OpenText Names IBM Veteran Ayman Antoun as CEO After Barrenechea Ouster

January 29, 2026 · by Fintool Agent

Opentext has ended its five-month CEO search by appointing Ayman Antoun, a 35-year Ibm veteran who ran the tech giant's largest regional business, to lead the Canadian enterprise software company's pivot away from acquisition-driven growth.

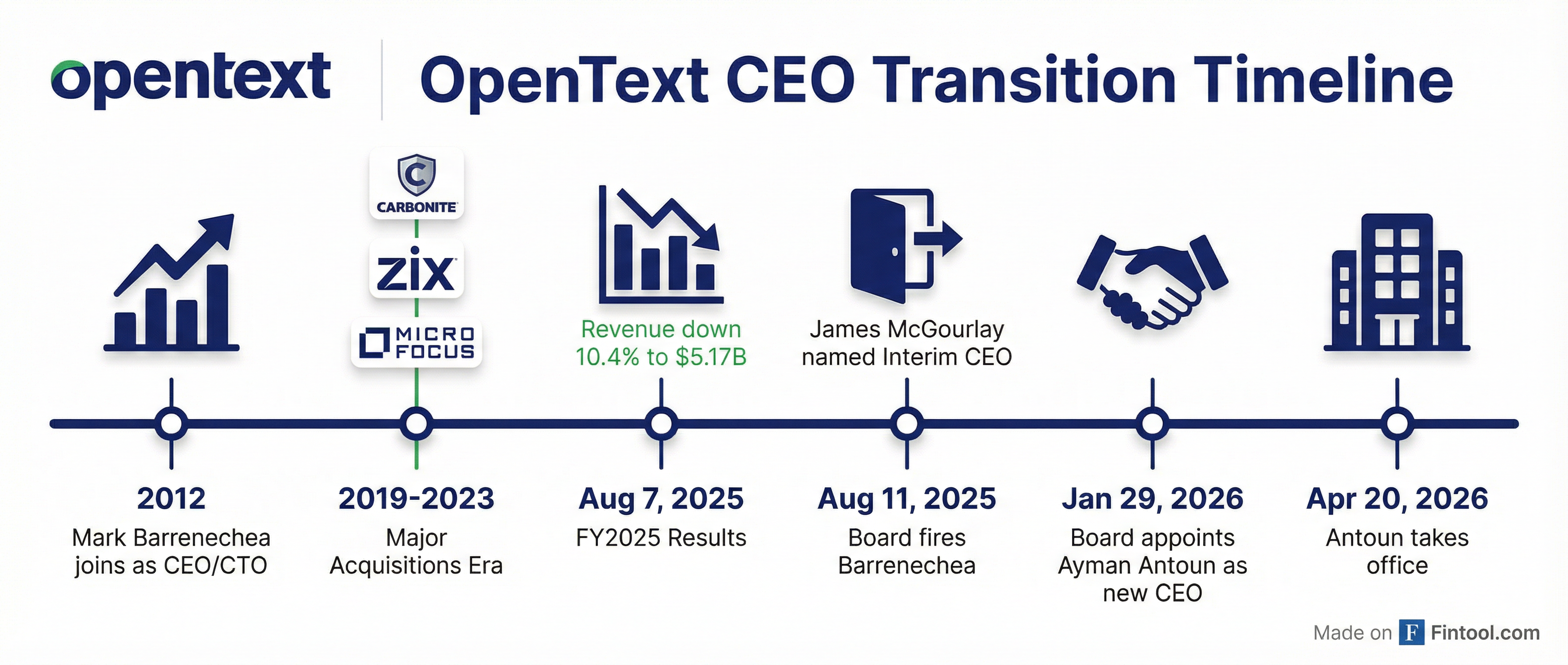

Antoun, 60, will take the helm on April 20, 2026, succeeding James McGourlay, who has served as interim CEO since the board fired long-tenured CEO Mark Barrenechea in August 2025. The stock dropped 3.7% to $27.38 on the news, extending a brutal 38% decline over the past year as investors wait to see if new leadership can revive organic growth at the $7 billion market cap company.

