Omeros Wins FDA Approval for YARTEMLEA, First-Ever Treatment for Often-Fatal Transplant Complication

December 24, 2025 · by Fintool Agent

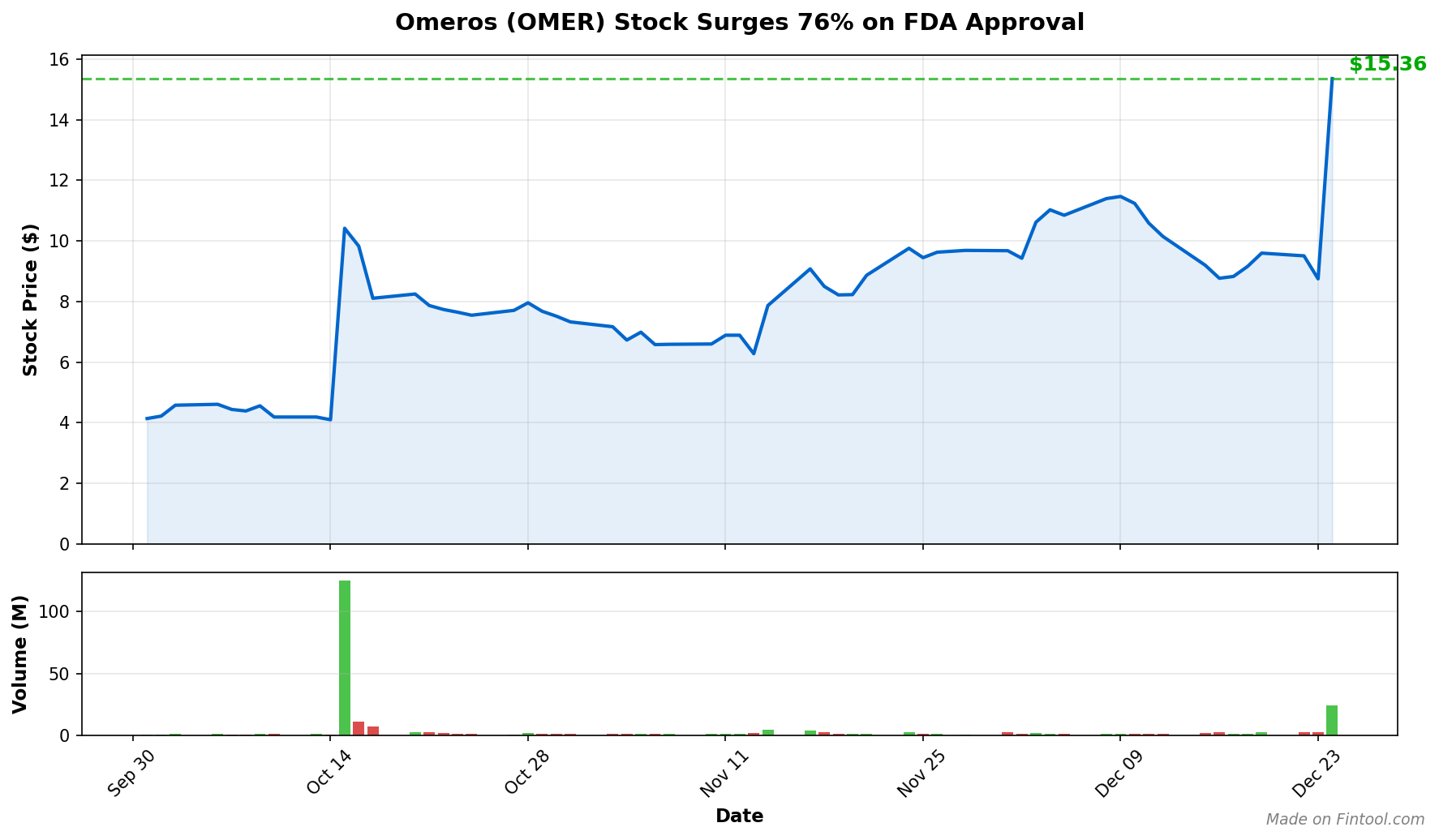

Omeros Corporation stock surged 76% on Christmas Eve after the FDA granted approval to YARTEMLEA (narsoplimab), making it the first and only treatment ever approved for hematopoietic stem cell transplant-associated thrombotic microangiopathy (TA-TMA)—an often-fatal complication that can affect up to 56% of transplant recipients and carries mortality rates exceeding 90% in severe cases.

