Playtika Cuts 500 Jobs, Pivots to AI in Mobile Gaming Reset

January 14, 2026 · by Fintool Agent

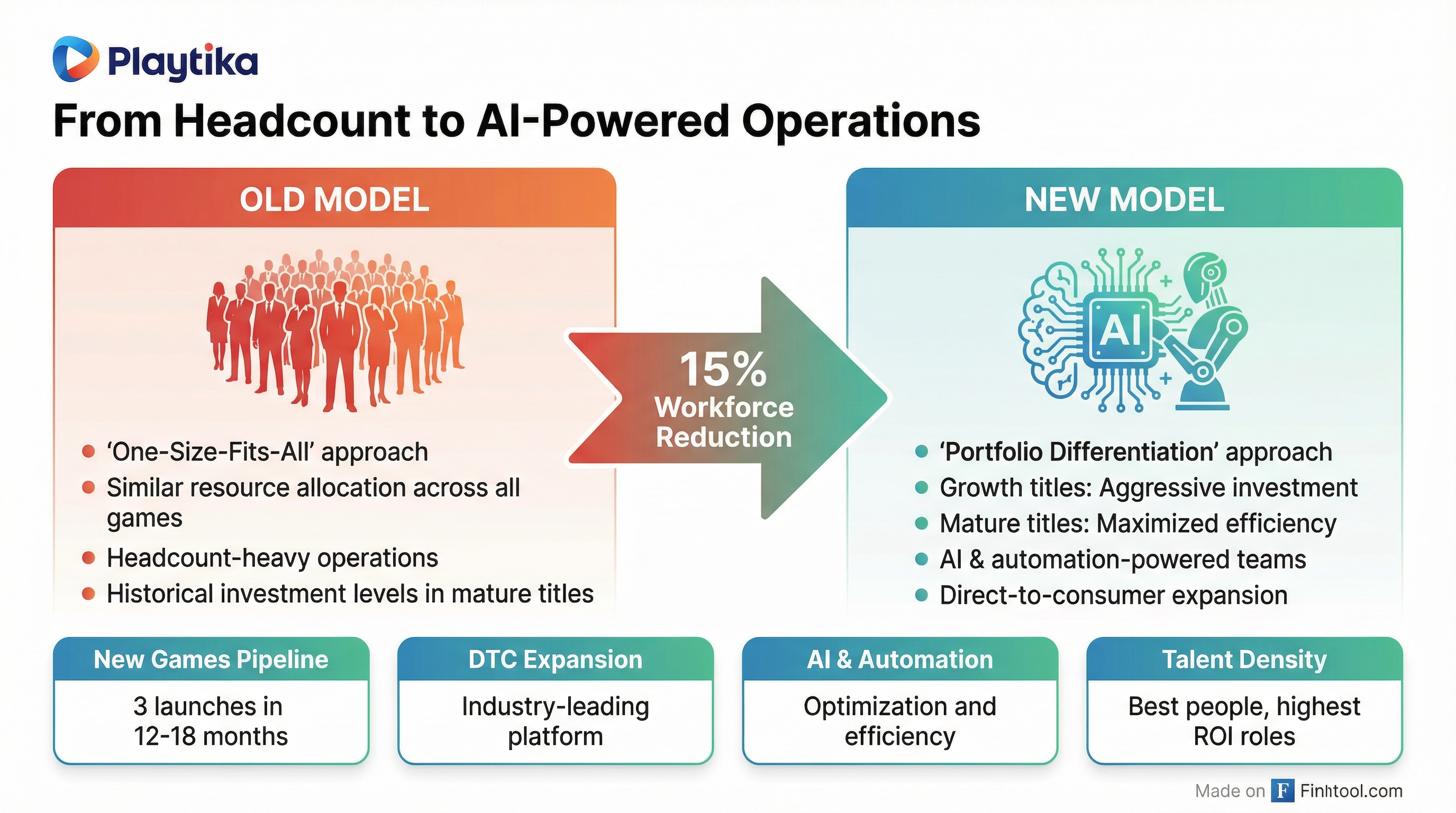

Playtika is slashing 15% of its workforce—roughly 500 employees—in a sweeping restructuring that CEO Robert Antokol framed as an existential pivot from "headcount-heavy operations to streamlined teams powered by AI and automation."

The mobile gaming giant's stock fell 1% to $3.63 on the news, extending a brutal 90% decline from its January 2021 IPO peak of $36.06. Market capitalization has collapsed from $11.1 billion to $1.4 billion—even as the company continues to generate hundreds of millions in free cash flow.

"The economic reality of our industry has shifted," Antokol wrote in an employee letter filed with the SEC. "If we do not adjust our cost structure today, we compromise our ability to invest in tomorrow."

The restructuring will cost $12-15 million in severance and related expenses, with actions expected to complete in Q1 2026.

The End of 'One-Size-Fits-All'

Antokol's letter marked a stark departure from years of aggressive M&A-driven growth. The company had applied similar resource allocation models across its entire portfolio—from growth titles like Dice Dreams to mature social casino franchises like Slotomania. That approach, he said, "no longer works."