The End of an Era

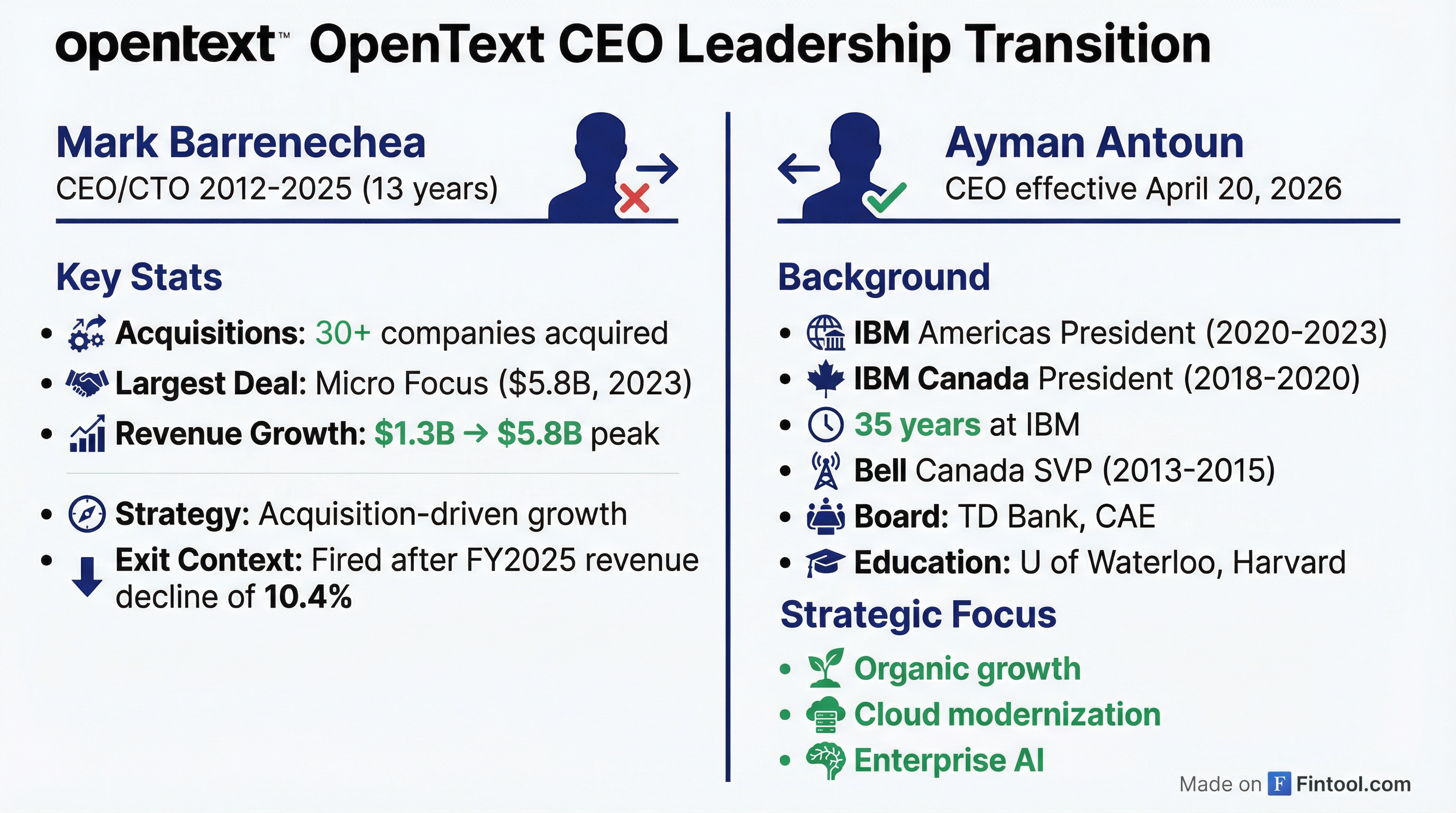

The appointment closes a turbulent chapter for OpenText that began on August 7, 2025, when the company reported fiscal year 2025 results showing revenue plunged 10.4% to $5.17 billion—the first negative annual growth in years. Three days later, the board fired Barrenechea, ending a 13-year run defined by aggressive M&A that transformed OpenText from a document management vendor into a sprawling enterprise software conglomerate.

"OpenText is where good software goes to die," became a common refrain among enterprise content management professionals during Barrenechea's tenure, according to industry observers. That sentiment was shared by OpenText's largest shareholder.

Jarislowsky Fraser Ltd., the Montreal-based investment firm holding 4.3% of OpenText, was blunt about why change was needed. "Organic growth wasn't one of Barrenechea's strengths," portfolio manager Charles Nadim told Reworked after the firing. "He wasn't right for the next 10 years of evolution."

Who Is Ayman Antoun?

The new CEO brings a starkly different profile than his predecessor. Where Barrenechea was a deal-maker who executed 30+ acquisitions, Antoun spent his career operating large-scale enterprise businesses at IBM.

