Progressive CFO John Sauerland to Retire After Decade Leading Insurer's 523% Stock Run

January 28, 2026 · by Fintool Agent

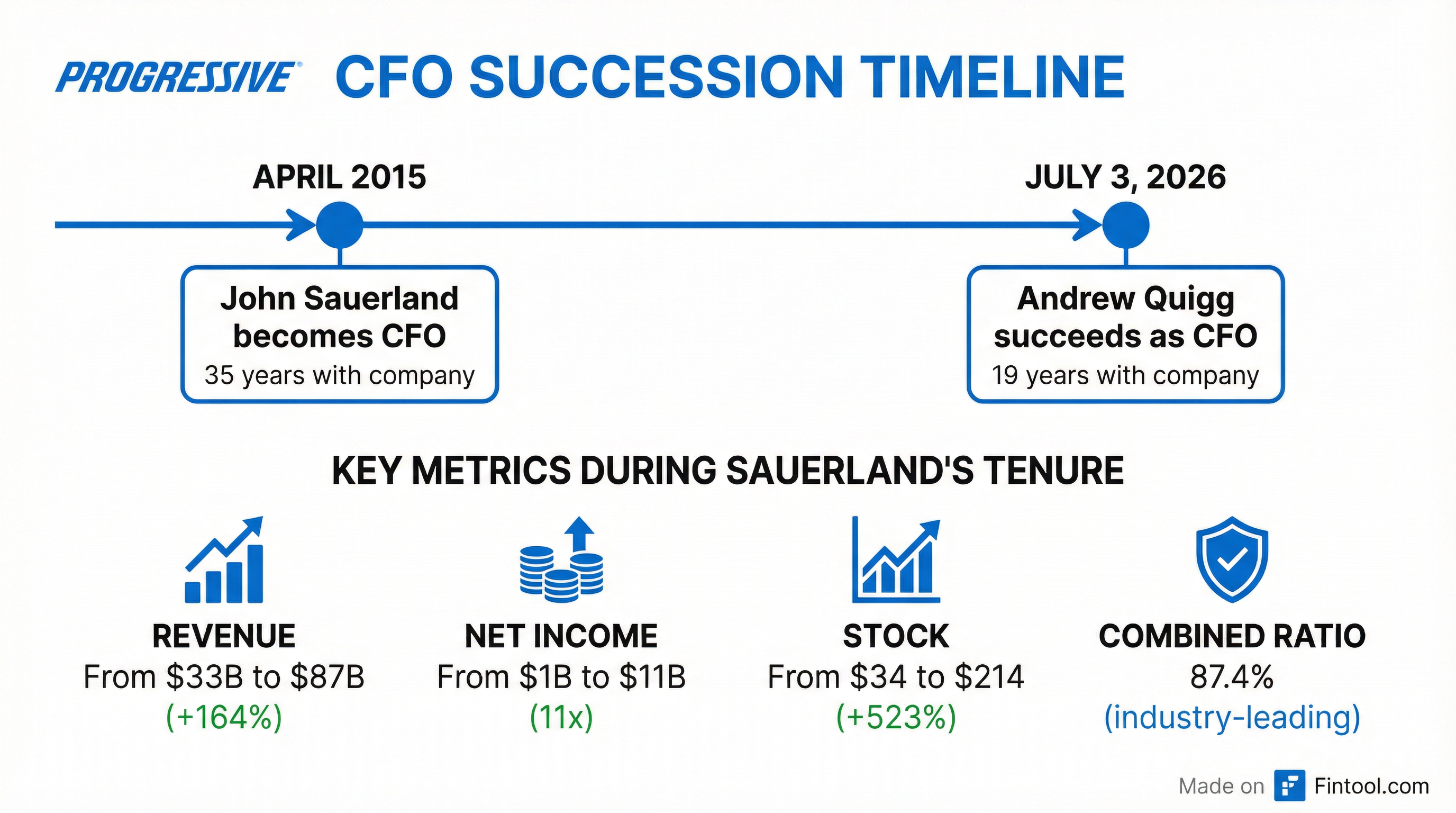

Progressive announced today that Chief Financial Officer John Sauerland will retire on July 3, 2026, capping a 35-year career with the nation's second-largest auto insurer. Chief Strategy Officer Andrew Quigg will succeed him, continuing a pattern of internal succession at the Mayfield Village, Ohio-based company.

Shares rose 4.1% to $214.46 on the news, which accompanied strong Q4 2025 results showing net income up 25% year-over-year. The CFO transition represents an orderly retirement rather than any performance concerns or activist pressure — Sauerland leaves with the stock having delivered a 523% total return during his decade as CFO.

A Decade of Transformation

When Sauerland assumed the CFO role in April 2015, Progressive had revenue of $33 billion and was primarily an auto insurer competing against giants like GEICO and State Farm. Over the following decade, he helped architect the company's transformation into a diversified personal lines powerhouse.

Key Financial Milestones Under Sauerland's CFO Tenure:

| Metric | FY 2016 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $22.9B | $73.6B | +221% |

| Net Income | $1.0B | $8.5B | +722% |

| Diluted EPS | $1.76 | $14.40 | +718% |

| Total Assets | $33.4B | $105.7B | +216% |

| Return on Equity | 13.1% | 37.0% | +24 pts |

The company's combined ratio — the key profitability metric for insurers — improved from 95.8% in 2022 to 88.8% in 2024, well below the 96% target that Progressive has historically used as its profitability threshold.

The Full-Career Progressive Man

Unlike many corporate CFOs who cycle through multiple companies, Sauerland is a career Progressive employee. He joined as a summer intern in 1990, became a full-time assistant product manager in Cleveland in 1991, and worked his way through nearly every corner of the business before reaching the C-suite.

His career path included:

- Product Manager for Iowa, Kansas, South Dakota, and Pennsylvania

- General Manager for Mississippi, then Minnesota and Wisconsin

- Claims General Manager overseeing 24/7 service for eight Midwestern states

- President of Direct Business (2006)

- President of Personal Lines (8 years before becoming CFO)

- Chief Financial Officer (April 2015 - July 2026)

"We are so grateful to John for his 35 years of service to Progressive, including the last 10 as our CFO," said CEO Tricia Griffith. "John's thoughtful leadership and dedication to Progressive throughout his career have been instrumental to our growth and success."

Sauerland holds a bachelor's degree in applied mathematics from UCLA and an MBA from the University of Chicago.

Successor: The Harvard-Trained Strategist

Andrew Quigg brings a different pedigree but similar longevity. The incoming CFO joined Progressive in 2007 after stints at McKinsey, General Mills, and Merrill Lynch. He holds a bachelor's in applied mathematics and economics from Yale and an MBA from Harvard Business School.

As Chief Strategy Officer since July 2018, Quigg has been responsible for developing corporate strategies for profitable growth — precisely the forward-looking perspective needed in the CFO role as Progressive navigates industry disruption from telematics, autonomous vehicles, and climate-related catastrophe losses.

His pre-Progressive experience includes:

- Summer Associate at McKinsey & Company

- Financial Analyst at General Mills

- Analyst at Merrill Lynch

- Board Member at Upstart (fintech lending platform)

At Progressive, Quigg progressed through:

- Agency Auto Product Manager

- Business Leader for Direct Media

- Customer Experience General Manager

- Chief Strategy Officer (July 2018 - present)

Insider Trading Context

Sauerland has been a regular seller of Progressive shares through scheduled transactions, consistent with long-tenured executives managing concentrated positions. According to SEC filings, his most recent transactions include:

| Date | Transaction | Shares | Price |

|---|---|---|---|

| Jan 20, 2026 | Option Exercise | 6,776 | $0.00 |

| Jan 20, 2026 | Tax Withholding | 2,339 | $201.32 |

| Jan 8, 2026 | Award Grant | 1,179 | $0.00 |

| Nov 28, 2025 | Sale | 5,000 | $228.48 |

His current ownership stands at approximately 227,500 shares worth roughly $49 million at today's prices — a substantial position that aligns his interests with shareholders through the transition.

Record Q4 and Full Year Results

The retirement announcement accompanied strong Q4 2025 results, helping shares overcome the typical uncertainty that accompanies executive departures:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Net Premiums Written | $19.5B | $18.1B | +8% |

| Net Premiums Earned | $21.1B | $19.1B | +10% |

| Net Income | $2.95B | $2.36B | +25% |

| EPS (Diluted) | $5.02 | $4.01 | +25% |

| Combined Ratio | 88.0% | 87.9% | +0.1 pts |

For full year 2025, Progressive delivered:

- Net premiums written: $83.2 billion (+12% YoY)

- Net income: $11.3 billion (+33% YoY)

- EPS: $19.23 (+34% YoY)

- Combined ratio: 87.4%

- Policies in force: 38.6 million (+10% YoY)

What It Means for Investors

The CFO transition appears well-orchestrated with minimal disruption risk:

Bullish signals:

- Five-month transition window allows thorough knowledge transfer

- Internal succession maintains strategic continuity

- Quigg's strategic background aligns with growth-focused priorities

- Strong Q4/FY2025 results demonstrate operational momentum

- Record underwriting profitability provides cushion for any transition friction

Watch items:

- Quigg has no prior CFO experience at a public company

- Progressive faces intensifying competition as industry profitability improves

- Climate-related catastrophe volatility remains a wildcard

- Stock trading 27% below 52-week highs despite strong results

The next major data point comes at Progressive's Q4 investor relations conference call scheduled for March 3, 2026, where Sauerland and Quigg are expected to present together on capital and investment strategy.