PublicSquare Founder Michael Seifert Out as CEO, Loses Voting Control in Fintech Pivot

January 29, 2026 · by Fintool Agent

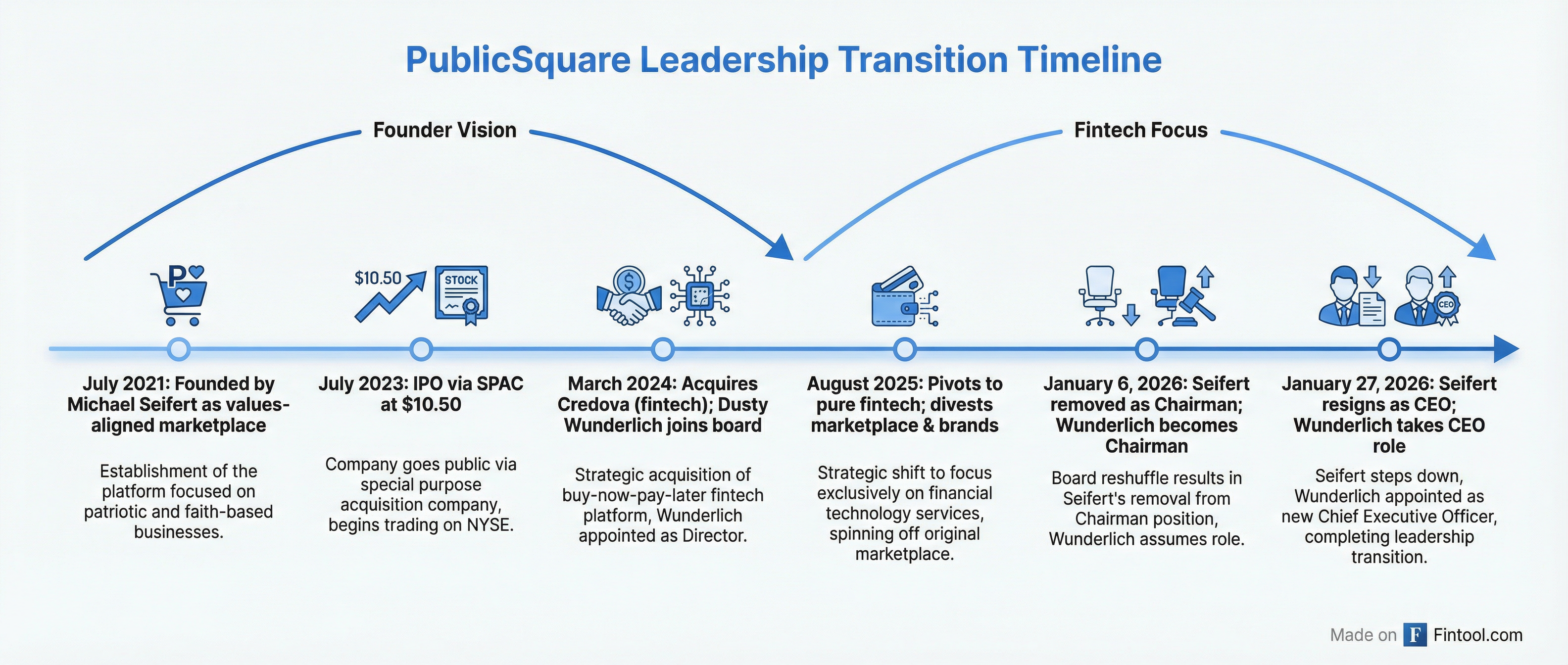

Publicsquare founder Michael Seifert has resigned from all positions at the company he built, just three weeks after being stripped of his chairman title. The departure marks the end of an era for the "anti-woke" marketplace that captivated conservative media—and signals a complete strategic transformation.

Seifert forfeited 1 million Class C shares as part of his exit agreement, triggering a countdown that will end his 51% voting control within 30 days. Taking his place as CEO is Dusty Wunderlich, the former CEO of Credova, whose fintech company PublicSquare acquired in March 2024.

"This leadership change is a critical step in the Company's transition toward credit and payments, with a focus on cash flow efficiency," said Blake Masters, Lead Independent Director. "We are grateful for Michael's founding vision and his support of this transition."

The Two-Week Unraveling

The speed of Seifert's exit is striking. On January 6, 2026, PublicSquare announced what appeared to be a governance improvement: Seifert would remain as CEO while Wunderlich took over as non-executive chairman. The company praised the move as "delineating board oversight" and "enhancing operational focus."

Twenty-one days later, Seifert was gone entirely.