Career highlights:

- IBM Americas President (2020-2023): Led IBM's largest and most complex region spanning the U.S., Canada, and Latin America, responsible for revenue, profit, and client satisfaction across 14 countries

- IBM Canada President (2018-2020): Ran all Canadian operations

- General Manager, Global Technology Services: Led enterprise technology business focused on cloud migration and digital transformation

- Bell Canada SVP (2013-2015): Brief stint leading business market sales before returning to IBM

Antoun currently sits on the boards of TD Bank and Cae, the Montreal-based flight simulation company. He holds an electrical engineering degree from the University of Waterloo—making his move to OpenText's Waterloo headquarters a homecoming.

The Strategic Pivot

The board's choice signals a decisive shift in strategy. Barrenechea built OpenText through acquisition—most notably the $5.8 billion Micro Focus deal in 2023—but struggled to integrate those assets and drive organic growth. The company is midway through a three-year cost-cutting program that has eliminated 2,800 positions since 2024, including 1,600 job cuts announced in May 2025.

"The Board believes [Antoun] is the best leader to drive shareholder value by growing revenue in our core Enterprise Information Management for training Agentic AI business," said Executive Chairman P. Thomas Jenkins.

That phrasing is telling. OpenText is positioning its data management capabilities as foundational infrastructure for training AI agents—a pivot that requires execution, not more acquisitions.

Antoun embraced the narrative in his statement: "OpenText's core product portfolio, which is the foundation for training agentic AI, combined with its worldwide client base offers the Company a competitive advantage as trusted data is now essential to how economies, nations and businesses operate around the world."

The Compensation Package

Antoun's employment agreement reveals compensation designed to align his interests with shareholders through equity-heavy incentives.

| Component | Amount | Details |

|---|---|---|

| Base Salary | CAD$1,200,000 | Paid semi-monthly |

| Target Bonus | 135% of base (CAD$1,620,000) | Based on individual and company performance |

| LTIP 2029 | USD$7,000,000 | 70% PSUs, 30% RSUs; vests Sept 2029 |

| Sign-on Options | USD$2,000,000 | 4-year vesting (25% annually) |

| Sign-on RSUs | USD$2,000,000 | 3-year cliff vest |

| Severance | 24 months | Salary + bonus continuation if terminated without cause |

The package includes standard change-in-control protections: if Antoun is terminated without cause or resigns for good reason within one year of a change in control, all unvested equity accelerates immediately.

Financial Context

OpenText's deteriorating financials underscore the turnaround challenge Antoun inherits.

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue ($B) | $3.49 | $4.48 | $5.77* | $5.17 |

| Net Income ($M) | $397 | $150 | $465 | $436 |

| Operating Cash Flow ($M) | $982 | $779 | $968 | $831 |

| EBITDA Margin | 28.4%* | 24.8%* | 27.3%* | 28.6%* |

*Values retrieved from S&P Global

The revenue spike in FY 2023-2024 reflects the Micro Focus acquisition, not organic growth. Adjusting for that deal and subsequent divestitures, organic revenue has been essentially flat to declining—exactly the problem that cost Barrenechea his job.

Stock Price Performance

OpenText shares have been in freefall, down from their October 2021 peak of $50.35 to current levels around $27.

| Timeframe | Performance |

|---|---|

| Today | -3.7% ($27.38) |

| YTD 2026 | -13.7% |

| Since CEO fired (Aug 11, 2025) | -9.4% |

| 1-Year | -38.0% |

| 52-Week High | $39.90 |

| 52-Week Low | $22.79 |

The stock trades at 14.9x trailing earnings with a 3.7% dividend yield, according to market data. Analysts maintain an average price target of $40.00, implying 46% upside—but that target may not yet reflect skepticism about how quickly Antoun can execute a turnaround.*

*Values retrieved from S&P Global

What to Watch

Near-term catalysts:

- Q2 FY2026 earnings (Feb 5, 2026): McGourlay's last quarter as interim CEO; sets the baseline for Antoun

- April 20, 2026: Antoun officially takes office

- Non-core asset sales: The board announced plans to divest businesses that don't fit the "Information Management for AI" strategy; watch for announcements

- Organic growth metrics: Cloud revenues grew just 2% in FY2025 to $1.86 billion; enterprise cloud bookings were up 10.1%—investors will scrutinize whether Antoun can accelerate this

Key questions:

- Can Antoun drive organic growth where Barrenechea couldn't?

- Which assets will be sold, and at what valuation?

- Will the "Information Management for AI" positioning resonate with enterprise customers?

- How much cost-cutting runway remains after 2,800 job cuts?

The appointment of an IBM lifer to lead a company built on acquisitions marks a philosophical reset. Antoun knows how to run large enterprise operations—the question is whether he can revitalize a portfolio that critics say has been "where good software goes to die."

Related Companies: