Earnings summaries and quarterly performance for PSQ Holdings.

Executive leadership at PSQ Holdings.

Michael Seifert

Chief Executive Officer

Brian Billingsley

President of Financial Technology

Dusty Wunderlich

Chief Strategy Officer

James Giudice

Chief Legal Officer and General Counsel

James Rinn

Chief Financial Officer and Treasurer

Mike Hebert

Chief Operating Officer

Randy Carlson

Chief Technology Officer

Sarah Gabel Seifert

President of EveryLife, Inc.

Board of directors at PSQ Holdings.

Research analysts who have asked questions during PSQ Holdings earnings calls.

Darren Aftahi

Roth Capital Partners

4 questions for PSQH

Barry Haimes

Sage Asset Management

2 questions for PSQH

Francesco Marmo

Maxim Group

1 question for PSQH

Thomas Forte

D.A. Davidson & Co.

1 question for PSQH

Recent press releases and 8-K filings for PSQH.

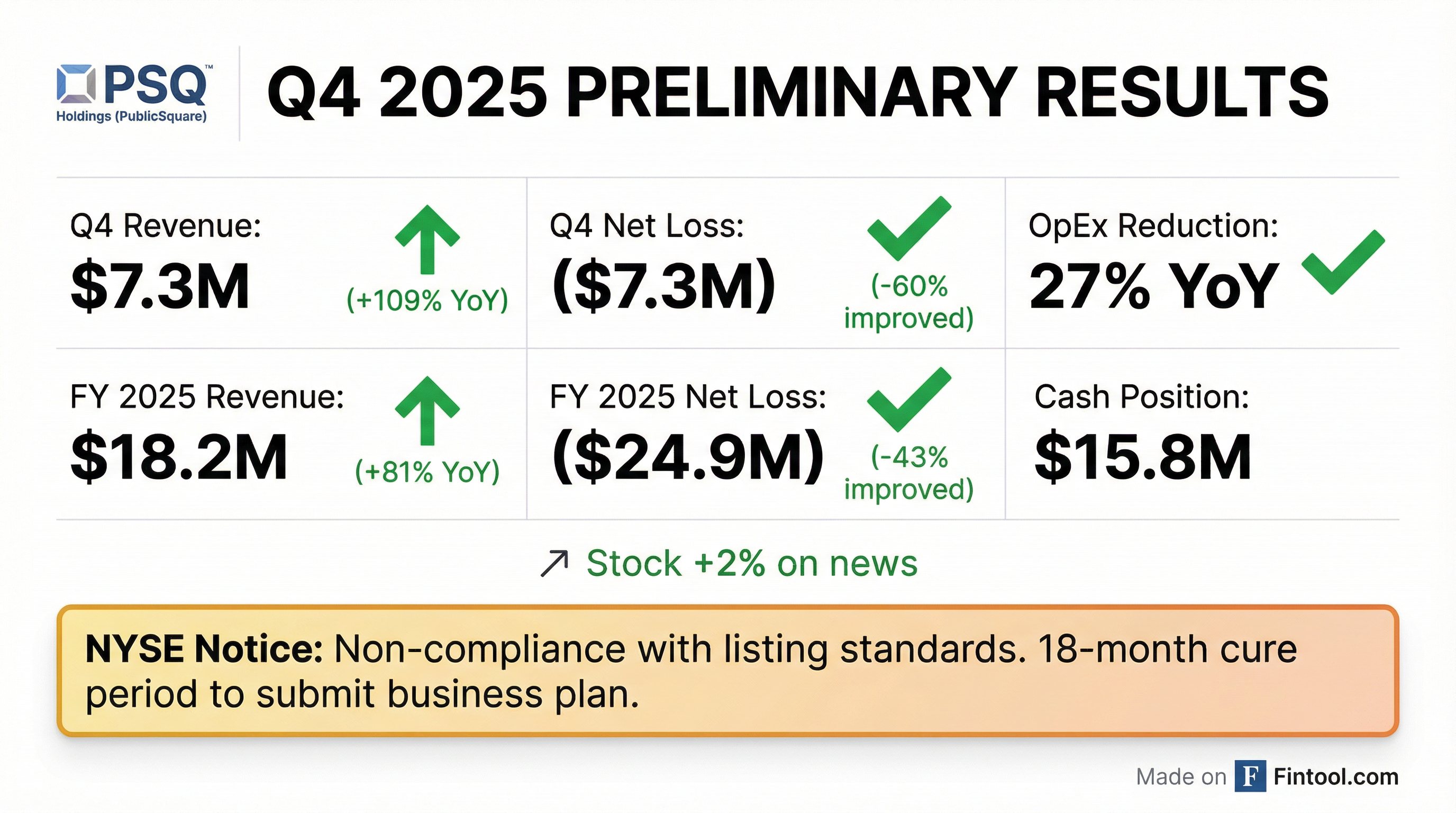

- PSQ Holdings, Inc. reported preliminary, unaudited net revenue of $7.3 million for Q4 2025, representing 109% year-over-year growth, and $18.2 million for full-year 2025, an 81% year-over-year growth.

- The company significantly improved its financial performance, with a Q4 2025 net loss of $7.3 million (a 60% improvement year-over-year) and a full-year 2025 net loss of $24.9 million (a 43% improvement year-over-year), with loss per share improving to $(0.55) for the full year.

- On February 10, 2026, PSQ Holdings received a notice from the NYSE for non-compliance with listing standards concerning minimum total market capitalization, stockholders' equity, and average closing stock price.

- The company plans to submit a business plan to the NYSE within 45 days to address non-compliance with Rule 802.01B and intends to regain compliance with Rule 802.01C within a six-month cure period.

- PSQ Holdings, Inc. (PublicSquare) has appointed Dusty Wunderlich as its new Chief Executive Officer, effective January 27, 2026, following the resignation of Michael Seifert from his positions as CEO and a member of the Board of Directors.

- This leadership change is part of the Company's strategic transition to focus on core fintech businesses, including credit and payments.

