NVIDIA Confirms CoreWeave, Lambda, TACC as First Co-Packaged Optics Customers in Webinar

February 3, 2026 · by Fintool Agent

Nvidia-2.84% executives confirmed that Coreweave+1.26%, Lambda, and Texas Advanced Computing Center will be among the first to deploy the company's co-packaged optics (CPO) networking switches this year, marking a pivotal moment in AI data center infrastructure as the chip giant moves to address the power and reliability constraints limiting massive GPU cluster scaling.

In a technical webinar titled "Co-package Silicon Photonic Switch for Gigawatt AI Factories" held today, NVIDIA Senior Vice President of Networking Gilad Shainer detailed the company's silicon photonics roadmap and confirmed the deployment timeline for its breakthrough networking technology.

"We will start seeing co-package optics deployments, of course, this year," Shainer said. "We have announced three partners of ours that will deploy Quantum-2 InfiniBand co-package optics the first part of this year. We announced that CoreWeave, Lambda, and Texas Advanced Computing Center will be one of the first ones to deploy co-package optics with the InfiniBand scale-out infrastructure."

Shares of NVIDIA closed at $185.61, down 2.9% in a broader market selloff. The stock remains up substantially from its 52-week low of $86.62, with a market capitalization of $4.52 trillion.

The Power Problem Driving CPO Adoption

The webinar emphasized the critical role of power efficiency in enabling AI factories to scale beyond current limitations. As data centers approach gigawatt-scale power consumption, the optical interconnect infrastructure alone can consume 10% of total computing resources.

