Peloton Cuts 11% of Workforce, Targeting Engineers Days Before Earnings

January 30, 2026 · by Fintool Agent

Peloton Interactive is cutting 11% of its workforce—approximately 286 employees—with the reductions hitting engineering teams hardest, according to Bloomberg. CEO Peter Stern informed staff on Friday, just days before the company reports fiscal second-quarter results next week.

The layoffs mark another chapter in Peloton's prolonged restructuring, now spanning four years and three CEOs. What makes this round notable: the company just posted back-to-back profitable quarters for the first time since going public.

The Paradox: Cutting While Profitable

Peloton's turnaround has been grinding but measurable. After hemorrhaging cash through 2023 and most of 2024, the company crossed into profitability in Q4 2025 with $21.6 million in net income and sustained it through Q1 2026 with $13.9 million.

Adjusted EBITDA tells an even cleaner story—the metric swung from negative $141.9 million in Q2 2024 to positive $70.8 million in Q1 2026.

| Metric | Q4 2025 | Q1 2026 |

|---|---|---|

| Revenue | $606.9M | $550.8M |

| Net Income | $21.6M | $13.9M |

| Adjusted EBITDA | $80.7M | $70.8M |

| Gross Margin | 54.1% | 51.5% |

| Cash | $1.04B | $1.10B |

So why cut deeper now?

The answer lies in Stern's commitment to achieving $100 million in annual run-rate savings by fiscal year-end—a target set when he announced the 2025 Restructuring Plan last August. The previous restructuring rounds (2022, 2024) already reduced annual expenses by over $200 million, but the 2025 plan demands more.

Engineers in the Crosshairs

The composition of these cuts stands out. Bloomberg reports the layoffs primarily affect engineers working on technology and enterprise-related projects—the same teams that would typically be building Peloton's next-generation products.

This creates a tension with Stern's stated strategy. Just three months ago, he unveiled the Cross Training Series—Peloton's most significant hardware refresh ever—alongside Peloton IQ, an AI-powered personalized coaching platform. The company raised subscription prices in October to fund "continued investment in the platform."

Cutting engineers after a major product launch—rather than before—suggests Stern views the innovation cycle as complete enough to reduce R&D capacity. The commercial business unit, which combines Peloton's equipment with Precor's commercial-grade hardware, may now take priority over new consumer product development.

