Palantir Lands Biggest Korea Deal Yet: Hundreds of Millions from HD Hyundai

January 20, 2026 · by Fintool Agent

Palantir Technologies has secured its largest deal in South Korea—worth hundreds of millions of dollars over several years—in a major expansion of its strategic partnership with HD Hyundai, one of the world's largest shipbuilding and industrial conglomerates.

The agreement, announced Monday from the World Economic Forum in Davos, will deploy Palantir's Foundry and Artificial Intelligence Platform (AIP) across HD Hyundai's entire business ecosystem—from shipyards to robotics to electric systems. Many HD Hyundai affiliates will use the AI technology for the first time.

"HD Hyundai is a pioneering force in global industry, and the significant expansion of our partnership marks an exciting new chapter," said Dr. Alex Karp, Palantir's co-founder and CEO. "We are committed to advancing our strategic collaboration and driving the group's competitiveness."

Karp told Reuters he is "very bullish" on Korea's market.

From Oil Refining to Robotics

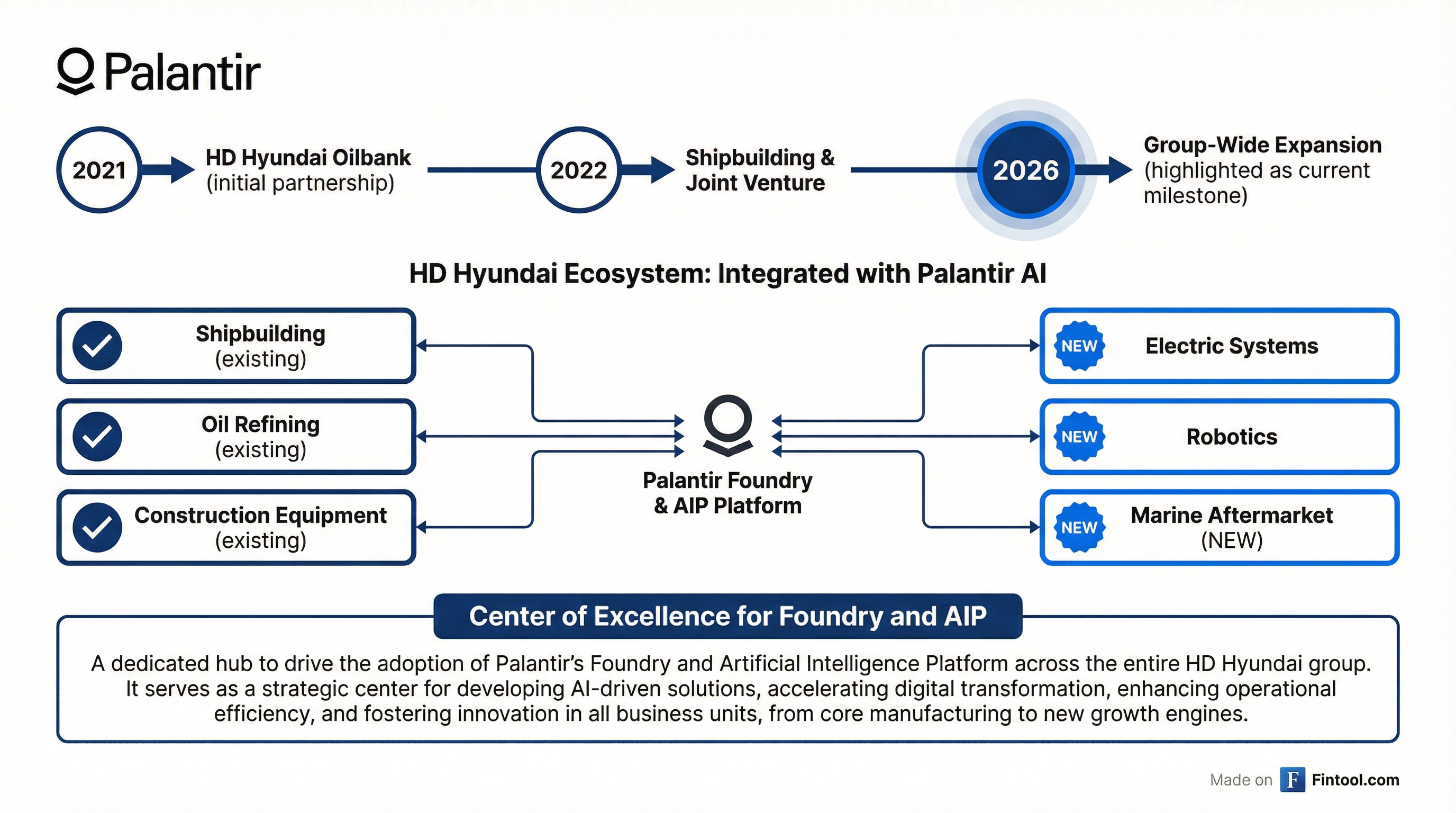

The partnership has evolved significantly since its origins in 2021 when Palantir began working with HD Hyundai Oilbank. It expanded into shipbuilding in 2022, when the companies created a jointly-owned entity in South Korea—with Palantir holding a controlling interest—to serve Japanese and Korean markets.

The new phase dramatically broadens Palantir's footprint across HD Hyundai's businesses:

| Division | Status | AI Use Cases |

|---|---|---|

| HD Hyundai Oilbank | Existing | Refinery operations, crude selection, predictive maintenance |

| Shipbuilding | Existing | Digital twin orchestration, 3D modeling, "Future of Shipyard" initiative |

| Construction Equipment | Existing | Recent pilots, operational excellence |

| Electric Systems | New | First-time Foundry/AIP deployment |

| Robotics | New | First-time Foundry/AIP deployment |

| Marine Aftermarket | New | First-time Foundry/AIP deployment |

"This expanded strategic partnership marks an important turning point in connecting data and workflows across HD Hyundai into a single, cohesive system—enabling faster and more sophisticated decision-making," said Chung Kisun, Chairman of HD Hyundai.

Center of Excellence

A key component of the expanded deal is Palantir's commitment to establish a Center of Excellence for Foundry and AIP within HD Hyundai over the next few years. The center will train employees throughout the conglomerate to leverage advanced analytics and AI, "cultivating a new wave of AI-driven innovation."

