Earnings summaries and quarterly performance for Rocket Companies.

Executive leadership at Rocket Companies.

Varun Krishna

Chief Executive Officer

Bill Emerson

President

Brian Brown

Chief Financial Officer and Treasurer

Heather Lovier

Chief Operating Officer

Jonathan Mildenhall

Chief Marketing Officer

Shawn Malhotra

Chief Technology Officer

William Banfield

Chief Business Officer

Board of directors at Rocket Companies.

Research analysts who have asked questions during Rocket Companies earnings calls.

Jeffrey Adelson

Morgan Stanley

6 questions for RKT

Mark DeVries

Deutsche Bank

6 questions for RKT

Ryan Nash

Goldman Sachs & Co.

5 questions for RKT

Douglas Harter

UBS

4 questions for RKT

Ryan McKeveny

Zelman & Associates

4 questions for RKT

Mihir Bhatia

Bank of America

3 questions for RKT

Bose George

Keefe, Bruyette & Woods

2 questions for RKT

Derek Sommers

Jefferies

2 questions for RKT

Don Fandetti

Wells Fargo

2 questions for RKT

Lucas Haimes

Goldman Sachs

1 question for RKT

Recent press releases and 8-K filings for RKT.

- Rocket Companies reported Q4 2025 total revenue, net of $2.69 billion and adjusted revenue of $2.44 billion, with GAAP net income of $68 million and adjusted net income of $316 million. For the full year 2025, total revenue, net was $6.695 billion, and adjusted revenue was $6.859 billion, with a GAAP net loss of $234 million and adjusted net income of $628 million.

- The company provided Q1 2026 adjusted revenue guidance of between $2.6 billion to $2.8 billion, which includes $150 million from a reclassification of warehouse interest.

- Rocket Companies announced a three-year strategic alliance with Compass International Holdings to expand housing inventory and streamline the home buying and selling experience.

- Brian Brown, the current CFO, was appointed President, effective February 26, 2026, and will continue in his CFO and Treasurer roles.

- Rocket Companies reported Adjusted Revenue of $2,440 million and Adjusted EBITDA of $592 million for Q4 2025.

- The company's Q4 2025 financial results include the full quarter consolidation of Mr. Cooper, contributing to a servicing portfolio of $2.1 trillion in unpaid principal balance (UPB) for 2025. Q3 2025 results included the full quarter consolidation of Redfin.

- Rocket maintains a strong total liquidity position of $10.1 billion.

- The company achieved an ~80% refinance net recapture rate in FY 2025, leveraging its AI-driven, vertically integrated platform and ecosystem that includes Redfin and Mr. Cooper.

- Rocket Companies reported adjusted revenue of $2.4 billion for Q4 2025, exceeding guidance by $140 million, and $6.9 billion for the full year 2025. Adjusted diluted EPS was $0.11 in Q4 and $0.28 for the full year. Adjusted EBITDA for Q4 increased to $592 million, with margins expanding to 24%.

- The company successfully integrated the Redfin and Mr. Cooper acquisitions, with Redfin expense synergies fully realized six months ahead of plan and Mr. Cooper synergies on track to be realized ahead of the original 2027 target.

- Rocket Companies announced a historic strategic alliance with Compass to address home affordability, leveraging Redfin's home listings, Compass's network of 340,000 real estate agents, and Rocket Mortgage's integrated pricing bundle.

- For Q1 2026, Rocket expects adjusted revenue between $2.6 billion and $2.8 billion. The company grew its market share to 5.5% in Q4 2025 and anticipates a stronger mortgage market in 2026, with most industry forecasts predicting double-digit growth.

- Rocket Companies reported adjusted revenue of $2.4 billion for Q4 2025, exceeding guidance by $140 million, and $6.9 billion for the full year 2025. Adjusted diluted EPS was $0.11 per share in Q4 2025 and $0.28 for the full year.

- The company achieved $592 million in adjusted EBITDA in Q4 2025, with margins expanding to 24%, and a full-year adjusted EBITDA margin of 19%. Net rate lock volume, excluding correspondent, was $36 billion in Q4 2025, with a gain on sale margin of 320 basis points.

- Integration of the Redfin and Mr. Cooper acquisitions is ahead of schedule, with Redfin expense synergies fully realized 6 months ahead of plan and Mr. Cooper synergies on track to be realized well ahead of the original 2027 target.

- Rocket announced a historic partnership with Compass, making Redfin the exclusive home search portal for Compass's Private Exclusives and Coming Soon listings, and Rocket Mortgage Compass's digital mortgage partner.

- For Q1 2026, Rocket expects adjusted revenue to be between $2.6 billion and $2.8 billion. The company anticipates the 2026 mortgage market to be stronger than 2025, with most industry forecasts calling for double-digit growth.

- Rocket Companies reported strong Q4 2025 adjusted revenue of $2.4 billion, exceeding the high end of its guidance by $140 million, with adjusted diluted EPS of $0.11 and adjusted EBITDA of $592 million.

- The company successfully integrated its Redfin and Mr. Cooper acquisitions, fully realizing Redfin expense synergies 6 months ahead of plan and being on track to realize Mr. Cooper synergies ahead of the original 2027 target.

- Rocket announced a strategic partnership with Compass, making Redfin the exclusive home search portal for Compass's listings and Rocket Mortgage Compass's digital mortgage partner, aiming to improve home affordability and lead flow.

- For the full year 2025, Rocket generated $6.9 billion in adjusted revenue and $0.28 in adjusted diluted EPS, while growing its market share to 5.5% in Q4.

- For Q1 2026, Rocket expects adjusted revenue to be between $2.6 billion and $2.8 billion.

- Rocket Companies reported Q4 2025 total revenue, net of $2.69 billion and adjusted revenue of $2.44 billion, exceeding guidance, with GAAP net income of $68 million and adjusted net income of $316 million.

- For the full year 2025, the company generated total revenue, net of $6.7 billion and adjusted net income of $628 million.

- A three-year strategic alliance with Compass International Holdings was announced to expand housing inventory and streamline the home buying process, with Rocket Mortgage serving as Compass's digital mortgage partner.

- Brian Brown, the current CFO, was appointed President of Rocket Companies, effective February 26, 2026, while continuing his CFO and Treasurer duties.

- The company anticipates Q1 2026 adjusted revenue to be between $2.6 billion and $2.8 billion.

- Rocket Companies and Compass International Holdings announced a three-year strategic alliance to expand home listing inventory and enhance the home buying and selling experience.

- Compass International Holdings' unique inventory, including 'Coming Soon' and 'Private Exclusive' properties, will appear on Redfin.com, potentially adding more than 500,000 additional listings and drawing nearly 2 billion visits in 2026.

- The partnership integrates home search, real estate professionals, and Rocket Mortgage financing, providing Compass International Holdings' professionals access to over 1 million buyer inquiries generated through Redfin.

- Rocket Mortgage will offer preferred pricing for Compass clients, including a one-percentage-point interest-rate reduction for the first year of their loan or a lender credit of up to $6,000.

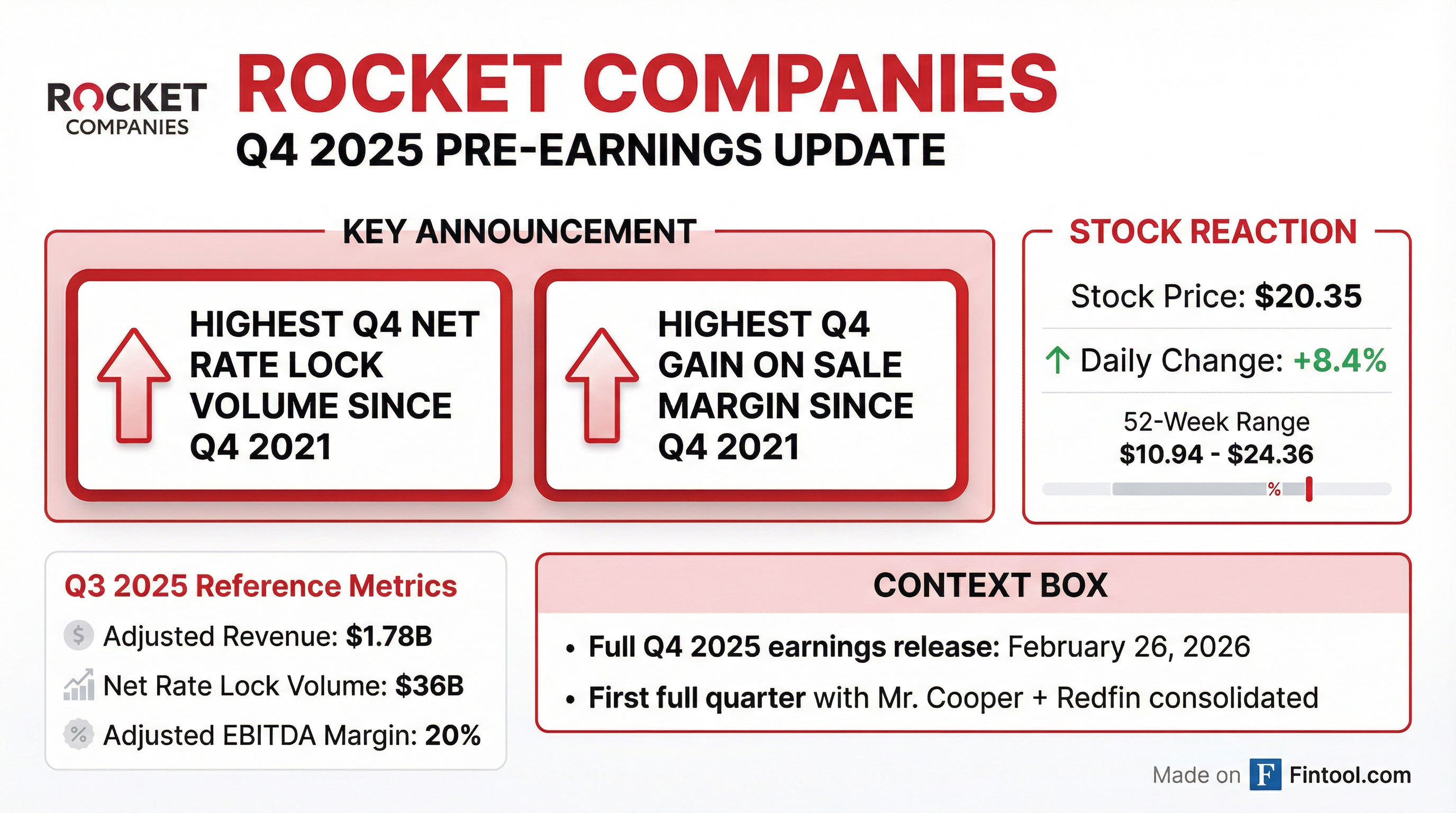

- Rocket Companies, Inc. (NYSE: RKT) announced on February 3, 2026, that it expects to report the highest fourth quarter net rate lock volume and gain on sale margin since the fourth quarter of 2021.

- The company will issue its fourth quarter and full year 2025 earnings on February 26, 2026, followed by a conference call at 4:30 p.m. ET.

- Rocket Companies CEO Varun Krishna announced the lender is on track to produce its highest mortgage loan volume and highest gain-on-sale margins in four years, which caused the stock to rise about 6%.

- This performance is attributed to Rocket's tightly integrated origination and servicing platform, enhanced with AI, and recent acquisitions including Redfin and Mr. Cooper.

- The rebound in lending activity is supported by a decline in 30-year mortgage rates to roughly 6%, with Mortgage News Daily reporting a specific drop to 5.99%.

- Krishna also highlighted industry forecasts predicting mortgage market volumes could grow as much as 25% through 2026, and existing home sales could increase by up to 10%.

- Rocket Companies and its affiliates face a national consumer class action lawsuit alleging a pay-to-play referral and steering scheme that pressured partner agents to direct buyers to Rocket loans, violating RESPA.

- The lawsuit claims Rocket Homes required agents to pay a 35% referral fee and steer clients to Rocket Mortgage, even if disadvantageous, seeking treble damages for borrowers who financed with Rocket since January 1, 2019.

- Plaintiffs cite Rocket's Q3 2025 revenue of $1.78 billion, a 148% year-over-year increase, as evidence the alleged scheme benefited the company.

- Rocket Companies denies the allegations and plans to dispute the claims. Separately, a recent Sixth Circuit ruling allowing Rocket Mortgage to compel arbitration in a different consumer suit could affect how other claims proceed.

Fintool News

In-depth analysis and coverage of Rocket Companies.

Quarterly earnings call transcripts for Rocket Companies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more