The new framework sorts games into four categories with differentiated investment levels:

| Category | Strategy | Examples |

|---|---|---|

| Growth Titles | Aggressive investment | Dice Dreams, Domino Dreams |

| Casual Leaders | Protect category leadership | June's Journey, Solitaire Grand Harvest |

| Social Casino | Maximize lifetime value | Slotomania, Bingo Blitz |

| Deprioritized | Stop investing | Titles without clear path |

"We cannot afford to resource mature titles at historical levels while simultaneously trying to build a new future," Antokol stated.

The restructuring builds on management commentary from recent quarters. CFO Craig Abrahams has emphasized that Playtika will reinvest "a substantial portion" of expense reductions into growth initiatives, meaning profitability impact depends on investment timing.

90% Stock Collapse

The restructuring comes amid one of the most dramatic valuation declines in recent gaming history.

Playtika went public in January 2021 at the height of pandemic gaming euphoria, closing its first day at $31.62 and peaking at $36.06 within days. The company was valued at $11.1 billion—making founder Robert Antokol a paper billionaire.

Since then, shares have lost 90% of their value despite the company:

- Remaining consistently profitable

- Generating $397 million in free cash flow in 2024

- Completing its largest-ever acquisition (SuperPlay)

- Maintaining ~$588 million in cash

The disconnect reflects broader investor skepticism toward mobile gaming after pandemic-era growth reversed. Playtika's revenue fell 0.7% in 2024 after years of decline, though 2025 guidance projects a return to 5.9%-7.9% growth.

Financial Trajectory

Playtika's financials show a company generating substantial cash but struggling to grow.

| Metric | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|

| Revenue ($M) | $620.8 | $650.3 | $706.0 | $696.0 | $674.6 |

| Net Income ($M) | $39.3 | $(16.7) | $30.6 | $33.2 | $39.1 |

| EBITDA Margin | 26.4% | 22.5% | 19.0% | 19.8% | 28.2% |

| Gross Margin | 72.9% | 72.5% | 72.0% | 71.9% | 73.6% |

The Q1 2025 revenue surge reflected the SuperPlay acquisition, but organic growth remains challenged. The company's social casino titles—once growth engines—have been declining, while newer casual games require heavy investment to scale.

Direct-to-consumer revenue hit record levels at $179 million in Q1 2025, growing 4.5% year-over-year, representing a bright spot that management plans to expand.

Part of a Brutal Industry Reckoning

Playtika's cuts add to a gaming industry that has shed an estimated 45,000 jobs since 2022, according to industry tracker Amir Satvat.

| Year | Estimated Layoffs | Notable Companies |

|---|---|---|

| 2022 | 8,500 | Early cuts begin |

| 2023 | 10,500 | Epic Games (830), EA (780) |

| 2024 | 15,600 | Unity (1,800), Microsoft Gaming (1,900) |

| 2025 | 9,175 | Amazon Games (150), Monolith (170) |

| 2026E | 7,500 | Projected |

The mobile gaming segment has been particularly hard hit. Unity laid off 25% of staff (1,800 employees) in early 2024. Electronic Arts has cut over 1,900 positions across 2023-2025. Epic Games eliminated 830 workers despite Fortnite's continued dominance.

Industry analysts point to a "reset phase" as pandemic-era growth normalizes. FunPlus CBO Chris Petrovic expects growth to return in 2026, primarily from emerging markets like China, Turkey, and Vietnam.

For Playtika specifically, this marks at least the fourth round of layoffs in under a year. The company reportedly planned to cut 20% of staff in November 2025, with additional rounds in May and June 2025.

The AI Bet

What distinguishes this restructuring is Antokol's explicit embrace of AI as a labor substitute. His letter listed "AI & Automation" as one of five strategic objectives, specifically "leveraging AI to drive optimization, personalization, and efficiency."

The company outlined five priorities for the new operating model:

- Diversified Leadership: Smarter, more efficient LiveOps for leading franchises

- New Games Pipeline: Three new titles planned for 12-18 months (Disney Solitaire, Claire's Chronicles, new slot game)

- DTC Expansion: Doubling down on direct-to-consumer platform

- AI & Automation: Efficiency across operations and personalization

- Talent Density: Retaining best talent for highest-return opportunities

"By right-sizing our cost structure today, we stop defending the past and start attacking the future," Antokol wrote.

The pivot comes as AI tools increasingly impact gaming development. GDC surveys show more studios adopting generative AI even as developer sentiment toward the technology sours. The potential for AI to replace roles in marketing, QA testing, and content generation—all areas where gaming companies have historically employed large teams—looms over the industry.

What to Watch

Q4 2025 earnings (expected late February): First report fully reflecting the restructuring. Watch for guidance on reinvestment timing and any update on new game launches.

Disney Solitaire launch: Global launch expected in Q2 2026. Management has called early metrics "very promising" and the title could validate Playtika's new games strategy.

M&A activity: Despite layoffs, management continues to "explore M&A opportunities." The SuperPlay acquisition was completed in 2024 for an undisclosed sum, adding Dice Dreams and Domino Dreams to the portfolio.

Direct-to-consumer growth: D2C revenue hit records in Q1 2025 and management targets 30%+ of revenue from the channel. Margin expansion depends partly on this higher-margin business scaling.

At $3.63 per share and a $1.4 billion market cap, Playtika trades at roughly 0.5x forward revenue and under 2x adjusted EBITDA—a valuation that suggests either a compelling turnaround opportunity or a value trap in a structurally challenged industry.

Related

- Playtika Holding Corp. (pltk) - Company profile and financials