In shipbuilding specifically, Palantir's platforms serve as the orchestration layer supporting HD Hyundai's "Future of Shipyard" initiative, complementing digital twin and 3D modeling efforts designed to modernize one of the world's largest shipbuilding operations.

Asia Strategy at a Crossroads

The HD Hyundai deal comes at a pivotal moment for Palantir's international strategy. While the company has achieved explosive growth in its US business—with commercial revenue surging 93% year-over-year in Q2 2025—international commercial revenue has faced headwinds, particularly in Europe.

Management has explicitly stated that the company is focused on "capitalizing on targeted growth opportunities in Asia, the Middle East and beyond," while remaining focused on accelerating US business.

Palantir also maintains a joint venture in Japan with SOMPO Holdings, established in 2019, in which it obtained a controlling interest in 2022.

The company's recent financial performance has been remarkable:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $828M | $884M | $1,004M | $1,181M |

| Net Income | $79M | $214M | $327M | $476M |

| EBIT Margin | 1.3%* | 19.9%* | 26.8%* | 33.3%* |

*Values retrieved from S&P Global

Market Reaction

Palantir shares traded around $167.50 in early trading Tuesday, down roughly 2% in a broad market selloff driven by Trump administration tariff threats. The stock has surged approximately 138% over the past year, giving the company a market capitalization of approximately $383 billion.

At its current valuation, the "hundreds of millions" HD Hyundai deal represents a modest but strategically significant addition to a business that generated $1.2 billion in revenue last quarter alone. More importantly, it demonstrates Palantir's ability to land major enterprise AI deployments outside its US stronghold.

What to Watch

Near-term: Palantir is scheduled to report Q4 2025 earnings in early February. Investors will look for commentary on international commercial momentum and whether the HD Hyundai expansion signals broader Asia-Pacific acceleration.

Medium-term: Execution on the Center of Excellence will be crucial. Success at HD Hyundai could become a template for similar enterprise-wide AI deployments across Asia's industrial giants.

Risk factors: Palantir has acknowledged that its joint venture structures in Korea and Japan "limit our ability to independently sell our platforms, provide certain services, engage certain customers, or compete" in those markets—a trade-off for strategic operational advantages.

Related Company Profiles: Palantir Technologies