The 8-K filing states his resignation "was not the result of a disagreement between Mr. Seifert and the Company on any matter relating to the Company's operation, policies, or practices." But the separation agreement tells a different story: Seifert forfeited 1 million shares, agreed to an 18-month lockup limiting sales to 50,000 shares per month, and signed a 24-month non-compete and non-solicitation agreement.

From Marketplace to Fintech: The Strategic Pivot

The departure caps a transformation that began in August 2025, when PublicSquare announced it would divest its marketplace and EveryLife baby products brand to focus exclusively on fintech.

Seifert himself announced the pivot on the Q2 2025 earnings call: "While this has obviously been a heavy decision, I believe that in five years' time, we will look back on this decision as a truly pivotal moment in realizing the future we've always envisioned for Public Square."

The company's FinTech segment now comprises three businesses:

- Credova: Buy-now-pay-later focused on outdoor sports and firearms

- PSQ Payments: Payment processing for "values-aligned" merchants

- PSQ Impact: Fundraising platform for conservative nonprofits

By Q3 2025, PublicSquare had classified its Marketplace and Brands segments as discontinued operations.

Stock Collapse: Down 88% From Peak

The strategic transformation has come at a brutal cost for shareholders. PSQH shares closed at $0.92 on January 28—down 88% from the December 3, 2024 high of $7.77, which coincided with Donald Trump Jr.'s appointment to the board.

The stock fell 77% in 2025, making it one of the worst-performing software stocks of the year.

| Metric | Value |

|---|---|

| January 2025 Open | $4.45 |

| Current Price (Jan 28, 2026) | $0.92 |

| 52-Week High | $7.77 (Dec 3, 2024) |

| 52-Week Low | $0.89 (Jan 28, 2026) |

| 2025 Return | -77% |

| Peak-to-Trough Decline | -88% |

The Voting Control Countdown

Perhaps the most significant consequence of Seifert's exit is the loss of "controlled company" status. Under PublicSquare's charter, Seifert's Class C shares—which gave him approximately 51% voting power—automatically convert to Class A common stock 30 days after he ceases serving as a director or officer.

That conversion will occur on February 27, 2026.

Following conversion, PublicSquare will need to comply with NYSE governance requirements it previously avoided, including:

- A majority of independent directors within one year

- Fully independent compensation and nominating committees within one year

- At least one independent member on each committee within 90 days

"There can be no assurance that the Company will be able to satisfy such requirements," the filing warns. "Failure to meet such requirements could subject the Company to delisting from the NYSE."

Who is Dusty Wunderlich?

The new CEO brings a starkly different profile than the media-savvy founder he replaces. Wunderlich built Credova as a fintech platform serving the firearms industry—a sector systematically excluded from traditional banking relationships under policies like Operation Choke Point.

His background spans multiple fintech ventures:

- Credova (2020-2024): CEO of the buy-now-pay-later platform acquired by PublicSquare

- Bristlecone Holdings (2014-2017): CEO of point-of-sale financing solutions

- DCA Partners (2011-2013): Principal at boutique investment bank

Wunderlich holds an MBA and bachelor's in finance and economics from Missouri State University. The board cited his "fintech experience and deep knowledge of the Company's operations" as qualifications for the CEO role.

Financial Reality Check

Despite the leadership turmoil, PublicSquare's fintech business is showing growth. The company raised preliminary Q4 2025 revenue guidance to $6.7-6.9 million, exceeding prior guidance of $6.0 million by more than 10%.

| Metric | Q3 2025 | Guidance |

|---|---|---|

| Q4 2025 Revenue | - | $6.7-6.9M |

| FY 2026 Revenue | - | ≥$32M |

| FinTech Revenue Growth (Q/Q) | +28% | - |

| Payments Revenue Growth (Q/Q) | +50% | - |

| Credit Revenue Growth (Q/Q) | +22% | - |

However, the company remains deeply unprofitable. As of September 30, 2025, PublicSquare had an accumulated deficit of $144.7 million.

What to Watch

Near-term catalysts:

- February 27, 2026: Class C shares convert; controlled company status ends

- March 2026: Deadline to have at least one independent committee member

- Q4 2025 Earnings: First results under new leadership

Key questions:

- Can PublicSquare meet NYSE independence requirements?

- Will the fintech pivot drive profitability, or continue burning cash?

- How will Seifert's departure affect the company's conservative brand identity?

The company that launched with Tucker Carlson advertising and CPAC appearances now finds itself led by a fintech operator rather than a political movement figure. Whether that's a feature or a bug depends on whether you view PublicSquare as a mission-driven marketplace or a payments business serving an underbanked niche.

Related Companies: PSQ Holdings (psqh)