Earnings summaries and quarterly performance for OPEN TEXT.

Research analysts who have asked questions during OPEN TEXT earnings calls.

Paul Treiber

RBC Capital Markets

6 questions for OTEX

Raimo Lenschow

Barclays

5 questions for OTEX

Richard Tse

National Bank Financial

5 questions for OTEX

Stephanie Price

CIBC World Markets

5 questions for OTEX

Thanos Moschopoulos

BMO Capital Markets

5 questions for OTEX

Kevin Krishnaratne

Scotiabank

4 questions for OTEX

David Kwan

TD Cowen

2 questions for OTEX

George Kurosawa

Citigroup Inc.

2 questions for OTEX

Samad Samana

Jefferies

2 questions for OTEX

Seth Gilbert

D.A. Davidson & Co.

2 questions for OTEX

Adhir Kadve

Eight Capital

1 question for OTEX

Billy Fitzsimmons

Jefferies

1 question for OTEX

George Michael Kurosawa

Citigroup

1 question for OTEX

Karl Keirstead

UBS

1 question for OTEX

William Fitzsimmons

Jefferies

1 question for OTEX

Recent press releases and 8-K filings for OTEX.

- Open Text Corporation has increased its Fiscal 2026 share repurchase program by US$200 million.

- The new maximum aggregate value for the share repurchase program is US$500 million.

- This normal course issuer bid (NCIB) is in effect from August 12, 2025, to August 11, 2026.

- As of January 31, 2026, the company had already purchased approximately US$190 million of common shares for cancellation during Fiscal 2026.

- OpenText has increased its Fiscal 2026 share repurchase program by US$200 million, raising the total authorized limit to US$500 million.

- The normal course issuer bid (NCIB) allows for the purchase of up to 24,906,456 Common Shares and is in effect from August 12, 2025, to August 11, 2026.

- As of January 31, 2026, OpenText has already purchased approximately US$190 million of Common Shares for cancellation during Fiscal 2026.

- The increase reflects management's confidence in the company's robust cash flow engine.

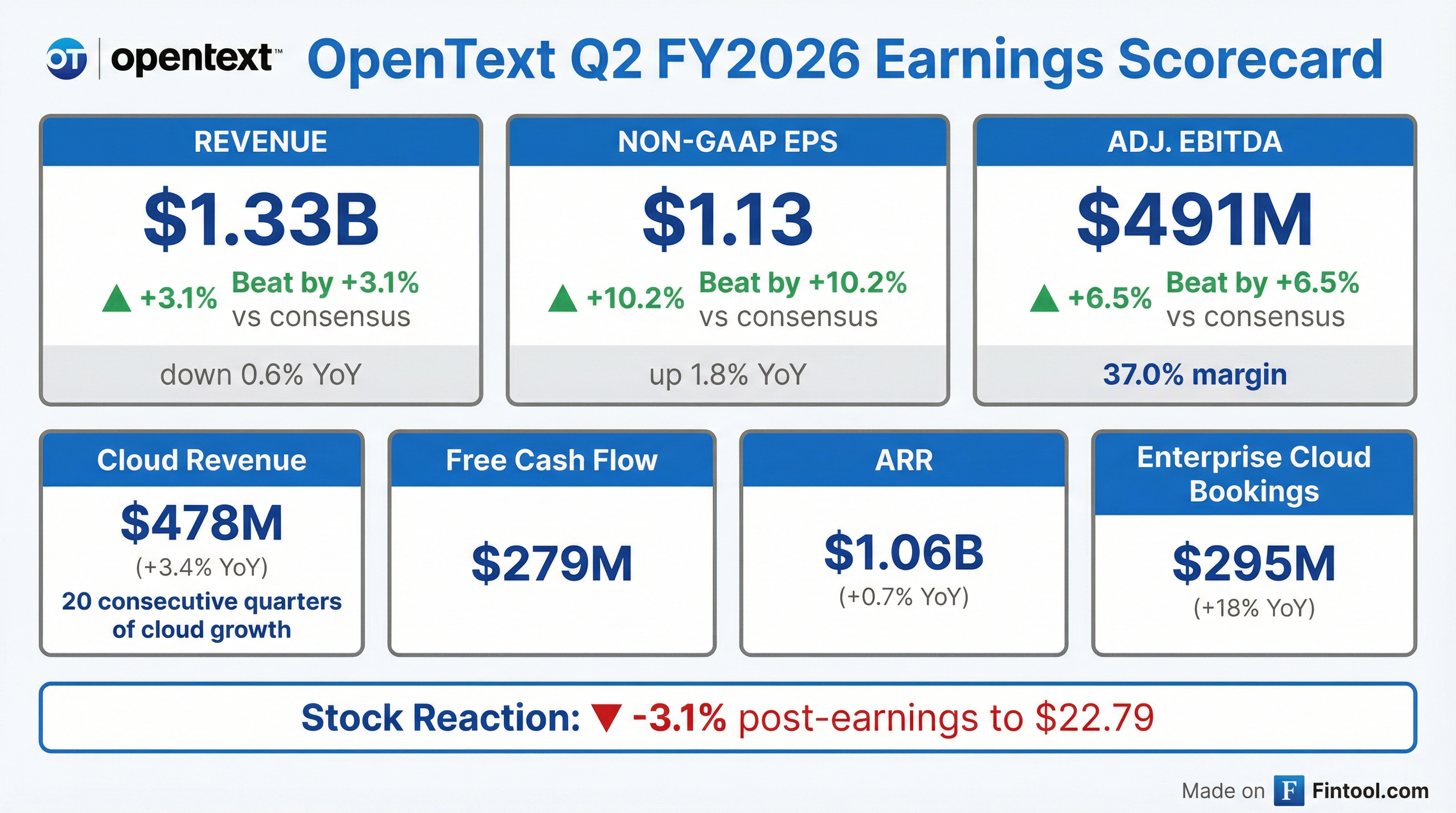

- OpenText reported Q2 fiscal 2026 total revenues of $1,330,000,000, with cloud revenue up 3.4% to $478,000,000, and non-GAAP diluted EPS of $1.13, up 1.8%.

