrounds."

Nike also disclosed significant investments in historically Black colleges and universities (HBCUs) and Hispanic-serving institutions (HSIs), committing $10 million over five years for scholarships and academic partnerships—spending $2.95 million in 2023 alone.

Layoffs Add Context to Investigation

The EEOC probe comes as Nike undergoes significant workforce reductions under CEO Elliott Hill's "Win Now" turnaround plan. The company recently announced 775 layoffs at U.S. distribution centers in Tennessee and Mississippi as part of a supply-chain consolidation.

Those cuts follow approximately 740 job reductions at Nike's Beaverton, Oregon headquarters in spring 2024, tied to an anticipated $2 billion cost-savings initiative. As of May 2025, Nike employed roughly 77,800 workers globally.

The EEOC's interest in Nike's layoff selection process suggests regulators are examining whether demographic considerations influenced which employees were terminated—a potentially explosive allegation given the scale of recent reductions.

Nike also recently eliminated its Chief Technology Officer and Chief Commercial Officer roles, resulting in additional executive departures.

Financial Backdrop: Nike's Challenging Turnaround

The EEOC action lands as Nike navigates significant financial headwinds:

| Metric | FY 2025 | FY 2024 | YoY Change |

|---|---|---|---|

| Revenue | $46.3B | $51.4B | -10% |

| Net Income | $3.2B | $5.7B* | -44% |

| EBIT Margin | 8.0%* | 13.1%* | -510 bps |

| Gross Margin | 42.7% | 44.7% | -200 bps |

*Values retrieved from S&P Global.

The company also faces $1.5 billion in incremental annual tariff costs under the Trump administration's trade policies, expected to reduce gross margins by 120 basis points in FY 2026.

Market Reaction: Stock Rises Despite Headlines

Despite the federal legal action, Nike shares closed up 5% at $63.98 on February 4, 2026, with intraday trading reaching a high of $63.99. The stock remains below its 52-week high of $82.44 but has recovered from its year low of $52.28.

The muted reaction may reflect investor belief that the EEOC probe, while headline-grabbing, poses limited near-term financial risk compared to Nike's core business challenges of declining revenue, margin compression, and inventory issues.

Broader Implications for Corporate America

The Nike case represents a major escalation in the EEOC's anti-DEI enforcement campaign under Chair Lucas. In December 2025, Lucas posted a video on social media directly urging "white males who have experienced discrimination at work based on your race or sex" to file complaints with the agency.

The EEOC has also subpoenaed Northwestern Mutual in a similar DEI-related investigation, seeking information on promotion policies and metrics tied to diversity programs.

Employment law experts say the Nike action could set precedent for how companies design and document their diversity programs:

- Program documentation: Companies may need to demonstrate that DEI initiatives create opportunities rather than impose quotas

- Layoff procedures: Workforce reductions may face scrutiny for demographic disparities

- Subpoena compliance: Resistance to EEOC information requests risks court enforcement

What to Watch

- Nike's response: Whether the company challenges the subpoena in court or complies with information requests

- Court ruling: A federal judge's decision on the subpoena enforcement could establish precedent for future DEI investigations

- Quarterly earnings impact: Any mention of the investigation in Nike's next earnings call (expected March 2026)

- Broader industry response: How other companies with robust DEI programs adjust their disclosures and practices

Related: