Redfin CEO Glenn Kelman Steps Down After 20 Years, Ending Founding Era

January 13, 2026 · by Fintool Agent

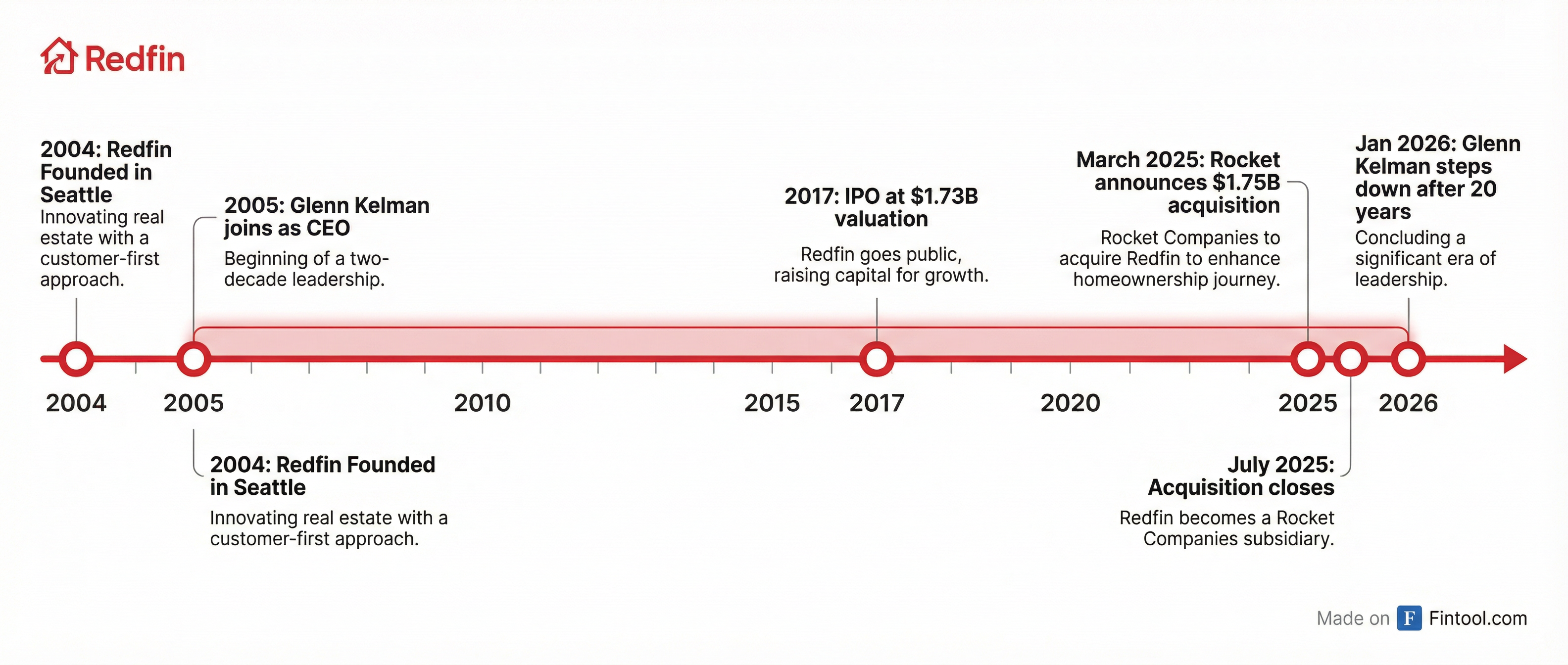

Glenn Kelman, the outspoken leader who transformed Redfin from a three-person startup into a tech-enabled real estate giant, announced Tuesday that he is stepping down as CEO after 20 years. The departure comes just six months after Rocket Companies completed its $1.75 billion acquisition of the Seattle-based brokerage, marking the end of an era in real estate technology.

"I gave it my all! Leaving was my decision," Kelman wrote on LinkedIn, adding that he hopes "to use all that I learned to do something as good as Redfin, in a different field."

Rocket CEO Varun Krishna will assume interim leadership of Redfin while the company searches for a permanent successor. Kelman's last day in the office is Friday, January 16, though he will remain available in an advisory capacity through April 1.

The Kelman Era: From Apartment to IPO

Kelman joined Redfin in 2005, when the company was barely more than an idea housed in a Seattle apartment. Under his leadership, Redfin pioneered map-based real estate search, built a network of over 2,200 agents across 42 states, and saved consumers more than $1 billion in commissions through its discounted brokerage model.

The company went public in 2017 at a $1.73 billion valuation, a milestone that validated the tech-first approach to residential real estate.

| Metric | Value |

|---|---|

| Tenure as CEO | 20 years (2005-2026) |

| IPO Valuation (2017) | $1.73 billion |

| Acquisition Value (2025) | $1.75 billion |

| Consumer Savings | $1+ billion in commissions |

| Agents Network | 2,200+ across 42 states |

| Monthly Visitors | 50 million |

Integration Into Rocket's Homeownership Empire

Rocket Companies announced the all-stock acquisition in March 2025, positioning the deal as a way to create a "one-stop shop for homeownership" combining America's largest mortgage lender with its most-visited real estate brokerage.

The deal closed on July 1, 2025, with Redfin rebranding as "Redfin Powered by Rocket" and introducing Rocket Preferred Pricing—a program offering homebuyers who use both Redfin agents and Rocket Mortgage a one percentage point rate reduction in the first year or up to $6,000 in lender credits.

Rocket expects more than $200 million in run-rate synergies by 2027, including $140 million in cost savings from eliminating duplicate operations and over $60 million in revenue synergies from cross-selling mortgage and real estate services.

Rocket's Consolidation Push

The Redfin acquisition was part of Rocket's aggressive expansion under CEO Varun Krishna. Just weeks after announcing the Redfin deal, Rocket revealed a $9.4 billion stock acquisition of mortgage servicer Mr. Cooper, creating a vertically integrated homeownership platform spanning search, brokerage, origination, and servicing.

Rocket shares closed at $22.76 on Tuesday, down 1.8%, giving the company a market capitalization of approximately $64.3 billion. The stock has more than doubled from its 52-week low of $10.41 as investors bet on the integration thesis.

| Rocket Companies (RKT) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Revenue | $413M | $401M | $401M | $388M |

| Net Income | ($124M) | ($2M) | ($10M) | $34M |

| Total Equity | $8.9B | $7.4B | $8.6B | $9.0B |

What Comes Next

Kelman's exit is a pivotal moment for Rocket's integration strategy. Krishna now faces the challenge of preserving Redfin's distinct culture and consumer-first brand while extracting the promised synergies. The search for Kelman's replacement will be closely watched—Rocket needs a leader who can bridge the gap between a scrappy Seattle tech company and a Detroit-based mortgage giant.

For Kelman, the departure caps a career defined by challenging real estate industry norms. In his LinkedIn farewell, he expressed gratitude to Rocket and hinted at future ventures: "I hope to use all that I learned to do something as good as Redfin, in a different field."

The housing market will be watching to see whether Redfin's consumer-first ethos survives the transition—or whether "Powered by Rocket" becomes the dominant identity.

Related: Rocket Companies