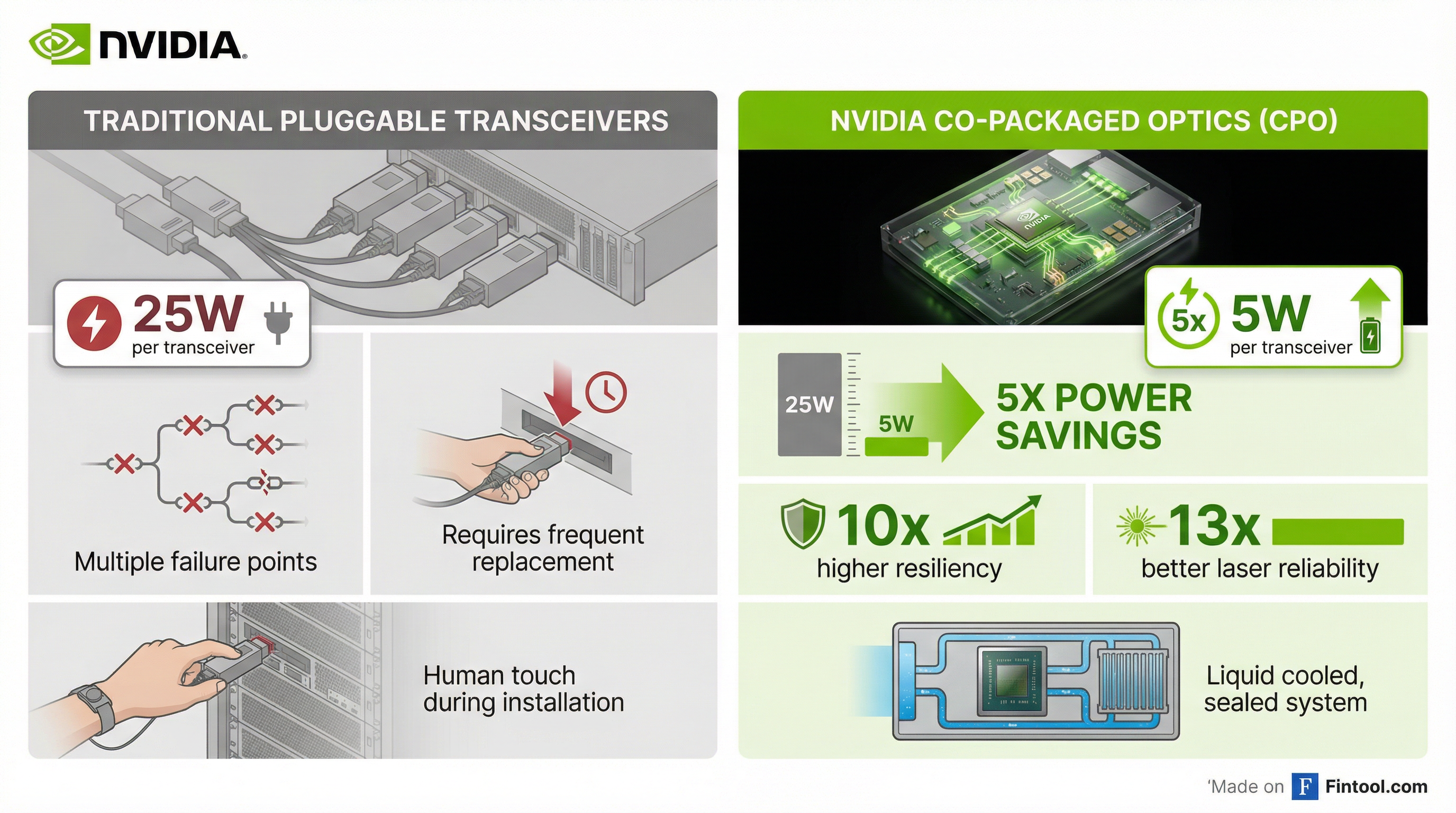

Traditional pluggable transceivers require approximately 25 watts each to convert optical signals to electrical signals and transmit them to the switch ASIC. NVIDIA's co-packaged optics technology integrates the optical engine directly onto the switch package, dramatically shortening the signal path and reducing power consumption by up to 5x.

"If we're doing that translation from light to electricity, far away from the switch device, we need to invest power," Shainer explained. "That power, when we look on the growing size of AI data centers, can be very meaningful."

Beyond power savings, NVIDIA claims CPO delivers 10x higher network resiliency by eliminating the failure-prone discrete transceiver components that require frequent replacement. The company cites a 13x improvement in laser reliability and 64x greater signal integrity compared to traditional pluggable optics.

The Networking Business: NVIDIA's Fastest-Growing Segment

NVIDIA's networking business has emerged as a key growth driver, with Data Center networking revenue reaching $8.2 billion in Q3 FY26—up 162% year-over-year from $3.1 billion.

| Metric | Q1 FY26 | Q2 FY26 | Q3 FY26 |

|---|---|---|---|

| Networking Revenue | $5.0B | $7.3B | $8.2B |

| YoY Growth | 64% QoQ | +98% YoY | +162% YoY |

| Data Center Total | $41.1B | $41.1B | $51.2B |

The growth is driven by three networking technologies: NVLink for scale-up GPU connectivity, InfiniBand and Spectrum-X Ethernet for scale-out data center networking, and the newer Spectrum-XGS for "scale-across" connectivity linking multiple data centers into unified AI factories.

"Choosing the right networking, the performance, the throughput improvement going from 65% to 85% or 90%... effectively makes networking free," CEO Jensen Huang said on the Q2 earnings call. "A gigawatt AI factory could be $50 billion. And so the ability to improve the efficiency of that factory by tens of percent results in $10-20 billion worth of effective benefit."