- In connection with his departure, Michael Seifert forfeited 1,000,000 shares of Class C common stock, and his remaining capital stock is subject to an 18-month lockup with limits on monthly and daily sales.

- As a result of Mr. Seifert's resignation, all outstanding shares of Class C common stock will convert into Class A common stock on February 27, 2026, causing the Company to lose its "controlled company" status under NYSE rules and requiring it to comply with new corporate governance standards.

- PSQ Holdings announced preliminary fourth-quarter 2025 revenue estimates of between $6.7 and $6.9 million, exceeding its previously issued guidance of $6.0 million by more than 10%.

- The company reaffirmed its full-year 2026 revenue guidance of greater than or equal to $32.0 million.

- Dusty Wunderlich has been named Chairman of the Board, replacing Michael Seifert, who continues as President and Chief Executive Officer.

- Blake Masters has been appointed Lead Independent Director, and Michael Perkins has been elevated to Chief Operating Officer.

- PSQ Holdings announced leadership changes, including Dusty Wunderlich being named Chairman of the Board and Michael Perkins elevated to Chief Operating Officer.

- The company's preliminary fourth-quarter 2025 revenue estimates are expected to be between $6.7 and $6.9 million, exceeding its prior guidance of $6.0 million by more than 10%.

- PublicSquare reaffirmed its full-year 2026 revenue guidance of greater than or equal to $32.0 million.

- PSQ Holdings, Inc. (PublicSquare) announced a registered direct offering of approximately $7.5 million.

- The offering, which closed on December 19, 2025, includes 1,800,000 shares of Class A common stock, 5,018,184 pre-funded warrants, and 8,522,730 common warrants.

- The combined purchase price for each share (or pre-funded warrant) and accompanying common warrant is $1.10.

- Common warrants have an exercise price of $1.18 per share, while pre-funded warrants have an exercise price of $0.0001 per share.

- The net proceeds from the offering are designated for general corporate purposes, including working capital.