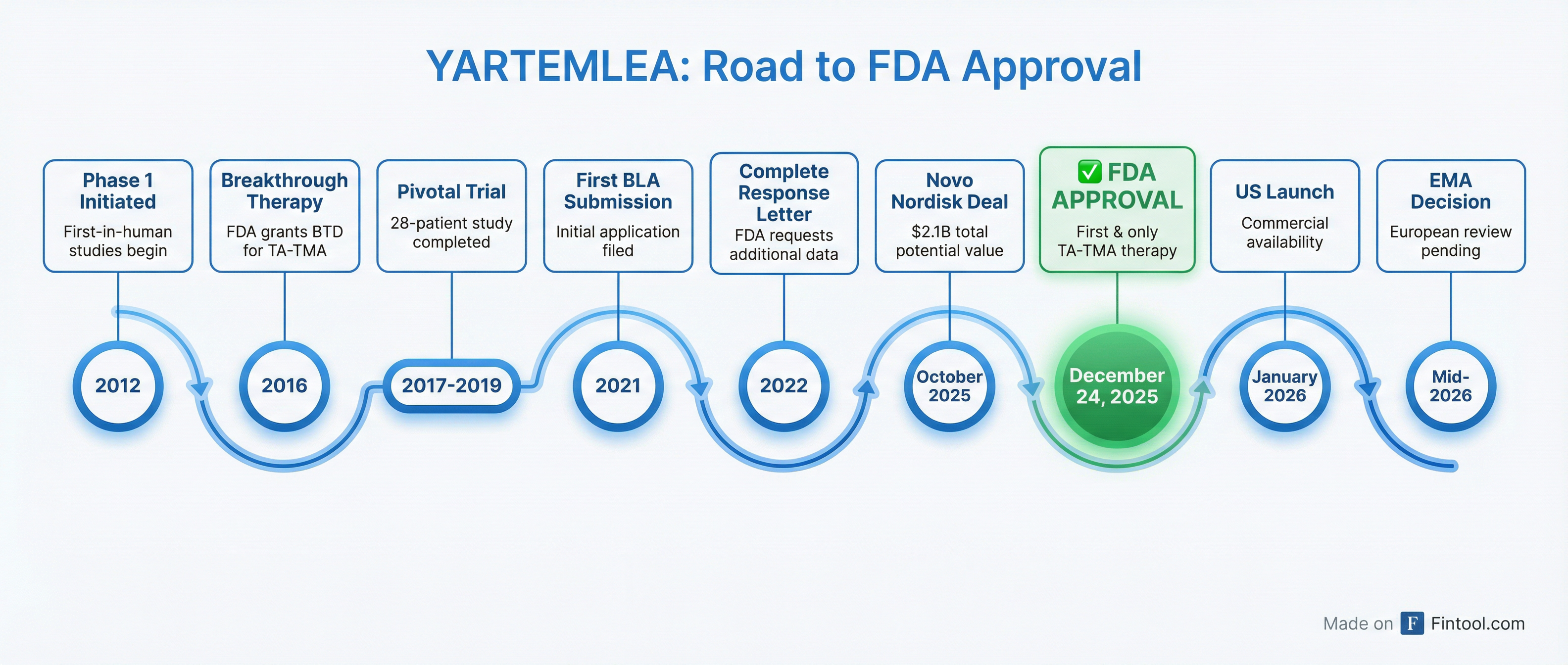

The approval marks the culmination of a decade-long regulatory journey for the Seattle-based biotech, which previously received a Complete Response Letter from the FDA before resubmitting with compelling survival data showing 3- to 4-fold lower mortality risk compared to supportive care alone.

The Market Reaction

OMER shares closed at $15.36, up $6.61 (+76%) on massive volume of 24.5 million shares—nearly 10 times the average daily trading volume. The stock touched a new 52-week high of $17.65 intraday, a dramatic reversal from its 52-week low of $2.95 earlier this year.

The approval transforms Omeros from a clinical-stage biotech burning cash with no commercial products to a company with a first-in-class approved therapy addressing a significant unmet medical need. The company plans to launch YARTEMLEA in the U.S. in January 2026.