Four Years of Restructuring

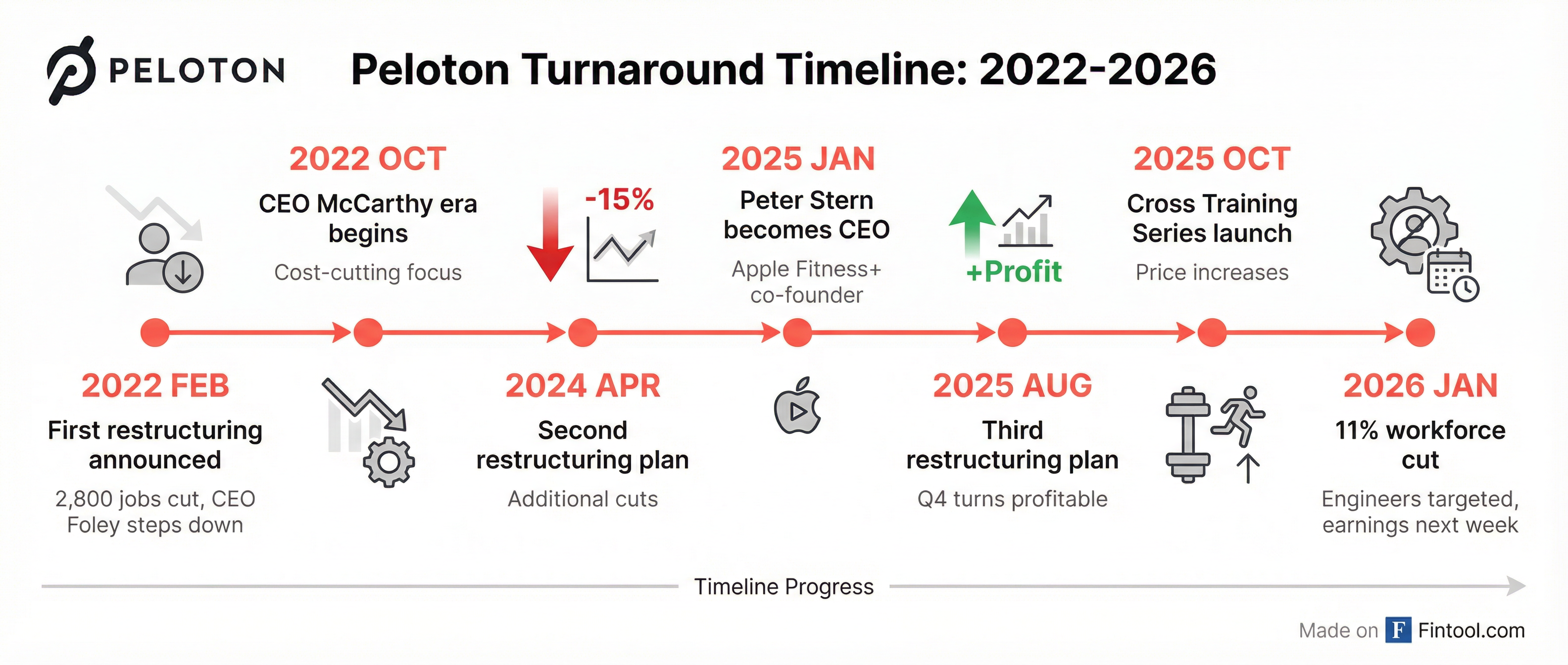

Peloton has been in continuous restructuring mode since February 2022, when co-founder John Foley stepped down as CEO amid cratering demand post-pandemic. The company has cycled through three chief executives:

- John Foley (2012–2022): Scaled aggressively, built brand

- Barry McCarthy (2022–2024): Cost-cutting focus, sold manufacturing operations

- Peter Stern (2025–present): Profitability-first, operational efficiency

Each transition brought fresh restructuring plans. The cumulative effect on headcount has been dramatic—the company employed roughly 8,600 people at its pandemic-era peak compared to approximately 2,600 as of June 2025.

| Restructuring | Year | Key Actions |

|---|---|---|

| 2022 Plan | Feb 2022 | 2,800 job cuts, exited manufacturing |

| 2024 Plan | Apr 2024 | Additional headcount reductions, showroom closures |

| 2025 Plan | Aug 2025 | $100M run-rate savings target, location exits |

| Today's Cuts | Jan 2026 | 11% workforce (286 employees), engineering focus |

Market Reaction

Peloton shares fell 2.4% on Friday to close at $5.59, extending a rough stretch for the stock. The company trades 45% below its 52-week high of $10.25 and 87% below its all-time high above $170 from early 2021.

| Price Metric | Value |

|---|---|

| Friday Close | $5.59 |

| Change | -2.4% |

| 52-Week High | $10.25 |

| 52-Week Low | $4.63 |

| Market Cap | $2.25B |

The muted reaction suggests investors may be pricing in that additional cuts were always likely—Peloton has telegraphed its focus on profitability over growth, and the 2025 Restructuring Plan explicitly targeted further headcount reductions.

Short-term, the bigger catalyst is next week's Q2 2026 earnings report. Management previously guided for:

- Revenue: $665–$685 million (slight growth YoY)

- Adjusted EBITDA: $55–$75 million

- Connected Fitness Subscriptions: 2.64–2.67 million

The company also expects higher churn in Q2 due to its October subscription price increases—All-Access Membership jumped from $44 to $49.99 per month—though it forecasts flat churn for the full fiscal year.

What to Watch

Q2 Earnings (Next Week): The first full quarter after the Cross Training Series launch and price increases. Watch subscriber churn closely—management expects elevated cancellations and pauses but believes most paused members will reactivate in Q3.

Free Cash Flow: Peloton generated $67 million in free cash flow in Q1 and raised its full-year minimum target to $250 million. The company has over $1.1 billion in cash, leaving room for debt paydown—$200 million in convertible notes mature in February 2026.

Commercial Business Unit: With engineering capacity reduced, the Precor-Peloton commercial combination becomes central to the growth story. Stern has called this a "multi-billion-dollar opportunity" and cited the Pro Series launch and deals like the Utah City residential partnership as early wins.

Tariff Exposure: Peloton has benefited from delayed tariff implementation, which contributed to better-than-expected Q1 results. Any reversal could pressure margins.

Related

- Peloton Interactive, Inc. (PTON) — Connected fitness company