- PSQ Holdings, Inc. (PublicSquare) announced significant year-over-year growth in its Payments and Credit businesses for the 2025 Black Friday through Cyber Monday (BFCM) period.

- Gross Merchandise Volume (GMV) processed by the PSQ Payments business increased by 536%, growing from $1.2 million in 2024 to $7.8 million in 2025 during the BFCM period.

- The company's Credova credit business saw its GMV increase by 75%, from $706,000 in 2024 to $1.24 million in 2025 during the BFCM period.

- The number of loan and lease contracts for the Credova credit business also grew by 73%, from 931 contracts in 2024 to 1,066 contracts in 2025.

- Public Square reported net revenue from continuing operations of $4.4 million for Q3 2025, marking a 37% year-over-year increase. FinTech revenue, encompassing payments and credit offerings, also reached $4.4 million, with payments revenue growing 50% quarter over quarter and credit revenue increasing 22% quarter over quarter.

- The company demonstrated improved financial performance, reducing its net loss to $12 million in Q3 2025 from $13.1 million in Q3 2024, and achieving a 37% improvement in net loss per common share to $0.26. Operating expenses decreased 13% compared to the prior year period.

- Public Square reaffirmed its Q4 2025 revenue guidance of approximately $6 million and its Full Year 2026 revenue guidance of greater than or equal to $32 million.

- Strategically, the company is doubling down on FinTech, with plans to monetize its brand segment (EveryLife) and marketplace segment, expecting a purchase agreement for the brand segment by the end of Q4 2025.

- PSQ Holdings, Inc. reported net revenue from continuing operations of $4.4 million for the third quarter ended September 30, 2025, representing a 37% increase compared to the prior year period.

- Earnings per share improved to $(0.26) for Q3 2025, a 37% improvement from $(0.41) in Q3 2024.

- The company reaffirmed its fourth quarter 2025 revenue guidance of approximately $6.0 million and full year 2026 revenue guidance of greater than or equal to $32.0 million.

- As of September 30, 2025, PublicSquare had $12.3 million of cash and cash equivalents.

- PublicSquare is negotiating to purchase certain intellectual property assets from Tandym, Inc. for proposed consideration including $5.75 million in Class A Common Stock and up to $1.0 million in cash.

- PSQ Holdings is positioning itself to lead a new era of finance, focusing on technology-driven disruption and values-driven innovation in response to perceived systemic de-banking and a significant wealth transfer.

- The company is building a fully integrated financial ecosystem encompassing payments, credit, digital assets, and treasury services, with core pillars like Credova, PSQ Payments, PSQ Impact, and private-label credit/debit being integrated in 2025.

- PSQ Holdings plans to divest EveryLife by the end of Q4 2025, expecting a market value of 1-2x TTM revenue of $13.4 million as of September 30, 2025, with proceeds intended to fund Fintech product innovation.

- Projected GAAP Fintech revenue for 2H 2025 is $10.0 million (Q3 2025E: $4.0 million, Q4 2025E: $6.0 million) and $32.0 million for 2026E.

- PSQ Holdings is executing a strategic pivot to focus on fintech, monetizing its EveryLife brand and Marketplace to bolster its balance sheet and fund innovation. The EveryLife brand's exit price is expected to be 1-2 times trailing 12-month revenue, which was $12.4 million as of June 30, 2025.

- The company is expanding its fintech offerings to include crypto as a payment method and corporate treasury asset, with plans to allocate to major cryptos like Bitcoin and Ethereum in Q4 2025.

- New initiatives include the launch of PSQ Impact, a fundraising platform for the conservative movement featuring crypto donations, and an acquisition for a digital private label credit card technology platform expected to close in early Q4 2025.

- Management believes the company is currently undervalued, expecting a blended peer group valuation of around 10x revenue for its fintech segments, suggesting a potential 100%+ arbitrage on stock price based on next 12 months revenue.

Fintool News

In-depth analysis and coverage of PSQ Holdings.

Quarterly earnings call transcripts for PSQ Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more