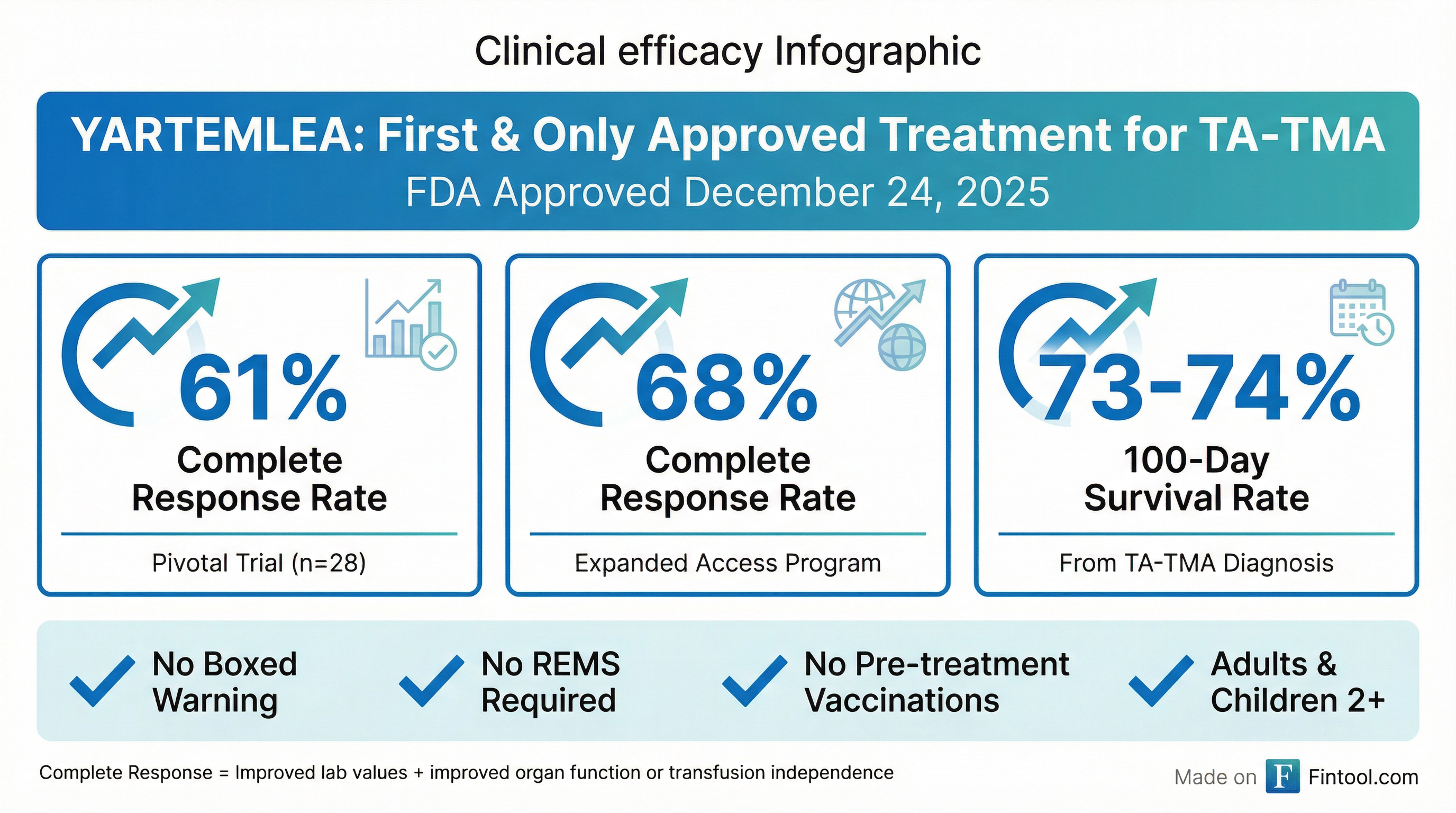

Clinical Data: A Breakthrough for Transplant Patients

The FDA's decision was supported by robust efficacy data showing complete response rates of 61% in the pivotal 28-patient trial and 68% in the 221-patient Expanded Access Program.