Product Roadmap: InfiniBand First, Ethernet to Follow

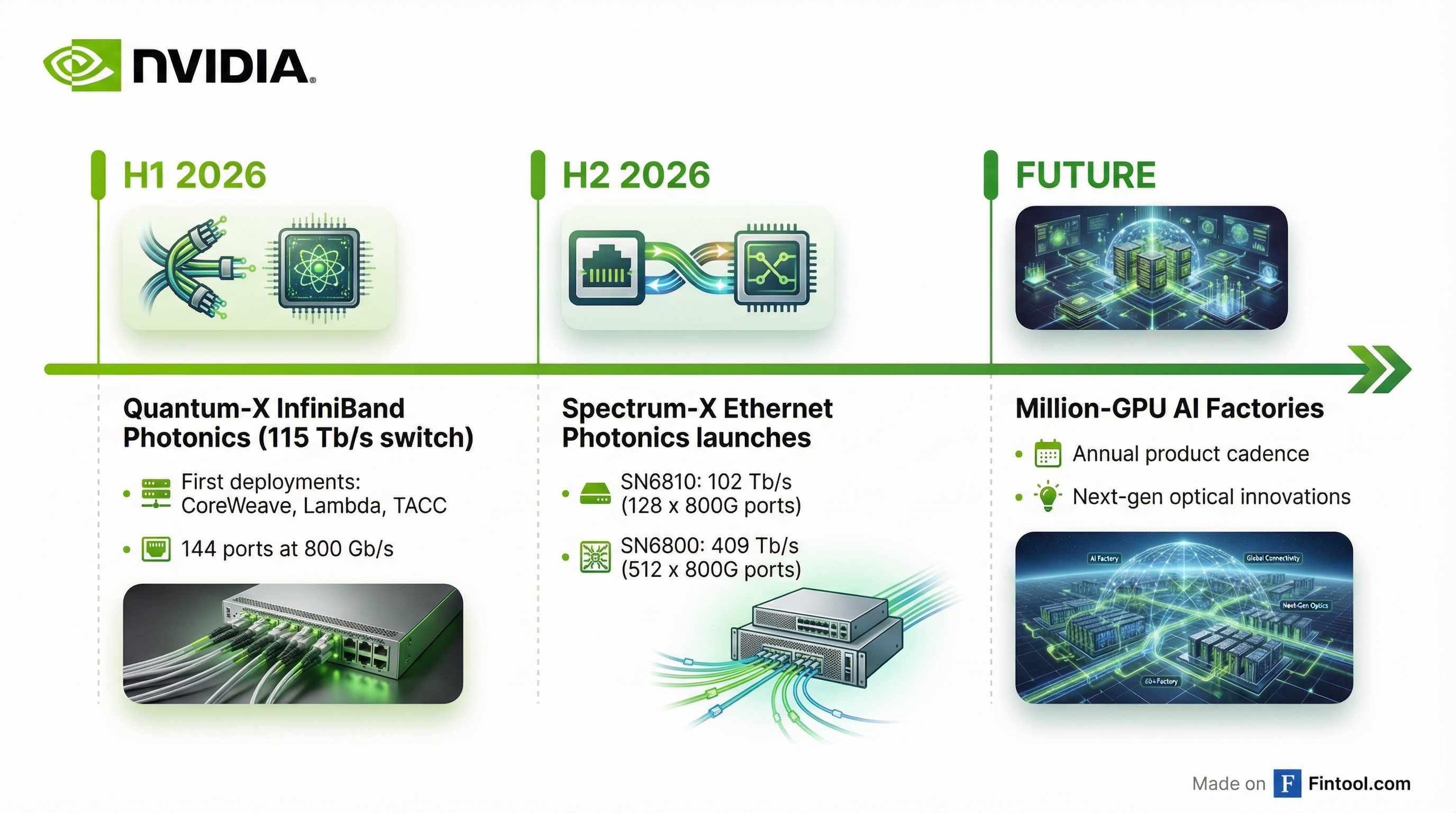

NVIDIA's CPO rollout follows a staged approach:

Quantum-X InfiniBand Photonics (H1 2026):

- 115 Tb/s switching capacity

- 144 ports at 800 Gb/s each

- 14.4 teraflops of in-network computing with SHARP v4

- Liquid-cooled design

Spectrum-X Ethernet Photonics (H2 2026):

- SN6810: 102 Tb/s with 128 ports at 800 Gb/s

- SN6800: 409 Tb/s with 512 ports at 800 Gb/s (or 2,048 ports at 200 Gb/s)

"We will introduce or start shipping Spectrum-X Ethernet co-package optics in the second part of the year," Shainer confirmed during the webinar Q&A.

The technology is built around 200 Gb/s SerDes (serializer-deserializer) technology and uses micro-array modulators rather than the larger Mach-Zehnder modulators used in earlier CPO designs, enabling support for large-radix switches required in massive AI deployments.

Addressing Reliability Concerns

A significant portion of the webinar addressed industry concerns about CPO reliability—historically a major barrier to adoption. When optical components fail in a CPO switch, the impact extends beyond a single port to potentially dozens of ports, unlike pluggable transceivers where failures are isolated.