- The company maintained its full-year fiscal 2026 total revenue growth outlook of 1%-2% and projects Q3 2026 total revenue between $1,260,000,000 and $1,280,000,000.

- Ayman Antoun has been appointed as the new CEO, expected to join in a couple of months.

- OpenText is continuing its portfolio reshaping with the divestiture of Vertica for $150,000,000 and the completed divestiture of eDOCS for $163,000,000. The company also plans to further increase its existing $300,000,000 share buyback program.

- The company is focused on pivoting to higher growth by investing in its core content cloud business and enterprise information management for AI.

- OpenText reported Q2 F'26 Total Revenues of $1,327 million, a 0.6% year-over-year decrease, with GAAP EPS at $0.66 (down 24.1%) and Non-GAAP A-EPS at $1.13 (up 1.8%).

- The company provided an F'26 outlook for Total Revenue Growth of 1% to 2% and Cloud Revenue Growth of 3% to 4%. The Q3 F'26 Total Revenue outlook is between $1,260 million and $1,280 million.

- OpenText announced the sale of Vertica for US$150 million, with proceeds intended to reduce outstanding debt, following the prior divestiture of eDOCS for $163 million.

- The company has an existing $300 million share repurchase program and intends to further increase it in F'26.

- OpenText reported strong Q2 fiscal 2026 results, with total revenues of approximately $1.33 billion, overall cloud growth of 3.4% year-over-year, and enterprise cloud bookings up 18% year-over-year to $295 million.

- The company reaffirmed its fiscal year 2026 total revenue growth target of 1%-2% year-over-year, and expects Q3 total revenues between $1.26 billion and $1.28 billion with an adjusted EBITDA margin between 33.0% and 33.5%.

- As part of its portfolio reshaping strategy, OpenText agreed to divest Vertica for $150 million and completed the divestiture of eDOCS for $163 million, aiming for one divestiture per quarter to focus on core businesses like Content and AI.

- OpenText announced Ayman Antoun as its new CEO, with James McGourlay transitioning to an executive role, and plans to further increase its existing $300 million share buyback program.

- OpenText reported Q2 fiscal 2026 total revenues of $1.33 billion and non-GAAP diluted EPS of $1.13, representing a 1.8% increase year-over-year. Cloud revenue grew 3.4% year-over-year, with enterprise cloud bookings up 18% year-over-year to $295 million.

- The company reaffirmed its FY26 revenue target of 1%-2% growth year-on-year and expects Q3 total revenues between $1.26 billion and $1.28 billion.

- OpenText announced the divestiture of Vertica for $150 million and the closing of the eDOCS divestiture for $163 million, as part of a strategy to divest one business unit or product category per quarter to focus on its core content cloud and AI businesses.

- Ayman Antoun was appointed as the new CEO, bringing over three decades of global technology experience, most recently as president of IBM Americas.

- OpenText reported total revenues of $1.327 billion and cloud revenues of $478 million for the second quarter of fiscal year 2026, marking 20 consecutive quarters of cloud organic growth.

- The company achieved a net income of $168 million and a robust Adjusted EBITDA margin of 37.0% in Q2 FY26.

- Ayman Antoun was appointed Chief Executive Officer, effective April 20, 2026, and OpenText announced the divestiture of Vertica for US$150 million and completed the divestiture of eDOCS for US$163 million.

- OpenText returned $119 million to shareholders, comprising $69 million via dividends and $50 million in share repurchases, and declared a quarterly cash dividend of $0.275 per common share.

- Open Text Corporation reported total revenues of $1.327 billion for the second quarter ended December 31, 2025, a 0.6% year-over-year decrease, with cloud revenues growing 3.4% year-over-year to $478 million, marking its 20th consecutive quarter of cloud organic growth.

- For Q2 FY26, the company achieved GAAP net income of $168 million and Non-GAAP diluted EPS of $1.13.

- Adjusted EBITDA for the quarter was $491 million, representing a 37.0% margin.

- OpenText announced the appointment of Ayman Antoun as Chief Executive Officer, effective April 20, 2026, and completed the divestiture of eDOCS for US$163 million, while also announcing the divestiture of Vertica for US$150 million.

- The Board declared a quarterly cash dividend of $0.275 per common share, payable on March 20, 2026, to shareholders of record on March 6, 2026.

- Open Text Corporation (OTEX) has reached a definitive agreement to divest Vertica, a part of its non-core Analytics portfolio, to Rocket Software Inc. for US$150 million in cash.

- Vertica contributed approximately US$80 million in annual revenue in OpenText's fiscal year ended June 30, 2025.

- OpenText intends to use the proceeds from the sale to reduce its outstanding debt.

- The transaction is expected to close during fiscal year 2026.

- Open Text Corporation (OTEX) has reached a definitive agreement to divest Vertica to Rocket Software Inc. for US$150 million in cash.

- Vertica, part of OpenText's non-core Analytics portfolio, contributed approximately US$80 million in annual revenue in OpenText's fiscal year ended June 30, 2025.

- OpenText intends to use the proceeds from the sale to reduce its outstanding debt.

- The transaction is expected to close during fiscal year 2026, subject to customary approvals and closing conditions.

Fintool News

In-depth analysis and coverage of OPEN TEXT.

Quarterly earnings call transcripts for OPEN TEXT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more