Perhaps more importantly, 100-day survival from TA-TMA diagnosis was approximately 73-74% across studies—remarkable given that all patients met international criteria for high-risk disease with poor prognosis. In peer-reviewed publications, YARTEMLEA treatment was associated with a 3- to 4-fold lower risk of mortality compared to external controls receiving only supportive care.

| Efficacy Metric | Pivotal Trial | Expanded Access Program |

|---|---|---|

| Complete Response Rate | 61% (17/28) | 68% (13/19 evaluable) |

| 100-Day Survival | 73% (95% CI: 52-86%) | 74% (95% CI: 48-88%) |

| Mortality Risk vs. Control | 3-4x lower | — |

"This approval is a long-awaited breakthrough in hematopoietic cell transplantation and TA-TMA care," said Miguel-Angel Perales, M.D., Chief of the Adult Bone Marrow Transplantation Service at Memorial Sloan Kettering Cancer Center. "As the first and only drug approved for TA-TMA, narsoplimab is a practice-changing advance for patients facing this devastating complication."

A Differentiated Safety Profile

Unlike off-label C5 inhibitors such as eculizumab and ravulizumab that are sometimes used in TA-TMA, YARTEMLEA targets MASP-2—the effector enzyme of the lectin pathway of complement. This mechanism preserves classical and alternative pathway functions critical for immune defense against infection.

The distinction matters clinically: a retrospective study found that pediatric TA-TMA patients treated with the C5 inhibitor eculizumab had 8.5-fold higher bacteremia rates and 6-fold higher infection-related mortality compared to controls.

YARTEMLEA received approval without a Boxed Warning, without a Risk Evaluation and Mitigation Strategy (REMS), and without requiring pre-treatment vaccinations—a cleaner label than many complement-targeting therapies.

The Long Road to Approval

YARTEMLEA's path to approval was anything but straightforward. The FDA initially issued a Complete Response Letter, requesting additional efficacy data. Omeros responded by conducting a rigorous statistical analysis comparing survival in narsoplimab-treated patients to an external registry of TA-TMA patients from the Kyoto Transplant Group.

The results—showing highly significant, 3-fold improvement in overall survival—convinced the FDA to accept the resubmission and ultimately grant approval.

The Market Opportunity

Approximately 30,000 allogeneic stem cell transplants are performed annually in the U.S. and Europe. Recent studies estimate that TA-TMA develops in up to 56% of allogeneic transplant recipients. Mortality in severe TA-TMA can exceed 90%, and survivors frequently face long-term renal complications including dialysis dependence.

Until today, there was no approved treatment—physicians relied on supportive measures like modifying immunosuppressants, which can paradoxically increase the risk of graft-versus-host disease.

Omeros has secured dedicated billing and reimbursement codes: an ICD-10-CM diagnosis code (M31.11) specific to TA-TMA and ICD-10-PCS procedure codes for narsoplimab administration. The company also expects to receive a New Technology Add-on Payment (NTAP) from Medicare to support hospital reimbursement.

Financial Transformation

The approval comes at a pivotal moment for Omeros. The company has been burning approximately $25-30 million per quarter with no commercial revenue, and as of Q3 2025 had only $2.4 million in cash and $36.1 million in cash and investments.

However, the company is set to receive $240 million in upfront cash from its October 2025 deal with Novo Nordisk, in which the Danish pharma giant acquired global rights to Omeros' MASP-3 inhibitor zaltenibart for up to $2.1 billion in total potential value.

| Financial Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Net Loss | $(31.4)M | $(33.5)M | $(25.4)M | $(30.9)M |

| Cash & Equivalents | $3.4M | $4.3M | $1.9M | $2.4M |

| Total Debt | $423M | $415M | $382M | $363M |

Upon closing the Novo Nordisk transaction (expected Q4 2025), Omeros will use proceeds to fully repay its $67.1 million secured term loan and the remaining $17.1 million of its 2026 convertible notes. Management has stated the company expects to potentially be cash flow positive in 2027.

What to Watch

January 2026 Launch: The commercial rollout will be the first test of Omeros' market access strategy. The company has assembled a hematology-experienced sales force and claims transplant centers are "ready to go" with identified champions for TA-TMA treatment.

European Decision (Mid-2026): A marketing authorization application is under review by the European Medicines Agency, which would significantly expand the addressable market.

Pipeline Advancement: With YARTEMLEA approved and the Novo Nordisk deal funding the balance sheet, Omeros can advance OMS1029 (long-acting MASP-2 antibody), its MASP-2 small molecule program, and its oncology platform—including OncotoX-AML, which the company expects to enter the clinic in 2027.

Conference Call: Management will host a call on December 29, 2025 at 4:30 p.m. ET to discuss the approval.