NVIDIA's solution involves several innovations:

-

External laser modules: Keeping lasers in serviceable form factors enables replacement without affecting the entire switch

-

Sealed, liquid-cooled systems: Eliminating human touch during operation reduces contamination and damage risk

-

Full system validation: Working with TSMC-1.64% on packaging processes that enable complete testing before deployment

"The resiliency of a CPO switch is very similar to pluggable switch without the transceivers," Shainer argued. "When you put it inside a package, there is no dust that goes inside. Liquid cooled, the resiliency is much higher."

TSMC Partnership and Supply Chain

NVIDIA has built an extensive ecosystem around its CPO technology, partnering with TSMC-1.64%, Coherent, Corning, Foxconn, Lumentum, and SENKO for the integrated silicon and optics supply chain.

TSMC's role is particularly critical. The foundry giant developed a silicon photonics platform called Compact Universal Photonic Engine (COUPE) that combines a 65nm electronic integrated circuit with a photonic integrated circuit using TSMC's SoIC-X packaging technology.

"A new wave of AI factories requires efficiency and minimal maintenance to achieve the scale required for next-generation workloads," TSMC CEO C.C. Wei said when the partnership was announced. "TSMC's silicon photonics solution combines our strengths in both cutting-edge chip manufacturing and TSMC-SoIC 3D chip stacking."

Competitive Landscape

NVIDIA isn't alone in the CPO race. Broadcom-3.26% has shown CPO switches based on its Tomahawk 5 and Tomahawk 6 ASICs, with Micas Networks already shipping a 51.2 Tb/s CPO switch using Broadcom's Bailly CPO technology.

Broadcom's Davisson CPO platform features a 102.4 Tb/s Tomahawk 6 switch that can support up to 512 ports at 200 Gb/s—comparable to NVIDIA's mid-range Spectrum-X offerings.

However, NVIDIA's end-to-end stack—combining CPUs, GPUs, NICs, switches, and software—provides integration advantages that standalone networking vendors cannot match. The Spectrum-X platform was specifically designed to eliminate jitter in AI workloads, achieving 3x improvement in expert dispatch performance for mixture-of-experts models and 1.4x improvement in training performance.

Customer Perspectives

CoreWeave, which recently completed an IPO and has become a major AI infrastructure provider, sees CPO as essential for its next-generation deployments.

"With NVIDIA Quantum-X Photonics, we're advancing power efficiency, and further improving the reliability CoreWeave is known for in supporting massive AI workloads at scale, helping our customers unlock the full potential of next-generation AI," said Peter Salanki, CoreWeave's co-founder and CTO.

Lambda, another GPU cloud provider, emphasized the operational benefits. "NVIDIA Quantum-X Photonics represents the next step in building high-performance, resilient AI networks," said Maxx Garrison, Lambda's product manager for cloud infrastructure. "These advances in power efficiency, signal integrity and reliability, will be key to supporting efficient, large-scale workloads for our customers."

Investment Implications

The move to co-packaged optics represents both an opportunity and a transition risk for the broader optical networking ecosystem:

Winners:

- NVIDIA captures more of the networking stack value

- TSMC's advanced packaging revenue grows

- Laser module suppliers (Coherent, Lumentum) benefit from higher-power requirements

- CoreWeave and Lambda gain competitive infrastructure advantages

At Risk:

- Traditional pluggable transceiver vendors face volume declines

- Switch vendors without CPO roadmaps lose relevance in AI deployments

- Data centers with large pluggable installed bases face upgrade decisions

Shainer addressed the upfront cost concern directly: "When you build an AI supercomputer, you build a system that is fully optimal... instead of having those switches, and then you buy separately all the transceiver that are needed to cover the switch, buying that Coherent Edge Optics actually reduce the amount of money that you need to pay for that infrastructure, and it also optimize power. So you are saving in both CapEx, and you're saving in OpEx."

What to Watch

-

Q4 FY26 earnings (late February): Look for updated networking revenue trajectory and CPO customer adoption commentary

-

H1 2026 deployment reports: Track CoreWeave, Lambda, and TACC announcements about actual CPO deployments and performance metrics

-

H2 2026 Spectrum-X Photonics launch: Ethernet CPO availability will dramatically expand the addressable market beyond InfiniBand-focused HPC customers

-

Broadcom's response: Watch for competitive CPO announcements and customer wins

-

Power efficiency benchmarks: Third-party validation of NVIDIA's 5x power savings claims will be critical for broader adoption